Is ASFX safe?

Business

License

Is ASFX A Scam?

Introduction

ASFX is a forex broker that has emerged in the online trading landscape, offering a range of financial instruments including forex, commodities, indices, and cryptocurrencies. As a relatively new entrant, it positions itself as a platform designed for traders seeking various account types and high leverage options. However, the rise of online trading has also led to an influx of unregulated brokers, making it essential for traders to carefully assess the credibility and safety of any trading platform. This article aims to provide an objective analysis of ASFX, focusing on its regulatory status, company background, trading conditions, and overall safety for investors. Our investigation is based on a thorough review of multiple sources, including user reviews, regulatory databases, and financial analysis reports.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its safety and legitimacy. Regulatory bodies ensure that brokers adhere to strict financial standards, thereby safeguarding traders' funds and promoting fair trading practices. In the case of ASFX, it operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that ASFX does not provide the protections typically afforded by regulated entities, such as segregated accounts or compensation schemes. This lack of oversight significantly increases the risks associated with trading on this platform. Furthermore, ASFX claims to be based in the UK, yet there is no record of its existence in the Financial Conduct Authority (FCA) database, suggesting that it may not be operating legally within that jurisdiction. This situation presents a red flag for potential investors, as unregulated brokers often lack accountability and can engage in dubious practices.

Company Background Investigation

ASFX is registered under the name ASFX Markets Incorporated, with its purported headquarters located at 4th Floor, 107 Leadenhall Street, London, EC3A 4AF, United Kingdom. However, the lack of transparency surrounding its ownership and management structure raises additional concerns. The company's website provides minimal information about its history or the individuals behind its operations.

The management team's background is not disclosed, which is unusual for a trading platform. Typically, reputable brokers provide information about their leadership to establish credibility. The absence of such details can indicate a lack of accountability and transparency, which are crucial for building trust with potential clients. Furthermore, the company's relatively recent establishment (in 2021) and the lack of a proven track record in the industry further diminish confidence in its operations.

Trading Conditions Analysis

Understanding the trading conditions offered by ASFX is vital for potential users. The broker claims to provide various account types, including micro, mini, prime, luxury, and Islamic accounts, with a minimum deposit requirement of $100. However, the overall fee structure raises concerns.

| Fee Type | ASFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.2 pips | 0.6 - 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Unspecified | Varies |

ASFX advertises zero commissions, which may seem appealing; however, the spreads are significantly wider than those offered by regulated brokers. A spread of 2.2 pips for major currency pairs is notably high and could substantially impact trading profitability. Additionally, the lack of clarity regarding overnight interest rates and potential hidden fees raises questions about the overall cost of trading on this platform. Traders should be cautious, as higher trading costs can erode profits and increase the risk of losses.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. ASFX does not provide adequate information regarding its fund security measures, which is a significant drawback. The absence of segregated accounts means that client funds may not be kept separate from the broker's operational funds, increasing the risk of loss in the event of insolvency.

Moreover, ASFX does not offer negative balance protection, a crucial feature that prevents traders from losing more than their initial investment. This lack of protective measures can lead to severe financial consequences for traders, especially in volatile market conditions. The historical absence of any reported security incidents or fund mismanagement does not mitigate the risk, as the lack of regulation means there is no oversight to ensure that client funds are handled responsibly.

Customer Experience and Complaints

Analyzing customer feedback is essential in understanding the overall user experience with ASFX. Many reviews indicate a pattern of complaints regarding withdrawal difficulties, high fees, and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Limited |

| Customer Support | High | Poor |

Several users have reported being unable to withdraw their funds, which is a common issue with unregulated brokers. Complaints about high fees and lack of transparency regarding the fee structure further exacerbate these concerns. Additionally, the quality of customer support has been criticized, with many users stating that their inquiries went unanswered or were met with inadequate responses. These patterns of complaints suggest that ASFX may not prioritize customer satisfaction, raising further doubts about its reliability.

Platform and Trade Execution

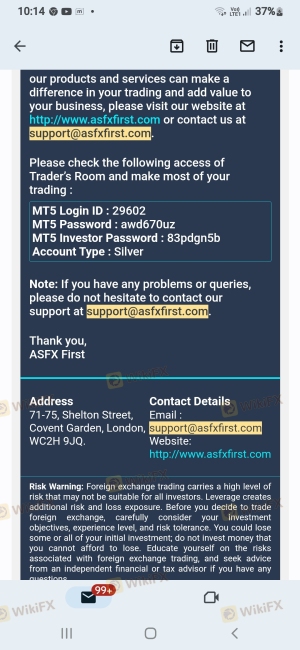

Evaluating the performance of the trading platform is crucial for any trader. ASFX claims to utilize the MetaTrader 5 platform, known for its user-friendly interface and advanced trading tools. However, there have been reports of issues accessing the platform, including security warnings when attempting to connect.

The execution quality of orders, including slippage and rejection rates, is another critical aspect to consider. While ASFX claims to provide a seamless trading experience, the lack of regulatory oversight raises concerns about potential manipulation of trading conditions. Traders should be wary of platforms that do not provide transparent execution policies, as this can lead to unexpected costs and losses.

Risk Assessment

Using ASFX presents several risks that traders should carefully consider. The lack of regulation, high trading costs, and poor customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | High spreads and potential hidden fees |

| Operational Risk | Medium | Platform access issues and execution quality |

To mitigate these risks, traders should conduct thorough research before investing with ASFX. It is advisable to start with a demo account, if available, to familiarize oneself with the platform's functionality and trading conditions before committing real funds.

Conclusion and Recommendations

In conclusion, ASFX presents several red flags that suggest it may not be a safe or reliable trading option. The absence of regulation, high trading costs, and negative customer feedback indicate that traders should exercise extreme caution. While ASFX offers a variety of trading instruments and account types, the risks associated with trading on this platform outweigh the potential benefits.

For traders seeking safer alternatives, it is recommended to consider regulated brokers that offer robust investor protections, transparent fee structures, and reliable customer support. Overall, the consensus is clear: IS ASFX SAFE? Based on the evidence, it is advisable to approach ASFX with skepticism and consider more reputable options in the forex market.

Is ASFX a scam, or is it legit?

The latest exposure and evaluation content of ASFX brokers.

ASFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ASFX latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.