CMPL 2025 Review: Everything You Need to Know

Executive Summary

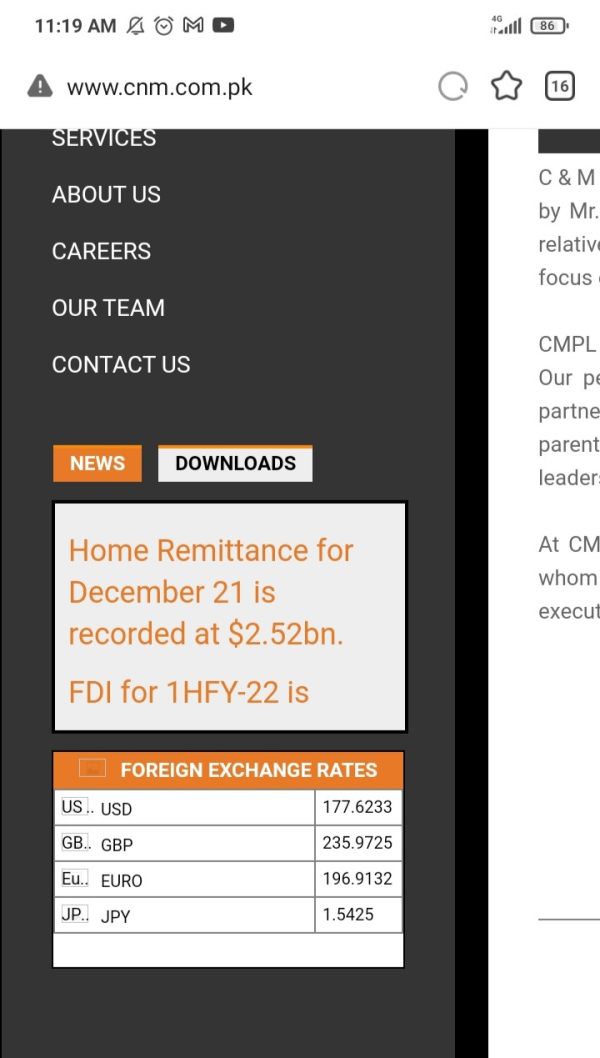

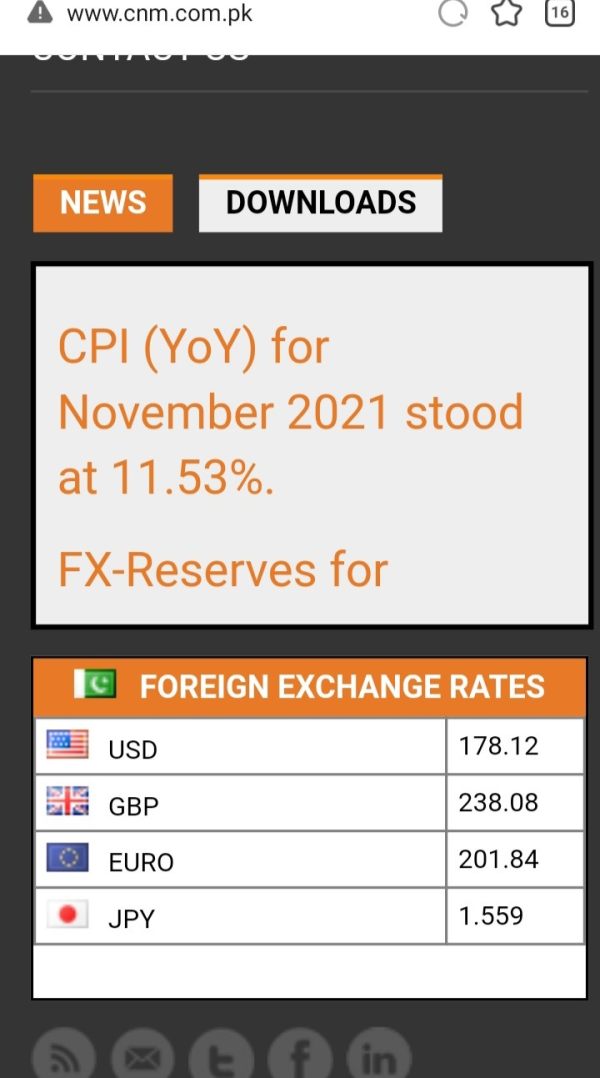

This comprehensive cmpl review examines a financial services company that has been operating since 2010. CMPL works as a money market and foreign exchange brokerage service provider, offering trading opportunities across multiple asset classes including forex, CFDs, commodities, and indices. Our analysis shows major concerns about the broker's regulatory status, as CMPL currently operates without proper regulatory oversight from recognized financial authorities.

CMPL received mixed employee ratings with an overall score of 3.9 out of 5, though job security ratings remain low at 3 points. Despite these moderate internal ratings, the broker's website cmpl.net maintains a positive trust score among users. The company targets traders seeking diversified trading instruments, but potential clients must carefully consider the regulatory risks associated with choosing an unregulated broker in today's complex financial landscape.

Important Notice

Traders should know that CMPL operates as an unregulated entity. This means different regional regulatory environments may present varying levels of risk and protection. The absence of oversight from established financial regulators such as the FCA, ASIC, or CySEC means that client funds may not benefit from standard investor protection schemes available with regulated brokers.

This evaluation is based on publicly available information and user feedback collected from various sources. Information may be subject to updates, and potential discrepancies could exist due to the dynamic nature of broker operations and policy changes. Traders are strongly advised to conduct their own research and verify current information directly with the broker before making any investment decisions.

Rating Framework

Broker Overview

CMPL was incorporated on June 1, 2010, under the Companies Ordinance 1984, establishing its headquarters in Pakistan. The company presents itself as a relatively new entity in the financial services sector, with founding sponsors focused on creating a delivery system specifically designed to provide top-tier money market and foreign exchange brokerage services to valued clients. The broker's team reportedly comprises experienced bankers and professionals with significant experience in related financial fields.

The company operates as a specialized financial services provider, concentrating primarily on currency markets and forex brokerage operations. CMPL's business model centers around providing access to multiple trading instruments including foreign exchange pairs, contracts for difference, commodity trading, and various market indices. This cmpl review finds that while the broker offers diverse trading opportunities, the lack of detailed operational information raises questions about transparency and client communication standards.

Regulatory Status: CMPL currently operates without regulation from recognized financial authorities, presenting potential risks for traders seeking protected investment environments.

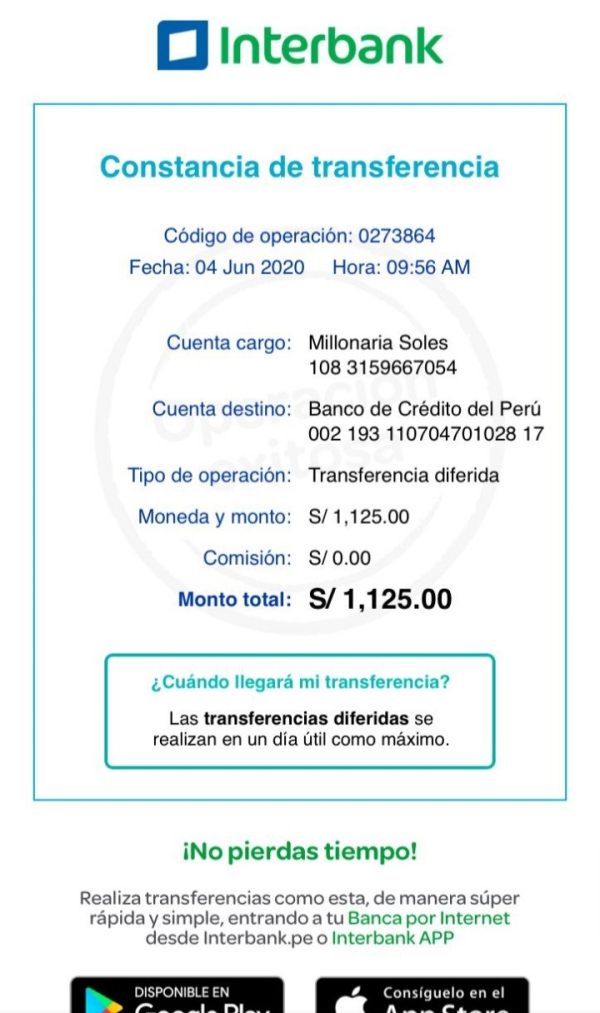

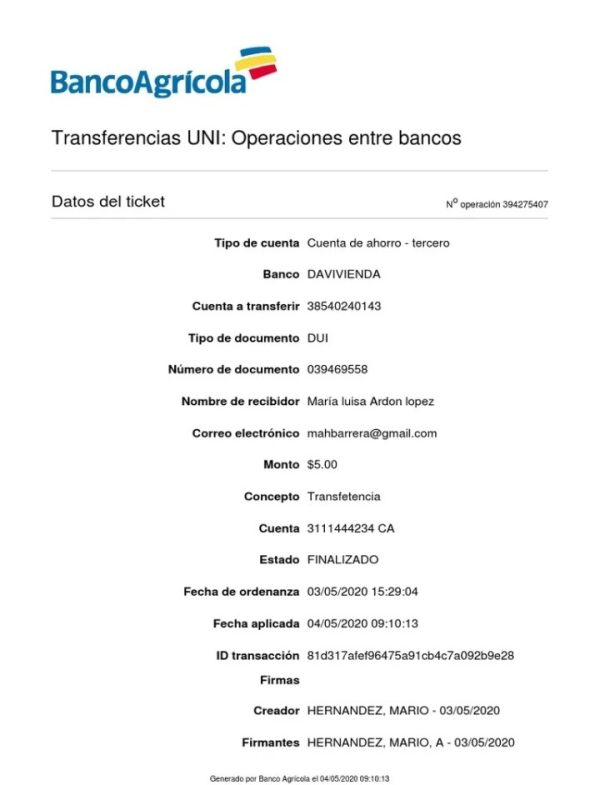

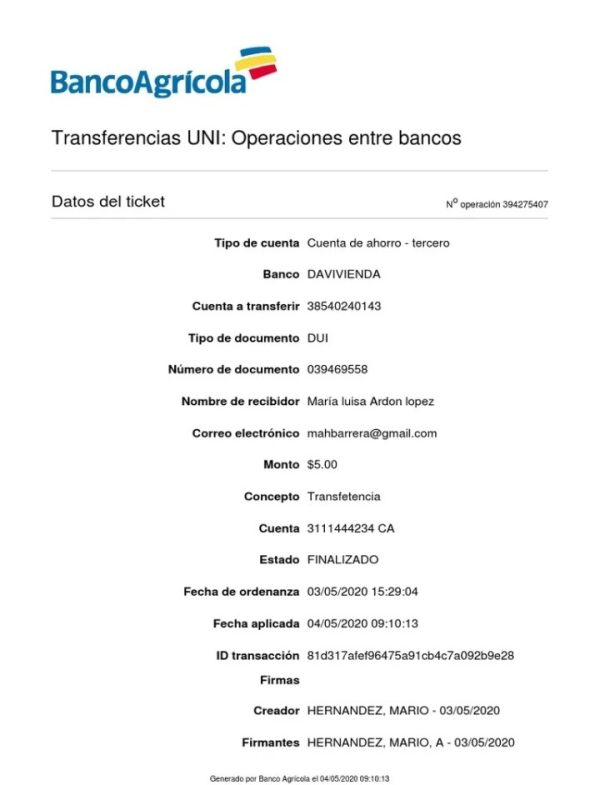

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in available documentation, which may indicate limited banking partnerships or disclosure practices.

Minimum Deposit Requirements: The broker has not clearly specified minimum deposit requirements in publicly available materials. This makes it difficult for potential clients to plan their initial investment strategies.

Bonus and Promotions: No specific information about promotional offers, welcome bonuses, or trading incentives is available in current documentation.

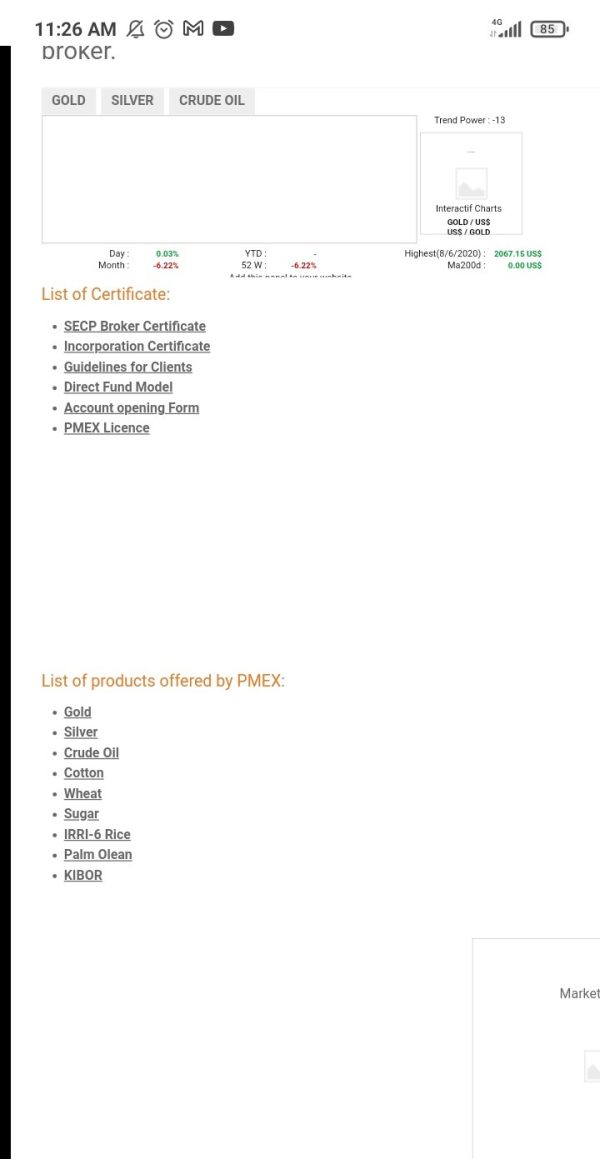

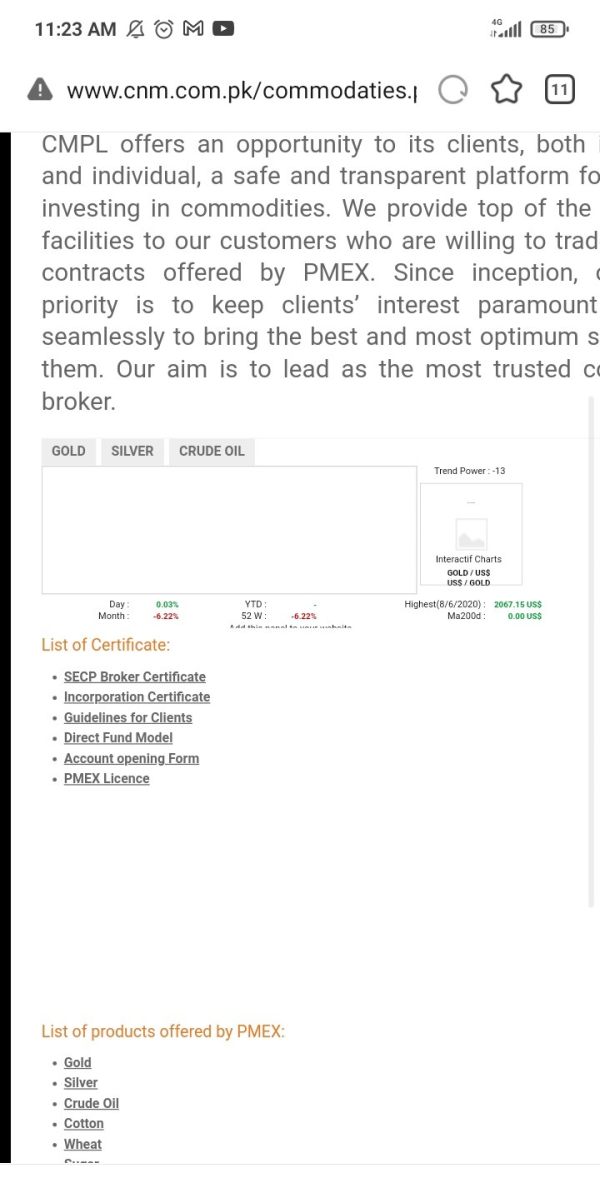

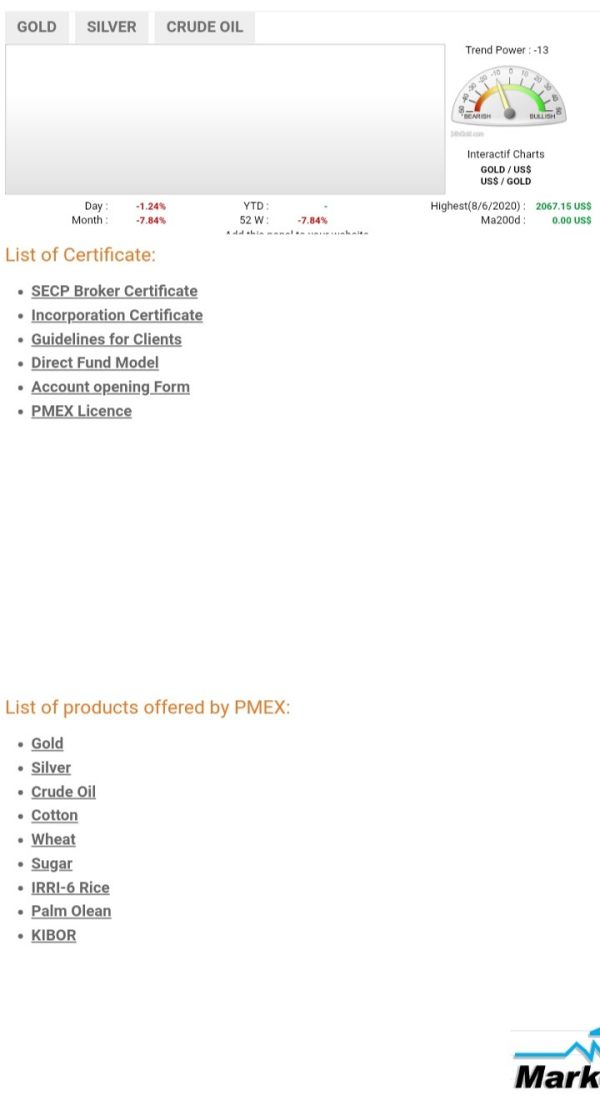

Tradable Assets: CMPL provides access to foreign exchange markets, contracts for difference, commodity trading, and various stock indices, offering a reasonably diverse range of trading instruments for different investment strategies.

Cost Structure: Critical information regarding spreads, commissions, overnight fees, and other trading costs remains unspecified. This creates uncertainty about the true cost of trading with this cmpl review subject.

Leverage Ratios: Specific leverage options and maximum leverage ratios are not detailed in available broker information.

Platform Options: The broker has not provided clear information about available trading platforms, mobile applications, or proprietary software solutions.

Geographic Restrictions: Information about regional restrictions or prohibited countries is not specified in current documentation.

Customer Service Languages: Available customer support languages are not detailed in accessible broker materials.

Account Conditions Analysis

The account conditions offered by CMPL remain largely unclear due to insufficient publicly available information. This cmpl review finds that the broker has not provided comprehensive details about account types, tier structures, or specific features that differentiate various account offerings. The absence of clear minimum deposit requirements makes it challenging for potential traders to understand entry-level investment expectations or to compare CMPL's accessibility against industry standards.

Account opening procedures and verification processes are not detailed in available documentation, which raises concerns about operational transparency. The lack of information about special account features, such as Islamic accounts for Muslim traders or institutional account options, suggests either limited service diversity or inadequate marketing communication. Without clear account condition specifications, traders cannot make informed decisions about whether CMPL's offerings align with their trading strategies and risk management requirements.

The absence of detailed account information also extends to unclear policies regarding account maintenance, inactivity fees, and account closure procedures. All of these are standard disclosure items for reputable brokers in the industry.

CMPL's trading tools and resources appear limited based on available information. The broker provides access to forex, CFDs, commodities, and indices trading but lacks detailed specifications about analytical tools and research resources. The absence of information about market analysis capabilities, real-time news feeds, economic calendars, and charting tools suggests either minimal tool offerings or poor communication about available resources.

Educational resources, which are crucial for trader development, are not mentioned in available broker documentation. The lack of webinars, tutorials, trading guides, or market education materials indicates that CMPL may not prioritize trader education and skill development. This absence is particularly concerning for new traders who require comprehensive learning resources to develop effective trading strategies.

Automated trading support, including expert advisor compatibility, algorithmic trading tools, and API access, remains unspecified. Modern traders increasingly rely on automated solutions, and the lack of clear information about these capabilities may limit CMPL's appeal to technologically sophisticated traders. The overall assessment suggests that CMPL's tools and resources may not meet contemporary trader expectations for comprehensive trading support.

Customer Service and Support Analysis

Customer service quality and availability remain unclear based on available information about CMPL's operations. The broker has not provided specific details about customer support channels, whether through live chat, email, phone support, or help desk systems. This lack of transparency about communication methods raises concerns about client support accessibility and responsiveness.

Response time expectations and service quality standards are not documented in available materials. This makes it impossible to assess whether CMPL maintains professional customer service standards. The absence of information about support team expertise, problem-solving capabilities, and technical assistance availability suggests potential limitations in client support infrastructure.

Multilingual support options, which are essential for international brokers, are not specified in current documentation. The lack of clear information about customer service hours, time zone coverage, and emergency support availability further compounds concerns about CMPL's commitment to comprehensive client service. Without documented customer service policies and performance standards, traders cannot assess whether CMPL provides adequate support for their trading activities and account management needs.

Trading Experience Analysis

The trading experience offered by CMPL remains largely unknown due to insufficient information about platform stability, execution speed, and overall trading environment quality. This cmpl review cannot assess platform reliability, server uptime, or connection stability without access to technical performance data or user experience reports detailing actual trading conditions.

Order execution quality, including fill rates, slippage statistics, and execution speed metrics, are not documented in available broker information. These factors are crucial for trader success, particularly for scalping strategies and high-frequency trading approaches. The absence of execution quality data makes it impossible to evaluate whether CMPL provides competitive trading conditions compared to established industry players.

Mobile trading capabilities and cross-platform synchronization features are not detailed in current documentation. This is concerning given the growing importance of mobile trading solutions. The lack of information about platform functionality, advanced order types, one-click trading, and risk management tools suggests either limited platform capabilities or inadequate communication about available features. Without comprehensive trading experience documentation, potential clients cannot assess whether CMPL's trading environment meets their operational requirements and performance expectations.

Trust and Safety Analysis

CMPL's trust and safety profile presents significant concerns due to the broker's unregulated status and lack of oversight from recognized financial authorities. The absence of regulation from established bodies such as the Financial Conduct Authority, Australian Securities and Investments Commission, or Cyprus Securities and Exchange Commission means that client funds do not benefit from standard investor protection schemes, compensation funds, or regulatory safeguards.

Fund security measures, including segregated account policies, client money protection, and banking partnerships, are not detailed in available documentation. This lack of transparency about financial safeguards raises serious questions about client fund security and the broker's commitment to maintaining industry-standard protection protocols. The absence of information about insurance coverage, audit procedures, and financial reporting further compounds trust concerns.

Company transparency regarding ownership structure, financial statements, and operational policies remains limited. Without regulatory oversight, there are no mandatory disclosure requirements that would typically provide traders with essential information about broker financial stability and operational integrity. The positive website trust rating mentioned in available information provides minimal reassurance given the absence of comprehensive regulatory protection and transparency measures.

User Experience Analysis

User experience with CMPL shows mixed results based on available feedback. Employee ratings of 3.9 out of 5 indicate moderate satisfaction levels among staff members. However, the notably low job security rating of 3 points raises concerns about internal stability and long-term operational continuity. These internal ratings may reflect broader organizational challenges that could impact client service quality and business reliability.

Website interface design and navigation ease are not specifically addressed in available user feedback. This makes it difficult to assess the quality of the client-facing digital experience. Account registration and verification processes remain undocumented, preventing evaluation of onboarding efficiency and user-friendliness. The absence of detailed user journey information suggests either limited user engagement or insufficient feedback collection mechanisms.

Fund management experience, including deposit and withdrawal processes, transaction speeds, and fee transparency, lacks specific user testimonials or documented procedures. Common user complaints and satisfaction patterns are not detailed in available information, preventing a comprehensive assessment of typical client experiences. The target user profile appears to be traders seeking diversified trading instruments, but without detailed user feedback, it's unclear whether CMPL successfully meets these client expectations and requirements.

Conclusion

This comprehensive cmpl review reveals that CMPL operates as a multi-asset broker offering forex, CFDs, commodities, and indices trading services. However, significant concerns exist regarding regulatory oversight and operational transparency. The broker's unregulated status represents the primary risk factor for potential clients, as it eliminates standard investor protections and regulatory safeguards typically available with licensed financial service providers.

CMPL may be suitable for experienced traders seeking diversified trading instruments who understand and accept the risks associated with unregulated brokers. However, the lack of detailed information about account conditions, trading costs, platform capabilities, and customer service standards makes it difficult to recommend this broker for most trading scenarios. The moderate employee satisfaction ratings and positive website trust scores provide limited reassurance given the absence of regulatory protection and comprehensive operational transparency.

The main advantages include access to multiple asset classes and potentially flexible trading conditions. The significant disadvantages encompass the lack of regulation, insufficient cost transparency, and limited publicly available information about trading conditions and client protections.