Regarding the legitimacy of Altai forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Altai safe?

Pros

Cons

Is Altai markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

EIGHTCAP PTY LTD

Effective Date: Change Record

2011-04-29Email Address of Licensed Institution:

compliance@eightcap.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

EIGHTCAP PTY LTD 'RIALTO SOUTH TOWER' L 35 525 COLLINS ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

0383734800Licensed Institution Certified Documents:

Is Altai Safe or Scam?

Introduction

Altai is a forex broker that has been gaining attention in the trading community. Positioned as a platform for both novice and experienced traders, it offers a range of trading instruments, including major currency pairs, commodities, and indices. However, the increasing number of forex brokers in the market necessitates that traders exercise caution and conduct thorough evaluations before committing their funds. The potential for scams and fraudulent activities in the forex industry is high, making it essential for traders to assess the legitimacy and safety of any broker they consider.

In this article, we will investigate the credibility of Altai by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and associated risks. Our assessment will be based on data gathered from credible sources, including regulatory bodies, user reviews, and financial analysis platforms.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. Regulation ensures that brokers adhere to industry standards, providing a level of protection to traders. Altai's regulation status is somewhat ambiguous; it does not appear to be regulated by any major financial authority, which raises concerns regarding its operational transparency and adherence to compliance standards.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of a regulatory license indicates that Altai operates without oversight from recognized authorities such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission). This lack of regulation is a significant red flag, as unregulated brokers may engage in practices that are not in the best interest of their clients. Without regulatory oversight, there is no guarantee of fund safety, ethical trading practices, or recourse in the event of disputes.

Company Background Investigation

Understanding the company behind a forex broker is essential in assessing its credibility. Altai has a relatively unclear background, with limited information available regarding its history and ownership structure. The lack of transparency about the company's establishment and its management team raises concerns about its reliability.

Furthermore, the management teams qualifications and professional experiences are crucial indicators of a broker's trustworthiness. Unfortunately, Altai does not provide adequate information about its executives, which further complicates the assessment of its credibility. A transparent broker typically shares details about its leadership and operational history, allowing potential clients to gauge its reliability.

Trading Conditions Analysis

Trading conditions, including fees and spreads, significantly impact a trader's overall experience. Altai claims to offer competitive trading conditions, but the specifics of its fee structure are not clearly outlined. Traders should be wary of any hidden fees that could erode their profits over time.

| Fee Type | Altai | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The absence of clear information regarding commissions and overnight interest rates is concerning. Traders should be cautious of brokers that do not provide transparent fee structures, as this may indicate potential exploitation of traders through hidden costs.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. Altai's measures for ensuring fund safety are not well-documented. It is crucial for brokers to implement robust fund segregation practices, ensuring that client funds are kept separate from the company's operational funds.

Additionally, investor protection mechanisms such as negative balance protection are essential. Altai's lack of clarity on these policies raises questions about the safety of client funds. Traders should always seek brokers that provide clear information about how they protect client funds and ensure their safety.

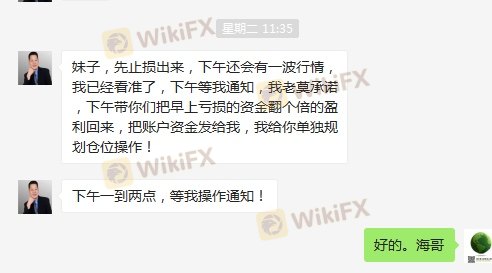

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of Altai are mixed, with some users reporting positive experiences while others have raised concerns. Common complaints include issues with withdrawal processes and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Service | Medium | Unresolved issues |

Several users have reported difficulties in withdrawing funds, which is a significant concern for any trader. The ability to access funds promptly is crucial, and any delays or complications can lead to frustration and financial losses.

Platform and Trade Execution

The trading platform's performance is another critical aspect to consider. Altai offers a trading platform that is user-friendly, but some users have reported issues with stability and execution quality.

Traders have experienced slippage and occasional order rejections, which can significantly impact trading outcomes. Signs of potential platform manipulation, such as frequent rejections during volatile market conditions, should be closely monitored by traders.

Risk Assessment

Using Altai carries inherent risks that traders must understand before engaging in trading activities. The absence of regulation, coupled with mixed customer feedback and unclear trading conditions, contributes to an elevated risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Operational Risk | Medium | Mixed reviews on platform stability |

| Financial Risk | High | Potential hidden fees and withdrawal issues |

To mitigate these risks, traders are advised to conduct thorough due diligence, maintain a cautious approach, and consider using smaller amounts for initial trades until they gain confidence in the broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that Altai is not entirely safe for traders. The lack of regulation, mixed customer feedback, and unclear trading conditions raise significant concerns. While some users may have had positive experiences, the potential for issues such as withdrawal delays and hidden fees cannot be overlooked.

Traders should exercise caution and consider alternative, well-regulated brokers that offer clear transparency, robust fund protection, and a proven track record of reliability. Recommended alternatives include brokers with strong regulatory oversight and positive customer reviews, ensuring a safer trading environment.

Is Altai a scam, or is it legit?

The latest exposure and evaluation content of Altai brokers.

Altai Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Altai latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.