GUOSEN SECURITIES Review 1

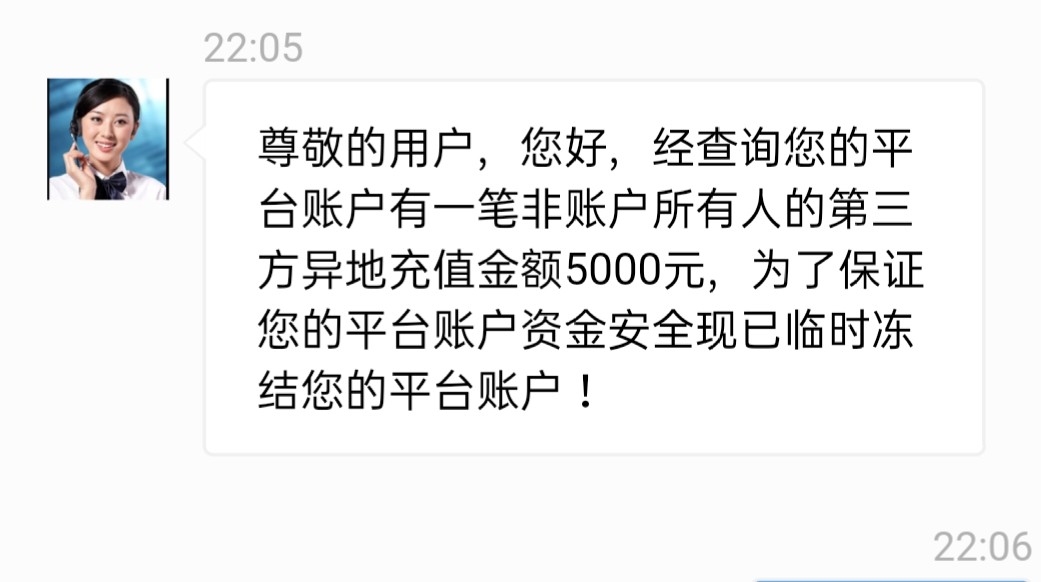

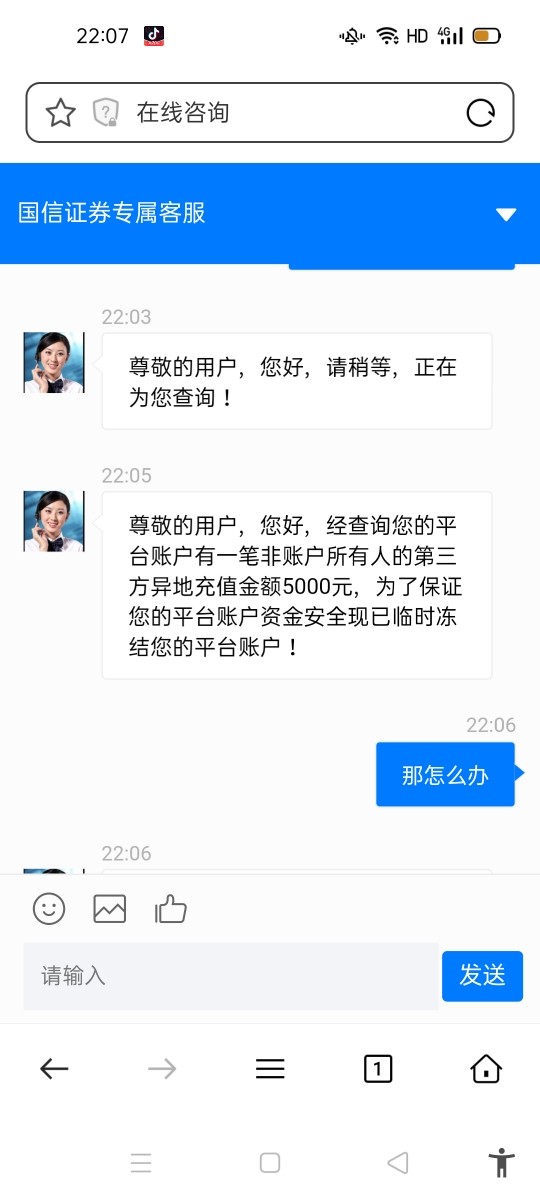

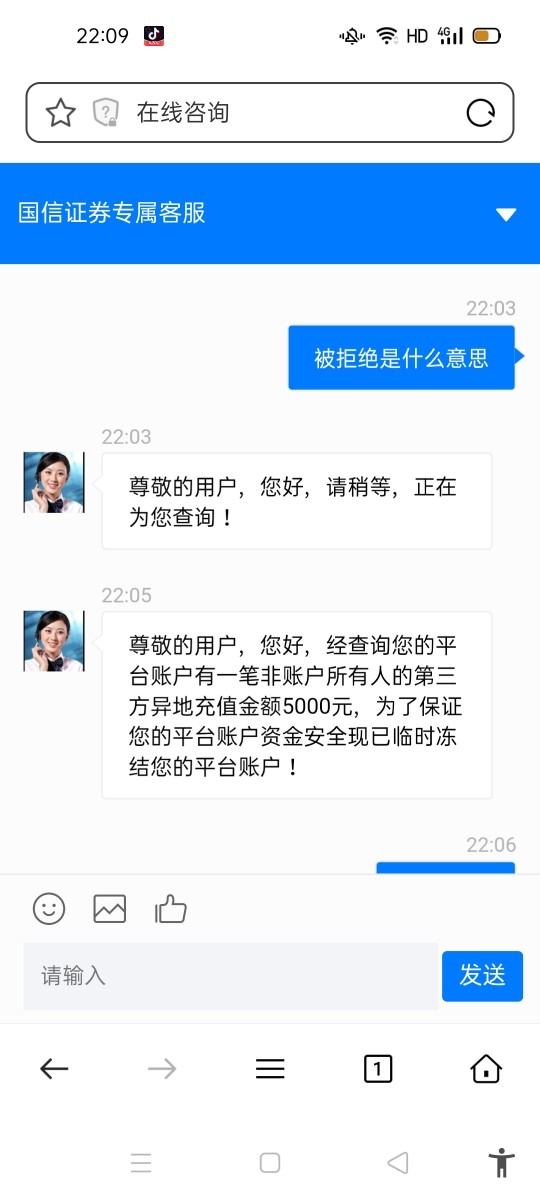

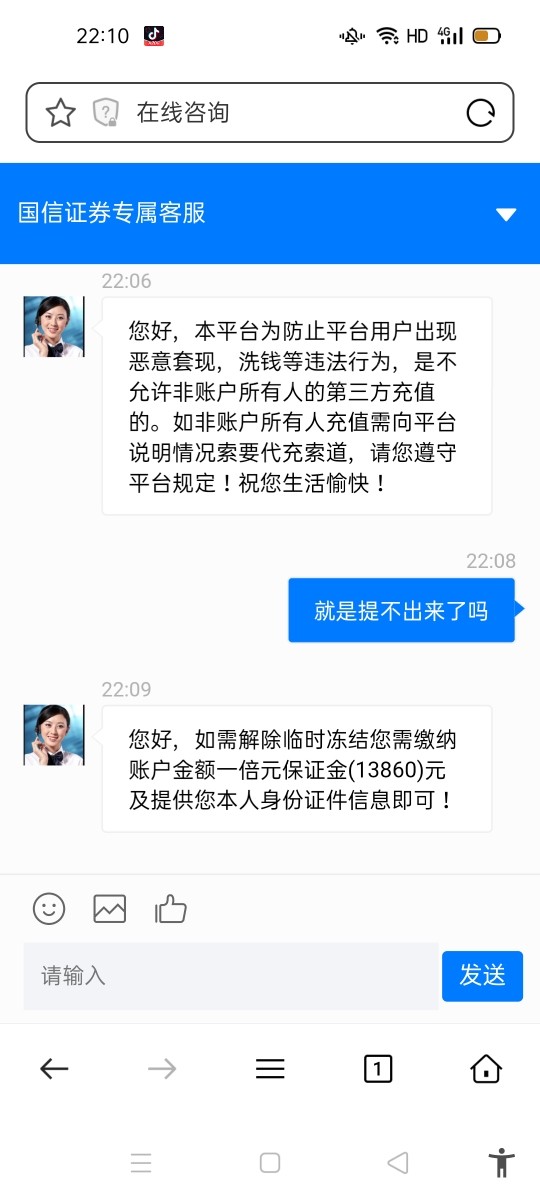

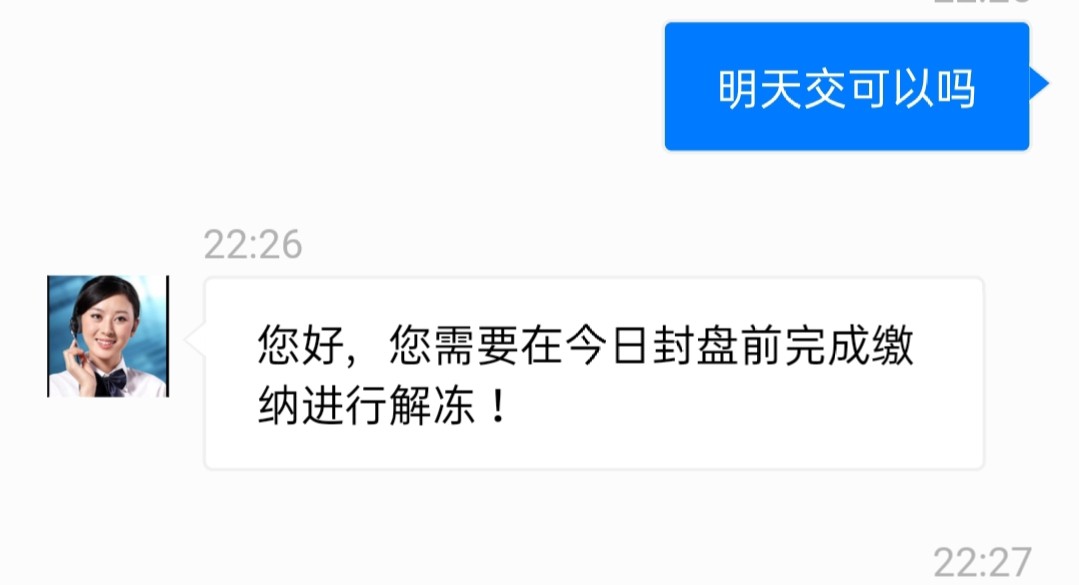

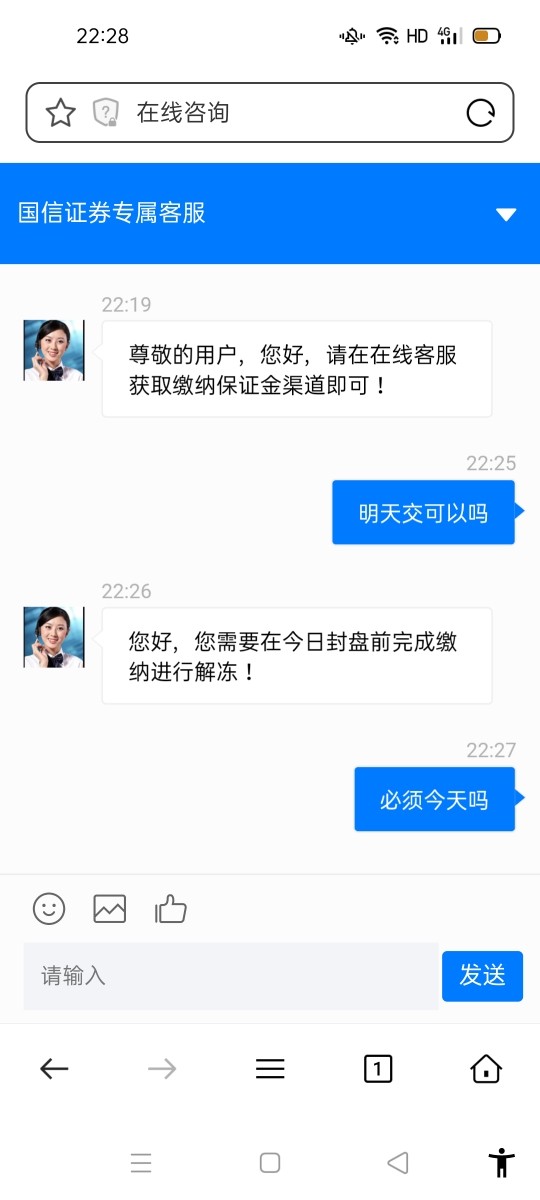

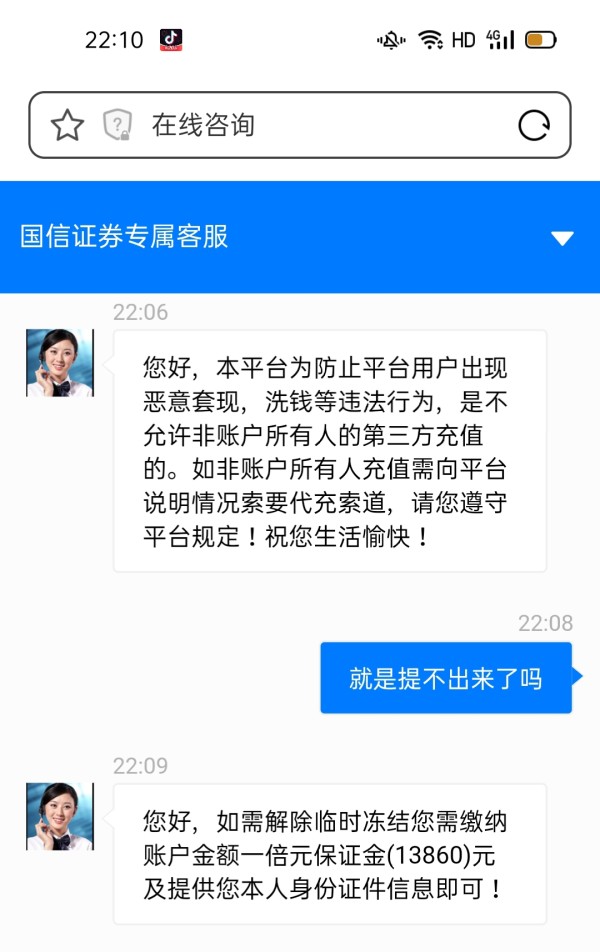

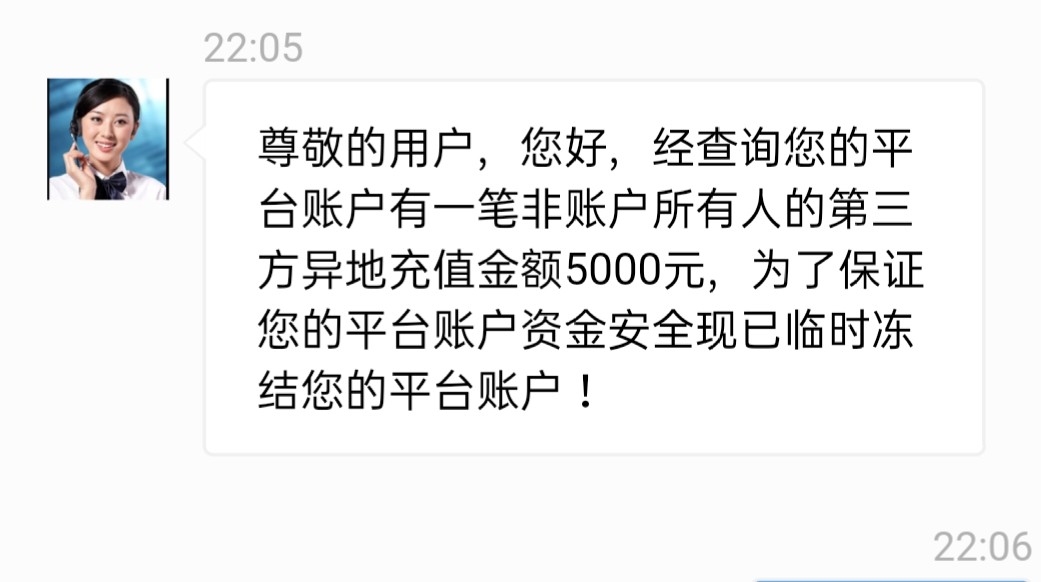

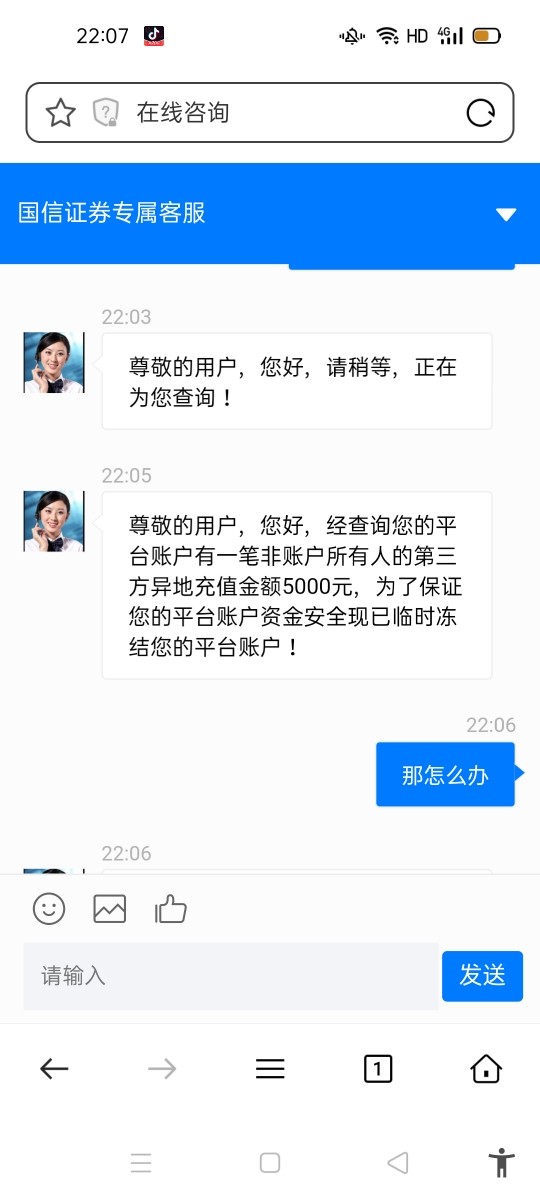

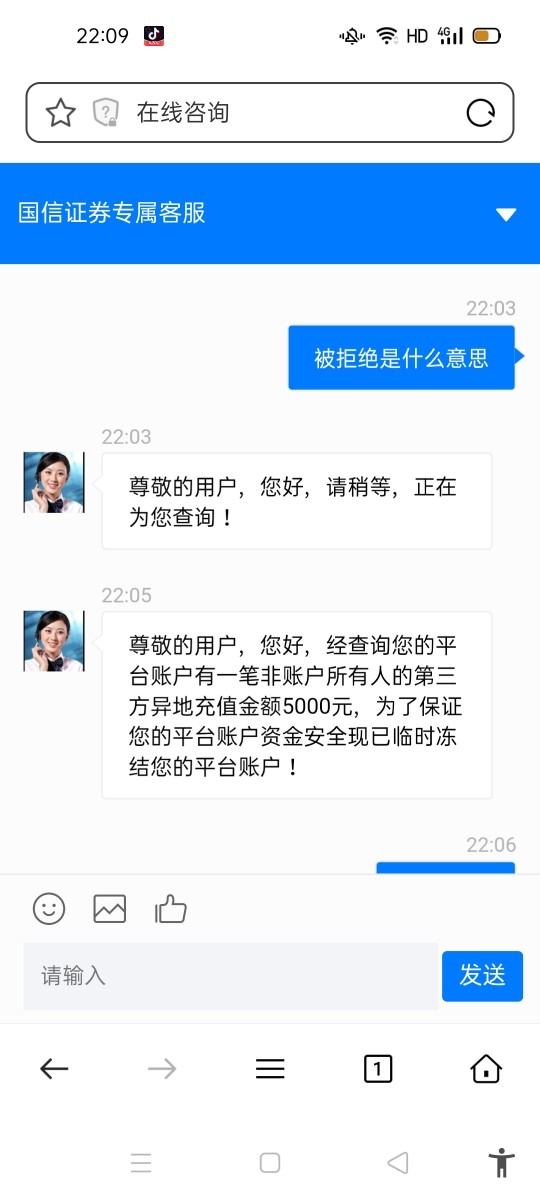

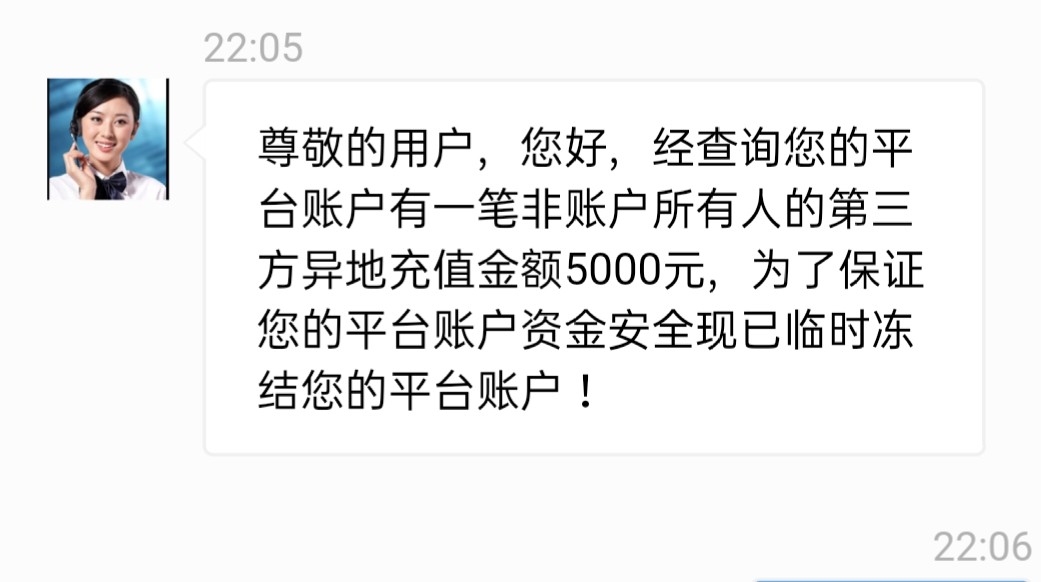

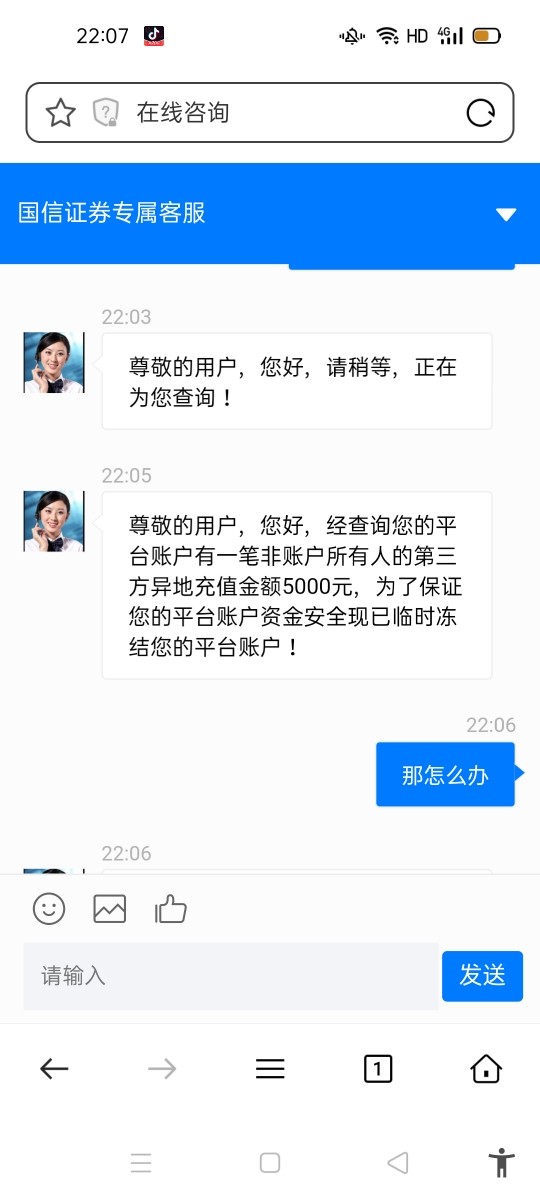

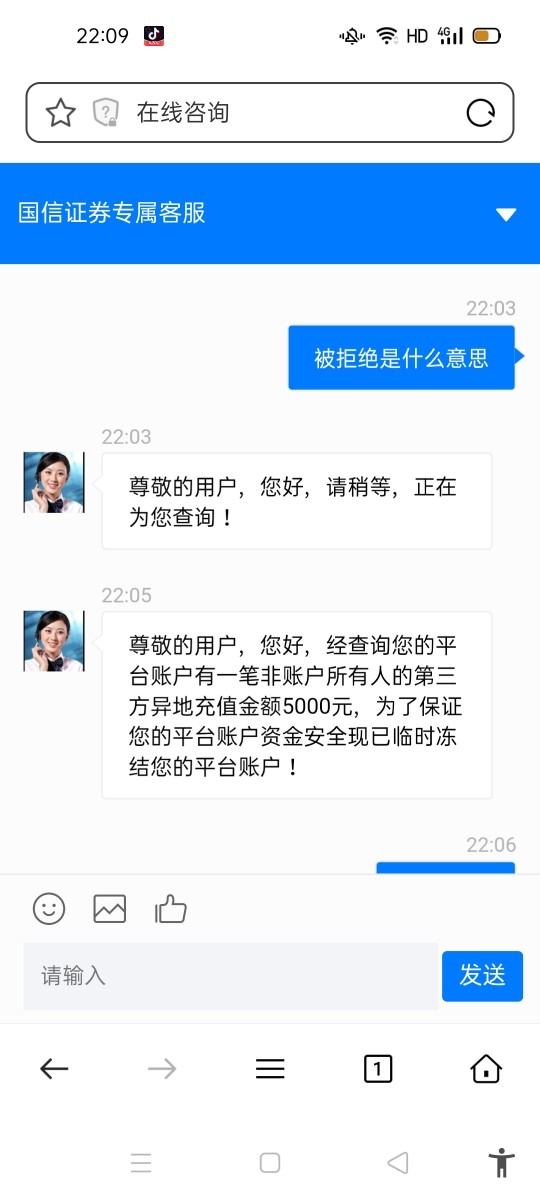

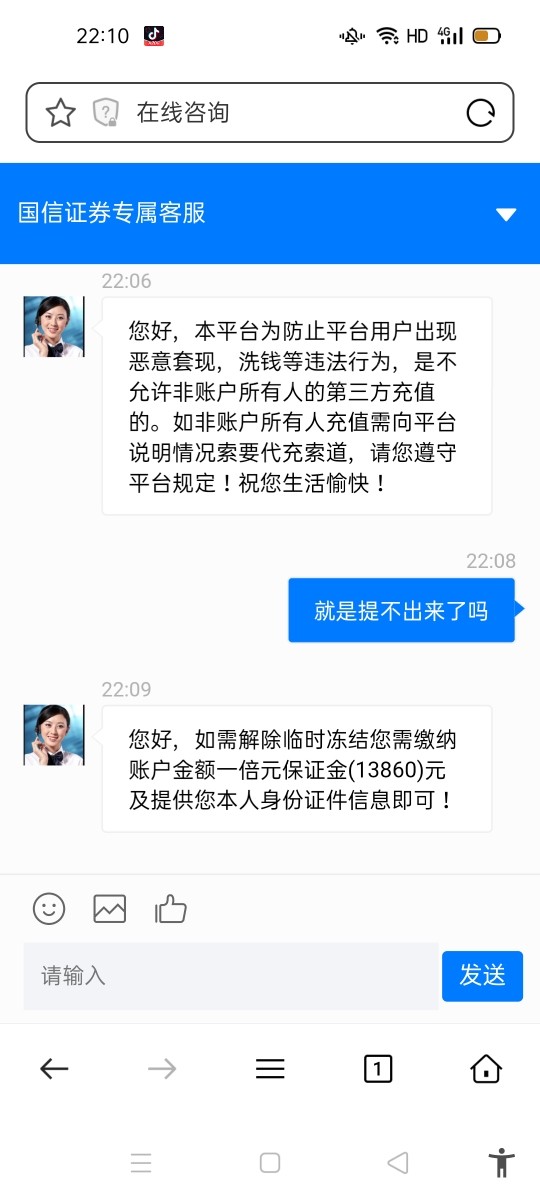

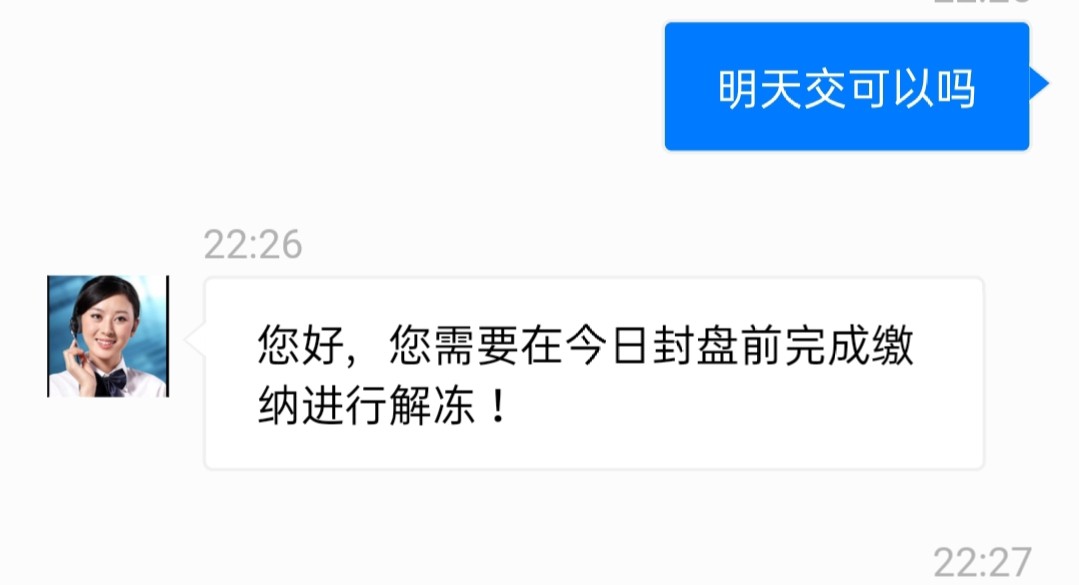

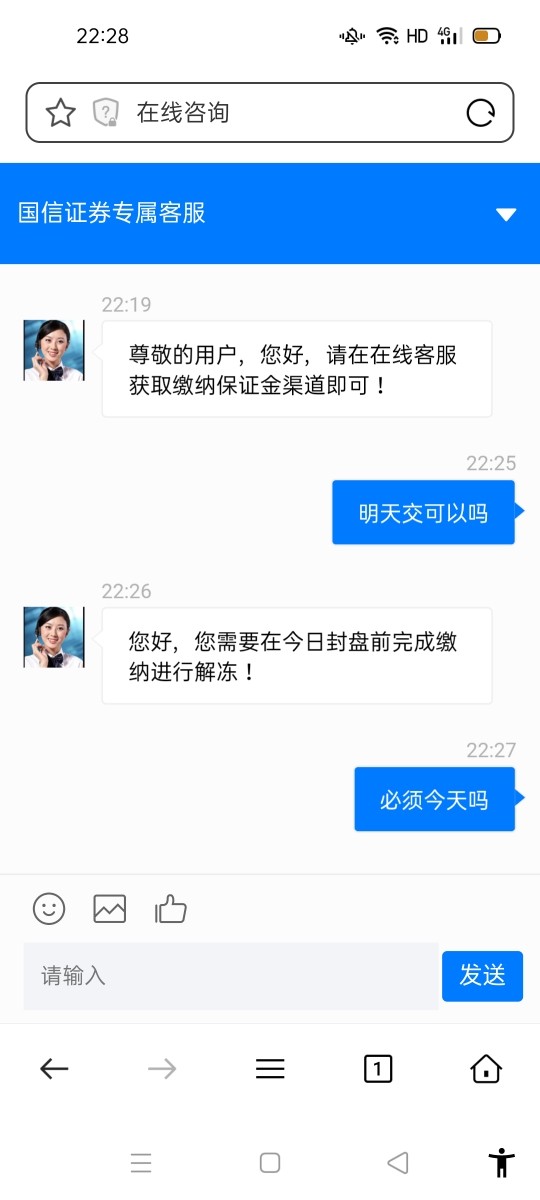

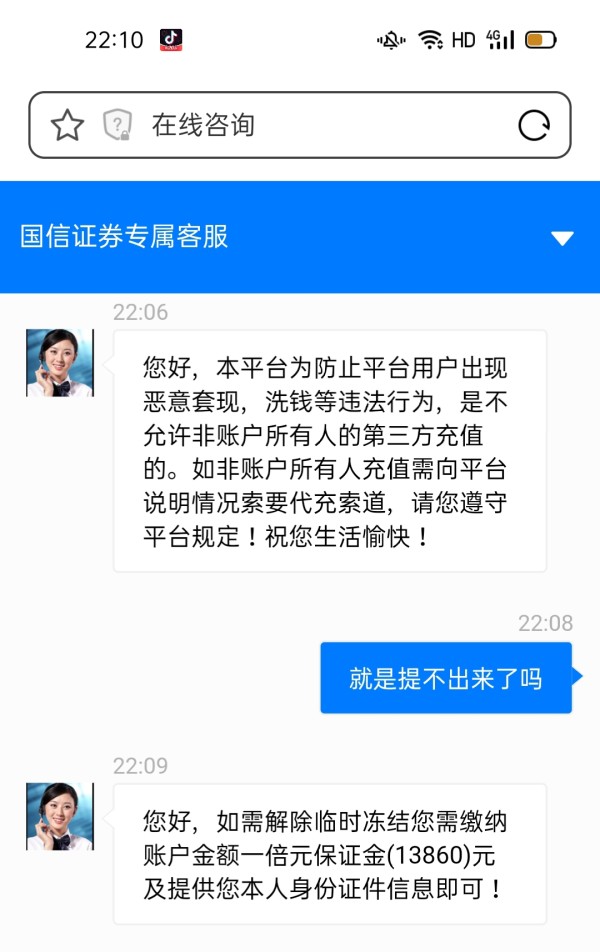

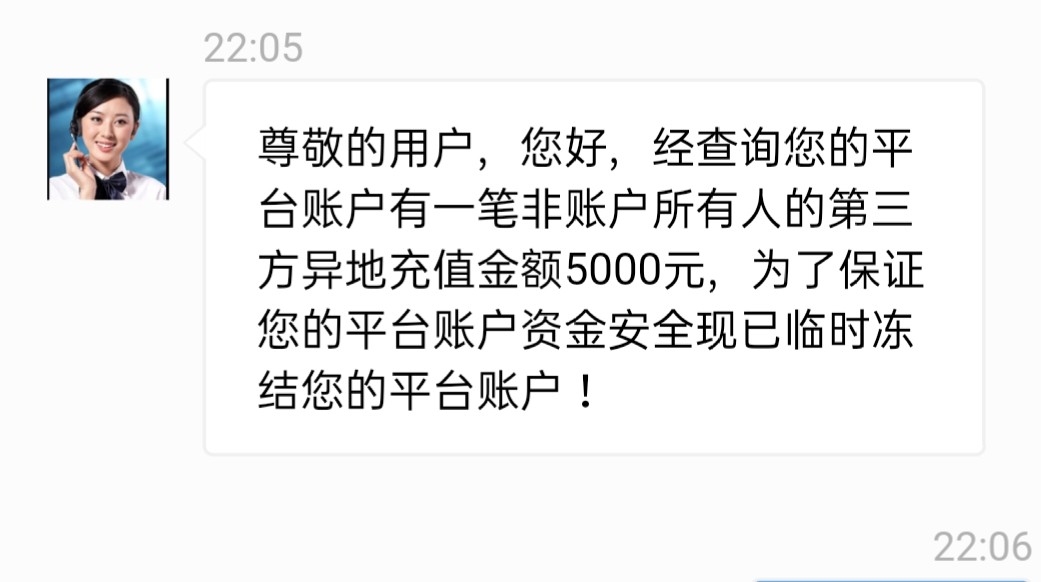

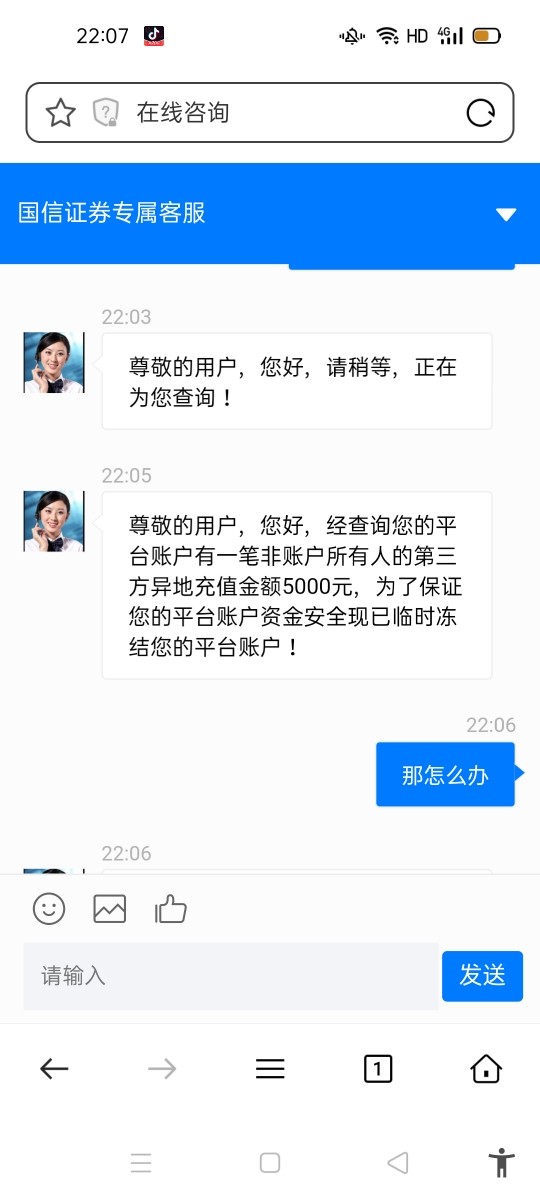

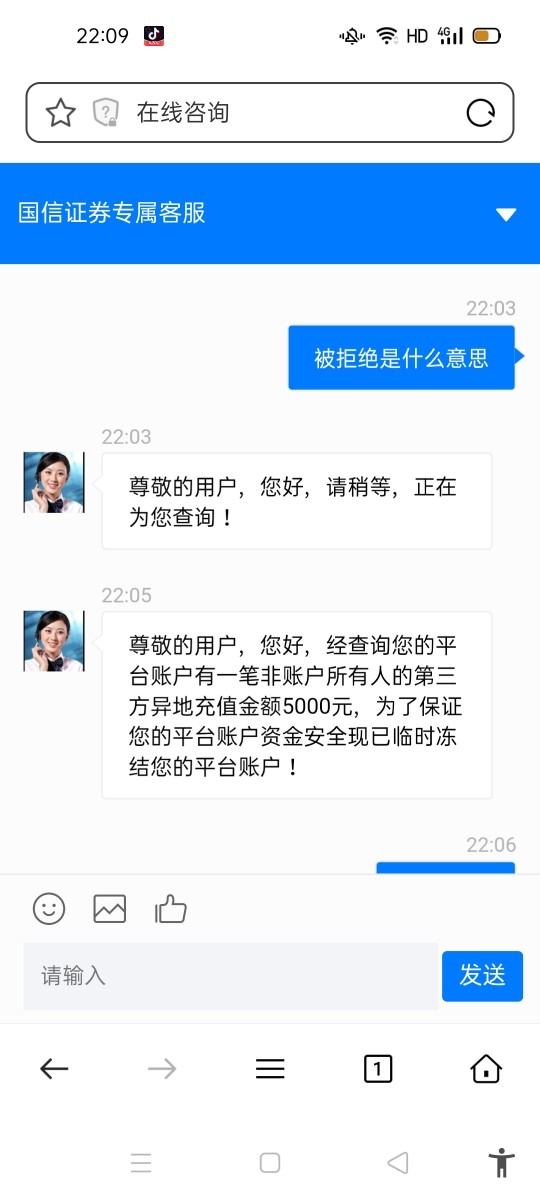

Unable to withdraw. My account has been frozen and I was asked to pay margin. I realize I am cheated then

GUOSEN SECURITIES Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Unable to withdraw. My account has been frozen and I was asked to pay margin. I realize I am cheated then

Guosen Securities is a legitimate Chinese stock broker with a moderate overall assessment. The company earns a 3.3 out of 5 employee rating that reflects a neutral market position. Established in 1994 and headquartered in Shenzhen, this full-license securities company has carved out a leading market share in the innovative enterprise segment. The firm is backed by a stable 'BBB+' credit rating from Fitch. The company's three-decade presence in China's financial markets demonstrates institutional stability, while its comprehensive securities services cater to both retail and institutional investors.

This guosen securities review reveals a broker primarily targeting Chinese investors seeking securities investment and foreign exchange trading opportunities. With recognized industry credentials and substantial market presence, Guosen Securities represents a middle-ground option for investors. The company prioritizes regulatory compliance and established market presence over cutting-edge trading features. The firm's focus on the domestic Chinese market provides deep local expertise but may limit international accessibility for overseas investors.

This evaluation primarily covers Guosen Securities' operations within the Chinese market. Services may not be available or suitable for investors in other jurisdictions. The regulatory framework and trading conditions discussed are specific to the Chinese securities market environment. This guosen securities review is based on publicly available information and user feedback collected from various sources, without involving actual trading experience testing.

Potential clients should verify current service availability, regulatory compliance, and trading conditions directly with the broker before making investment decisions. Financial services regulations and offerings may change over time.

| Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Specific account information not detailed in available materials |

| Tools and Resources | N/A | Trading tools and research resources not specified in source materials |

| Customer Service | N/A | Customer support details not mentioned in available information |

| Trading Experience | N/A | Platform performance data not provided in source materials |

| Trust & Credibility | 8/10 | Strong Fitch 'BBB+' rating demonstrates institutional credibility and industry recognition |

| User Experience | 6/10 | Glassdoor 3.3/5 employee rating reflects moderate user satisfaction levels |

Guosen Securities Co., Ltd. stands as one of China's established financial institutions. The company was founded in 1994 with headquarters strategically located in Shenzhen, one of China's major financial centers. As a full-license securities company, Guosen has developed a comprehensive business model that includes securities brokerage, investment banking, and asset management services. The firm has achieved recognition as one of the top 10 brokerages in China by total assets and revenue as of 2023.

This demonstrates significant market presence and institutional capability within the domestic Chinese market. The company's business strategy focuses particularly on the innovative enterprise segment, where it has established a leading market position. This specialization reflects Guosen's commitment to supporting China's evolving economic landscape, particularly in technology and innovation sectors.

According to DCFmodeling reports, the firm's growth trajectory over nearly three decades positions it as a significant player in China's securities industry. However, specific details regarding trading platform types, available asset classes, and regulatory oversight mechanisms are not comprehensively detailed in available public materials. This suggests the need for direct inquiry for prospective clients seeking detailed operational information.

Regulatory Environment: Available materials do not specify the exact regulatory authorities overseeing Guosen Securities operations. The firm operates as a legitimate Chinese stock broker within the country's financial regulatory framework.

Deposit and Withdrawal Methods: Specific information about funding methods and processes is not detailed in the available source materials.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in the current information summary.

Promotional Offers: Details regarding bonus structures or promotional campaigns are not mentioned in available materials.

Trading Assets: The range of tradeable instruments and asset classes is not comprehensively outlined in the source information.

Cost Structure: Specific information about spreads, commissions, and fee schedules is not provided in the available materials. This requires direct contact with the broker for detailed pricing information.

Leverage Ratios: Leverage options and maximum ratios are not specified in the current information summary.

Platform Options: Details about trading platform choices and technological infrastructure are not mentioned in available materials.

Geographic Restrictions: Specific regional limitations are not detailed in the source information.

Customer Service Languages: Available language support options are not specified in current materials.

This guosen securities review highlights the need for prospective clients to seek additional detailed information directly from the broker regarding operational specifics.

The account structure and opening requirements for Guosen Securities remain largely unspecified in available public materials. This creates a significant information gap for potential clients. Without detailed information about account types, minimum deposit requirements, or special features, it becomes challenging to assess the accessibility and suitability of the broker's offerings for different investor profiles.

The absence of specific account opening process descriptions or user experience feedback regarding registration procedures suggests that interested parties would need to contact the broker directly for comprehensive account information. The lack of transparency regarding account conditions, including any special account types such as Islamic accounts or professional trader accounts, limits the ability to make informed comparisons with other brokers in the market.

This information deficit represents a notable weakness in the broker's public communication strategy, particularly for potential international clients who might require specific account features or have particular regulatory requirements. Without clear documentation of account maintenance fees, inactivity charges, or other account-related costs, prospective clients cannot adequately assess the total cost of maintaining a trading relationship with Guosen Securities.

This guosen securities review emphasizes the importance of obtaining detailed account information before proceeding with account opening procedures.

The trading tools and research resources offered by Guosen Securities are not comprehensively detailed in available public information. This creates uncertainty about the technological capabilities and analytical support provided to clients. Modern trading requires sophisticated tools for market analysis, risk management, and trade execution, yet the specific offerings from Guosen in these areas remain unclear from publicly available sources.

Educational resources, which are crucial for trader development and ongoing market education, are not specified in the available materials. The absence of information about research publications, market commentary, or educational webinars suggests either limited offerings in this area or poor communication of available resources to potential clients.

Automated trading support and API access, increasingly important features for active traders and institutional clients, are not mentioned in the available information. The lack of detail about technical analysis tools, charting capabilities, or third-party integrations limits the ability to assess whether Guosen Securities can meet the needs of sophisticated trading strategies or professional trading operations.

Customer service capabilities and support infrastructure details are notably absent from available public information about Guosen Securities. The availability of customer support channels, response times, and service quality metrics are not specified. This makes it difficult to assess the level of client support prospective customers can expect.

Multilingual support capabilities, particularly important for international clients or those preferring languages other than Chinese, are not detailed in available materials. Given the broker's Chinese market focus, language support may be primarily in Chinese, but this assumption requires verification for international clients considering the platform.

Support availability hours, whether 24/7 or limited to specific time zones, and the range of issues that customer service can address are not clarified in public materials. The absence of user feedback regarding customer service experiences or problem resolution effectiveness creates additional uncertainty about the support quality clients can expect from this broker.

The trading experience offered by Guosen Securities lacks detailed documentation in available public sources. This creates significant uncertainty about platform performance, execution quality, and overall user interface design. Platform stability, execution speeds, and order processing capabilities are fundamental aspects of trading experience that remain unspecified in current materials.

Mobile trading capabilities and cross-platform synchronization features are not detailed, despite their increasing importance in modern trading environments. The absence of information about platform downtime, technical support for trading issues, or backup systems raises questions about the reliability of the trading infrastructure.

Order types available, trading hours, and market access specifics are not comprehensively outlined. This limits the ability to assess whether the platform meets the needs of different trading styles or strategies. This guosen securities review highlights the need for direct platform demonstration or trial access to properly evaluate the trading experience quality.

Guosen Securities demonstrates solid institutional credibility through its Fitch credit rating of 'BBB+' with a stable outlook. This indicates recognized financial stability and industry standing. The rating reflects the company's ability to meet its financial obligations and suggests a level of institutional reliability that provides confidence to potential clients and industry partners.

The firm's establishment in 1994 and subsequent growth to become one of China's top 10 brokerages by assets and revenue demonstrates long-term market presence and business sustainability. This track record suggests institutional stability and the ability to navigate various market conditions over nearly three decades of operation.

However, specific regulatory license numbers, detailed compliance frameworks, and fund protection measures are not clearly outlined in available public materials. The absence of detailed information about client fund segregation, insurance coverage, or regulatory oversight mechanisms creates gaps in the transparency that modern investors typically expect from financial service providers.

User experience assessment for Guosen Securities is primarily informed by the Glassdoor employee rating of 3.3 out of 5 stars, based on 65 employee reviews. This reflects a moderate level of satisfaction within the organization. While employee satisfaction doesn't directly correlate with client experience, it can provide insights into the company's operational culture and service delivery capabilities.

The neutral rating suggests that while the company maintains basic operational standards, there may be areas for improvement in terms of workplace satisfaction that could potentially impact service delivery quality. However, specific client feedback regarding user interface design, ease of navigation, or overall platform usability is not available in current public materials.

Registration and verification processes, fund operation experiences, and common user complaints are not detailed in available information. This limits the ability to provide a comprehensive user experience assessment. The target user profile appears to be investors seeking securities investment and foreign exchange trading opportunities, primarily within the Chinese market context.

Guosen Securities presents itself as a legitimate and established Chinese securities broker with moderate overall performance characteristics. The firm's nearly three-decade market presence, Fitch 'BBB+' credit rating, and position among China's top 10 brokerages by assets demonstrate institutional credibility and market recognition.

However, the significant lack of detailed information about trading conditions, platform features, and service specifics creates challenges for potential clients seeking comprehensive broker evaluation. The broker appears most suitable for investors primarily focused on Chinese securities markets and those prioritizing institutional stability over advanced trading features or international market access.

While the company's market position and credit rating provide confidence in its legitimacy and financial stability, prospective clients should conduct direct inquiries to obtain detailed information about trading conditions, costs, and service features before making commitment decisions.

FX Broker Capital Trading Markets Review