Ttrade 2025 Review: Everything You Need to Know

Summary

This Ttrade review looks at a broker that offers good trading conditions. The broker has spreads starting from 0.0 pips and high dynamic leverage. Users have given mixed but mostly positive feedback on review platforms, with Trustpilot scores of 4.1/5 from 110 reviews and 4.3/5 from 398 reviews under different profiles. The broker gives access to popular trading platforms including MT4/MT5 alongside its own web-based platform. It also offers services from Trading Central and TradingView for market analysis.

Ttrade targets intermediate to advanced traders who want low trading costs and high leverage opportunities. The broker talks about its "razor-thin spreads" and claims to offer some of the lowest spreads in the market. However, potential users should know that 83% of retail investor accounts lose money when trading CFDs with this provider. This is a big risk factor that needs careful thought. The overall assessment suggests a broker with good trading conditions but limited transparency about regulatory oversight and complete service details.

Important Notice

Regional Entity Differences: Current available information does not give specific regulatory details for Ttrade. This may result in different levels of investor protection and risk exposure depending on the user's location. Traders should check the regulatory status that applies to their region before using this broker.

Review Methodology: This evaluation uses user feedback from review platforms and publicly available marketing materials. The assessment does not account for specific regulatory environments or complete testing of all trading conditions, as detailed regulatory information was not available in the source materials.

Rating Framework

Broker Overview

Ttrade works as a financial services provider focusing on forex and CFD trading. The broker emphasizes competitive pricing structures. The broker's main value centers around offering raw spreads starting from 0.0 pips and positions itself as providing "the lowest spreads in the market." While specific founding details and complete company background information are not detailed in available sources, the broker appears to have built a presence in the retail trading sector. It focuses on cost-effective trading solutions.

The broker's business model revolves around providing multiple trading platforms to fit different trader preferences and experience levels. According to available information, Ttrade offers its own web-based trading platform alongside the industry-standard MetaTrader 4 and MetaTrader 5 platforms. This multi-platform approach suggests an effort to serve both novice traders who may prefer simple web-based interfaces and experienced traders who need the advanced features of professional trading software. The integration of third-party analytical services like Trading Central and TradingView further shows a commitment to providing complete trading resources beyond basic execution services.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing Ttrade's operations. This represents a significant transparency gap for potential clients seeking regulatory assurance.

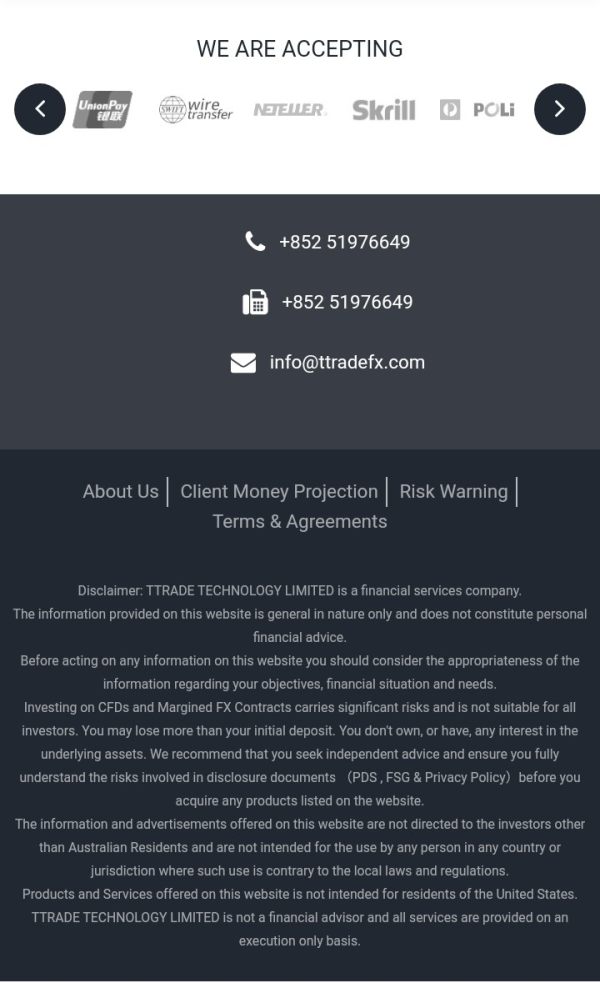

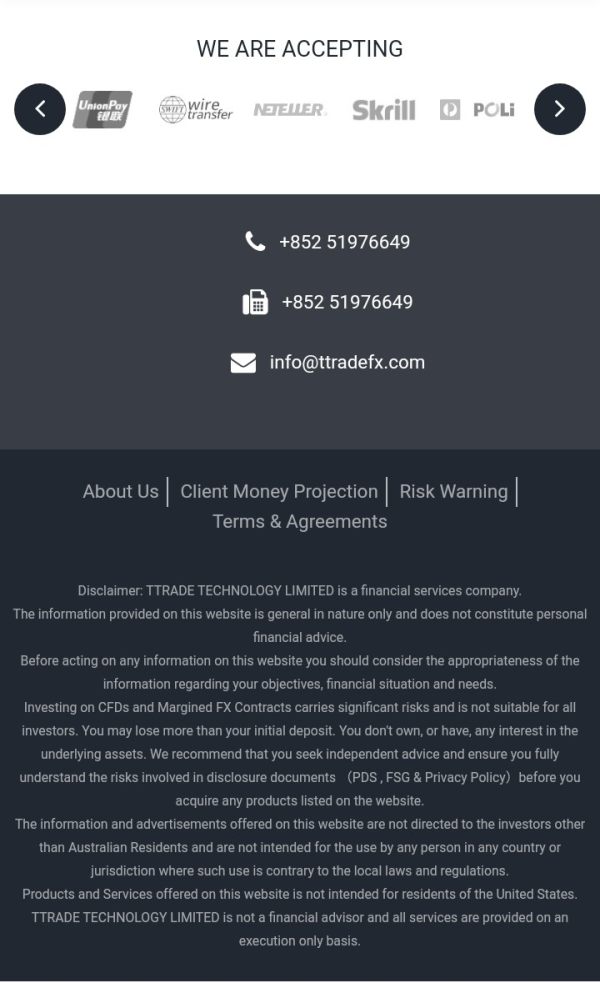

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in the source materials.

Minimum Deposit Requirements: The minimum deposit threshold required to open an account with Ttrade is not specified in available documentation.

Bonuses and Promotions: Current promotional offers or bonus programs are not mentioned in the available information sources.

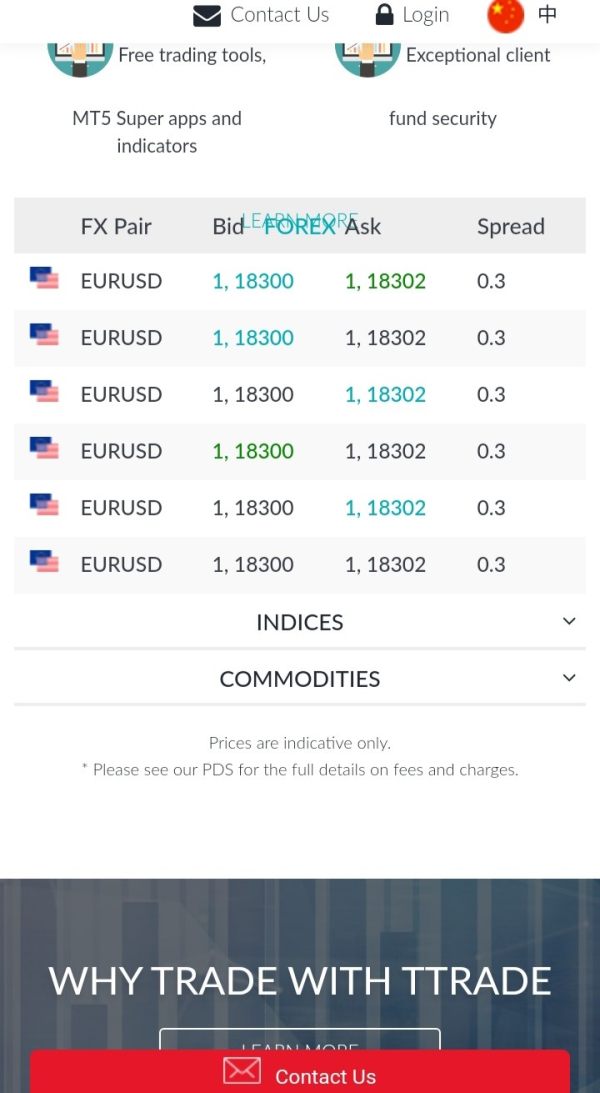

Tradeable Assets: While the broker appears to offer forex and CFD trading, the complete range of available instruments and asset classes is not fully detailed.

Cost Structure: The primary cost advantage highlighted is spreads beginning from 0.0 pips. Commission structures and additional fees are not clearly outlined in available materials.

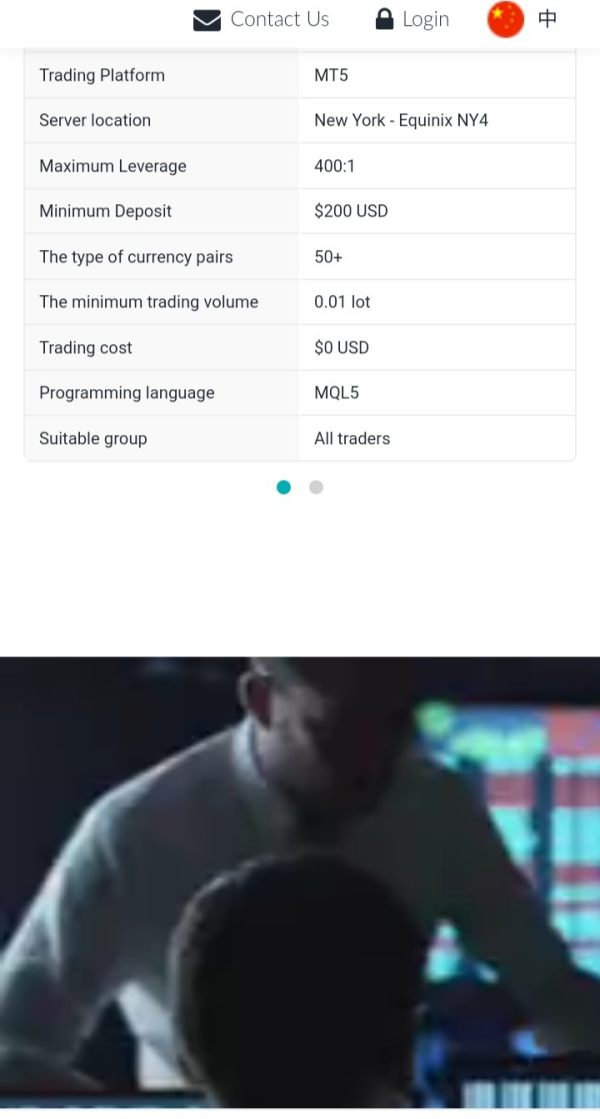

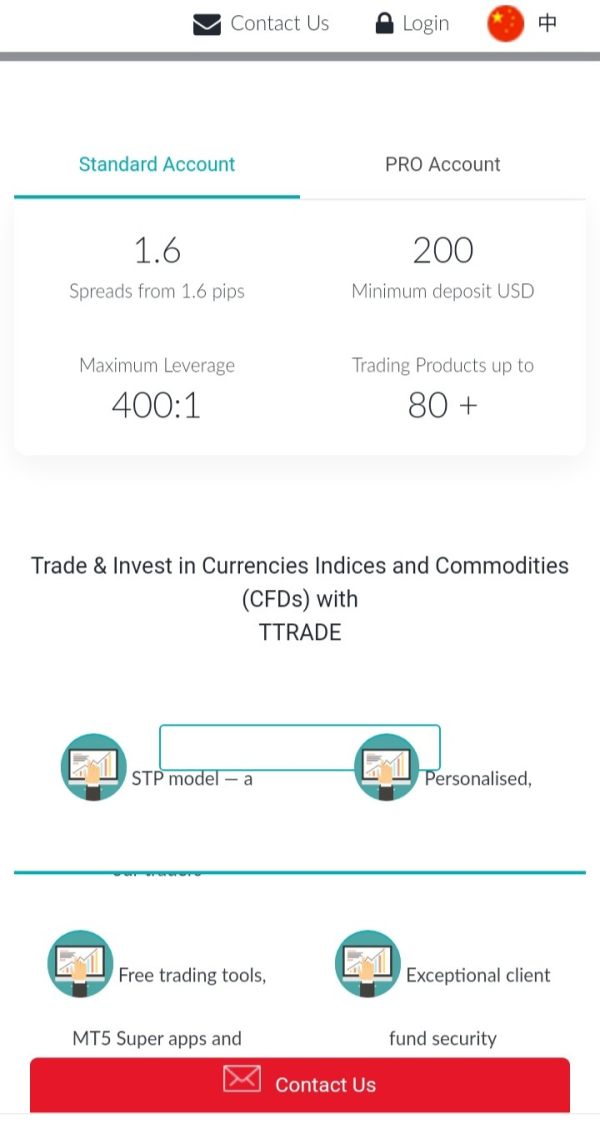

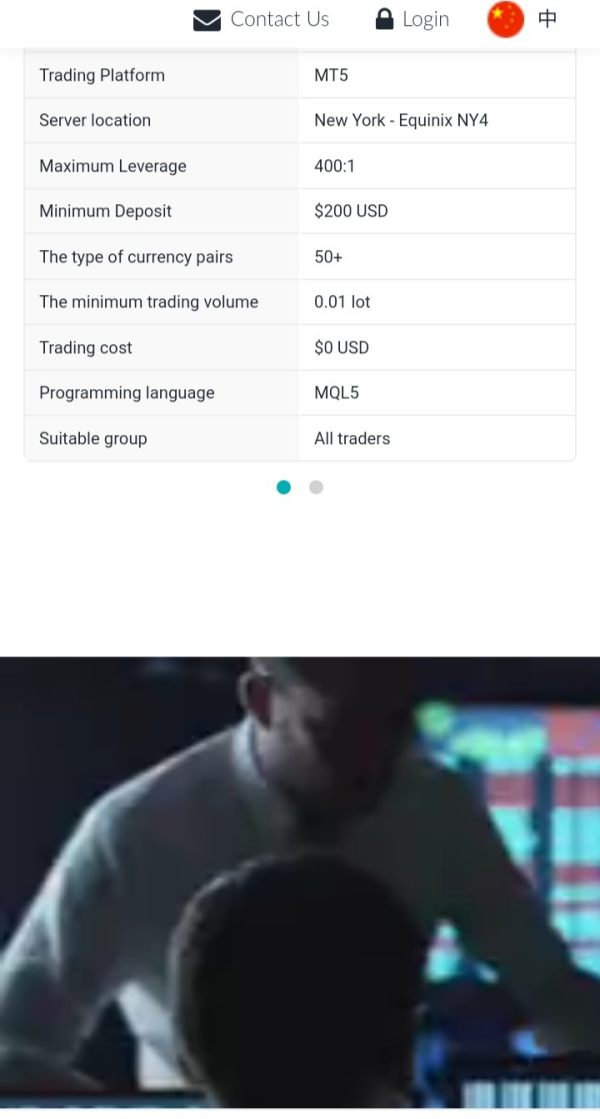

Leverage Ratios: The broker mentions offering "high dynamic leverage." Specific maximum leverage ratios are not provided in the source information.

Platform Options: Ttrade provides access to its own web-based trading platform, MetaTrader 4, and MetaTrader 5. This offers flexibility for different trading styles and preferences.

Geographic Restrictions: Information about countries or regions where services may be restricted is not available in the current documentation.

Customer Support Languages: Available customer service languages are not specified in the source materials.

This Ttrade review reveals a broker with competitive pricing claims but limited transparency in several key operational areas. Traders typically consider these areas when selecting a financial services provider.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

The account conditions offered by Ttrade present a mixed picture of competitive advantages and transparency concerns. The broker's headline feature of spreads starting from 0.0 pips represents a potentially attractive offer for cost-conscious traders. This is particularly true for those engaging in high-frequency trading or scalping strategies where tight spreads significantly impact profits. However, the lack of detailed information about account types, minimum deposit requirements, and complete fee structures creates uncertainty about the true cost of trading with this provider.

Available sources do not specify whether Ttrade offers different account tiers with varying conditions. They also don't mention Islamic accounts for traders requiring Sharia-compliant trading, or special account features for professional clients. This information gap makes it difficult for potential clients to assess whether the broker's offerings align with their specific trading needs and financial capacity. The absence of clear minimum deposit information is particularly problematic, as this represents a basic barrier to entry that traders need to understand before committing to a platform.

User feedback suggests generally positive experiences with account conditions, as shown by the relatively high ratings on review platforms. However, without detailed verification of account opening processes, funding requirements, and account maintenance policies, this Ttrade review must note the significant transparency limitations. These limitations affect the overall assessment of account conditions.

Ttrade shows strong performance in the tools and resources category. The broker offers a complete suite of trading platforms and analytical services that serve different trader preferences and experience levels. The provision of both MetaTrader 4 and MetaTrader 5 platforms ensures compatibility with the vast majority of trading strategies and expert advisors. The own web-based platform offers an alternative for traders who prefer browser-based access without software downloads.

The integration of Trading Central and TradingView services represents a significant value addition. These services provide traders with professional-grade market analysis, technical indicators, and research capabilities. Trading Central is particularly valued for its institutional-quality research and trade ideas, while TradingView offers advanced charting capabilities and social trading features that many modern traders consider essential. This combination suggests that Ttrade recognizes the importance of complete analytical tools in supporting trader decision-making.

However, the evaluation is limited by the lack of specific information about educational resources, automated trading support, or own research offerings. Many competitive brokers provide extensive educational materials, webinars, and trading tutorials that help develop trader skills and market understanding. The absence of detailed information about such resources in available materials prevents a higher rating. Though the core platform and analytical tool offerings represent a solid foundation for serious trading activities.

Customer Service and Support Analysis (7/10)

Customer service evaluation for Ttrade relies primarily on user feedback from review platforms. This feedback generally shows positive experiences with support quality and responsiveness. The broker's ratings of 4.1/5 and 4.3/5 on different review platforms suggest that users are generally satisfied with the level of support they receive. However, specific details about support channels, availability hours, and response times are not available in the source materials.

The positive user ratings imply that Ttrade has established effective support processes and maintains staff capable of addressing client concerns adequately. However, modern traders typically expect multiple support channels including live chat, email, phone support, and complete FAQ resources. The absence of specific information about available support methods, multilingual capabilities, and 24-hour availability represents a significant information gap. This gap affects the assessment.

Professional trading environments require reliable and knowledgeable customer support, particularly during volatile market conditions when technical issues or account problems can have immediate financial implications. While user feedback suggests satisfactory support experiences, the lack of detailed information about support infrastructure, staff qualifications, and problem resolution procedures prevents a higher rating. This prevents a higher rating in this category.

Trading Experience Analysis (7/10)

The trading experience offered by Ttrade appears to center around competitive pricing and platform accessibility. Spreads starting from 0.0 pips represent a potentially significant advantage for active traders. The availability of multiple trading platforms, including the widely-used MetaTrader suite and an own web-based option, provides flexibility for different trading styles and technical requirements. High dynamic leverage, while not specifically quantified, suggests that traders can access substantial position sizes relative to their account capital.

User feedback generally supports positive trading experiences, with review platform ratings showing satisfaction with the broker's trading environment. However, critical aspects of trading experience such as order execution speed, slippage rates, requoting frequency, and platform stability during high-volatility periods are not specifically addressed in available information. These factors are crucial for serious traders who require reliable execution and minimal interference with their trading strategies.

The integration of professional analytical tools through Trading Central and TradingView enhances the trading experience by providing complete market analysis and charting capabilities. However, without specific performance metrics, execution quality data, or detailed user testimonials about trading conditions during different market scenarios, this Ttrade review must acknowledge limitations. These limitations affect the ability to fully assess the trading experience quality.

Trust and Regulation Analysis (5/10)

The trust and regulation assessment for Ttrade reveals significant concerns due to the absence of clear regulatory information in available sources. Regulatory oversight is a basic aspect of broker evaluation, as it provides essential investor protections, dispute resolution mechanisms, and operational standards that safeguard client interests. The lack of specific regulatory details makes it difficult for potential clients to assess the level of protection and recourse available to them.

The prominent warning that "83% of retail investor accounts lose money when trading CFDs with this provider" is a standard regulatory requirement that shows significant risk. However, it also suggests some level of regulatory compliance. However, without identification of the specific regulatory authority requiring this disclosure, clients cannot verify the broker's standing with relevant financial regulators. They also cannot understand the specific protections available to them.

Fund safety measures, segregation of client funds, compensation schemes, and regulatory reporting requirements are typically key factors in establishing broker trustworthiness. The absence of detailed information about these critical safety measures significantly impacts the trust assessment. While user reviews suggest generally positive experiences, regulatory transparency remains a basic requirement for establishing institutional credibility. This is particularly important in the financial services sector.

User Experience Analysis (8/10)

User experience evaluation for Ttrade draws primarily from review platform feedback. This feedback shows generally positive satisfaction levels among clients. The ratings of 4.1/5 from 110 reviews and 4.3/5 from 398 reviews suggest that users find the overall experience satisfactory. Many reviews are categorized as "Excellent" or "Great." This positive feedback implies effective user interface design, smooth account management processes, and satisfactory overall service delivery.

The provision of multiple platform options serves different user preferences, from traders who prefer the advanced features of MetaTrader platforms to those who favor the convenience of web-based trading interfaces. The integration of professional analytical tools likely enhances user satisfaction by providing complete market analysis capabilities within the trading environment.

However, specific aspects of user experience such as account registration complexity, verification procedures, fund management processes, and mobile platform functionality are not detailed in available sources. Modern traders increasingly expect seamless mobile experiences, intuitive platform navigation, and efficient account management tools. While overall user feedback appears positive, the lack of detailed information about specific user experience elements prevents a higher rating. Though the available evidence suggests Ttrade maintains satisfactory standards in user experience delivery.

Conclusion

This Ttrade review reveals a broker that offers competitive trading conditions with notable strengths in platform variety and analytical tools. However, it also shows significant transparency limitations that affect overall assessment. The broker's emphasis on low spreads starting from 0.0 pips and high leverage options appeals to cost-conscious traders seeking competitive execution conditions. User feedback generally supports positive experiences, with review platform ratings showing satisfactory service levels across multiple areas.

However, the absence of clear regulatory information and limited transparency about essential service details such as minimum deposits, fee structures, and complete account conditions represents a significant concern. This is particularly important for traders prioritizing regulatory protection and operational clarity. The broker appears most suitable for intermediate to advanced traders who prioritize low trading costs and platform flexibility over complete regulatory transparency.

The main advantages include competitive spreads, multiple platform options, and positive user feedback. The primary disadvantages involve regulatory transparency gaps and limited detailed service information. Potential clients should carefully consider these factors and conduct additional due diligence about regulatory status before committing to this trading platform.