WST Review 2

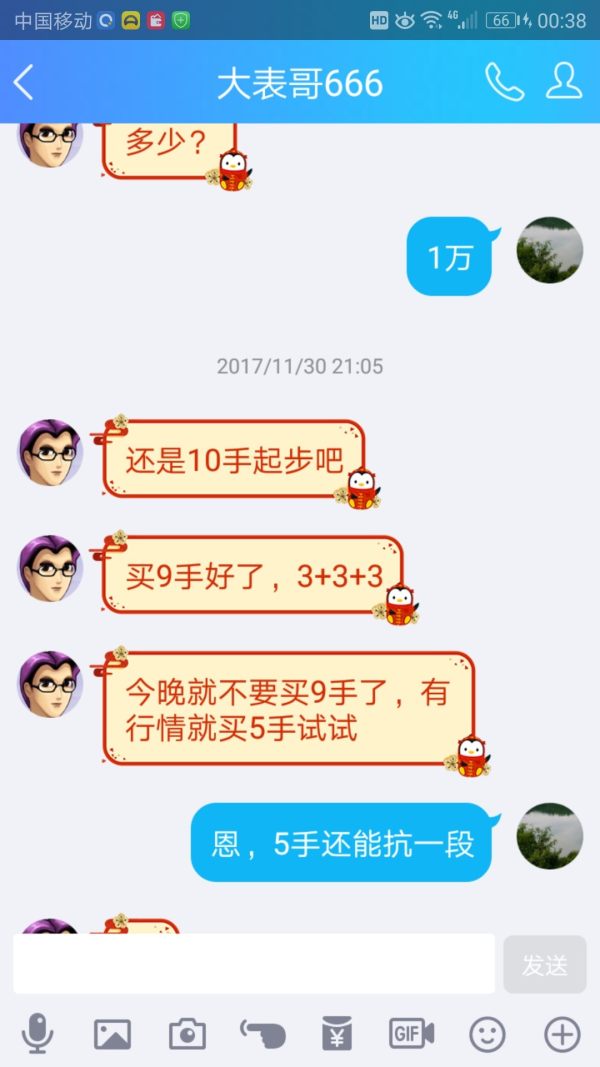

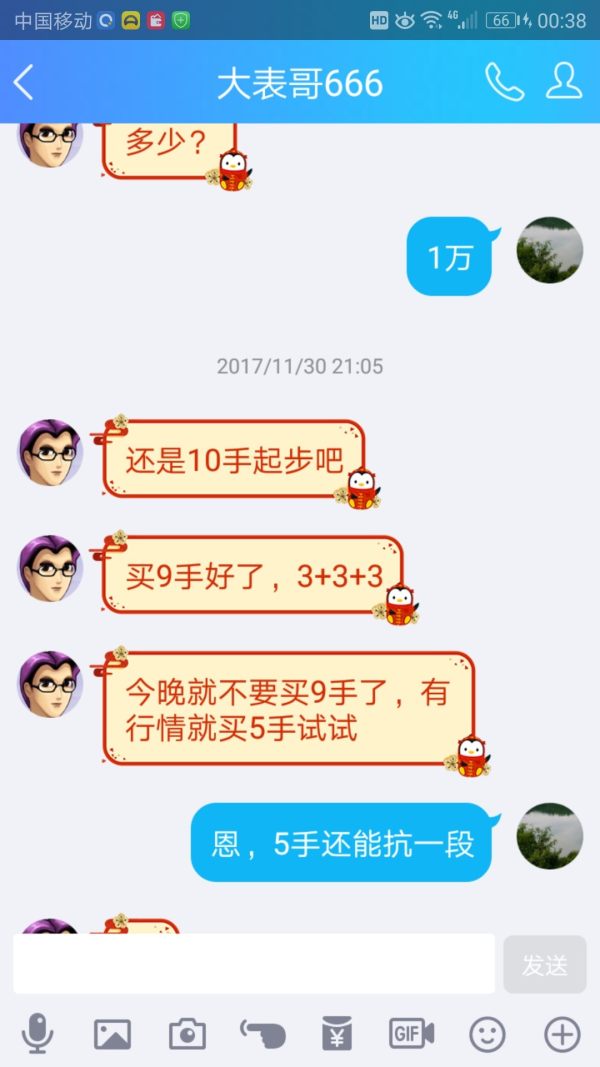

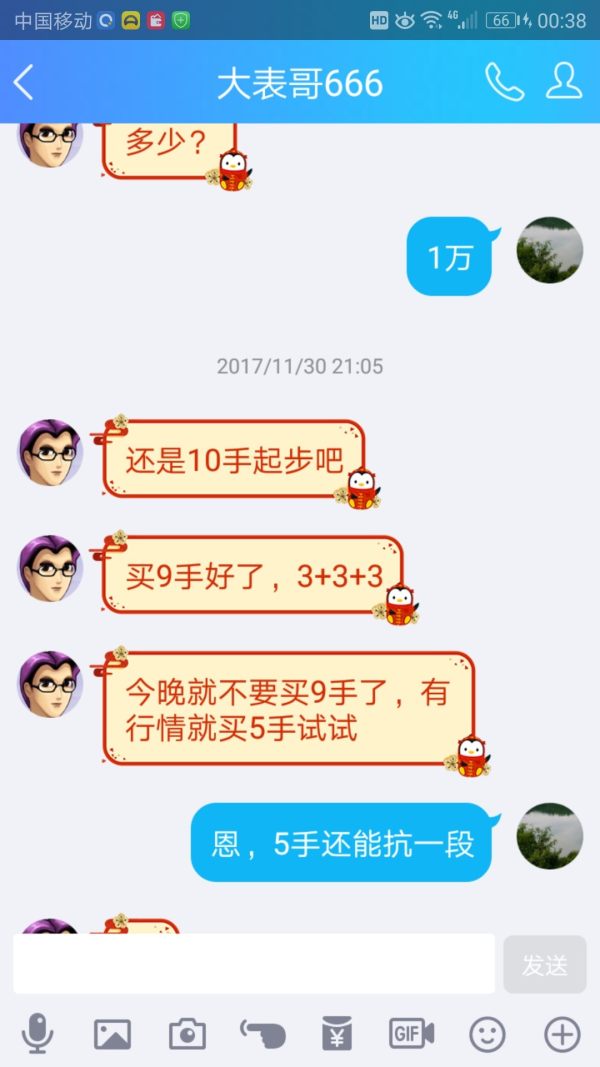

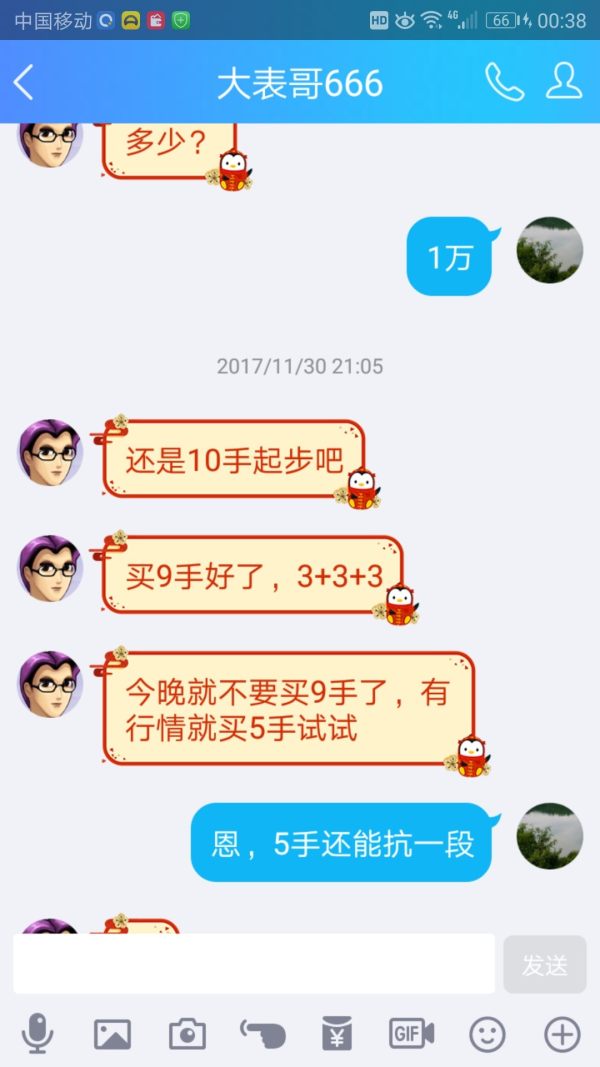

Its agent deliberately made my position liquidated, trading on wrong directions.

WST froze my account for no reason. Their agent deliberately gave me wrong directions and froze my account after I lost all my money.

WST Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Its agent deliberately made my position liquidated, trading on wrong directions.

WST froze my account for no reason. Their agent deliberately gave me wrong directions and froze my account after I lost all my money.

This comprehensive WST review examines West Pharmaceutical Services, Inc. WST works as a forex trading service provider. Based on available information, WST positions itself within the foreign exchange trading sector, though detailed operational specifics remain limited in publicly accessible documentation. The company targets investors seeking participation in forex markets. Stock-related information potentially serves as additional reference material for trading decisions.

Our evaluation reveals significant information gaps regarding key trading conditions, regulatory oversight, and user feedback. WST presents itself as a forex service provider. However, the lack of comprehensive operational details raises questions about transparency and accessibility for potential clients. This review maintains a neutral stance given the limited verifiable information available about WST's specific trading offerings, platform capabilities, and regulatory compliance status.

The assessment indicates that potential users should exercise caution and seek additional information before engaging with WST's services. This is particularly important regarding regulatory protection and trading conditions.

This WST review is based on publicly available information and industry standard evaluation criteria. Significant information gaps exist regarding regulatory status, trading conditions, and user experiences. Different regional entities may operate under varying regulatory frameworks and offer different services. However, specific details about WST's global operations are not detailed in available sources.

Readers should independently verify all information and consider consulting with financial advisors before making trading decisions. The evaluation methodology acknowledges potential information limitations and focuses on available data points. It also highlights areas requiring further investigation.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Insufficient information available in source materials |

| Tools and Resources | N/A | Specific trading tools and resources not detailed |

| Customer Service | N/A | Support structure and availability not documented |

| Trading Experience | N/A | Platform performance and execution quality unspecified |

| Trust and Security | N/A | Regulatory status and safety measures unclear |

| User Experience | N/A | User feedback and interface details not provided |

West Pharmaceutical Services, Inc. operates as a foreign exchange trading service provider. Comprehensive details about its establishment date and corporate history are not extensively documented in available materials. The company positions itself within the forex trading sector, offering services to investors interested in currency market participation. However, specific information about the company's founding year, leadership structure, and operational milestones remains limited in accessible documentation.

The business model appears focused on foreign exchange trading services. Detailed descriptions of service offerings, target market segments, and competitive positioning are not thoroughly outlined in available sources. This WST review notes that while the company identifies as a forex service provider, the scope and nature of its trading solutions require further clarification for comprehensive evaluation.

Available information suggests WST maintains an online presence through its official website. Specific details about trading platform types, supported asset classes, and regulatory oversight are not comprehensively detailed in source materials. The lack of detailed operational information presents challenges for thorough assessment of the company's service capabilities and market positioning.

Regulatory Oversight: Available sources do not provide specific information about WST's regulatory status, licensing jurisdictions, or compliance frameworks. This represents a significant information gap for potential clients seeking regulatory protection.

Deposit and Withdrawal Methods: Payment processing options, supported currencies, and transaction procedures are not detailed in accessible documentation. This limits assessment of operational convenience.

Minimum Deposit Requirements: Specific capital requirements for account opening and trading participation are not specified in available materials.

Promotional Offers: Information about welcome bonuses, trading incentives, or promotional campaigns is not documented in source materials.

Trading Assets: WST positions itself as a forex service provider. However, the specific currency pairs, asset categories, and trading instruments available through WST are not comprehensively listed.

Cost Structure: Details about spreads, commissions, overnight fees, and other trading costs are not provided in available documentation. This makes cost comparison challenging.

Leverage Options: Maximum leverage ratios, margin requirements, and risk management parameters are not specified in accessible sources.

Platform Selection: Trading platform options, software providers, and technical capabilities are not detailed in this WST review due to information limitations.

Geographic Restrictions: Service availability by region and any territorial limitations are not documented in source materials.

Customer Support Languages: Available languages for client support and communication are not specified in accessible documentation.

The evaluation of WST's account conditions faces significant limitations due to insufficient information in available sources. Traditional forex brokers typically offer multiple account types ranging from basic retail accounts to professional trading solutions. However, WST's specific account structure is not documented in accessible materials.

Minimum deposit requirements serve as crucial entry barriers for potential traders. These requirements are not specified in available documentation. This information gap prevents assessment of accessibility for different trader segments, from beginners with limited capital to experienced traders seeking premium services.

Account opening procedures, verification requirements, and documentation standards are not detailed in source materials. Modern forex brokers typically implement KYC compliance procedures. However, WST's specific onboarding process remains unclear based on available information.

Special account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions are not mentioned in accessible documentation. This WST review cannot provide definitive guidance on accommodation for specific religious or cultural trading requirements without additional information from the broker.

Assessment of WST's trading tools and analytical resources is constrained by limited information availability in source materials. Contemporary forex brokers typically provide comprehensive suites including technical analysis tools, economic calendars, market research, and automated trading capabilities. However, WST's specific offerings are not detailed.

Research and analysis resources form critical components of informed trading decisions. These resources are not documented in available sources. Professional forex services commonly include market commentary, technical analysis reports, and fundamental research. However, WST's research capabilities remain unspecified.

Educational resources for trader development, including webinars, tutorials, and market education materials, are not mentioned in accessible documentation. The availability of learning materials significantly impacts broker suitability for novice traders. However, this evaluation cannot assess WST's educational commitment.

Automated trading support, including Expert Advisor compatibility and algorithmic trading infrastructure, is not addressed in available materials. Modern trading environments increasingly emphasize automation capabilities. However, WST's technical support for automated strategies requires clarification.

Evaluation of WST's customer service framework is limited by insufficient information in available sources. Effective forex brokers typically maintain multi-channel support systems including live chat, telephone support, and email assistance. However, WST's specific support infrastructure is not documented.

Response time standards and service quality metrics are not provided in accessible materials. Professional forex services commonly commit to specific response timeframes and service level agreements. However, WST's support performance standards remain unclear.

Multi-language support capabilities are essential for international forex operations. These capabilities are not detailed in available documentation. Global forex brokers typically provide support in multiple languages to serve diverse client bases. However, WST's language capabilities require verification.

Operating hours for customer support, including weekend and holiday availability, are not specified in source materials. This WST review cannot assess the accessibility of support services across different time zones without additional information.

Assessment of WST's trading experience is significantly limited by information gaps in available sources. Platform stability and execution speed are critical factors for forex trading success. These factors are not documented in accessible materials. Professional forex environments require reliable infrastructure and rapid order processing. However, WST's technical performance remains unverified.

Order execution quality, including slippage rates and requote frequency, is not detailed in available documentation. These factors significantly impact trading profitability and user satisfaction. However, specific performance metrics for WST are not provided.

Platform functionality and feature completeness are not comprehensively described in source materials. Modern forex platforms typically include advanced charting, multiple order types, and risk management tools. However, WST's platform capabilities require detailed verification.

Mobile trading experience is increasingly important for contemporary forex traders. This experience is not addressed in accessible documentation. The availability and functionality of mobile applications significantly impact trading flexibility. However, WST's mobile solutions are not specified in this WST review.

Evaluation of WST's trustworthiness faces substantial challenges due to limited regulatory information in available sources. Regulatory licensing serves as the primary foundation for broker credibility. However, WST's specific regulatory status is not documented in accessible materials.

Client fund protection measures, including segregated account structures and deposit insurance, are not detailed in available documentation. These protections form critical safeguards for trader capital. However, WST's security arrangements require verification.

Corporate transparency, including financial reporting and operational disclosure, is not comprehensively addressed in source materials. Established forex brokers typically maintain transparent operations with regular financial reporting. However, WST's transparency standards remain unclear.

Industry reputation and third-party evaluations are not extensively documented in available sources. Professional recognition and peer assessments provide valuable credibility indicators. However, comprehensive reputation analysis for WST requires additional research.

Assessment of WST's user experience is constrained by limited feedback and interface information in available sources. Overall user satisfaction levels are typically measured through reviews and testimonials. These levels are not documented in accessible materials.

Interface design and platform usability are critical factors for trading efficiency. These factors are not detailed in available documentation. User-friendly design significantly impacts trading performance and satisfaction. However, WST's interface quality requires direct evaluation.

Registration and account verification processes are not comprehensively described in source materials. Streamlined onboarding procedures enhance user experience. However, WST's account setup efficiency remains unspecified.

Common user concerns and complaint patterns are not documented in available sources. Understanding typical user challenges helps assess service quality. However, comprehensive user feedback analysis for WST is not available in this review.

This comprehensive WST review reveals significant information limitations that prevent definitive assessment of the broker's services and capabilities. WST positions itself as a forex trading service provider. However, the lack of detailed information about regulatory status, trading conditions, platform capabilities, and user experiences creates substantial evaluation challenges.

The absence of specific regulatory information, trading costs, platform details, and user feedback suggests that potential clients should exercise considerable caution and conduct additional research before engaging with WST's services. The information gaps identified throughout this evaluation highlight the importance of transparency in forex broker operations.

Based on available information, this review cannot provide a clear recommendation for or against WST's services. Potential users are advised to seek additional information directly from the broker and verify regulatory status before making trading decisions.

FX Broker Capital Trading Markets Review