xinsheng 2025 Review: Everything You Need to Know

Summary

This comprehensive xinsheng review evaluates one of the emerging players in the forex trading landscape. Based on available information and user feedback, xinsheng presents itself as a legitimate and secure forex trading platform that targets traders who prioritize safety and reliability in their trading activities. The broker appears to cater to both novice and experienced traders seeking exposure to forex and CFD markets.

According to Scamadviser and WikiBit reports, xinsheng has garnered attention for its commitment to security standards and user trust. The platform demonstrates good safety scores and trust ratings derived from user evaluations, making it particularly appealing to individual investors who value platform integrity. While the broker shows promise in terms of legitimacy, traders should note that comprehensive information about specific trading conditions remains limited in publicly available sources.

The broker primarily serves individual investors interested in forex and CFD trading. It positions itself as a reliable option for those seeking a secure trading environment without compromising on essential trading features.

Important Notice

Traders should be aware that different regional entities within the xinsheng network may operate under varying regulatory frameworks and service offerings. These differences can significantly impact trading conditions, available instruments, and customer protection measures depending on your geographical location.

This evaluation is based on comprehensive analysis of user reviews, company background information, and publicly available data from multiple sources including WikiBit and Scamadviser. Due to limited detailed information in available resources, some aspects of the broker's services require further investigation by potential clients.

Rating Framework

Broker Overview

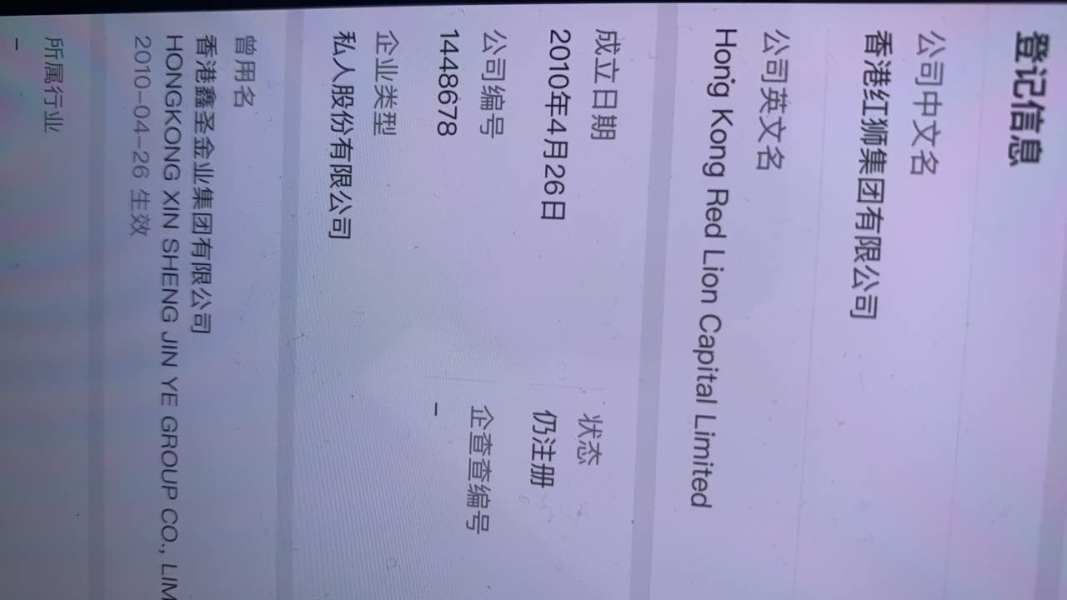

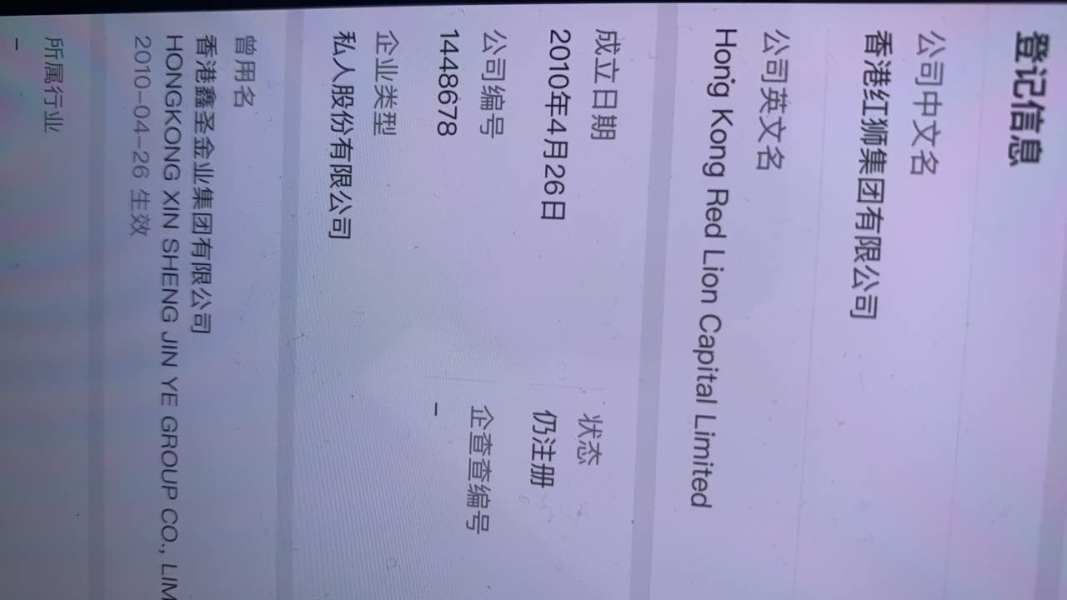

xinsheng emerges in the forex trading sector with backing from established manufacturing entities, including Foshan Xinsheng Furniture Co., Ltd. and Hangzhou Xinsheng Precision Machinery Co., which have built solid reputations in their respective manufacturing industries. This diversified corporate background suggests financial stability and operational experience, though the transition into financial services represents a new venture for these entities.

The broker's business model focuses on providing forex and CFD trading services to individual investors. Specific details about their operational structure and founding year remain undisclosed in available documentation. The company's approach appears to emphasize security and user trust, as evidenced by positive safety evaluations from independent review platforms.

According to this xinsheng review, the platform offers access to foreign exchange markets and contracts for difference, targeting retail traders seeking reliable trading conditions. However, comprehensive information about trading platform types, specific asset coverage, and regulatory oversight remains limited in publicly accessible sources, requiring potential clients to conduct additional due diligence.

Regulatory Coverage: Available sources do not specify particular regulatory jurisdictions or licensing authorities overseeing xinsheng's operations. Potential traders should investigate this independently.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in current source materials.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in available documentation.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not elaborated in accessible sources.

Tradeable Assets: Based on available information, the platform provides access to forex markets and CFD instruments. The complete range of available assets requires further clarification from the broker directly.

Cost Structure: Comprehensive information about spreads, commissions, overnight fees, and other trading costs is not detailed in current source materials. This makes cost comparison challenging.

Leverage Ratios: Specific leverage offerings for different instruments and account types are not specified in available documentation.

Platform Options: Trading platform choices and technological infrastructure details are not comprehensively covered in accessible sources.

Geographic Restrictions: Information about restricted countries or regional limitations is not specified in current documentation.

Customer Support Languages: Available language support for customer service is not detailed in source materials.

This xinsheng review highlights the need for traders to contact the broker directly for comprehensive service details.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of xinsheng's account conditions faces limitations due to insufficient detailed information in available sources. Without specific data about account types, minimum deposit requirements, or account opening procedures, providing a comprehensive assessment becomes challenging. Potential traders should directly contact the broker to understand available account structures and their respective features.

The absence of detailed account condition information in public sources suggests that xinsheng may provide customized account offerings. It may also maintain different service levels that are not publicly advertised. This approach, while potentially beneficial for personalized service, creates uncertainty for traders seeking transparent condition comparisons.

Special account features such as Islamic accounts, demo account availability, or professional trading accounts are not mentioned in current source materials. The lack of publicly available account condition details represents a significant information gap that potential clients must address through direct broker communication.

This xinsheng review emphasizes the importance of obtaining comprehensive account documentation before committing to any trading relationship. This is especially important given the limited publicly available information about specific terms and conditions.

The assessment of xinsheng's trading tools and resources encounters significant limitations due to sparse information in available sources. Without detailed specifications about analytical tools, charting capabilities, or research resources, evaluating the platform's technological offerings becomes problematic for potential traders.

Educational resources, which are crucial for trader development, are not specifically mentioned in current documentation. The absence of information about webinars, tutorials, market analysis, or trading guides suggests either limited educational support or inadequate public disclosure of available resources.

Automated trading support, including expert advisor compatibility or algorithmic trading features, remains unspecified in accessible sources. This information gap is particularly relevant for traders who rely on automated strategies or require advanced trading tools for their operations.

Research and analysis resources, including market commentary, economic calendars, or fundamental analysis tools, are not detailed in current source materials. This makes it difficult to assess the platform's analytical capabilities.

Customer Service and Support Analysis

Evaluating xinsheng's customer service quality proves challenging due to limited specific information in available sources about support channels, response times, or service quality metrics. The absence of detailed customer service information represents a significant consideration for potential traders who value responsive support.

Available communication channels, including live chat, email support, or telephone assistance, are not comprehensively detailed in current documentation. This lack of transparency about support accessibility could impact trader confidence, particularly for those requiring immediate assistance during trading hours.

Response time expectations and service level agreements are not specified in accessible sources. This makes it difficult for potential clients to understand support quality standards. The absence of this information suggests the need for direct inquiry with the broker about service commitments.

Multilingual support capabilities and customer service hours are not detailed in current source materials. This could be particularly relevant for international traders operating across different time zones.

Trading Experience Analysis

The assessment of xinsheng's trading experience faces substantial limitations due to insufficient platform performance data in available sources. Without specific information about execution speeds, platform stability, or order processing quality, evaluating the actual trading environment becomes challenging for potential users.

Platform functionality and user interface design details are not comprehensively covered in accessible documentation. This information gap affects traders' ability to assess whether the platform meets their technical requirements and trading style preferences.

Mobile trading capabilities and cross-device synchronization features are not specifically mentioned in current source materials. Given the importance of mobile trading in today's market, this represents a significant information void for modern traders.

Order execution quality metrics, including slippage rates, requote frequency, or execution speed statistics, are not provided in available sources. These technical performance indicators are crucial for traders, particularly those employing scalping or high-frequency strategies.

This xinsheng review underscores the necessity for potential traders to request detailed platform demonstrations or trial access. This will help properly evaluate trading experience quality.

Trust Level Analysis

xinsheng demonstrates relatively strong trust indicators based on available evaluation data. According to reports from Scamadviser and WikiBit, the broker maintains good safety scores and trust ratings, suggesting a legitimate operational framework. These positive trust indicators represent one of the few concrete positive aspects highlighted in current source materials.

The company's association with established manufacturing entities, including Foshan Xinsheng Furniture Co., Ltd. and Hangzhou Xinsheng Precision Machinery Co., provides some corporate credibility through diversified business operations. This background suggests financial stability, though it doesn't necessarily guarantee forex trading expertise.

However, specific regulatory licensing information is not detailed in available sources. This represents a significant transparency gap for trust assessment. The absence of clear regulatory oversight details could concern traders who prioritize regulated trading environments.

Third-party verification and independent audits are not mentioned in current documentation. This limits the ability to confirm operational transparency and financial segregation practices that are crucial for trader protection.

User Experience Analysis

Comprehensive user experience evaluation faces significant constraints due to limited detailed feedback and interface information in available sources. Without specific user testimonials or detailed platform reviews, assessing overall satisfaction levels becomes challenging for potential traders.

Registration and account verification processes are not detailed in current documentation. This makes it difficult to evaluate onboarding efficiency and user-friendliness. This information gap affects traders' ability to anticipate the account opening experience and required documentation.

Fund management experience, including deposit and withdrawal processes, processing times, and associated costs, is not comprehensively covered in accessible sources. These operational aspects significantly impact overall user satisfaction and platform usability.

Interface design and navigation ease are not specifically addressed in current source materials. This prevents assessment of platform accessibility for traders with varying technical expertise levels.

Conclusion

This xinsheng review reveals a broker with promising trust indicators but significant information transparency challenges. While the platform demonstrates good safety scores and maintains associations with established business entities, the limited availability of comprehensive trading condition details creates uncertainty for potential traders.

xinsheng appears most suitable for traders who prioritize security and are willing to conduct extensive due diligence through direct broker communication. The platform may appeal to those seeking a secure trading environment, though the lack of detailed public information requires careful investigation.

The primary advantage lies in demonstrated safety scores and trust ratings. The main disadvantage involves insufficient public disclosure of trading conditions, costs, and platform features. Potential traders should request comprehensive documentation and consider demo testing before committing to live trading accounts.