Is AMCC safe?

Business

License

Is AMCC Safe or a Scam?

Introduction

AMCC, also known as AMCC Markets Limited, positions itself as a forex broker offering a variety of financial instruments, including forex, cryptocurrencies, and commodities. Established in 2023 and headquartered in the United States, AMCC aims to attract both novice and experienced traders with its diverse offerings and high leverage options. However, as the online trading landscape becomes increasingly saturated, it is vital for traders to exercise caution and thoroughly evaluate the legitimacy of brokers like AMCC.

This article investigates whether AMCC is a safe trading option or a potential scam. The assessment will utilize a structured framework that includes the broker's regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk profile. By analyzing these aspects, we aim to provide a comprehensive overview of AMCC's credibility and safety.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor influencing its trustworthiness. An unregulated broker poses higher risks to traders as it operates without oversight from financial authorities. In the case of AMCC, it has been noted that the broker lacks proper regulation from any recognized financial authority, raising serious concerns about the safety of client funds and the transparency of its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory framework means that AMCC is not bound by any legal standards or practices that ensure fair trading and customer protection. Furthermore, warnings have been issued by various financial regulators regarding AMCC's unlicensed status, indicating non-compliance with industry regulations. This lack of oversight significantly undermines the safety of traders' investments and raises questions about the legitimacy of AMCC as a broker.

Company Background Investigation

AMCC Markets Limited claims to operate from Colorado, USA, but its transparency regarding ownership and operational history is lacking. The company has not provided verifiable details about its founders or management team, which is concerning for potential investors. A reputable broker typically has a management team with a strong background in finance, trading, and compliance, but AMCC does not disclose such information, further diminishing its credibility.

Moreover, the company's communication channels are limited, with only an email address provided for customer support. This lack of accessibility can be problematic for traders seeking assistance or clarification on their accounts, raising further concerns about the broker's reliability. The opacity surrounding AMCC's operations and management structure raises significant red flags, leading to questions about whether AMCC is safe for trading.

Trading Conditions Analysis

When evaluating a broker's trading conditions, factors such as fees, spreads, and commissions are critical. AMCC requires a minimum deposit of $50, which is relatively low compared to many brokers, but this accessibility does not necessarily translate to favorable trading conditions. The fee structure at AMCC lacks transparency, with many costs not clearly disclosed. Traders have reported unexpected charges and withdrawal fees, which can significantly impact their overall profitability.

| Fee Type | AMCC | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.7 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies ($5 - $10 per lot) |

| Overnight Interest Rate | Varies | 2% - 3% |

The spreads offered by AMCC are higher than those of many regulated brokers, which can erode potential profits. Additionally, the lack of a clearly defined commission structure raises concerns about potential hidden costs. Traders should be wary of brokers that do not provide clear and upfront information regarding their fees, as this can lead to unexpected financial burdens.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. AMCC does not provide sufficient information regarding its fund security measures, which is a significant concern. A reputable broker typically segregates client funds from operational funds and offers investor protection schemes. However, AMCC has not disclosed whether it follows such practices, leaving traders vulnerable to potential financial mismanagement.

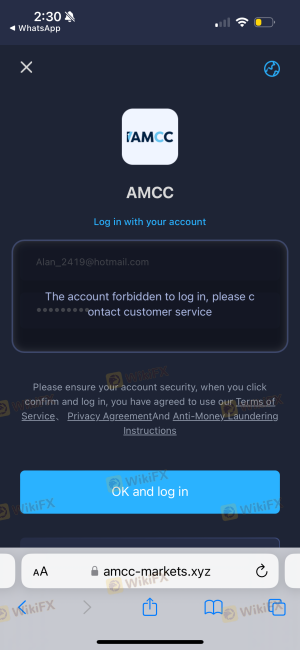

The absence of information on fund segregation and investor protection policies raises questions about the safety of traders' investments. Furthermore, the lack of regulatory oversight means that there is no safety net for traders in the event of financial mismanagement or insolvency. Historically, there have been reports of traders facing difficulties in withdrawing their funds from AMCC, leading to allegations of fraudulent practices. This history of fund withdrawal issues is a critical factor to consider when evaluating whether AMCC is safe for trading.

Customer Experience and Complaints

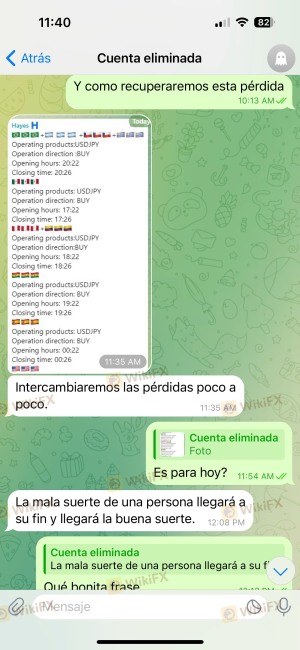

Customer feedback is a vital aspect of assessing a broker's reliability. Numerous reviews and complaints about AMCC indicate a pattern of negative experiences among traders. Common complaints include difficulty in fund withdrawals, unresponsive customer support, and issues with trade execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

| Trade Execution Issues | High | Poor |

Several traders have reported that their withdrawal requests were delayed for weeks or even months, leading to frustration and financial loss. Additionally, the customer support team has been criticized for being unresponsive, which can exacerbate issues faced by traders. One typical case involved a trader who requested a withdrawal after several months of trading but was met with repeated delays and vague responses from customer support. This situation highlights the potential risks associated with trading with AMCC and raises questions about the broker's commitment to customer service.

Platform and Trade Execution

The trading platform offered by AMCC is another crucial factor in evaluating its safety. The broker claims to utilize a proprietary platform, but there have been reports of platform instability and execution issues, including slippage and order rejections. Traders have expressed concerns about the quality of trade execution, with some experiencing significant delays during high-volatility periods.

The combination of execution issues and the lack of regulatory oversight raises significant doubts about whether AMCC is a safe trading option. Allegations of potential price manipulation further exacerbate these concerns, particularly for traders who rely on accurate pricing for their trades. The overall user experience on the platform is critical, and any instability can lead to significant financial losses.

Risk Assessment

When considering the overall risk of trading with AMCC, several factors must be taken into account. The lack of regulation, transparency issues, and negative customer experiences contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | Withdrawal issues reported |

| Operational Risk | Medium | Platform stability concerns |

| Customer Support Risk | High | Unresponsive support reported |

Given the high-risk assessment, potential traders should exercise extreme caution when considering AMCC. It is advisable to thoroughly research and consider alternative brokers with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about the safety and legitimacy of AMCC. The lack of regulation, transparency issues, and negative customer experiences strongly suggest that this broker may not be a safe option for traders.

For those considering trading, it is crucial to prioritize brokers that are regulated by reputable financial authorities and have a proven track record of customer satisfaction. Recommended alternatives include brokers like IG, OANDA, or Forex.com, which offer robust regulatory protections and positive user experiences.

In summary, while AMCC may present itself as a viable trading option, the potential risks and red flags associated with it lead to the conclusion that AMCC is not a safe trading option. Traders should remain vigilant and seek safer alternatives to protect their investments.

Is AMCC a scam, or is it legit?

The latest exposure and evaluation content of AMCC brokers.

AMCC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AMCC latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.