WCG 2025 Review: Everything You Need to Know

Executive Summary

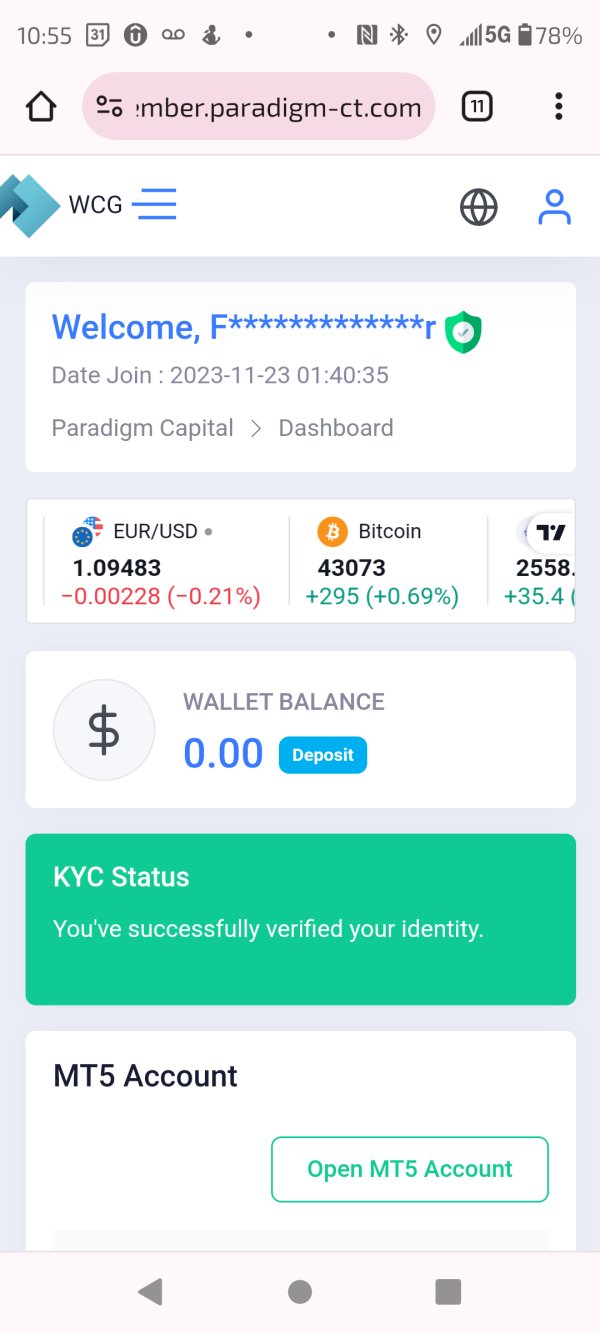

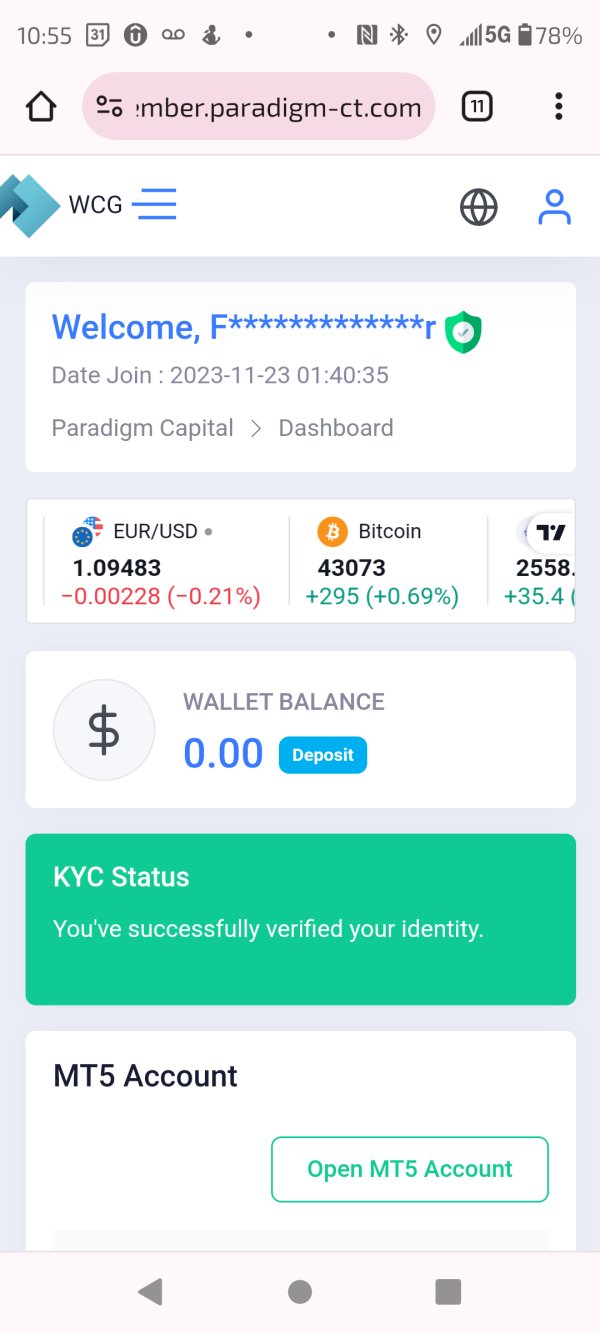

WCG Markets presents itself as a multi-asset trading platform targeting Asian and European markets. The company offers what it claims to be flexible commission structures and diverse trading opportunities suitable for different types of investors. This wcg review examines a broker that positions itself as serving over one million investors across various asset classes including forex, precious metals, crude oil, futures, stocks, and cryptocurrencies.

The broker operates under WCG Markets UK Ltd, based in London. It provides CFD services across multiple asset categories. According to available information, WCG is registered with the Financial Services Authority of St. Vincent and the Grenadines, though specific license details remain unclear in publicly available documentation.

WCG's primary appeal lies in its multi-asset approach. The platform caters to both retail and institutional investors seeking diversified investment opportunities. The platform emphasizes its flexible commission structure, though specific details about trading conditions, minimum deposits, and leverage ratios are not clearly outlined in available public information. This lack of transparency in key trading parameters presents challenges for potential clients seeking comprehensive broker evaluation.

The broker's regulatory standing, while present, lacks the depth of information typically expected from established financial service providers. This may impact trader confidence and overall trust assessment.

Important Notice

This evaluation is based on publicly available information and should be considered alongside regional regulatory differences that may apply to WCG's operations across different jurisdictions. Users should independently verify regulatory compliance and trading conditions specific to their location. WCG's regulatory policies may vary between regions.

The assessment methodology employed in this review relies on accessible public information and available user feedback. No specific user ratings or comprehensive satisfaction surveys were available during the compilation of this analysis. Prospective clients are advised to conduct independent due diligence and consider multiple information sources before making trading decisions.

Evaluation Framework

Broker Overview

WCG Markets UK Ltd operates from London, positioning itself as a significant player in the Asian and European trading markets. The company claims to serve over one million investors. However, verification of this figure through independent sources remains challenging. The broker's business model centers on providing CFD services across a comprehensive range of asset classes, appealing to traders seeking diversified investment opportunities within a single platform.

The company's operational focus spans multiple continents, with particular emphasis on serving clients in Asia and Europe. This geographical targeting suggests a strategic approach to market penetration in regions with growing retail trading interest. However, specific founding details, company history, and ownership structure information are not readily available in public documentation.

WCG's primary business model revolves around CFD provision across various asset categories including foreign exchange, precious metals, crude oil, futures contracts, equity instruments, and cryptocurrency products. This wcg review notes that while the asset diversity appears comprehensive, specific contract specifications, trading conditions, and execution methods lack detailed public disclosure. The broker operates under registration with the Financial Services Authority of St. Vincent and the Grenadines. However, this regulatory framework may offer different investor protections compared to more established financial centers.

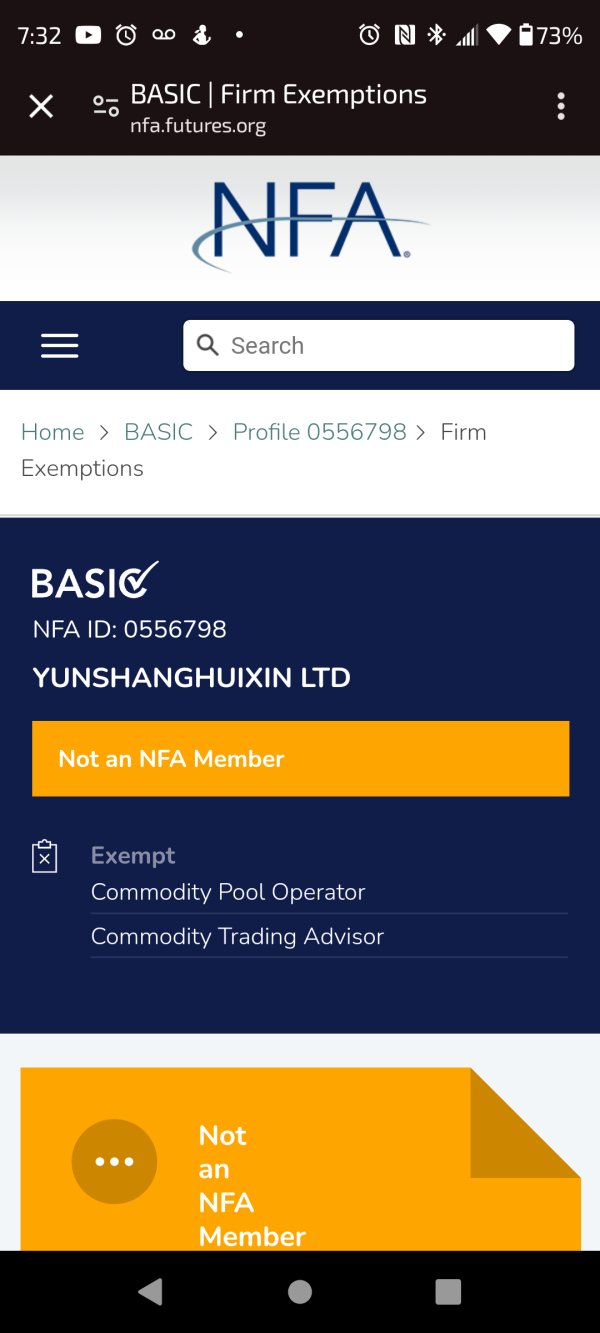

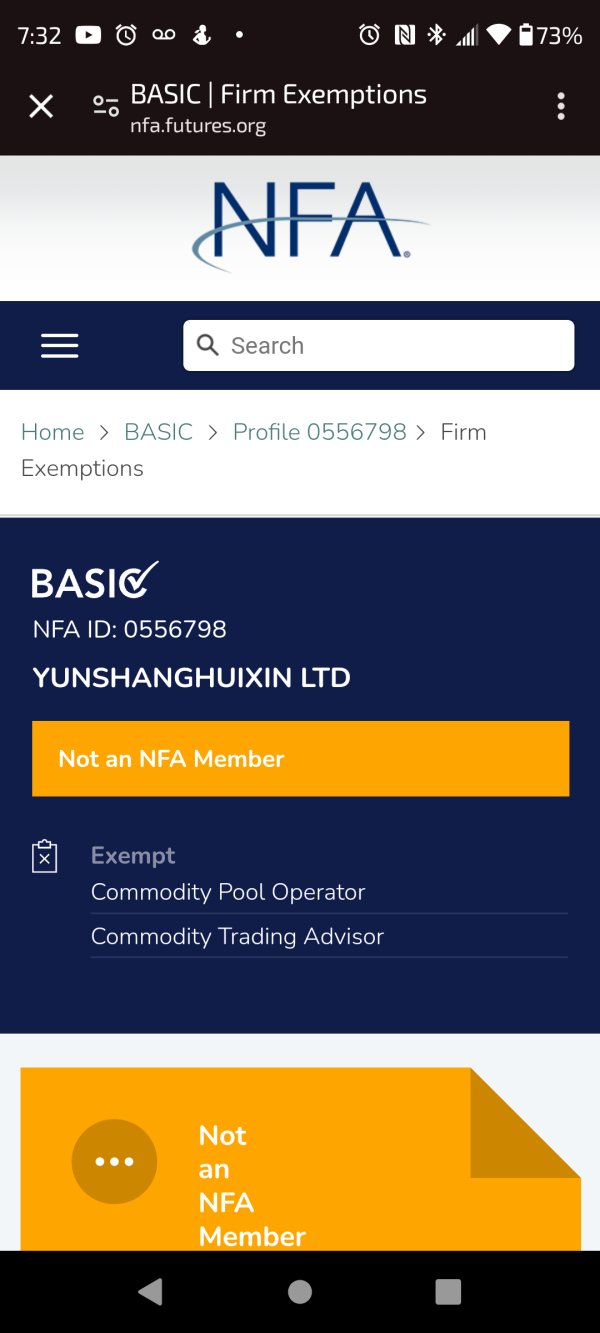

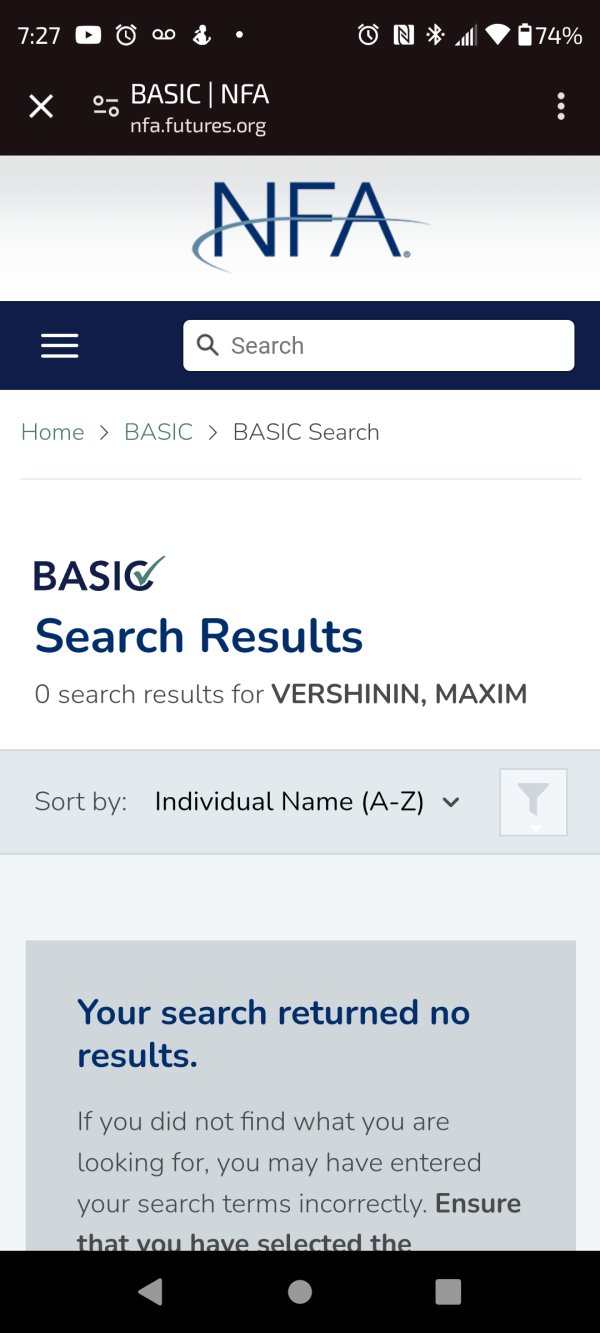

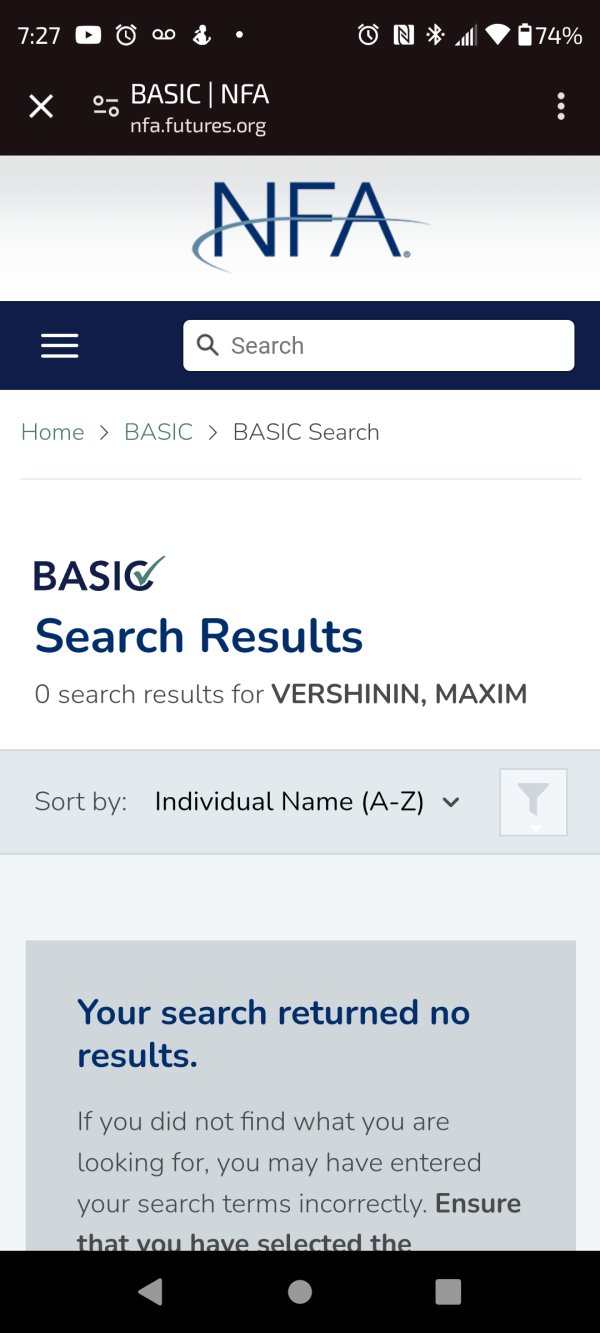

Regulatory Status: WCG operates under registration with the Financial Services Authority of St. Vincent and the Grenadines. However, specific license numbers and regulatory compliance details are not clearly specified in available documentation. This may raise questions about transparency and regulatory oversight depth.

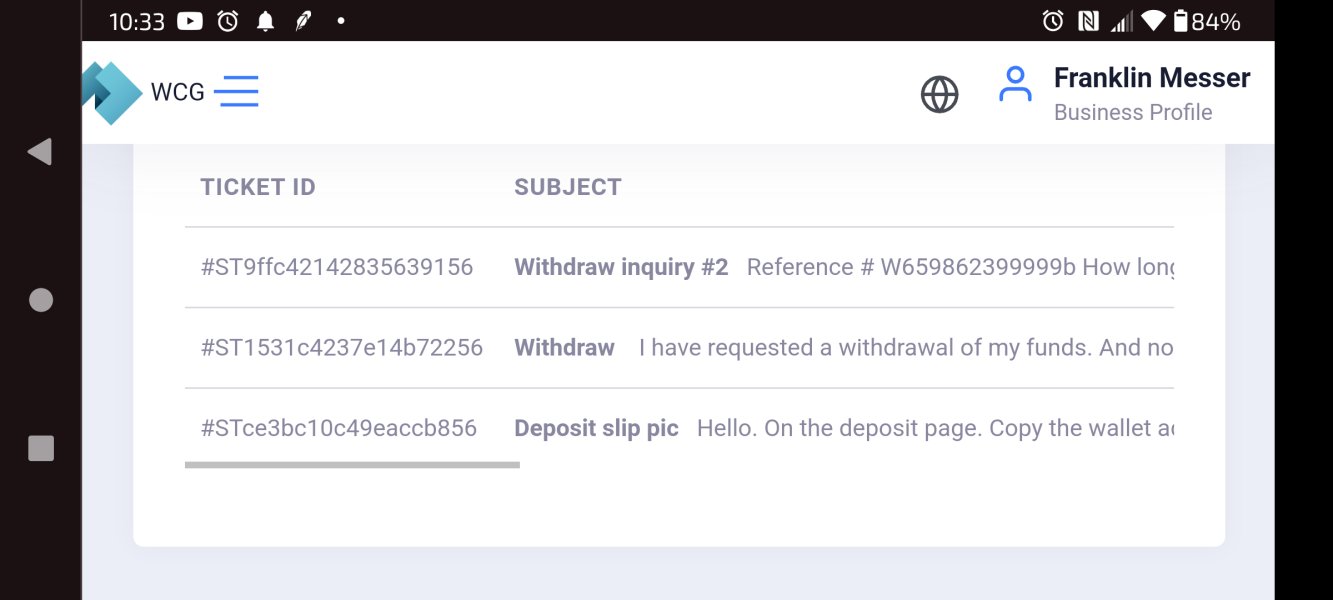

Account Funding Methods: Specific information regarding deposit and withdrawal methods, processing times, and associated fees is not detailed in available public information. This lack of clarity on financial operations may concern potential clients seeking comprehensive cost understanding.

Minimum Deposit Requirements: No specific minimum deposit amounts are mentioned in available sources. This makes it difficult for potential traders to plan their initial investment requirements or compare with industry standards.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not detailed in accessible information. This suggests either absence of such offerings or limited marketing transparency.

Tradeable Assets: The platform offers forex pairs, precious metals, crude oil products, futures contracts, stock CFDs, and cryptocurrency instruments. This wcg review notes the apparent breadth of offerings. However, specific instrument counts and availability details remain unspecified.

Cost Structure: While described as having flexible commission structures, specific spread information, commission rates, overnight fees, and other trading costs are not publicly detailed. This opacity in cost structure presents challenges for traders seeking to calculate potential trading expenses.

Leverage Ratios: Maximum leverage offerings and leverage variations across different asset classes are not specified in available information. This limits assessment of risk management parameters.

Platform Options: Specific trading platform types, whether proprietary or third-party solutions, mobile application availability, and platform features are not detailed in accessible sources.

Detailed Scoring Analysis

Account Conditions Analysis (Score: 5/10)

The assessment of WCG's account conditions faces significant limitations due to insufficient publicly available information. Traditional broker evaluations typically examine multiple account tiers, each designed for different trader profiles and investment levels. However, WCG's account structure details remain largely undisclosed in accessible documentation.

Account opening procedures, verification requirements, and onboarding processes are not clearly outlined. This creates uncertainty for potential clients regarding the practical aspects of beginning their trading relationship with the broker. The absence of clear minimum deposit information makes it challenging for traders to determine accessibility and plan their initial investments accordingly.

Special account features that many brokers offer, such as Islamic accounts for Sharia-compliant trading, VIP accounts for high-volume traders, or demo accounts for practice trading, are not specifically mentioned in available sources. This wcg review finds that the lack of detailed account information significantly impacts the ability to assess whether WCG's offerings align with various trader needs and preferences.

The evaluation suggests that prospective clients would need to contact the broker directly to obtain fundamental account information. This may indicate either limited marketing transparency or inadequate public disclosure practices compared to industry standards.

WCG's tool and resource offerings present a mixed picture based on available information. While the broker advertises access to multiple asset classes including forex, precious metals, crude oil, futures, stocks, and cryptocurrencies, specific details about trading tools, analytical resources, and educational materials remain largely unspecified in public documentation.

The breadth of asset classes suggests potential for diverse trading strategies and portfolio diversification opportunities. However, without detailed information about charting tools, technical indicators, market analysis resources, or automated trading capabilities, it becomes difficult to assess the platform's suitability for different trading styles and experience levels.

Educational resources, which are increasingly important for broker differentiation and client development, are not specifically mentioned in available sources. Modern traders often expect access to webinars, trading guides, market analysis, and educational content to support their trading development and decision-making processes.

Research and analysis capabilities, including economic calendars, market news feeds, and expert commentary, are not detailed in accessible information. These resources are typically crucial for informed trading decisions, particularly in volatile markets where timely information can significantly impact trading outcomes.

Customer Service and Support Analysis (Score: 5/10)

Customer service evaluation for WCG faces substantial limitations due to the absence of specific information regarding support channels, availability, and service quality metrics. Effective customer support typically encompasses multiple communication channels, including live chat, email, telephone support, and potentially social media engagement.

Response time expectations, which are crucial for traders who may need urgent assistance during active trading sessions, are not specified in available documentation. The trading environment often requires immediate support for technical issues, account problems, or urgent trading-related queries. This makes response time a critical service quality indicator.

Multilingual support capabilities, essential for a broker claiming to serve Asian and European markets, are not detailed in accessible sources. Given the diverse linguistic requirements across these regions, the absence of clear language support information may indicate service limitations for non-English speaking clients.

Service quality metrics, user satisfaction ratings, and specific examples of problem resolution are not available in public information. Without access to user testimonials or service quality indicators, this evaluation cannot provide definitive assessment of WCG's customer support effectiveness or reliability.

Trading Experience Analysis (Score: 6/10)

The trading experience assessment for WCG encounters significant challenges due to limited technical and operational information in public sources. Platform stability, execution speed, and order processing quality are fundamental aspects of trading experience that require detailed technical specifications and user feedback for proper evaluation.

Order execution quality, including slippage rates, requote frequency, and execution speed metrics, are not specified in available documentation. These factors directly impact trading profitability and user satisfaction. This is particularly true for active traders and those employing time-sensitive trading strategies.

Platform functionality, including charting capabilities, order types, risk management tools, and interface design, lacks detailed description in accessible sources. Modern trading platforms typically offer sophisticated analytical tools, multiple order types, and intuitive interfaces that significantly influence user experience and trading effectiveness.

Mobile trading capabilities, increasingly important for traders requiring market access while away from desktop computers, are not specifically addressed in available information. This wcg review notes that mobile platform quality often determines broker suitability for active traders and those requiring flexible market access.

Trust and Reliability Analysis (Score: 4/10)

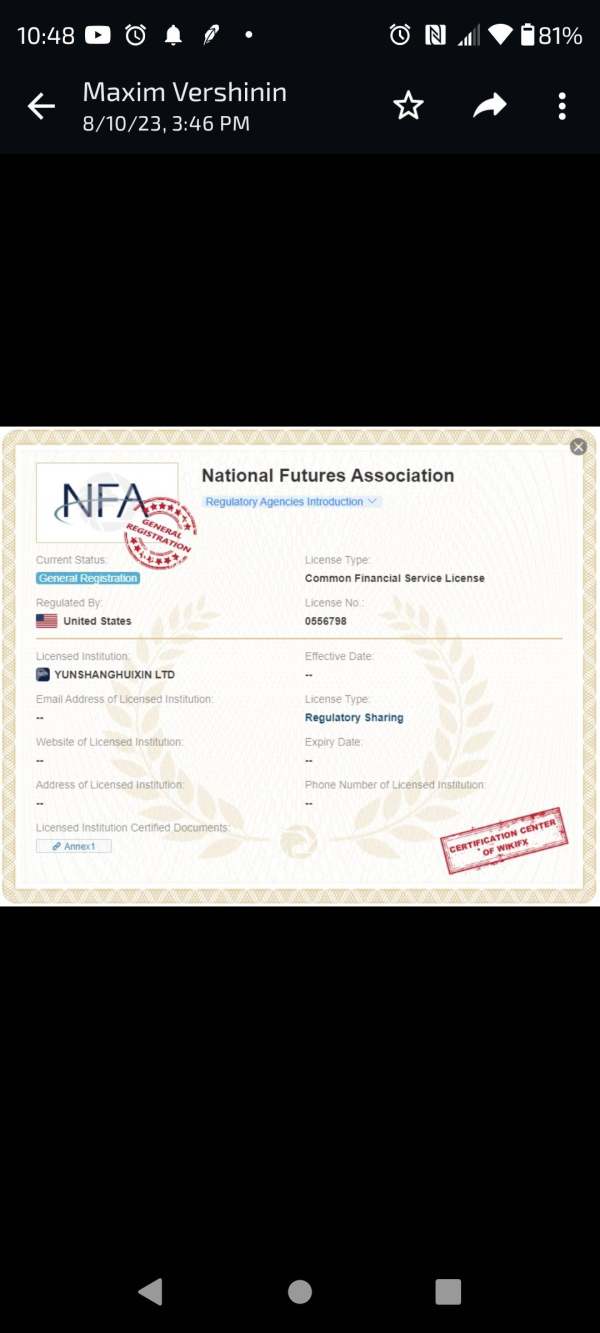

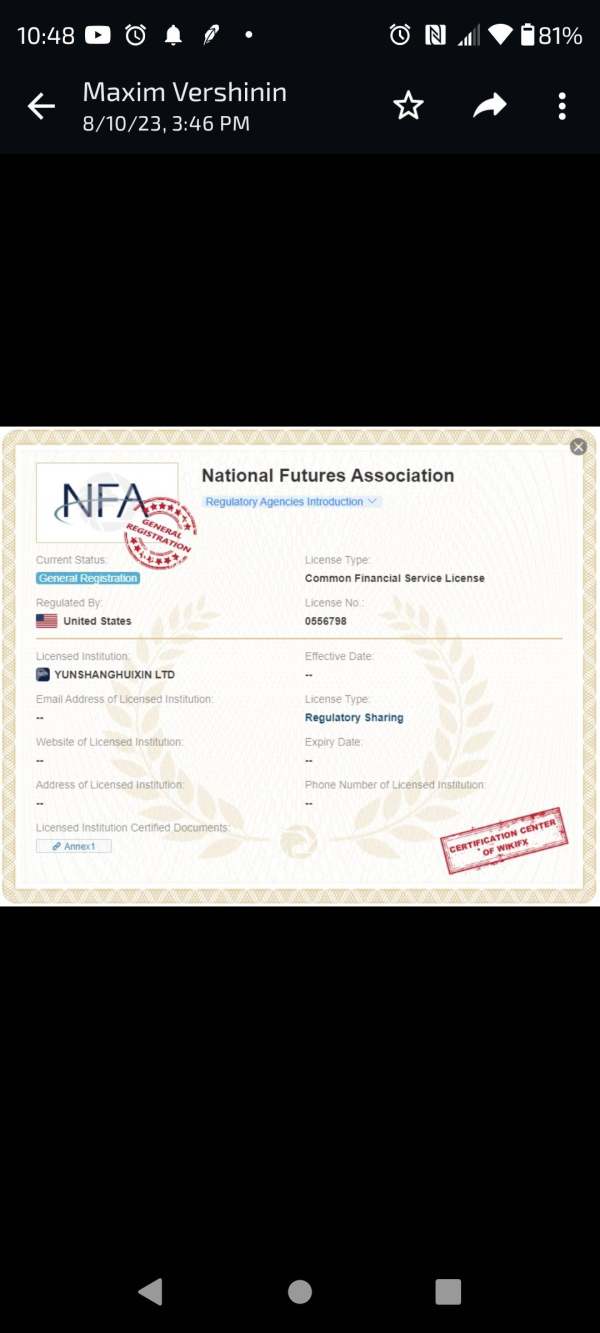

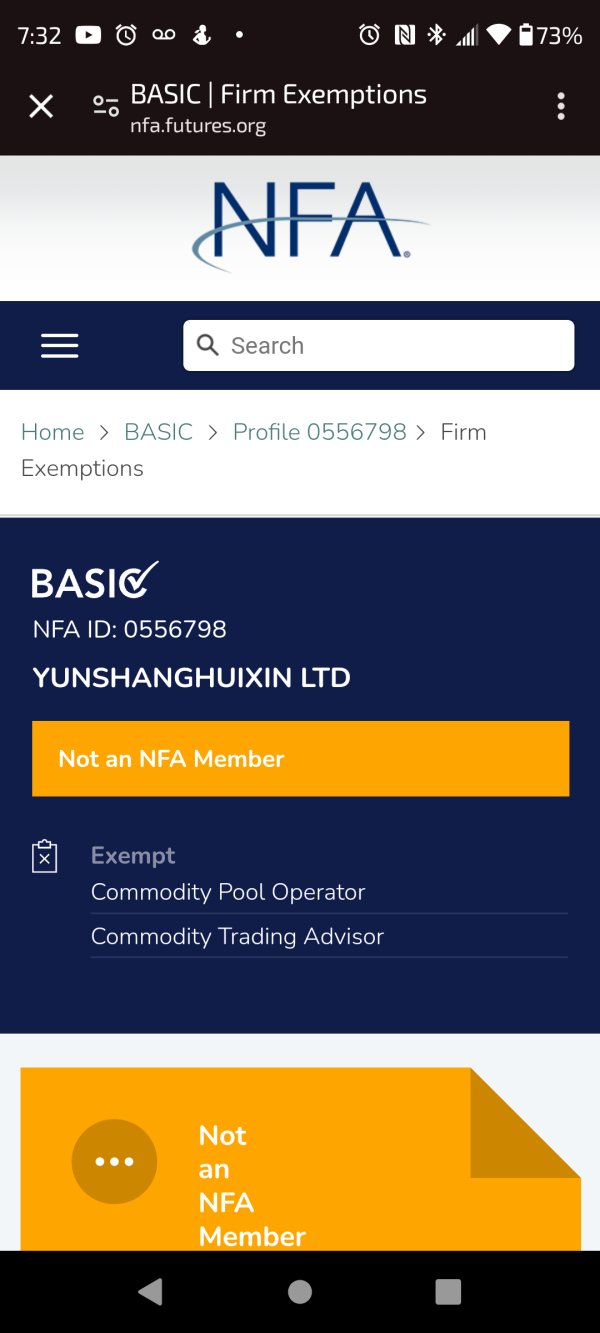

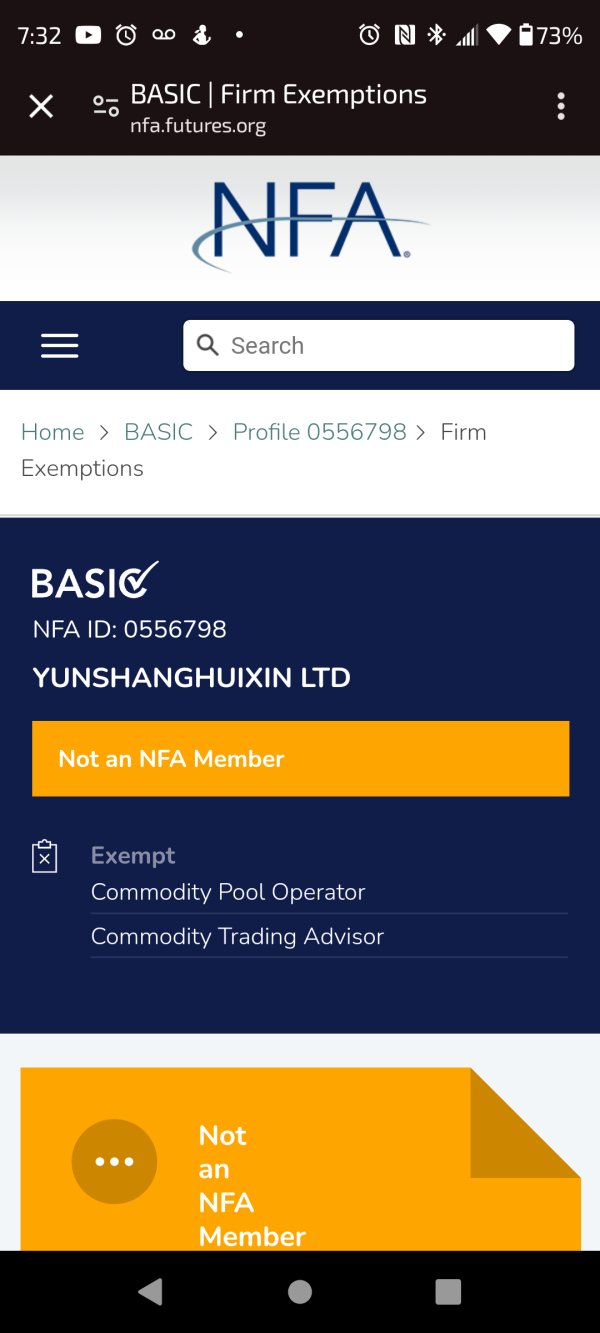

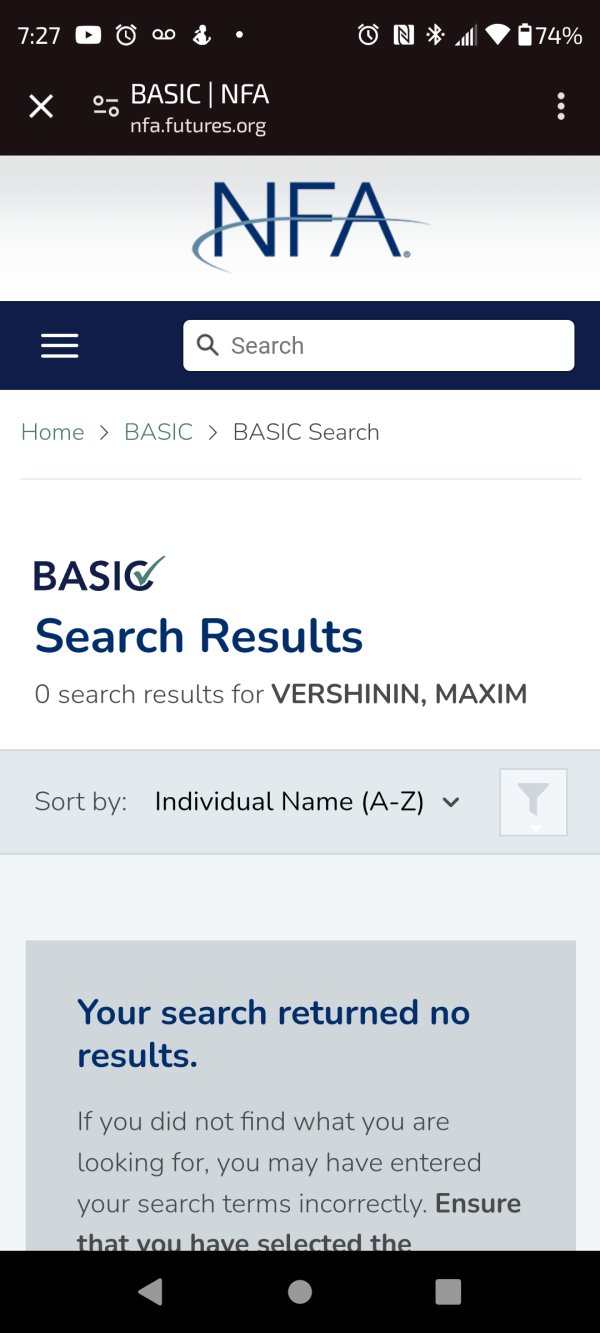

Trust assessment for WCG reveals several areas of concern primarily related to transparency and regulatory clarity. While the broker claims registration with the Financial Services Authority of St. Vincent and the Grenadines, specific license numbers and detailed regulatory compliance information are not readily available in public documentation.

The regulatory jurisdiction of St. Vincent and the Grenadines, while legitimate, may offer different levels of investor protection and regulatory oversight compared to more established financial centers. These include the FCA in the UK, ASIC in Australia, or CySEC in Cyprus. This regulatory framework may impact the level of client fund protection and dispute resolution mechanisms available to traders.

Client fund security measures, including segregated account arrangements, deposit insurance, and fund protection protocols, are not detailed in accessible information. These security measures are crucial for trader confidence. They represent fundamental aspects of broker trustworthiness in the financial services industry.

Company transparency, including detailed company information, ownership structure, and operational history, appears limited in public sources. Established brokers typically provide comprehensive company information, management details, and operational transparency to build client confidence and demonstrate regulatory compliance.

User Experience Analysis (Score: 5/10)

User experience evaluation for WCG faces significant limitations due to the absence of comprehensive user feedback and detailed platform information in available sources. Overall user satisfaction metrics, which typically provide valuable insights into broker performance and client relationships, are not accessible for analysis.

Interface design and platform usability, crucial factors for trader efficiency and satisfaction, lack detailed description in public documentation. Modern trading platforms require intuitive design, efficient navigation, and user-friendly interfaces to support effective trading activities and positive user experiences.

Registration and account verification processes, which form traders' first impressions of broker efficiency and professionalism, are not specifically outlined in available sources. Streamlined onboarding processes typically indicate operational efficiency and attention to user experience design.

Common user concerns, complaints, and positive feedback that would typically inform user experience assessment are not available in accessible sources. Without access to user testimonials, reviews, or satisfaction surveys, this evaluation cannot provide comprehensive insights into actual user experiences with WCG's services.

Conclusion

This wcg review reveals a broker with potentially diverse asset offerings and claims of serving a substantial client base. However, significant transparency limitations impact overall assessment. WCG Markets presents itself as a multi-asset platform suitable for retail and institutional investors seeking diversified trading opportunities across forex, commodities, stocks, and cryptocurrencies.

The broker's primary strengths appear to lie in its multi-asset approach and claimed flexibility in commission structures. However, the lack of specific information regarding trading conditions, regulatory details, and user feedback creates substantial evaluation challenges. The regulatory registration with St. Vincent and the Grenadines, while legitimate, may offer different investor protections compared to more established regulatory frameworks.

Potential clients should exercise additional due diligence given the limited transparency in key operational areas including account conditions, cost structures, and platform specifications. The absence of detailed user feedback and comprehensive regulatory information suggests that prospective traders should seek additional information directly from the broker. They should also consider alternative options with more transparent operational disclosure.