UNX Capital Review 1

Good broker, maybe it can develop over time

UNX Capital Forex Broker provides real users with 1 positive reviews, * neutral reviews and * exposure review!

Good broker, maybe it can develop over time

UNX Capital presents itself as a trusted forex broker with commitments to transparency and client safety. This makes it potentially suitable for investors looking to enter the forex and CFD markets. The company was established in 2005 and is headquartered in Australia, providing forex and CFD trading services to a global clientele. The broker primarily targets small to medium-sized investors and traders seeking high-risk investment opportunities.

UNX Capital operates as an online retail broker specializing in foreign exchange and contracts for difference trading. However, our unx capital review reveals that specific details about regulatory oversight, trading conditions, and user experiences remain limited in publicly available sources. The company's longevity in the market since 2005 suggests some level of operational stability. Potential clients should conduct thorough due diligence before committing funds.

The broker appears to focus on providing access to global CFD and forex markets. Comprehensive information about platform features, account types, and cost structures requires further investigation from official sources.

Information presented in this review is based on publicly available sources and user feedback. We have not conducted on-site verification of UNX Capital's operations. The information summary does not mention specific regulatory details, which means the broker's legal status may vary across different jurisdictions. Potential traders should independently verify the broker's regulatory standing in their respective countries before opening accounts.

This assessment reflects the current state of available information. It may not capture recent developments or changes in the broker's services. Traders are advised to consult official company communications and regulatory databases for the most current information.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account conditions not detailed in available information |

| Tools and Resources | N/A | Trading tools and resources not specified in information summary |

| Customer Service and Support | N/A | Customer support details not mentioned in available sources |

| Trading Experience | N/A | Trading experience specifics not detailed in information summary |

| Trust and Security | 6/10 | Based on company's self-proclaimed status as a trusted broker |

| User Experience | N/A | User experience details not specified in available information |

UNX Capital was established in 2005 as an Australian-headquartered online retail broker. The company specializes in forex and contracts for difference trading. The company positions itself as a provider of global trading services, offering access to international financial markets through its online platform. With nearly two decades of operation, UNX Capital has maintained its presence in the competitive forex brokerage landscape.

The broker's business model centers on providing retail clients with access to forex and CFD markets. Specific details about its execution model, liquidity providers, and technological infrastructure are not extensively documented in available sources. The company's Australian base suggests potential alignment with Australian financial services regulations. Specific regulatory details require verification.

Our unx capital review indicates that the broker focuses on serving individual traders rather than institutional clients. The company pays particular attention to those interested in high-risk trading opportunities. The company's target demographic appears to include both novice and experienced traders seeking exposure to global currency and CFD markets. Specific account tiers or client segmentation details are not clearly outlined in available information.

Regulatory Jurisdictions: Specific regulatory information is not mentioned in the information summary. This requires independent verification from official sources.

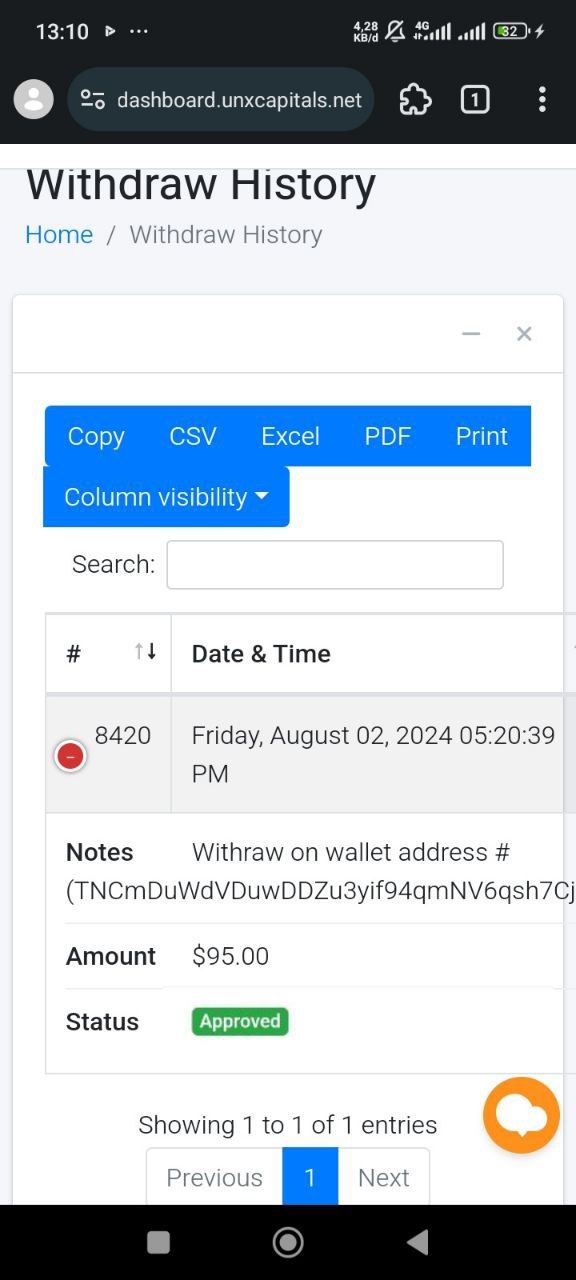

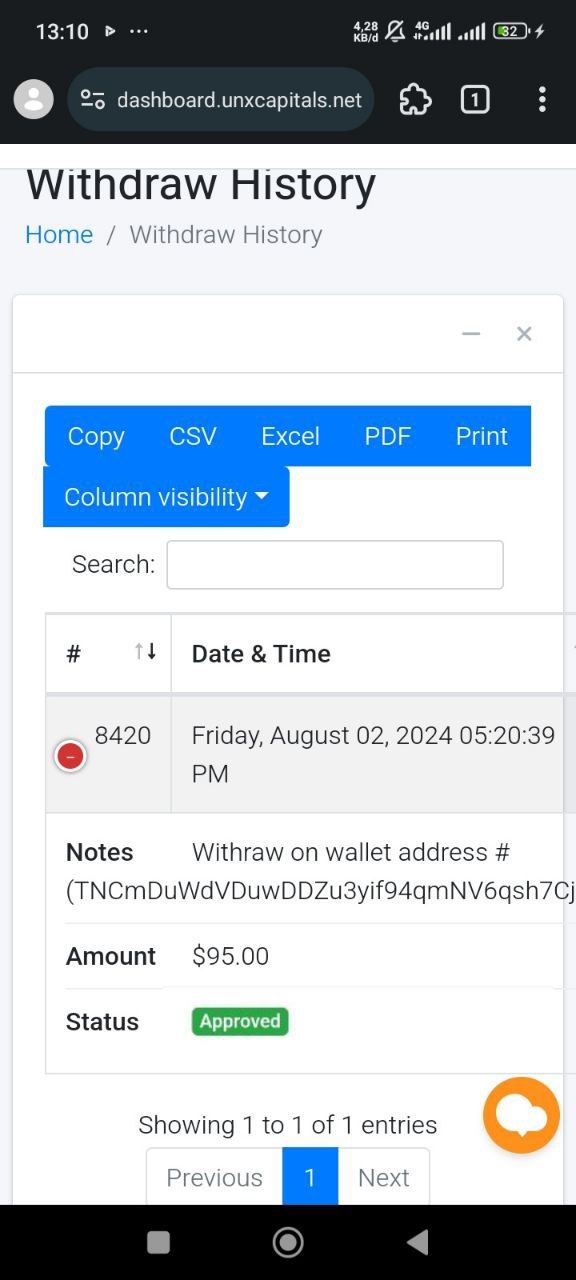

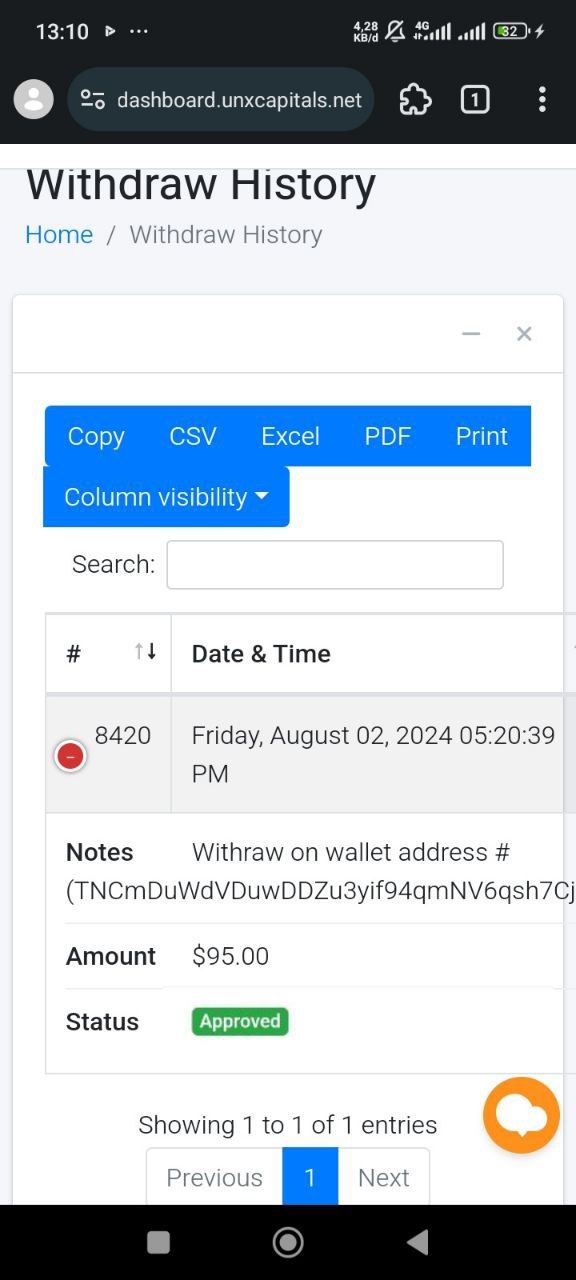

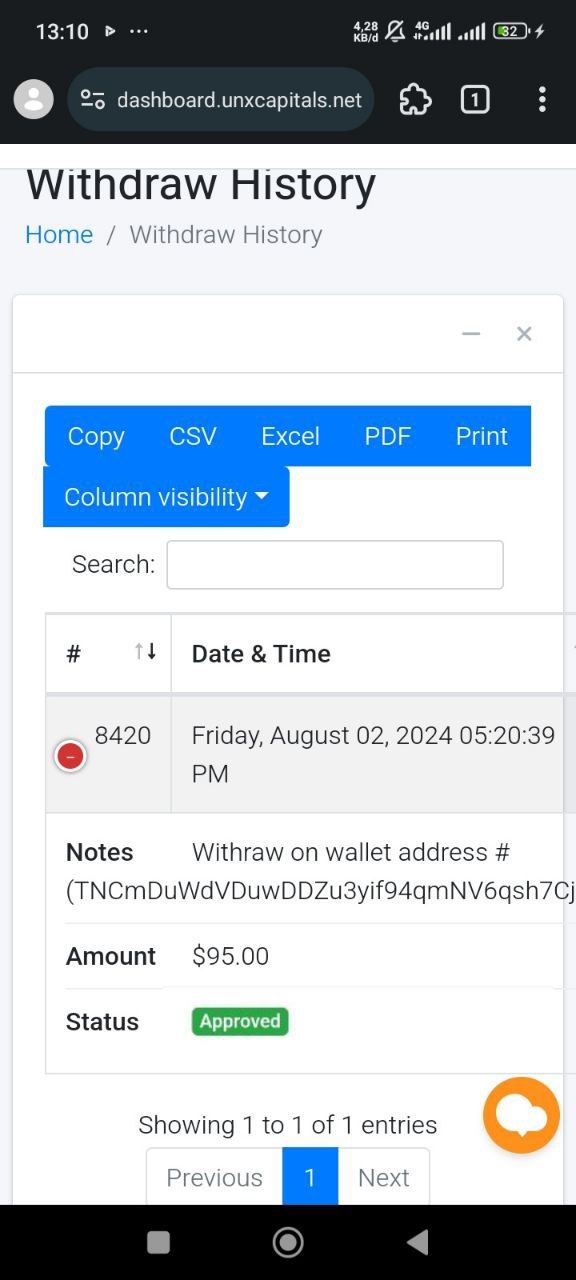

Deposit and Withdrawal Methods: Available funding options are not detailed in the information summary.

Minimum Deposit Requirements: Minimum deposit thresholds are not specified in available sources.

Bonuses and Promotions: Information about promotional offers is not mentioned in the information summary.

Tradeable Assets: The broker offers forex and CFD trading services. This provides access to currency markets and derivative instruments.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not detailed in the information summary.

Leverage Ratios: Leverage offerings are not specified in available information sources.

Platform Options: Trading platform details are not mentioned in the information summary.

Geographic Restrictions: Regional limitations are not specified in available sources.

Customer Support Languages: Supported languages for customer service are not mentioned in the information summary.

This unx capital review highlights the need for potential clients to seek additional information directly from the broker. They need details about these essential trading parameters.

The specific account conditions offered by UNX Capital are not detailed in available information sources. This makes it challenging to provide a comprehensive assessment of this crucial aspect. Account types, their respective features, and associated benefits remain unspecified in the information summary. Without clear details about minimum deposit requirements, account tiers, or special account features such as Islamic accounts for Muslim traders, potential clients cannot make informed decisions about which account type might suit their trading needs.

The absence of specific information about account opening procedures, verification requirements, and account management features represents a significant information gap. Industry-standard features such as demo accounts, managed accounts, or VIP services are not mentioned in available sources. This lack of transparency regarding account structures may concern potential clients who need to understand exactly what services and conditions they can expect.

Our unx capital review suggests that prospective traders should contact the broker directly. They need to obtain detailed information about account types, conditions, and requirements before making any commitment to open an account with the platform.

Information about trading tools and resources provided by UNX Capital is not specified in the available information summary. Essential trading tools such as charting packages, technical analysis indicators, economic calendars, and market research resources remain undetailed. The absence of information about educational resources, trading guides, or market analysis materials makes it difficult to assess the broker's commitment to supporting trader development and success.

Research and analysis resources are crucial for informed trading decisions but are not mentioned in available sources. The availability of automated trading support, expert advisors, or algorithmic trading capabilities also remains unclear. Without details about these fundamental trading support systems, potential clients cannot evaluate whether UNX Capital provides the necessary tools for their trading strategies.

The lack of information about platform-specific tools, mobile trading capabilities, or third-party integrations further complicates the assessment. Professional traders often require sophisticated tools and resources, and the absence of detailed information about these features may influence their broker selection decisions.

Customer service and support details for UNX Capital are not mentioned in the information summary. This creates uncertainty about the quality and availability of client assistance. Essential support features such as available communication channels, response times, and service quality standards remain unspecified. The absence of information about customer service hours, multilingual support capabilities, and problem resolution procedures makes it difficult to assess the broker's commitment to client satisfaction.

Professional forex brokers typically offer multiple support channels including live chat, email, phone support, and sometimes social media assistance. Without specific information about UNX Capital's customer service infrastructure, potential clients cannot evaluate whether the broker meets their support expectations. Response time commitments are crucial during volatile market conditions but are not detailed in available sources.

The quality of customer service often determines client satisfaction and retention in the competitive forex brokerage industry. Without user feedback or specific service quality metrics, this review cannot provide a comprehensive assessment of UNX Capital's customer support capabilities.

The trading experience offered by UNX Capital lacks specific details in available information sources. Platform stability, execution speed, and order processing quality are fundamental aspects of trading experience that remain unspecified. Without information about the trading platform's technical performance, user interface design, or execution capabilities, potential clients cannot assess whether the broker meets their trading requirements.

Order execution quality includes factors such as slippage, requotes, and execution speed during volatile market conditions but is not detailed in the information summary. These technical aspects significantly impact trading profitability and user satisfaction. Mobile trading capabilities are increasingly important for modern traders but are not mentioned in available sources.

The overall trading environment includes features such as one-click trading, advanced order types, and risk management tools but remains unclear. Our unx capital review indicates that traders should seek detailed information about platform capabilities and trading conditions directly from the broker before committing to their services.

UNX Capital's trust and security profile presents a mixed picture based on available information. The information summary mentions that UNX Capital is considered a trusted forex broker with commitments to transparency and client safety, but specific details about regulatory oversight and security measures are not provided. The absence of clear regulatory information raises questions about the broker's compliance with financial services regulations.

Fund security measures are crucial for client protection but are not detailed in available sources. Industry-standard protections such as segregated client accounts, deposit insurance, or compensation schemes are not mentioned. The company's transparency commitments are noted but lack specific details about reporting practices, audit procedures, or regulatory compliance measures.

User discussions about the broker's legitimacy and safety suggest that some clients have concerns about these aspects. Without comprehensive regulatory verification and detailed security protocols, the trust assessment remains limited to the broker's self-proclaimed status and general market presence since 2005.

User experience details for UNX Capital are not comprehensively covered in the information summary. Overall user satisfaction metrics, interface design quality, and ease of use assessments are not available from the sources reviewed. The registration and verification process significantly impacts initial user experience but is not detailed in available information.

Fund management experience includes deposit and withdrawal procedures, processing times, and associated fees but remains unspecified. These operational aspects directly affect user satisfaction and are crucial for evaluating the broker's service quality. The information summary mentions user concerns about high-risk investment opportunities, suggesting that some clients may have reservations about the broker's risk management approach.

Without specific user feedback, satisfaction surveys, or detailed user journey analysis, this review cannot provide a comprehensive assessment of the overall user experience. The absence of information about common user complaints or positive feedback patterns limits the ability to provide balanced insights into client satisfaction levels.

UNX Capital presents itself as an established forex broker with nearly two decades of market presence and commitments to transparency and safety. However, our comprehensive unx capital review reveals significant information gaps that potential clients should address before making trading decisions. While the broker's longevity since 2005 and Australian headquarters suggest operational stability, the absence of detailed regulatory information, trading conditions, and user experience data necessitates further investigation.

The broker appears most suitable for traders seeking high-risk investment opportunities in forex and CFD markets. The lack of specific account conditions and trading terms makes it difficult to recommend for particular trader types. The main advantages include the company's established market presence and stated commitments to transparency, while the primary disadvantages center on insufficient publicly available information about regulatory oversight, trading conditions, and user feedback.

Potential clients should conduct thorough due diligence before committing funds to UNX Capital. This includes direct communication with the broker to obtain detailed information about regulatory status, trading conditions, and service offerings.

FX Broker Capital Trading Markets Review