Is Sector safe?

Pros

Cons

Is Sector Safe or Scam?

Introduction

Sector is a relatively new player in the forex market, positioning itself as a broker offering various trading services to both novice and experienced traders. As the forex market continues to grow, it becomes increasingly important for traders to thoroughly assess the legitimacy and reliability of their brokers. This diligence is crucial in avoiding potential scams that could lead to significant financial losses. This article aims to investigate the safety and credibility of Sector by examining its regulatory status, company background, trading conditions, and customer feedback. The assessment is based on a comprehensive review of available data, including regulatory filings, user reviews, and expert opinions.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. A well-regulated broker is typically subject to stringent oversight, providing a layer of protection for traders. Unfortunately, Sector operates without regulation, which raises significant concerns about its legitimacy. The absence of regulatory oversight can expose traders to a higher risk of fraud and mismanagement.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The lack of a regulatory framework means that Sector is not held accountable to any financial authority, which can lead to unethical practices. Historically, brokers without regulation have been associated with various fraudulent activities, including the misappropriation of client funds. The lack of a transparent regulatory environment also means that traders have limited recourse in case of disputes or issues with their accounts.

Company Background Investigation

Sector's history and ownership structure are critical in assessing its trustworthiness. The broker was established relatively recently, which can be a red flag for potential investors. Newer brokers may lack the operational stability and reputation that longer-established firms possess. Furthermore, the ownership structure of Sector is not clearly disclosed, which raises concerns about transparency and accountability.

The management team behind Sector is also an essential factor to consider. A strong management team with a proven track record in the financial services industry can inspire confidence among traders. However, information regarding the qualifications and experience of Sector's management is scarce, leaving potential clients in the dark about who is running their trading operations.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for any trader. Sector's fee structure and trading conditions are critical to its overall attractiveness. The absence of transparency in fees and commissions can lead to unexpected costs that may affect a trader's profitability.

| Fee Type | Sector | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | N/A |

| Commission Model | N/A | N/A |

| Overnight Interest Range | N/A | N/A |

Reports suggest that Sector may have unusual fees or policies that could be detrimental to traders. For instance, hidden fees can significantly impact trading outcomes, making it vital for traders to understand all costs associated with trading on the platform. Without clear and accessible fee information, traders are left vulnerable to unexpected charges that could erode their investments.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Sector's measures to protect client funds are unclear, which raises serious doubts about the security of investments made through the broker. Secure fund management practices typically include segregating client funds from company assets, ensuring that client money is protected in case of financial difficulties.

Moreover, the absence of investor protection policies, such as negative balance protection, poses additional risks. Traders need to be aware of how their funds are handled and whether they are adequately protected from potential losses. Historical issues related to fund security can also indicate a broker's reliability, and any past controversies surrounding Sector should be thoroughly investigated.

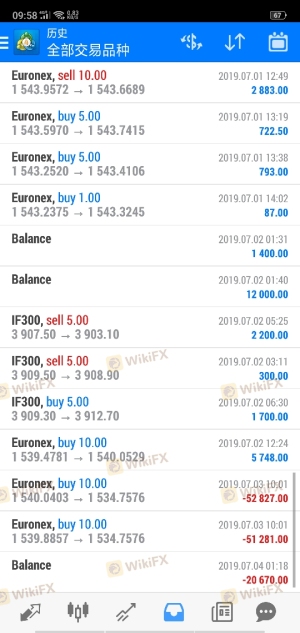

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's credibility. Reviews of Sector reveal a mixed bag of experiences, with many users reporting issues ranging from difficulty in withdrawing funds to poor customer service. Understanding common complaint patterns can help potential traders gauge the level of risk associated with using this broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Fair |

A few case studies highlight the problems faced by clients. For instance, one user reported significant delays in fund withdrawals, which led to frustration and distrust in the broker's operations. Another user mentioned inadequate responses from customer support, indicating a lack of attention to client concerns. Such issues can be indicative of deeper operational problems within the company.

Platform and Trade Execution

Evaluating the trading platform's performance and user experience is essential for effective trading. Sector's platform stability, execution quality, and user interface play a significant role in determining whether traders can successfully navigate the forex market. Any signs of manipulation or poor execution can lead to substantial losses.

Traders should also be aware of slippage and rejection rates, as these factors can affect the overall trading experience. A platform that frequently fails to execute trades at the desired price can lead to missed opportunities and financial losses. Therefore, a thorough assessment of Sector's trading platform is necessary for potential clients.

Risk Assessment

Using Sector as a trading platform involves various risks that potential traders must consider. Understanding these risks can help traders make informed decisions about whether to engage with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Fund Security Risk | High | Lack of transparency in fund management practices. |

| Customer Service Risk | Medium | Poor customer feedback indicates potential issues. |

To mitigate these risks, traders should conduct thorough research and consider using regulated alternatives. Seeking brokers with a strong regulatory background and positive client feedback can significantly reduce the likelihood of encountering issues.

Conclusion and Recommendations

In conclusion, the investigation into Sector raises several red flags regarding its legitimacy and safety. The absence of regulation, combined with a lack of transparency in fees and fund security measures, suggests that traders should exercise extreme caution when considering this broker. The mixed reviews and common complaints further underscore the potential risks involved.

For traders seeking to enter the forex market, it may be prudent to consider regulated alternatives with a proven track record of reliability and customer satisfaction. Brokers that prioritize transparency, regulatory compliance, and client support will likely provide a safer trading environment. Overall, while Sector may offer enticing trading conditions, the associated risks make it a potentially unsafe choice for traders.

Is Sector a scam, or is it legit?

The latest exposure and evaluation content of Sector brokers.

Sector Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sector latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.