BlaFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive blafx review looks at a trading platform that has received mixed feedback from the forex community. Based on current information and user testimonials, BlaFX presents itself as an online trading platform offering access to multiple asset classes including forex, stocks, commodities, indices, bonds, and cryptocurrencies. However, our analysis shows serious concerns about the broker's trustworthiness and how openly it operates.

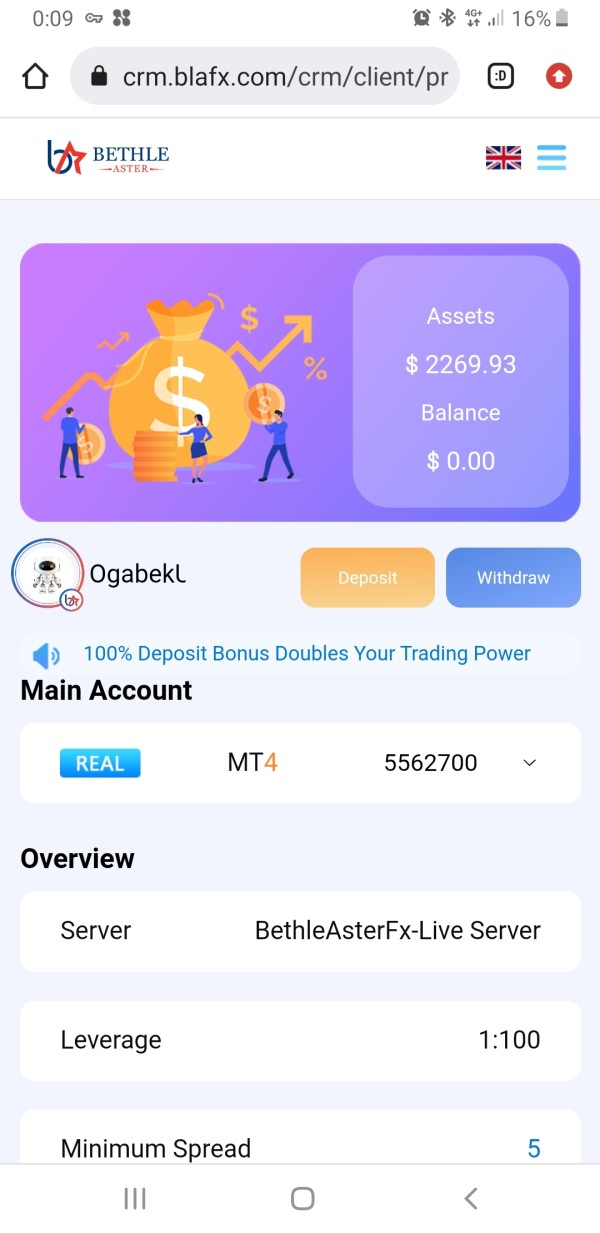

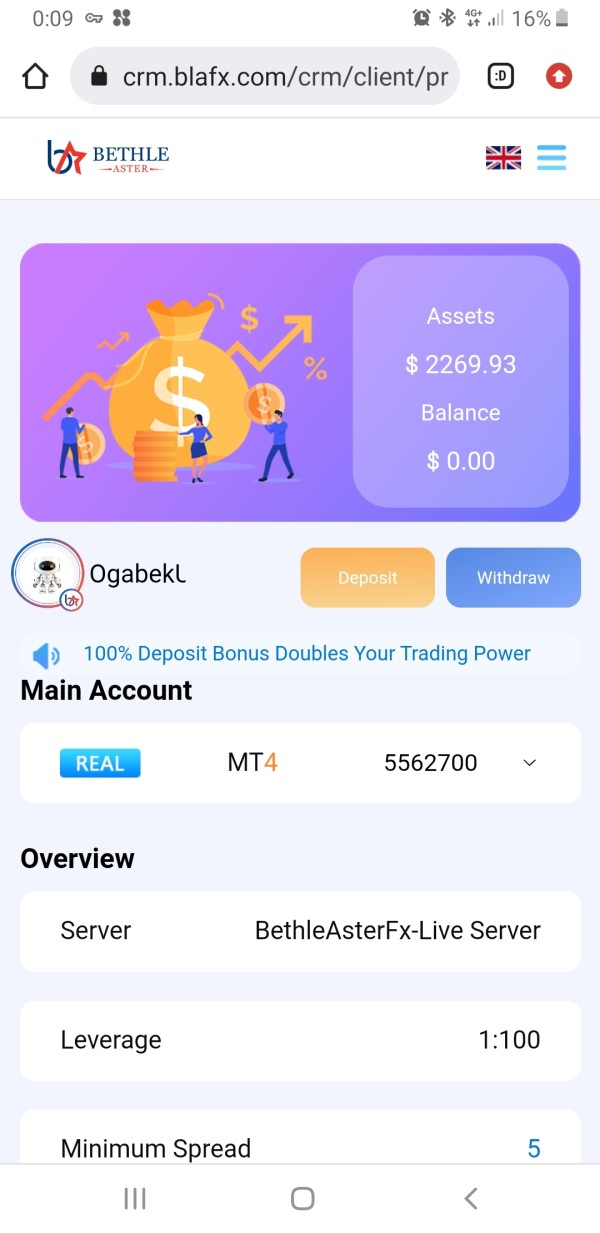

According to various industry sources and user feedback, BlaFX operates with a moderate trust rating. Several red flags exist that potential traders should carefully consider. The platform uses MetaTrader 4 (MT4) as its primary trading interface and claims to provide transparent spread information. However, user reports consistently highlight withdrawal difficulties and concerns about misleading promises, which significantly impact the overall user experience.

The broker appears to target traders interested in diversified asset portfolios. But the lack of comprehensive regulatory information and negative user feedback suggests that investors should exercise extreme caution. While the platform offers access to popular trading instruments, the absence of clear regulatory oversight and persistent user complaints about fund withdrawal issues make this broker a questionable choice for serious traders seeking reliable trading conditions.

Important Disclaimers

Regional Entity Variations: BlaFX has not provided specific regulatory information across different jurisdictions. Investors in various regions may face different legal protections and risk exposures when dealing with this broker. The absence of clear regulatory framework means that trader protections may vary significantly or be entirely absent depending on your location.

Review Methodology: This evaluation is based on currently available public information, user feedback, and industry reports. Due to limited transparency from the broker regarding key operational details, this review may not cover all possible trading experiences or outcomes. Potential clients should conduct additional research before making any investment decisions.

Rating Framework

Broker Overview

BlaFX positions itself as an online trading platform providing access to diverse financial markets. Critical information about the company's establishment date and corporate headquarters remains undisclosed in available sources. The broker's business model focuses on offering multi-asset trading opportunities, including traditional forex pairs alongside stocks, commodities, indices, bonds, and cryptocurrency instruments. However, the lack of basic corporate transparency raises immediate concerns about the platform's legitimacy and long-term viability.

The company's operational structure appears to center around providing retail traders with access to global financial markets through a simplified trading interface. According to available information, BlaFX emphasizes its commitment to transparent pricing models, particularly regarding spread disclosure. However, this claimed transparency contrasts sharply with the notable absence of detailed information about other crucial trading costs, including commissions, overnight fees, and withdrawal charges.

Platform and Asset Coverage: BlaFX operates exclusively through the MetaTrader 4 (MT4) platform, which represents a standard but somewhat dated choice in today's competitive brokerage landscape. The broker offers trading access across six major asset categories: foreign exchange pairs, individual stocks, commodity futures, market indices, government and corporate bonds, and various cryptocurrency instruments. While this diversification appears comprehensive on paper, the actual depth and quality of offerings within each category remain unclear due to limited detailed disclosure.

Regulatory Status: Perhaps most concerning is the complete absence of verifiable regulatory information in this blafx review. No major financial regulatory authority appears to oversee BlaFX's operations, which represents a significant red flag for potential clients seeking secure and legally compliant trading environments.

Regulatory Oversight: Available sources indicate no specific regulatory jurisdictions overseeing BlaFX operations. This absence of regulatory supervision means traders lack basic protections typically provided by established financial authorities such as segregated client funds, compensation schemes, or dispute resolution mechanisms.

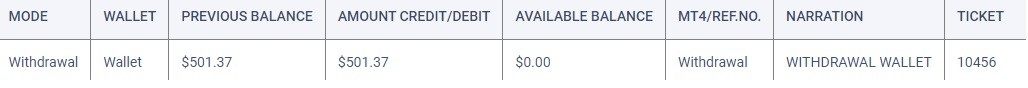

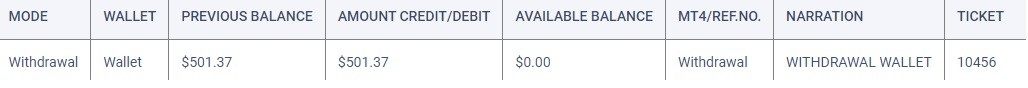

Deposit and Withdrawal Methods: Specific information regarding available funding methods has not been disclosed in accessible sources. This lack of transparency extends to withdrawal procedures, which is particularly concerning given numerous user complaints about withdrawal difficulties.

Minimum Account Requirements: The broker has not published clear information about minimum deposit requirements. This makes it impossible for potential clients to understand entry-level investment thresholds or account tier structures.

Promotional Offerings: No specific bonus or promotional programs have been identified in available source materials. This may reflect either the absence of such programs or inadequate disclosure practices.

Tradeable Assets: BlaFX provides access to six primary asset classes: currency pairs in the forex market, individual equity securities, commodity instruments, major market indices, bond securities, and cryptocurrency trading pairs. However, the specific number of instruments within each category remains undisclosed.

Cost Structure: While the broker claims to maintain transparent spread pricing, detailed information about commission structures, overnight financing rates, and other trading costs has not been made publicly available. This selective transparency raises questions about hidden fees that may impact overall trading profitability.

Leverage Ratios: Specific leverage offerings have not been disclosed in available source materials. This represents another significant gap in essential trading information.

Platform Options: BlaFX exclusively offers MetaTrader 4 as its trading platform. No mention of additional platform choices or proprietary trading software exists.

Geographic Restrictions: Information regarding restricted territories or regional limitations has not been specified in accessible sources.

Customer Support Languages: Available customer service languages have not been detailed in the materials reviewed for this blafx review.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions offered by BlaFX suffer from significant transparency issues that substantially impact the overall trading proposition. Available sources provide virtually no information about different account types, their respective features, or the specific benefits associated with higher-tier accounts. This lack of clarity makes it impossible for potential traders to make informed decisions about which account structure might best suit their trading style and capital requirements.

Minimum Deposit Concerns: The absence of published minimum deposit requirements represents a basic failure in disclosure standards. Reputable brokers typically provide clear information about entry-level capital requirements, allowing traders to plan their initial investments appropriately. BlaFX's failure to disclose this basic information suggests either poor operational standards or intentional obscurity.

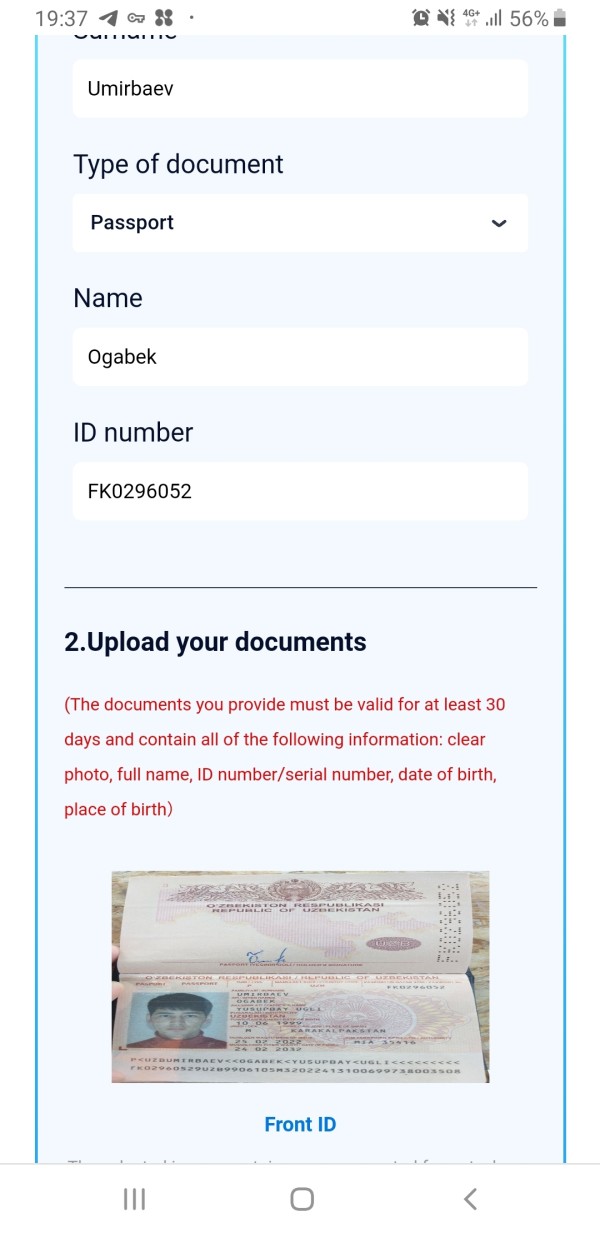

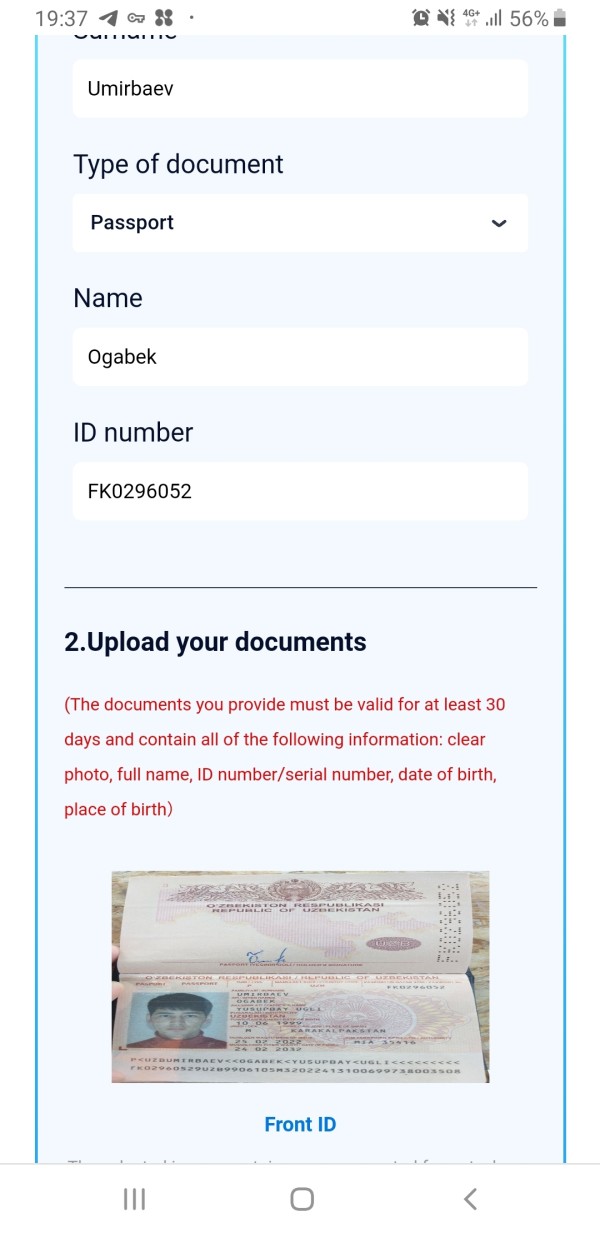

Account Opening Process: No detailed information about the account registration and verification procedures has been made available. This lack of transparency extends to documentation requirements, verification timeframes, and approval processes, all of which are essential considerations for prospective clients.

Special Features: The broker has not highlighted any unique account features, advanced trading tools, or premium services that might differentiate it from competitors. This absence of distinctive offerings, combined with the numerous negative user reports, significantly undermines the value proposition for potential clients seeking this blafx review for guidance.

BlaFX's trading infrastructure appears limited to the basic MetaTrader 4 platform. While functional, this represents a minimal approach to trader support and market analysis capabilities. The exclusive reliance on MT4, without mention of additional proprietary tools or enhanced features, suggests a bare-bones operation that may not meet the needs of sophisticated traders requiring advanced analytical capabilities.

Trading Tool Limitations: Beyond the standard MT4 offering, no additional trading tools, market scanners, or analytical software have been identified. Modern traders typically expect access to economic calendars, market sentiment indicators, technical analysis packages, and risk management tools, none of which appear to be prominently featured in BlaFX's service offering.

Research and Analysis Resources: Available sources indicate no provision of market research, daily analysis, trading signals, or educational content that would typically support trader decision-making. This absence of value-added services represents a significant disadvantage compared to full-service brokers who invest in comprehensive market analysis and trader education.

Educational Support: No mention of trading education programs, webinars, tutorials, or learning resources has been identified. This suggests that BlaFX may not prioritize trader development or skill enhancement.

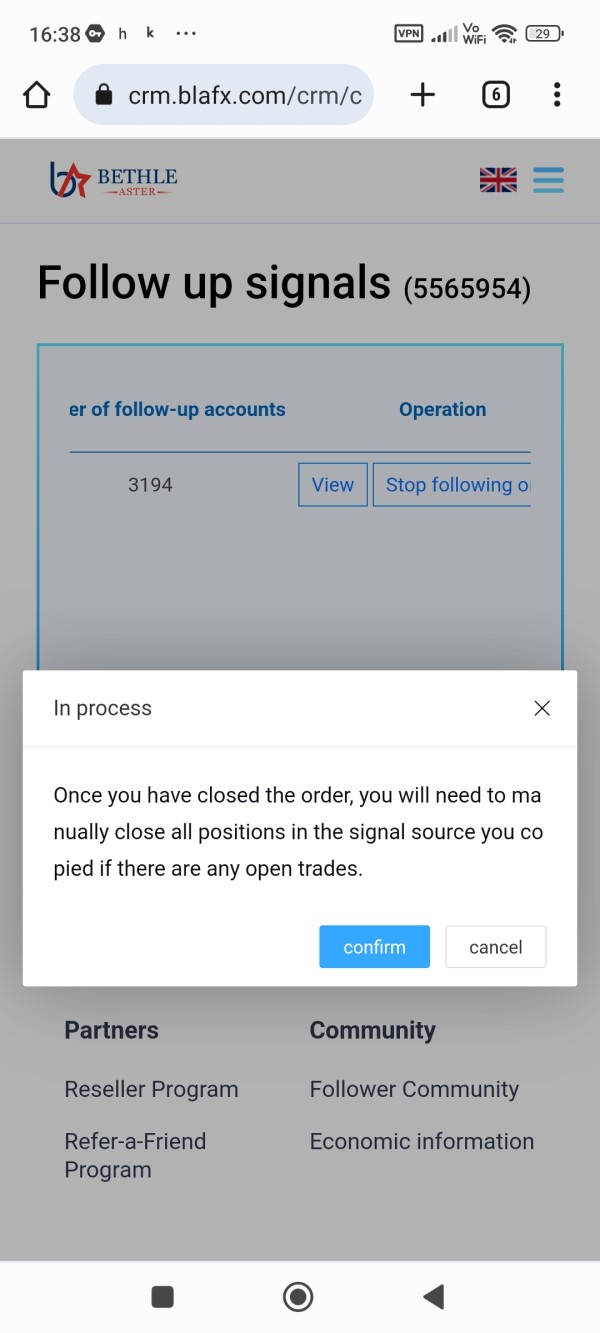

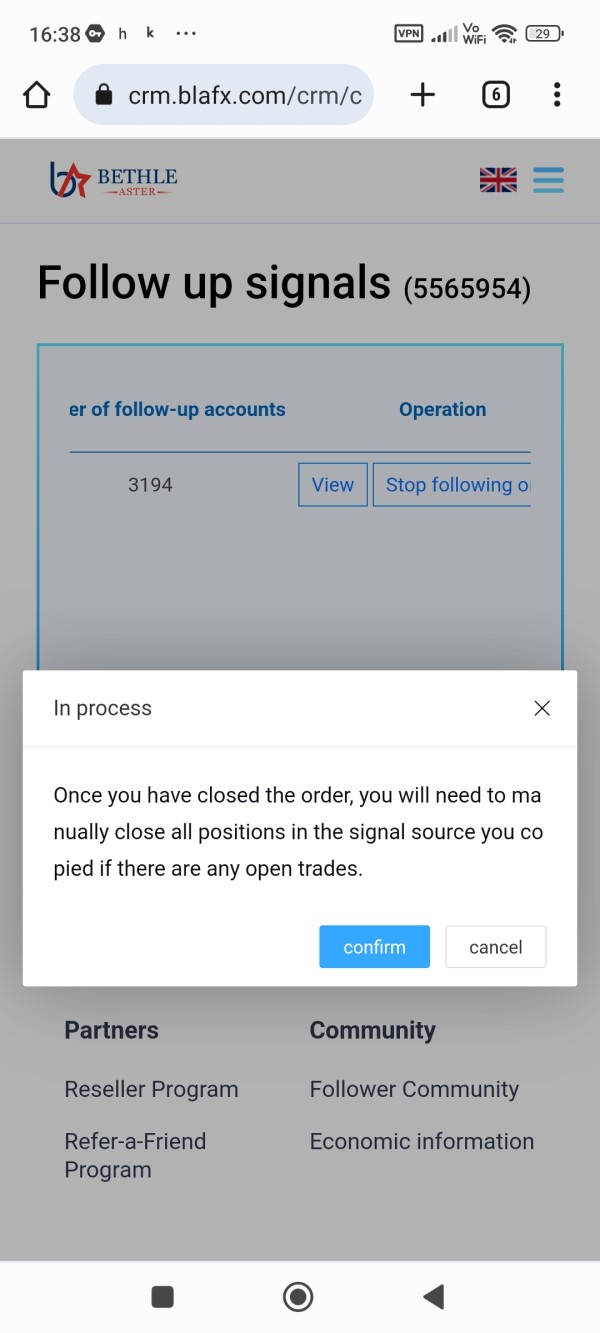

Automation Capabilities: While MT4 supports automated trading through Expert Advisors, there is no specific mention of BlaFX's support for algorithmic trading, copy trading, or other automated strategies that have become increasingly popular among retail traders.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of BlaFX's most significant weaknesses, with multiple user reports highlighting serious deficiencies in support quality and responsiveness. The persistent complaints about withdrawal difficulties strongly suggest systematic issues with customer service protocols and problem resolution capabilities.

Service Quality Issues: User feedback consistently points to unprofessional customer service interactions and inadequate problem resolution. These reports suggest that BlaFX may lack properly trained support staff or established procedures for handling client concerns effectively.

Response Time Concerns: While specific response time data is not available, user complaints about difficulty resolving issues imply that support responsiveness may be inadequate for traders requiring timely assistance with account or trading problems.

Communication Channels: The broker has not clearly specified available customer support channels, contact hours, or preferred communication methods. This makes it difficult for potential clients to understand how they might access help when needed.

Issue Resolution: Multiple user reports about withdrawal difficulties and unresolved complaints suggest that BlaFX may struggle with systematic issue resolution, particularly regarding financial transactions and account management problems.

Trading Experience Analysis (Score: 6/10)

The trading experience with BlaFX presents a mixed picture, with some positive elements such as transparent spread disclosure balanced against concerning user feedback about overall platform reliability and operational issues. While the broker claims to provide clear pricing information, the broader trading experience appears compromised by various operational challenges.

Platform Stability: User feedback suggests moderate platform performance, though specific data about execution speeds, server stability, or technical reliability is not available in reviewed sources. The exclusive use of MT4 provides a familiar interface for experienced traders but may limit advanced functionality.

Order Execution Quality: No specific information about order execution speeds, slippage rates, or fill quality has been disclosed. This makes it difficult to assess the technical quality of trade execution.

Platform Functionality: The basic MT4 offering provides standard trading capabilities but lacks the enhanced features and customization options that many modern traders expect from their trading environment.

Mobile Trading Experience: Available sources do not provide specific information about mobile trading capabilities, app quality, or cross-device synchronization features.

Trading Environment: While BlaFX claims to offer transparent spread information, user feedback suggests that the overall trading experience may be compromised by various operational issues and concerns about the broker's reliability, as highlighted throughout this blafx review.

Trust and Reliability Analysis (Score: 4/10)

Trust and reliability represent perhaps the most critical weaknesses in BlaFX's overall proposition. Multiple factors contribute to significant concerns about the broker's long-term viability and operational integrity. The complete absence of regulatory oversight represents a basic flaw that undermines confidence in the broker's commitment to industry standards and client protection.

Regulatory Concerns: The lack of supervision by any recognized financial regulatory authority means that BlaFX operates without the oversight mechanisms that typically protect retail traders. This absence of regulatory compliance represents a major red flag for potential clients seeking secure trading environments.

Fund Security Measures: No information about client fund segregation, deposit insurance, or other financial protection measures has been disclosed. This leaves traders without assurance about the safety of their deposited capital.

Corporate Transparency: The absence of basic corporate information, including company registration details, management team information, and operational history, significantly undermines confidence in the broker's legitimacy and transparency.

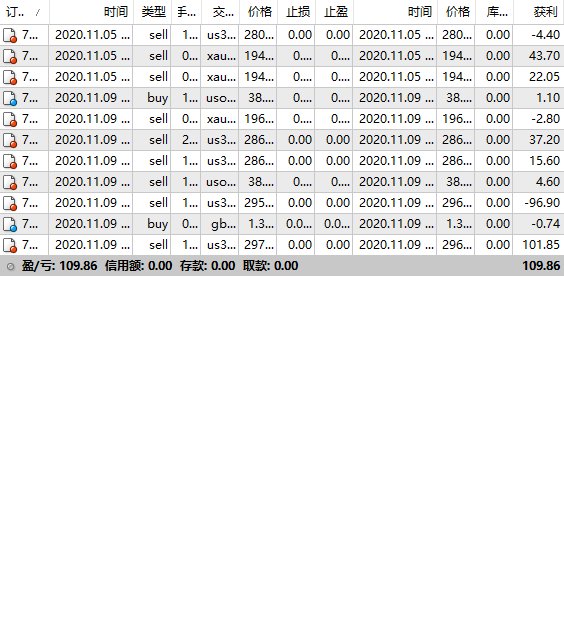

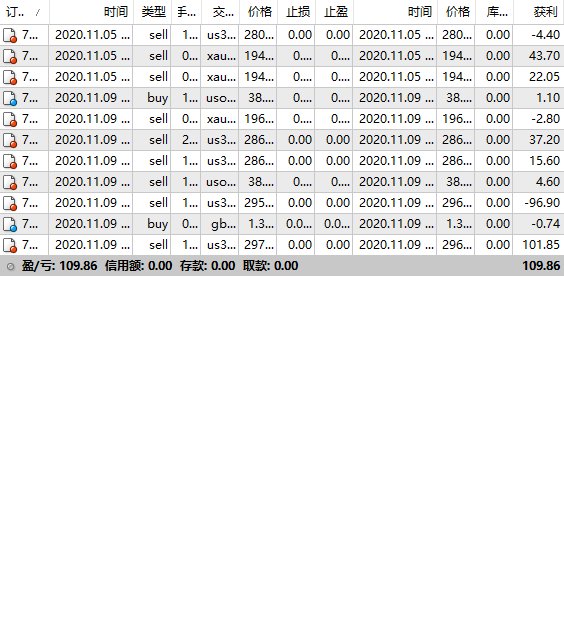

Industry Reputation: User feedback and industry reports consistently highlight negative experiences, particularly regarding withdrawal difficulties and misleading promises, which substantially damage the broker's reputation within the trading community.

Negative Event Handling: Reports of false promises and inadequate responses to user complaints suggest that BlaFX may lack proper procedures for managing client relationships and resolving disputes fairly and transparently.

User Experience Analysis (Score: 5/10)

The overall user experience with BlaFX appears characterized by significant dissatisfaction. User feedback reveals persistent problems that substantially impact trader satisfaction and confidence. While some traders may find the multi-asset offering appealing, the operational challenges and trust issues create substantial barriers to positive user experiences.

Overall User Satisfaction: Available user feedback indicates moderate to poor satisfaction levels, with particular emphasis on withdrawal difficulties and concerns about the broker's reliability and transparency.

Interface Design and Usability: While MT4 provides a familiar trading interface, the lack of additional platform options or enhanced features may limit the user experience for traders seeking more modern or customized trading environments.

Registration and Verification Process: The absence of clear information about account opening procedures creates uncertainty for potential clients. This may indicate inadequate attention to user experience design.

Financial Transaction Experience: User reports of withdrawal difficulties represent a critical failure in the basic user experience, as reliable access to deposited funds represents a basic expectation for any financial service provider.

Common User Complaints: The most frequently reported issues include withdrawal difficulties and concerns about false promises. This indicates systematic problems with core business operations rather than isolated incidents.

User Profile Analysis: BlaFX may appeal to traders interested in multi-asset exposure, but the significant operational concerns make it unsuitable for traders prioritizing reliability, transparency, and regulatory protection.

Improvement Recommendations: Substantial improvements in transparency, customer service quality, and regulatory compliance would be necessary to address the concerns highlighted in user feedback and this comprehensive evaluation.

Conclusion

This comprehensive blafx review reveals a trading platform with significant operational and trustworthiness concerns that substantially outweigh any potential benefits. While BlaFX offers access to multiple asset classes and claims transparent spread pricing, the absence of regulatory oversight, persistent user complaints about withdrawal difficulties, and lack of basic corporate transparency create an unacceptable risk profile for most traders.

The broker may initially appeal to traders seeking diversified asset exposure. But the issues identified throughout this analysis make BlaFX unsuitable for serious traders prioritizing security, reliability, and professional service standards. The combination of poor customer service, withdrawal difficulties, and absence of regulatory protection creates a trading environment that poses significant risks to client capital and trading success.

Primary Advantages: Limited to transparent spread disclosure and multi-asset trading access.

Critical Disadvantages: Include lack of regulatory oversight, withdrawal difficulties, poor customer service, limited platform options, and insufficient corporate transparency.

Recommendation: Based on the evidence reviewed, traders should exercise extreme caution and consider well-regulated alternatives that provide better client protection and operational reliability.