Regarding the legitimacy of XINSHENG forex brokers, it provides HKGX and WikiBit, .

Is XINSHENG safe?

Pros

Cons

Is XINSHENG markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

香港紅獅集團有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.rlc9000.comExpiration Time:

--Address of Licensed Institution:

九龍尖沙咀漆咸道南87-105號百利商業中心15字樓1511室Phone Number of Licensed Institution:

23927848Licensed Institution Certified Documents:

Is Xinsheng Safe or Scam?

Introduction

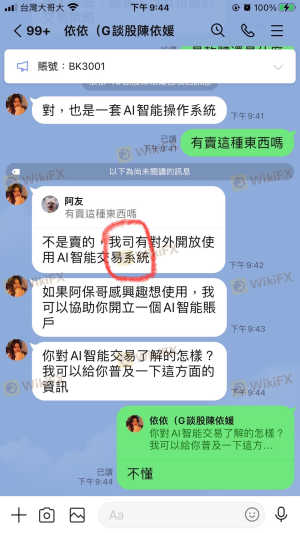

Xinsheng, a broker operating in the forex market, has garnered attention for its diverse trading offerings and purported regulatory compliance. As the forex market continues to expand, traders must exercise caution when selecting brokers, as the risk of scams and fraudulent activities remains prevalent. This article aims to provide a comprehensive analysis of Xinsheng, assessing its safety and legitimacy through a structured evaluation framework that includes regulatory status, company background, trading conditions, client experiences, and risk assessment.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety of any forex broker. Xinsheng claims to be regulated by the China Financial Futures Exchange (CFFEX), a body that oversees futures trading in China. However, the quality of regulation can vary significantly, and traders must understand the implications of such oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | 0272 | China | Regulated |

While being regulated by CFFEX lends some legitimacy to Xinsheng, it is essential to note that the quality of oversight from different regulatory bodies can differ. CFFEX primarily focuses on futures trading, which may not encompass the full range of forex trading activities. Moreover, there have been numerous reports and complaints from users regarding withdrawal issues and alleged scams, raising questions about the broker's compliance with regulatory standards. Therefore, it is crucial for potential traders to consider these factors carefully when evaluating whether is Xinsheng safe for their trading activities.

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its reliability. Xinsheng was established in Hong Kong and has been operational for several years. However, the lack of detailed information about its ownership structure and management team raises concerns about transparency.

The company's history is relatively short, and its development trajectory has not been extensively documented. While some reviews indicate that it has gained a reputation in certain trading circles, the absence of a well-defined corporate governance structure can be alarming for potential clients. Furthermore, the information available about the management team is sparse, which limits the ability to evaluate their qualifications and experience in the financial sector. A lack of transparency in a broker's operations can be a red flag for traders who are trying to determine if is Xinsheng safe for their investments.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's overall experience. Xinsheng provides various account types with different minimum deposit requirements, leverage options, and spreads. However, the broker's fee structure has raised eyebrows among users.

| Fee Type | Xinsheng | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.3%/day | 0.1% - 0.2%/day |

While the absence of a commission model may seem appealing, the spreads and swap fees can still accumulate, impacting overall profitability. Traders have reported experiencing unusually high spreads and hidden fees, which raises concerns about the broker's transparency. It is essential for traders to fully understand the fee structure and ensure that they are not caught off guard by unexpected costs, which leads to the question of whether is Xinsheng safe for trading.

Client Funds Security

The safety of client funds is a paramount concern for any trader. Xinsheng claims to implement various measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures remains uncertain, especially in light of numerous complaints regarding fund withdrawals and alleged scams.

Traders have reported instances where their accounts were frozen or funds were inaccessible, raising serious concerns about the broker's commitment to safeguarding client assets. The absence of insurance for clients further exacerbates these worries. Without adequate protection mechanisms in place, traders may find themselves at risk of losing their investments. Therefore, it is crucial to consider the safety of client funds when evaluating whether is Xinsheng safe for trading.

Client Experience and Complaints

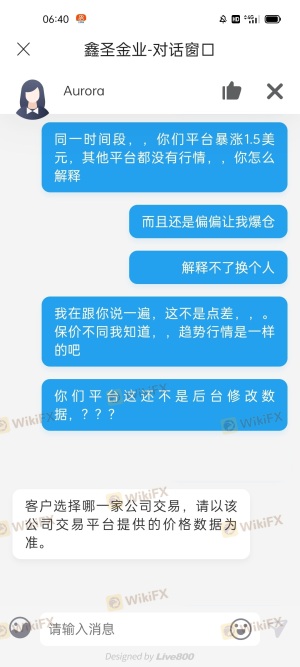

Client feedback is a valuable indicator of a broker's reliability. In the case of Xinsheng, numerous negative reviews have surfaced, highlighting common complaints such as difficulties in withdrawing funds, poor customer service, and alleged market manipulation.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Poor Customer Service | Medium | Inconsistent |

| Market Manipulation | High | Denied Claims |

Many users have reported being unable to access their funds after making deposits, leading to accusations of fraudulent behavior. The company's response to these complaints has often been inadequate, with many users expressing frustration over the lack of communication and support. Such patterns of complaints raise significant red flags regarding the broker's operations and whether is Xinsheng safe for potential traders.

Platform and Trade Execution

Evaluating the trading platform's performance is essential for understanding a broker's reliability. Xinsheng offers a trading platform that has been reported to have stability issues, with users experiencing slippage and order rejections during high volatility periods.

The quality of order execution is critical for traders, as delays or failures can result in significant losses. Reports of severe slippage and unfulfilled orders have surfaced, leading to suspicions of potential platform manipulation. Given these concerns, traders must carefully assess whether they can trust Xinsheng's platform for executing their trades effectively, further complicating the question of is Xinsheng safe for trading.

Risk Assessment

Using Xinsheng as a trading platform involves several risks that traders must consider. The lack of regulatory oversight, combined with numerous complaints regarding fund security and withdrawal issues, contributes to a high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Limited oversight and issues |

| Fund Security | High | Reports of inaccessible funds |

| Customer Service | Medium | Inconsistent and slow response |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Xinsheng. It is advisable to start with a small deposit, monitor the platform's performance, and ensure that withdrawal processes are smooth before committing larger amounts. This cautious approach can help traders determine whether is Xinsheng safe for their trading needs.

Conclusion and Recommendations

In conclusion, the evidence surrounding Xinsheng raises significant concerns regarding its safety and legitimacy as a forex broker. The broker's regulatory status is questionable, with numerous complaints from users about withdrawal issues and inadequate customer service. While Xinsheng offers a range of trading conditions, the lack of transparency and potential risks associated with fund security cannot be overlooked.

For traders considering engaging with Xinsheng, it is crucial to proceed with caution. It may be prudent to explore alternative brokers with stronger regulatory oversight and a proven track record of positive client experiences. Some recommended alternatives include brokers that are well-regulated and have a reputation for excellent customer service. Ultimately, potential traders must weigh the risks carefully and ask themselves, "Is Xinsheng safe?" before making any commitments.

Is XINSHENG a scam, or is it legit?

The latest exposure and evaluation content of XINSHENG brokers.

XINSHENG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XINSHENG latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.