Regarding the legitimacy of WCG forex brokers, it provides HKGX and WikiBit, .

Is WCG safe?

Business

License

Is WCG markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

文傳金業有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.wcghk.comExpiration Time:

--Address of Licensed Institution:

九龍灣啟祥道17號太豐匯1406室Phone Number of Licensed Institution:

38963600Licensed Institution Certified Documents:

Is WCG Markets A Scam?

Introduction

WCG Markets is an online trading platform that positions itself as a broker for forex and CFD trading, primarily targeting clients in Asia. Established in 2017 and based in Hong Kong, WCG Markets aims to provide a comprehensive trading experience across various financial instruments. However, the rise of online trading has also led to an increase in fraudulent activities, making it essential for traders to carefully assess the legitimacy and reliability of trading platforms. This article investigates whether WCG Markets is a safe choice for traders or if it poses significant risks. The evaluation is based on a thorough examination of available resources, including regulatory information, user reviews, and industry reports.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical factor in determining its legitimacy. WCG Markets claims to be regulated by the Hong Kong Gold Exchange (HK GX), which provides a level of oversight. However, it is crucial to understand the implications of this regulation, as not all regulatory bodies are created equal. Below is a summary of the regulatory information for WCG Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong Gold Exchange | 012 | Hong Kong | Verified |

While being regulated by HK GX offers some assurance, it is important to note that this regulatory body primarily focuses on precious metals trading and may not provide the same level of consumer protection as more established financial regulators like the FCA or ASIC. Furthermore, WCG Markets has received multiple complaints regarding its withdrawal processes and customer service, raising questions about its adherence to regulatory standards. Although no significant regulatory breaches have been reported during the evaluation period, the absence of tier-1 regulation poses a risk to traders. Therefore, while WCG Markets operates under a regulatory framework, the quality and robustness of that regulation should be scrutinized, leading to the question: Is WCG safe?

Company Background Investigation

WCG Markets was founded in 2017, focusing on providing trading services to clients in Hong Kong and other regions. The company operates under the name WCG Markets Ltd. and claims to have expanded its services to cater to international clients. However, details regarding the ownership structure and management team remain relatively obscure, which can be a red flag for potential investors.

The management team's experience and qualifications are essential in assessing the broker's reliability. Unfortunately, there is limited information available regarding the backgrounds of the individuals running WCG Markets. Transparency about management and operational practices is crucial in building trust with clients. The lack of comprehensive information regarding the company's leadership may indicate a potential risk for traders. Furthermore, the company's information disclosure practices raise concerns. A reputable broker should provide clear and accessible information about its operations, management, and financial health. In the case of WCG Markets, the absence of such transparency can lead to skepticism regarding its legitimacy, prompting further inquiry into whether WCG is safe for traders.

Trading Conditions Analysis

WCG Markets offers various trading conditions, including forex pairs, CFDs, and commodities. The overall fee structure is an essential aspect that traders need to consider when evaluating a broker. Below is a comparison of core trading costs:

| Fee Type | WCG Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 - 0.4 pips | 0.3 - 0.5 pips |

| Commission Structure | Variable | Variable |

| Overnight Interest Range | Variable | Variable |

The spreads offered by WCG Markets appear competitive, particularly for major currency pairs. However, the company has been criticized for its lack of transparency regarding commissions and other fees. Traders should be cautious of any hidden fees that may not be immediately apparent. Additionally, the absence of a clear commission structure can lead to confusion and unexpected costs for traders.

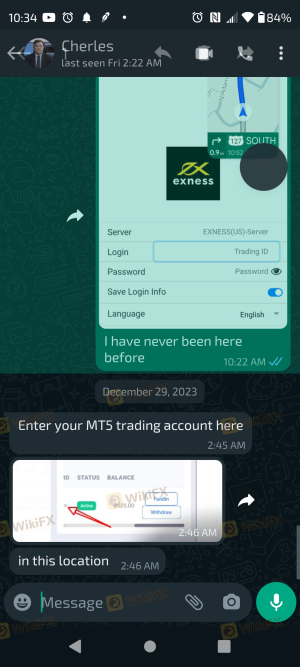

WCG Markets primarily uses the MetaTrader 4 (MT4) platform, which is well-regarded in the industry. However, the platform's functionality and execution speed can vary, impacting the overall trading experience. It is vital for traders to understand the complete fee structure and any potential costs associated with trading on WCG Markets before committing their funds. This analysis raises further concerns about whether WCG is safe for traders, given the potential for hidden costs and unclear fee structures.

Client Fund Safety

The safety of client funds is paramount when assessing a broker's credibility. WCG Markets claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. The broker asserts that client funds are held in separate accounts, which is a positive sign for potential investors. This practice helps ensure that clients' funds are not used for the broker's operational expenses. Additionally, negative balance protection is an essential feature that prevents traders from losing more than their initial investment, offering an extra layer of security.

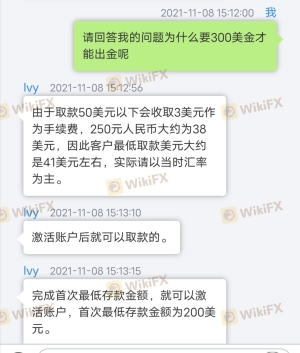

However, there have been reports of clients experiencing difficulties when attempting to withdraw funds from their accounts. These issues raise concerns about the broker's commitment to ensuring the safety and accessibility of client funds. Historical disputes regarding fund withdrawals can significantly affect a broker's reputation and should be taken into account by potential traders. Given the history of withdrawal issues, traders may wonder: Is WCG safe?

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's reliability. In the case of WCG Markets, user reviews reveal a mixed bag of experiences, with several complaints highlighting significant issues. Below is a summary of the main complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include withdrawal delays, unresponsive customer service, and a lack of clarity regarding trading conditions. Many users have reported being unable to withdraw their funds, leading to frustration and distrust in the platform. The company's response to these complaints has been criticized as inadequate, with many users feeling ignored or dismissed. For instance, one user reported depositing a significant amount but was unable to withdraw their funds, leading to a loss of trust in WCG Markets. Such experiences can severely impact a broker's reputation and should be carefully considered by potential clients when questioning if WCG is safe.

Platform and Trade Execution

The trading platform's performance is a critical factor in the overall trading experience. WCG Markets utilizes the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and robust functionality. However, users have reported varying experiences regarding order execution quality, with some noting instances of slippage and rejected orders during high volatility periods. Slippage can significantly impact trading outcomes, particularly for scalpers and day traders who rely on precise execution.

Additionally, any signs of platform manipulation or unfair practices can be detrimental to a broker's credibility. Traders should remain vigilant and report any suspicious activities to ensure a fair trading environment. The mixed reviews regarding platform performance further raise concerns about whether WCG is safe for traders looking for a reliable trading experience.

Risk Assessment

Engaging with WCG Markets presents several risks that potential traders should be aware of. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited regulatory oversight raises concerns. |

| Fund Safety Risk | Medium | Issues with fund withdrawals reported by users. |

| Customer Support Risk | High | Poor response to customer inquiries can lead to unresolved issues. |

Potential traders should consider these risks when deciding whether to engage with WCG Markets. It is advisable to implement risk mitigation strategies, such as starting with a demo account or investing only what one can afford to lose. Diversifying investments across multiple brokers can also help reduce exposure to any single platform's risks, leading to the question: Is WCG safe?

Conclusion and Recommendations

In conclusion, WCG Markets presents a mixed picture regarding its legitimacy and reliability as a trading platform. While it is regulated by the Hong Kong Gold Exchange, the quality of that regulation and the companys transparency raise significant concerns. Reports of withdrawal issues and poor customer support further complicate the broker's reputation.

Potential traders should exercise caution when considering WCG Markets. It is essential to weigh the risks and evaluate whether the broker aligns with their trading needs and risk tolerance. For those who prioritize regulatory assurance and robust customer support, exploring other reputable brokers may be a more prudent choice. Recommended alternatives include brokers with tier-1 regulation and a strong track record in customer service, such as eToro or IG Markets. Ultimately, the question remains: Is WCG safe? The evidence suggests that potential traders should proceed with caution.

Is WCG a scam, or is it legit?

The latest exposure and evaluation content of WCG brokers.

WCG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WCG latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.