ASFX 2025 Review: Everything You Need to Know

Executive Summary

ASFX is a forex broker worth considering for investment. However, the broker lacks clear regulatory information in its available documentation, which raises some concerns. This asfx review shows that ASFX stands out by offering the MetaTrader 5 trading platform and supporting multiple asset classes, including forex, stocks, energy commodities, precious metals, and cryptocurrencies. The platform works well for traders who want different investment options in one place.

ASFX provides educational resources to help traders make smart decisions. This shows the broker cares about helping clients grow their skills. But investors should know that the lack of clear regulatory oversight creates certain risks. The broker offers many asset classes through the popular MT5 platform, which suggests it wants to provide complete trading solutions, though traders should think carefully about the limited regulatory transparency when choosing this broker.

Important Notice

This asfx review uses information available as of March 10, 2024. The review does not include detailed user ratings or comprehensive complaint analysis because limited data is available. Available sources did not mention regulatory information, which may mean there are hidden fees or poor trading conditions that are not obvious right away. Traders should do their own research and check current terms and conditions directly with the broker before making investment decisions.

Rating Framework

ASFX receives the following ratings across six key areas based on available information:

Broker Overview

ASFX works as a forex and multi-asset broker. Available sources do not mention when the company started or its background details. The broker focuses on giving traders access to different financial markets through one trading platform, though complete details about how it operates remain unclear from current documentation.

The broker has found its place in the competitive forex market by offering the well-known MetaTrader 5 trading platform. This serves as its main trading interface. ASFX supports trading across multiple asset types including foreign exchange pairs, individual stocks, energy commodities, precious metals, and cryptocurrency instruments. This wide range of assets suggests the broker wants to serve traders with different investment preferences and strategies, though this asfx review notes that available sources did not mention specific regulatory oversight information, which is an important consideration for potential clients checking the broker's credibility and transparency.

Regulatory Status: Available sources do not mention specific regulatory authorities that oversee ASFX operations. This may raise concerns about investor protection and operational oversight.

Deposit and Withdrawal Methods: Current documentation does not mention specific information about available deposit and withdrawal methods. Traders need to ask the broker directly.

Minimum Deposit Requirements: Available sources do not specify the minimum deposit amount required to open an account with ASFX.

Bonus and Promotions: Available documentation does not mention information about welcome bonuses, promotional offers, or trading incentives.

Tradeable Assets: ASFX offers access to foreign exchange pairs, individual stocks, energy commodities, precious metals, and cryptocurrency instruments. This gives traders diverse investment opportunities.

Cost Structure: Available sources do not detail specific information about spreads, commissions, overnight fees, and other trading costs. This makes it hard to judge how competitive the broker's pricing is.

Leverage Options: Current documentation does not mention available leverage ratios for different asset classes.

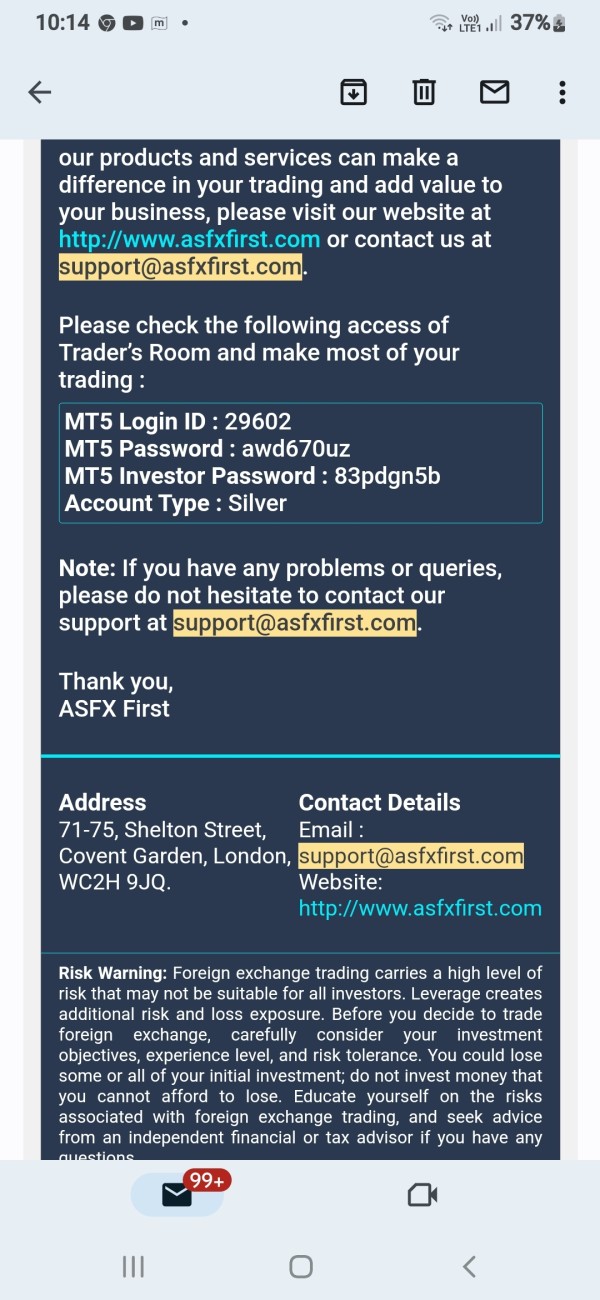

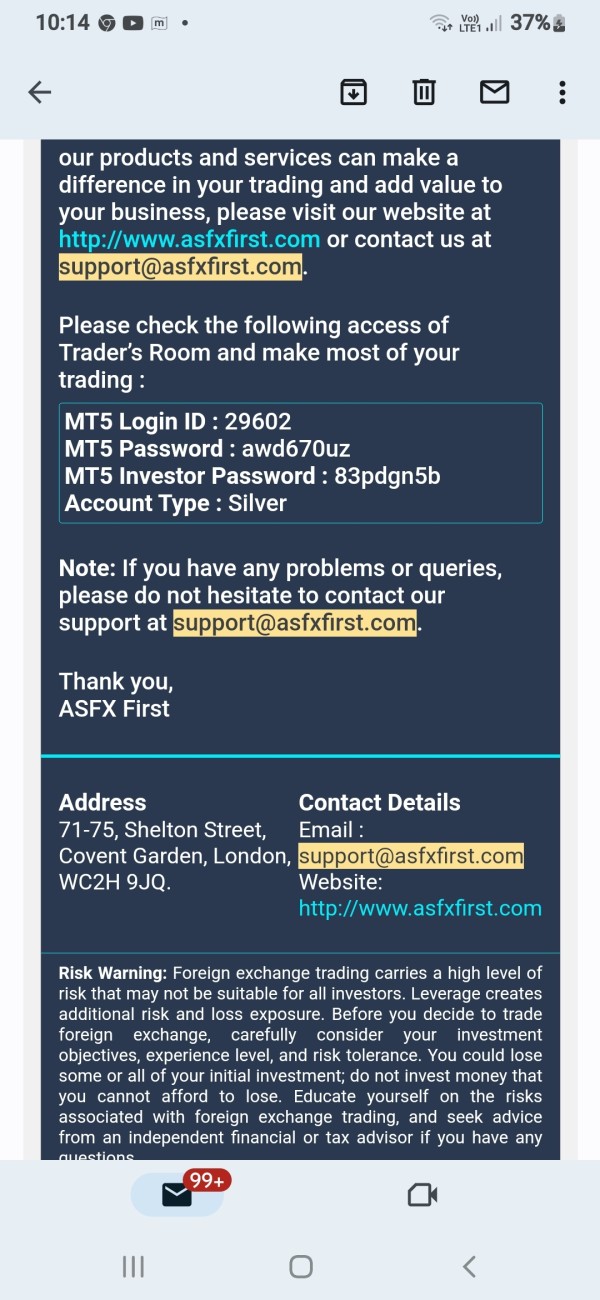

Platform Options: The broker provides the MetaTrader 5 trading platform as its main trading interface.

Geographic Restrictions: Available sources do not mention information about countries or regions where ASFX services may be restricted.

Customer Support Languages: Current documentation does not specify the languages that ASFX customer service supports.

This asfx review shows that potential clients need to get additional information directly from the broker about these essential trading details.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of ASFX's account conditions faces big limitations because available sources lack specific information. Current documentation does not mention details about the variety of account types offered, their special features, and related benefits. This lack of transparency makes it hard for potential clients to understand what account options might be available and how they might work with different trading strategies or experience levels.

Available sources do not specify minimum deposit requirements, which usually serve as a key factor in broker selection. The account opening process, required documentation, verification procedures, and timeframes are also not detailed. Information about special account features, such as Islamic accounts for traders who need swap-free trading conditions, is also missing from current documentation.

This asfx review cannot provide a meaningful rating for this dimension without access to comprehensive account condition details. Potential clients should contact ASFX directly to get specific information about available account types, their features, minimum deposit requirements, and any special conditions that may apply.

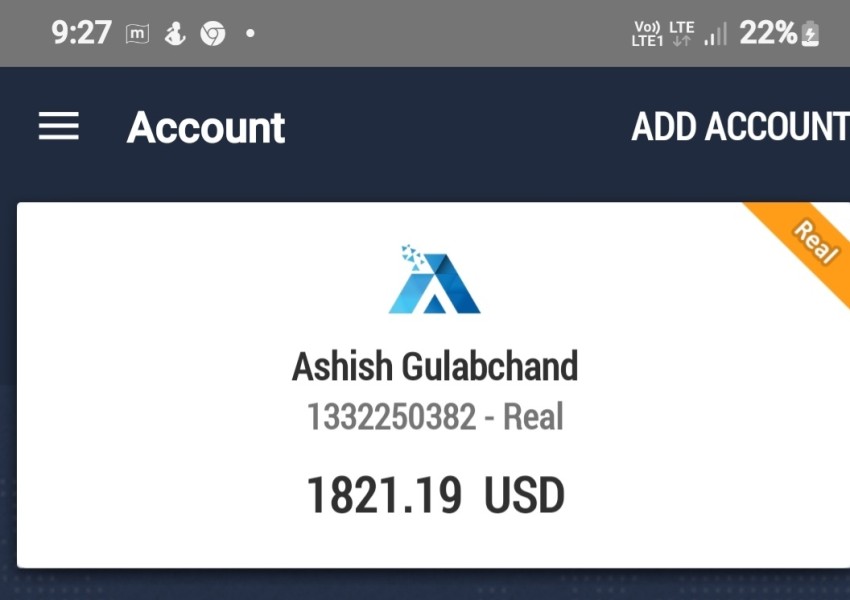

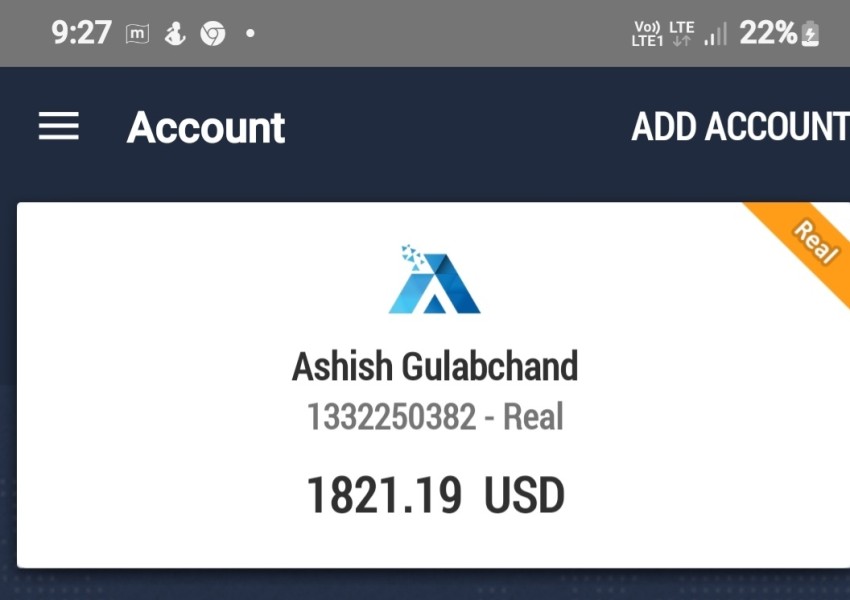

ASFX shows strength in its platform offering by providing the MetaTrader 5 trading environment. MT5 is widely known as a professional-grade trading platform. MT5 offers advanced charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and a comprehensive trading interface that appeals to both new and experienced traders.

The broker shows commitment to trader education by providing educational resources designed to help clients make informed trading decisions. This educational focus suggests ASFX knows how important client development and long-term trading success are, which is a positive sign for the broker's approach to client relationships. The availability of multiple asset classes including forex, stocks, energy commodities, precious metals, and cryptocurrencies through a single platform represents a big advantage for traders seeking portfolio diversification, since this multi-asset approach allows clients to respond to various market opportunities without maintaining accounts with multiple brokers.

Available sources do not mention specific details about additional research and analysis resources, market commentary, economic calendars, or proprietary trading tools. The extent of automated trading support and any platform customization options also remain unclear from current documentation.

Customer Service and Support Analysis

The assessment of ASFX's customer service capabilities is significantly limited by the absence of specific information in available sources. Available documentation does not mention critical details such as available support channels, whether through live chat, email, telephone, or social media platforms. This lack of information makes it impossible to evaluate how accessible and convenient it is to reach customer support when needed.

Available sources do not detail response time expectations, service quality standards, and the availability of multilingual support. Information about customer service operating hours, including whether support is available around the clock to accommodate global trading schedules, is also missing. The geographical coverage of customer support and any regional variations in service availability remain unclear.

This evaluation cannot provide meaningful insights into the actual quality of customer service provided by ASFX without access to customer feedback about support experiences, problem resolution effectiveness, or staff expertise. The absence of specific complaint handling procedures or escalation processes in available documentation further limits the assessment of customer support capabilities.

Trading Experience Analysis

The evaluation of trading experience with ASFX faces substantial limitations due to insufficient specific information in available sources. Platform stability, execution speed, and overall system reliability are crucial factors for trading success, yet current documentation does not detail these technical performance aspects. Order execution quality, including factors such as slippage, requotes, and fill rates, cannot be assessed based on available information.

The functionality and user interface of the MetaTrader 5 platform, while generally well-regarded in the industry, may have specific implementations or customizations by ASFX that are not described in available sources. Available sources do not specifically address mobile trading capabilities, cross-device synchronization, and platform accessibility across different operating systems.

Current documentation does not mention trading environment factors such as market depth, available order types, risk management tools, and real-time data quality. The absence of user feedback regarding actual trading experiences makes it impossible to provide insights into practical platform performance or identify any potential issues that traders might encounter.

This asfx review cannot provide a meaningful rating for trading experience due to the lack of specific technical and performance information in available sources.

Trust and Safety Analysis

The trust and safety evaluation of ASFX reveals significant concerns due to the absence of regulatory information in available sources. Regulatory oversight serves as a fundamental pillar of broker credibility, providing investor protection, operational standards, and recourse mechanisms in case of disputes. The lack of clear regulatory status raises questions about the level of protection available to client funds and the operational standards maintained by the broker.

Available documentation does not mention client fund security measures, such as segregated accounts, deposit insurance, or compensation schemes. The absence of information about regulatory compliance, audit procedures, or third-party oversight creates uncertainty about the broker's commitment to maintaining industry standards and protecting client interests. Available sources do not provide corporate transparency, including details about company ownership, management team, financial stability, and operational history, which makes it difficult for potential clients to assess the broker's credibility and long-term viability.

The absence of information about any regulatory actions, industry recognition, or third-party certifications further complicates the trust assessment.

ASFX receives a low rating for trust and safety given these significant gaps in regulatory and transparency information. This reflects the elevated risk profile associated with unclear regulatory status.

User Experience Analysis

The assessment of user experience with ASFX is constrained by the limited information available in current sources. Available documentation does not specifically address overall user satisfaction levels, interface design quality, and platform usability. The absence of user feedback makes it impossible to gauge actual client experiences or identify common satisfaction or dissatisfaction patterns.

Available sources do not detail registration and account verification processes, which significantly impact initial user experience. The efficiency of these procedures, required documentation, and completion timeframes remain unclear. The user experience related to funding accounts and withdrawal processes cannot be evaluated due to insufficient information.

Current documentation does not describe interface design elements such as navigation intuitiveness, visual clarity, and customization options. The learning curve for new users, availability of tutorials or guided tours, and overall platform accessibility for traders with different experience levels are not addressed.

Available sources cannot identify common user complaints, frequently requested features, or areas where ASFX may excel in user experience. The absence of user testimonials or experience reports limits the ability to provide meaningful insights into the practical aspects of using ASFX services.

Conclusion

This comprehensive asfx review reveals a broker with certain strengths in platform offering and asset diversity, but significant concerns regarding transparency and regulatory oversight. ASFX shows competency in providing the MetaTrader 5 platform and access to multiple asset classes including forex, stocks, commodities, and cryptocurrencies, which appeals to traders seeking diversified investment opportunities within a single platform environment.

The absence of clear regulatory information represents a substantial limitation that affects the overall assessment of the broker's credibility and safety profile. Traders who prioritize regulatory protection and transparent operational standards may find ASFX unsuitable for their needs. The broker appears most appropriate for experienced traders who understand the risks associated with less regulated environments and value platform functionality and asset diversity over regulatory assurance.

Potential clients must conduct thorough due diligence before engaging with ASFX services due to the lack of detailed information about account conditions, costs, customer service, and user experiences.