Is AceTrade safe?

Business

License

Is AceTrade A Scam?

Introduction

AceTrade has emerged as a notable player in the forex trading market, offering a range of trading services to both novice and experienced traders. However, the increasing number of scams in the forex industry necessitates that traders exercise caution when choosing a broker. Many potential investors often overlook the importance of thorough due diligence, which can lead to significant financial losses. This article aims to provide an objective analysis of AceTrade by examining its regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment. The information presented here is derived from various reputable sources, including regulatory bodies, user reviews, and financial analysis platforms.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its legitimacy. A well-regulated broker is typically subject to stringent oversight, which can protect investors from potential fraud. Unfortunately, AceTrade lacks proper regulatory oversight, as indicated by multiple sources.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a valid regulatory license raises significant concerns about the safety of client funds and the overall integrity of AceTrade. Regulatory bodies such as the FCA (Financial Conduct Authority) and CySEC (Cyprus Securities and Exchange Commission) have issued warnings about unregulated brokers, advising traders to avoid dealing with them. Furthermore, AceTrade's operations appear to be concentrated in New Zealand, where regulatory requirements are less stringent, allowing brokers to operate with minimal oversight. This situation poses a substantial risk for potential investors, as they may not have access to recourse mechanisms in case of disputes or financial loss.

Company Background Investigation

AceTrade operates under the name Ace Trade Global Limited, but detailed information about its ownership and management is sparse. The company claims to have been in operation for 5 to 10 years, but the lack of transparency surrounding its history is alarming.

The management teams background is another critical aspect to consider. A reputable broker typically has a team with extensive experience in financial markets and regulatory compliance. However, AceTrade's management team appears to lack the necessary credentials and industry recognition, further raising doubts about the company's legitimacy.

In terms of transparency, AceTrade does not provide comprehensive information regarding its operations, trading conditions, or financial performance. This lack of disclosure can be a red flag for potential investors, as it suggests that the company may not prioritize accountability or customer trust.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. AceTrade claims to provide competitive trading fees, but a closer examination reveals a potentially problematic fee structure.

| Fee Type | AceTrade | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Low |

| Commission Structure | Unclear | Clear |

| Overnight Interest Rates | High | Moderate |

The spreads offered by AceTrade on major currency pairs are reportedly higher than industry averages, which can significantly impact a trader's profitability. Additionally, the commission structure is not clearly defined, leaving traders uncertain about the costs they may incur. This lack of clarity can lead to unexpected fees, further complicating the trading experience. Overall, the trading conditions at AceTrade do not inspire confidence and may deter potential clients.

Customer Fund Safety

The safety of customer funds is a primary concern for any trader. AceTrade's lack of regulatory oversight raises serious questions about its fund security measures. The broker does not appear to have a robust system in place for safeguarding client funds, such as segregated accounts or investor compensation schemes.

Traders should be particularly cautious when dealing with unregulated brokers, as they may not have adequate measures to protect against insolvency or fraud. Furthermore, historical complaints regarding non-payment and fraud associated with AceTrade indicate that past clients have faced difficulties accessing their funds. This history of issues further underscores the risks involved in trading with AceTrade.

Customer Experience and Complaints

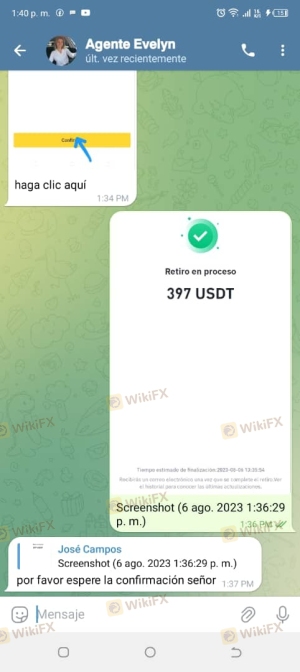

Customer feedback is invaluable when assessing a broker's reliability. A review of user experiences with AceTrade reveals a pattern of complaints, primarily focused on withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

Many users have reported being unable to withdraw their funds, with some claiming that their accounts were frozen without explanation. Additionally, customer service responses have been criticized for being slow and unhelpful, leaving clients feeling frustrated and unsupported.

One notable case involved a trader who attempted to withdraw their funds but faced repeated delays and unresponsive customer service. Ultimately, this individual was unable to recover their investment, highlighting the potential risks associated with AceTrade.

Platform and Execution

The performance of a trading platform is critical for a smooth trading experience. AceTrade's platform reportedly suffers from stability issues, which can lead to delays in order execution and increased slippage.

Traders have expressed concerns about the platform's reliability, with some noting instances of order rejections during high volatility. Such issues can severely impact a traders ability to capitalize on market opportunities and may indicate potential manipulation or technical shortcomings.

Risk Assessment

Using AceTrade comes with a comprehensive set of risks that traders should carefully consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | High spreads and unclear fees can erode profits. |

| Operational Risk | Medium | Platform instability may hinder trading success. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with AceTrade. Seeking out regulated brokers with transparent practices and a solid reputation can help ensure a safer trading environment.

Conclusion and Recommendations

In conclusion, the analysis of AceTrade raises significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, coupled with a history of complaints and poor customer service, suggests that potential investors should approach this broker with caution.

While AceTrade may offer certain trading opportunities, the associated risks outweigh the benefits. For traders seeking a reliable and trustworthy broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of positive customer experiences.

In summary, is AceTrade safe? The evidence points toward a high risk of fraud, and traders are encouraged to explore other options before committing their funds to this platform.

Is AceTrade a scam, or is it legit?

The latest exposure and evaluation content of AceTrade brokers.

AceTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AceTrade latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.