Is AILEN safe?

Pros

Cons

Is Ailen Safe or Scam?

Introduction

Ailen is a foreign exchange broker that entered the market in 2018, positioning itself as a platform for traders seeking diverse investment opportunities. However, the growing number of complaints and concerns about its operations has led many traders to question: Is Ailen safe? Evaluating the credibility and safety of a forex broker is crucial for traders, as the forex market can be fraught with risks, including potential scams and fraudulent practices. In this article, we will conduct a thorough investigation into Ailen's regulatory status, company background, trading conditions, customer experience, and overall safety to provide a comprehensive answer to the question of whether Ailen is a safe trading platform or a scam.

Regulation and Legitimacy

A broker's regulatory status is one of the most critical factors in determining its legitimacy. Ailen claims to be regulated by the National Futures Association (NFA) in the United States; however, a closer look reveals discrepancies that raise concerns about its compliance. Below is a summary of Ailen's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0520444 | United States | Unauthorized |

While Ailen operates under the NFA, the lack of proper authorization and the low score of 1.50 on platforms like WikiFX suggest that it may not meet the stringent requirements set by regulatory bodies. The NFA is known for its strict oversight, and brokers must adhere to high standards to ensure client protection. Ailen's questionable regulatory status raises red flags about its operational legitimacy and the safety of client funds.

Company Background Investigation

Ailen Global Limited, the parent company of Ailen, was established in 2018. Despite its claims of being headquartered in New York, investigations reveal that the actual registered address is a virtual office in Wilmington, Delaware. This discrepancy raises questions about the transparency and authenticity of the broker.

The management team behind Ailen lacks publicly available information, which is essential for assessing their expertise and credibility. A reputable broker typically provides detailed information about its team members, including their professional backgrounds and relevant experience in the financial industry. The absence of such information about Ailen contributes to the overall skepticism regarding its trustworthiness.

Moreover, the company's transparency in disclosing operational details and financial practices is minimal, further complicating the assessment of its reliability. Overall, the lack of a solid company background and credible management raises concerns about whether Ailen is safe for trading.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. Ailen offers a variety of trading instruments, including forex currency pairs, CFDs, and commodities. However, the costs associated with trading on its platform are crucial to consider.

| Cost Type | Ailen | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 2.0 pips | 1.5 pips |

| Commission Structure | Variable | Fixed or Variable |

| Overnight Interest Range | High | Moderate |

The spreads offered by Ailen are higher than the industry average, which could significantly impact profitability for traders. Additionally, the commission structure is not clearly defined, leading to potential hidden fees that could further erode traders' capital. Such discrepancies in trading conditions may indicate a lack of transparency and fairness in Ailen's pricing model.

Client Fund Security

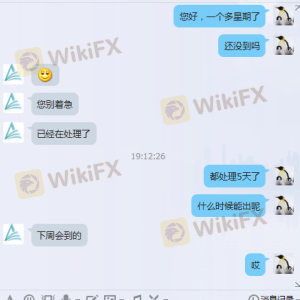

The safety of client funds is paramount in the forex industry. Ailen claims to implement several measures to secure clients' funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures remains questionable given the complaints about delayed withdrawals and unresponsive customer service.

The broker's history reveals instances where clients reported difficulties in accessing their funds, which raises concerns about the actual implementation of these security measures. Effective fund protection policies should include clear protocols for fund segregation, negative balance protection, and compensation schemes in case of broker insolvency. The lack of evidence supporting Ailen's commitment to these practices raises further doubts about whether Ailen is safe for traders.

Customer Experience and Complaints

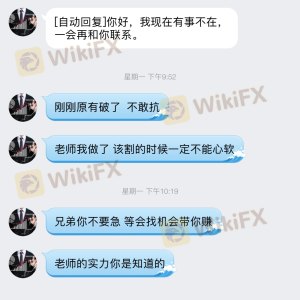

Customer feedback plays a significant role in assessing a broker's reliability. Ailen has garnered several complaints from users regarding withdrawal issues, unresponsive customer service, and unclear fee structures.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Hidden Fees | High | Poor |

Typical cases include users reporting that their withdrawal requests were ignored for weeks, leading to frustration and financial loss. These patterns of complaints indicate systemic issues within Ailen's operations, suggesting that the broker may not prioritize customer satisfaction or transparency. Such experiences raise significant concerns about the broker's integrity and whether it truly operates as a safe trading platform.

Platform and Trade Execution

The trading platform offered by Ailen is based on MetaTrader 4 (MT4), a popular choice among traders for its user-friendly interface and extensive features. However, the platform's performance, stability, and execution quality are essential for a positive trading experience.

While MT4 is generally reliable, users have reported instances of slippage and order rejections on Ailen's platform, which could hinder trading effectiveness. Additionally, the lack of advanced security features, such as two-factor authentication, raises concerns about the overall safety of the trading environment. Any signs of potential platform manipulation or execution issues could further deter traders from considering Ailen as a safe option.

Risk Assessment

Using Ailen as a trading platform presents several risks that potential clients should consider. Below is a summary of the key risk areas associated with Ailen:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unauthorized NFA status raises concerns. |

| Fund Security Risk | High | Complaints about withdrawal issues. |

| Transparency Risk | Medium | Lack of company and management information. |

| Trading Cost Risk | Medium | Higher spreads and unclear fees. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Ailen. It is advisable to start with a small investment to test the platform's reliability and responsiveness before committing larger amounts.

Conclusion and Recommendations

Based on the comprehensive analysis, it is evident that Ailen raises several red flags regarding its safety and legitimacy. The combination of unauthorized regulatory status, poor customer feedback, and questionable trading conditions suggests that Ailen may not be a safe broker for traders.

For those considering trading in the forex market, it is crucial to opt for brokers with solid regulatory oversight, transparent operations, and positive customer experiences. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which are known for their stringent compliance standards.

In conclusion, traders must exercise caution when dealing with Ailen. The evidence points toward potential risks that could jeopardize their investments, making it essential to prioritize safety and reliability in their choice of forex broker.

Is AILEN a scam, or is it legit?

The latest exposure and evaluation content of AILEN brokers.

AILEN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AILEN latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.