Regarding the legitimacy of WST forex brokers, it provides VFSC and WikiBit, .

Is WST safe?

Pros

Cons

Is WST markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

WALLSTREND HOLDING GROUP CO., LTD

Effective Date:

2019-02-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is WST Safe or a Scam?

Introduction

WST, also known as Wall Strend, is a forex broker established in 2017, primarily targeting clients in the United States and China. As the forex market continues to grow, traders are increasingly seeking reliable brokers that can offer a secure trading environment. However, with the rise of online trading platforms, the risk of encountering scams has also increased, making it crucial for traders to thoroughly evaluate the legitimacy of any broker before committing their funds. This article aims to provide an objective analysis of WST, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of multiple credible sources, including regulatory databases and user feedback, allowing us to assess whether WST is indeed safe for trading or potentially a scam.

Regulation and Legitimacy

The regulatory framework surrounding forex brokers is vital for ensuring the safety and security of traders' funds. A well-regulated broker typically adheres to stringent compliance standards, which can significantly reduce the risk of fraud. In the case of WST, the regulatory information is concerning. The broker has been associated with the Vanuatu Financial Services Commission (VFSC), but reports indicate that their license has been revoked. This raises significant red flags regarding their operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 40346 | Vanuatu | Revoked |

The revocation of WST's license suggests a lack of oversight that could expose clients to potential risks. Furthermore, the absence of regulation by more reputable authorities such as the U.S. Securities and Exchange Commission (SEC) or the Financial Conduct Authority (FCA) only adds to the uncertainty surrounding the broker's operations. It is essential for traders to recognize that the absence of robust regulatory oversight can lead to issues such as fraudulent practices, mismanagement of funds, and inadequate investor protection. Therefore, the question of is WST safe remains highly pertinent.

Company Background Investigation

WST was founded in 2017, positioning itself as a broker that aims to provide a variety of trading services. However, the company's background and ownership structure are not well-documented, which raises concerns about transparency. A thorough investigation into the management team reveals limited information about their professional experience and qualifications. This lack of clarity can lead to skepticism regarding the broker's operational integrity.

Moreover, the company's transparency in disclosing its financial health and operational practices appears to be lacking. Traders typically expect brokers to provide comprehensive information about their business practices, including financial statements and organizational structure. The absence of such information can make it challenging for potential clients to assess the broker's reliability. Therefore, the question of is WST safe becomes increasingly complex, as a broker without a clear and transparent background may pose additional risks to traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is crucial. WST claims to provide competitive trading fees, but feedback from users suggests otherwise. The broker's fee structure includes spreads and commissions that may not align with industry standards, which can impact traders' profitability.

| Fee Type | WST | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

Reports from users indicate that some fees may be hidden or not clearly communicated, leading to unexpected costs during trading. Such practices can create an environment of distrust and suspicion among traders, further complicating the question of is WST safe. It is imperative for traders to be aware of all potential costs associated with their trading activities to make informed decisions.

Customer Fund Safety

The safety of customer funds is a primary concern for any trader when selecting a broker. WST claims to implement various measures to protect client funds, including segregated accounts. However, the effectiveness of these measures is questionable, especially considering the broker's revoked license.

Traders need to be aware of the implications of using a broker that lacks robust regulatory oversight. Without a reliable safety net, such as investor compensation schemes, clients may find themselves vulnerable to losing their funds in the event of financial mismanagement or fraud. Additionally, the absence of negative balance protection policies can expose traders to significant financial risk. The history of any past incidents related to fund security can also provide valuable insights into the broker's reliability. Therefore, the question of is WST safe is not just about current practices but also about the historical context of fund management.

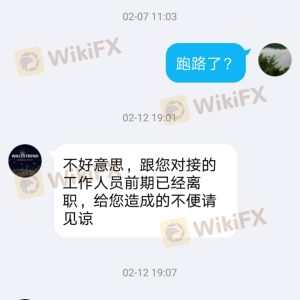

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. Reviews of WST reveal a mixed bag of experiences, with some users expressing satisfaction with the trading platform and customer support, while others report significant issues, including account freezes and poor communication from the broker's representatives.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Account Freezes | High | Slow Response |

| Misleading Information | High | Unresolved |

| Withdrawal Issues | High | Unresponsive |

Common complaints include account freezes without clear explanations and difficulties in withdrawing funds. Such issues can severely impact traders' experiences and trust in the broker. For instance, one user reported that their account was frozen after a series of miscommunications with the broker's agents, leading to significant financial losses. These patterns of complaints raise serious concerns about the broker's operational practices and customer service quality. Thus, the question of is WST safe is further validated by the experiences of its users.

Platform and Execution

The trading platform's performance is another critical factor in assessing a broker's reliability. WST claims to offer a user-friendly platform with fast execution speeds. However, user feedback suggests that there are significant issues related to order execution quality, including slippage and rejected orders. Such problems can severely impact traders' ability to execute their strategies effectively.

Moreover, indications of potential platform manipulation have been reported, where traders experienced unexpected price changes that were not aligned with market trends. This raises further questions about the integrity of WST's trading environment. Therefore, the inquiry into is WST safe encompasses not only the broker's claims but also the actual trading experience reported by users.

Risk Assessment

Using WST entails several risks that traders must be aware of before committing their funds. The lack of regulatory oversight, combined with user complaints regarding fund security and execution issues, contributes to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases potential for fraud. |

| Financial Risk | High | Concerns over fund safety and management practices. |

| Operational Risk | Medium | Issues with execution and customer service. |

To mitigate these risks, traders should consider diversifying their investments and using risk management strategies, such as setting stop-loss orders. Additionally, it is advisable to start with a demo account to familiarize oneself with the platform before committing substantial capital. Thus, the question of is WST safe emphasizes the importance of understanding and managing potential risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that WST may not be a safe choice for traders. The combination of revoked regulatory licenses, questionable customer experiences, and potential issues with fund safety raises significant concerns about the broker's legitimacy. Therefore, traders should exercise caution and consider alternative options that are regulated by reputable authorities.

For those seeking reliable forex trading platforms, it is advisable to explore brokers that are overseen by top-tier regulators, such as the SEC or FCA, ensuring a safer trading environment. Some recommended alternatives include brokers with established reputations and positive user feedback, which can provide a more secure trading experience. Ultimately, the question of is WST safe is best answered with a resounding caution, advising traders to prioritize their safety and security when selecting a forex broker.

Is WST a scam, or is it legit?

The latest exposure and evaluation content of WST brokers.

WST Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WST latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.