TCM Globals 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive tcm globals review reveals significant concerns about this relatively new broker. The concerns demand serious consideration from potential traders. Established in 2022 and headquartered in Cyprus, TCM Globals presents itself as a multi-asset trading platform offering forex, stocks, commodities, futures, bonds, and cryptocurrencies. However, our analysis uncovers troubling patterns that overshadow these apparent advantages.

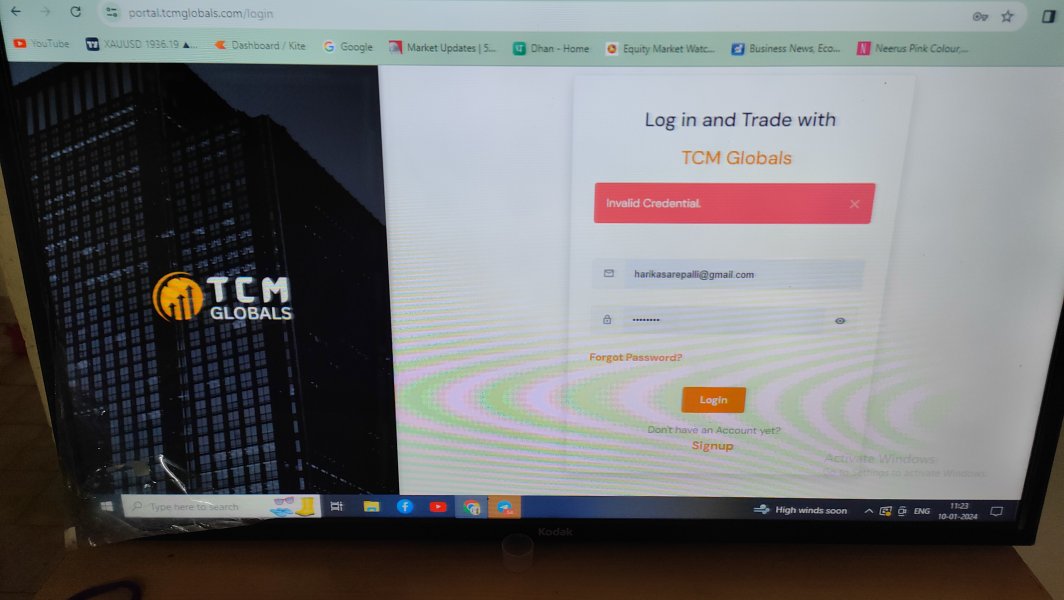

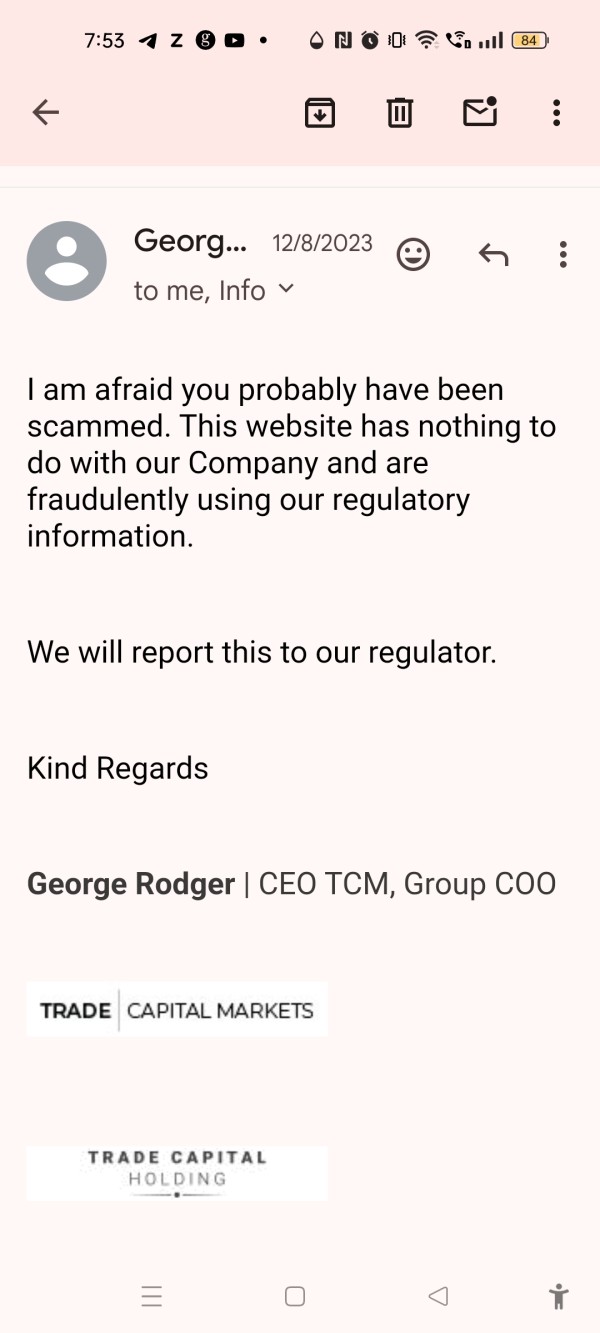

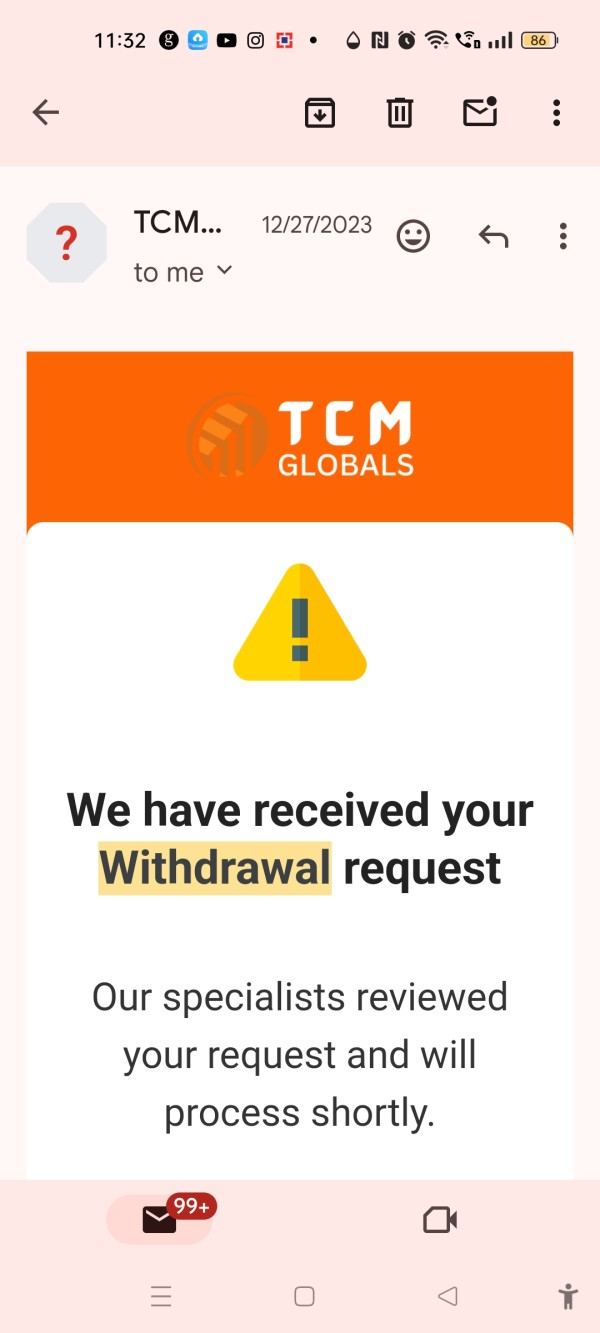

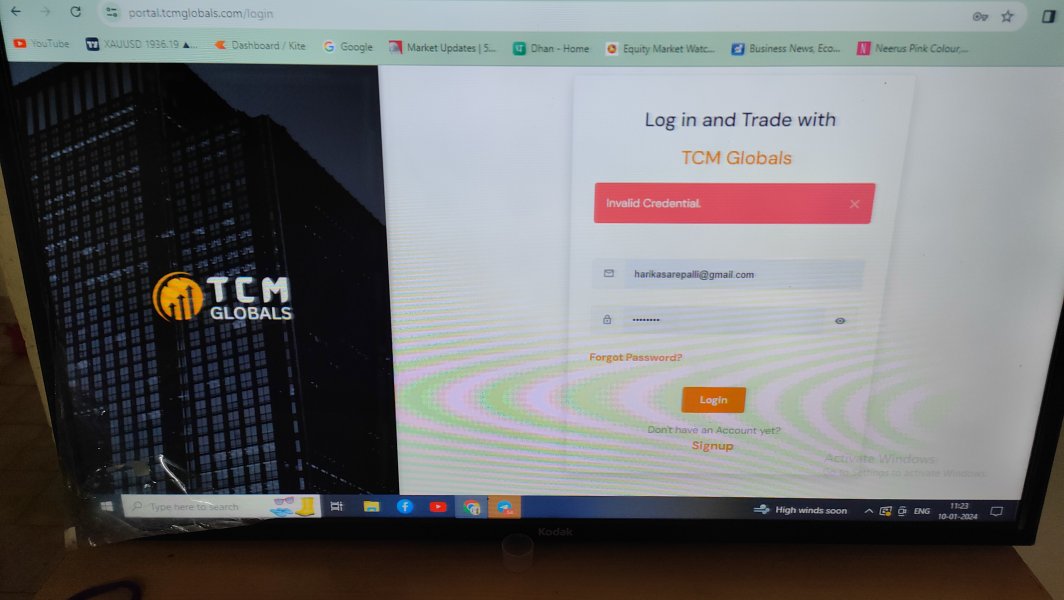

The broker's most concerning aspect lies in multiple user complaints highlighting fraudulent activities. These activities include systematic demands for additional deposits, fabricated profit displays, and ultimately, withdrawal restrictions that result in complete loss of invested funds. According to WikiFX and other regulatory monitoring platforms, TCM Globals operates without proper regulatory oversight, significantly amplifying the risk profile for potential clients.

While the platform may initially attract traders seeking diverse asset exposure through a single broker, the overwhelming evidence of scam-related activities and the absence of regulatory protection make this broker unsuitable for serious trading activities. The combination of unregulated status and documented user losses creates an environment where trader protection is virtually non-existent.

Important Notice

This evaluation acknowledges that regulatory frameworks vary significantly across different jurisdictions. Traders should understand that unregulated brokers like TCM Globals offer minimal legal recourse regardless of their location. The absence of regulatory oversight means that standard investor protection mechanisms, such as compensation schemes or dispute resolution procedures, are not available to users of this platform.

Our assessment methodology incorporates user feedback analysis, regulatory status verification, and available public information to provide a comprehensive evaluation. However, given the limited transparency from TCM Globals itself, some aspects of their operations remain unclear, which itself raises additional concerns about their commitment to transparency and accountability.

Rating Framework

Broker Overview

TCM Globals emerged in the competitive forex and CFD market in 2022. The company positioned itself as a Cyprus-based financial services provider. The company's relatively recent establishment coincides with an increasingly crowded brokerage landscape, where new entrants often struggle to differentiate themselves through legitimate means. Despite its short operational history, TCM Globals has already attracted significant attention, though unfortunately for largely negative reasons related to questionable business practices and regulatory concerns.

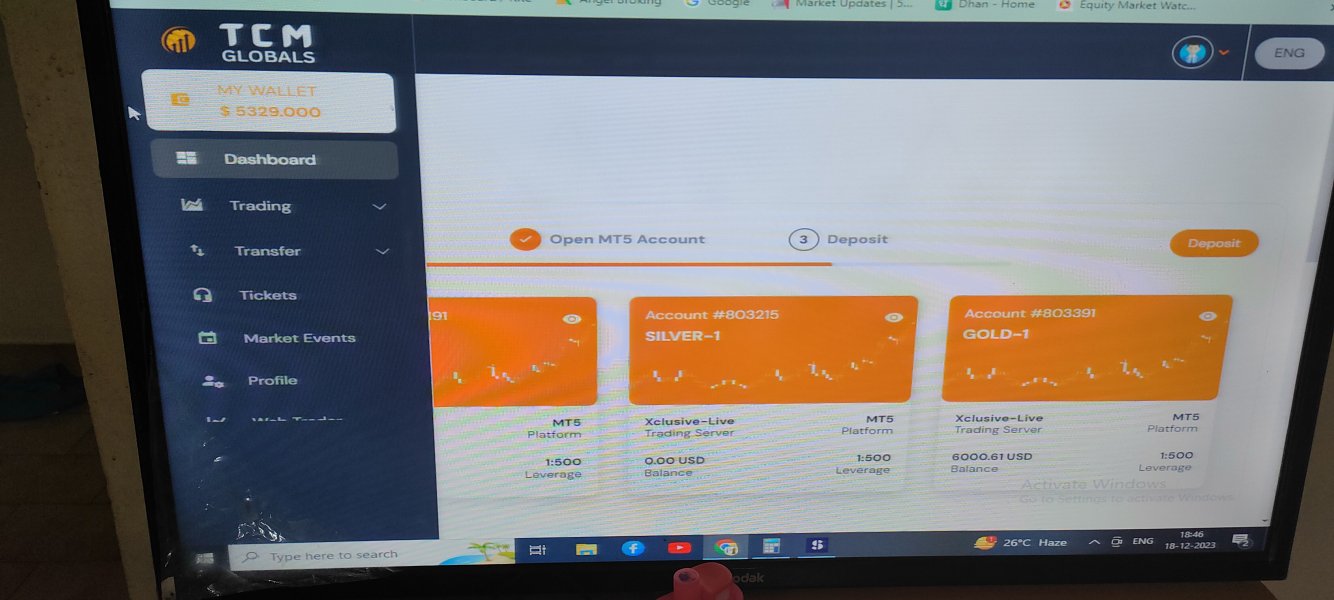

The broker's business model centers around providing access to multiple asset classes. These include traditional forex pairs, individual stocks, various commodities, futures contracts, government and corporate bonds, and the increasingly popular cryptocurrency market. This multi-asset approach theoretically allows traders to diversify their portfolios through a single platform, which can be attractive for those seeking simplified account management and potentially reduced trading costs.

However, the company's operational transparency raises immediate red flags. According to multiple sources including WikiFX, TCM Globals operates without proper regulatory authorization, which fundamentally undermines the safety and security that traders rightfully expect from their chosen broker. This unregulated status means that the standard protections typically associated with licensed financial service providers are simply not available to TCM Globals clients.

Regulatory Status: TCM Globals operates without authorization from recognized financial regulatory bodies. This is according to WikiFX and other monitoring platforms. This unregulated status represents a significant risk factor, as it means the broker is not subject to standard industry oversight, capital adequacy requirements, or client fund protection measures that regulated brokers must maintain.

Available Trading Assets: The platform provides access to forex currency pairs. It also offers individual stocks from various global markets, commodities including precious metals and energy products, futures contracts, bonds, and cryptocurrency trading opportunities. While this diversity appears comprehensive, the lack of specific details about spreads, available instruments, and trading conditions makes it difficult to assess the actual quality of these offerings.

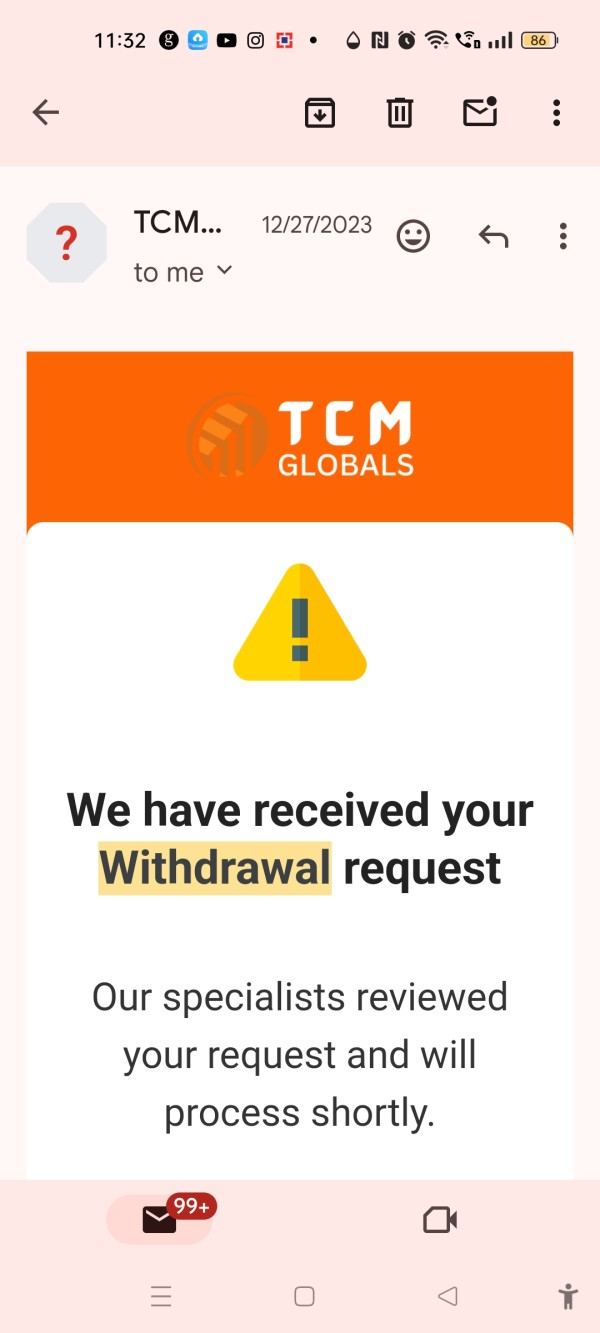

Deposit and Withdrawal Methods: Specific information regarding funding options and withdrawal procedures is not clearly detailed in available sources. However, user complaints consistently highlight significant difficulties in withdrawing funds, suggesting that regardless of the deposit methods offered, the withdrawal process appears to be problematic.

Account Requirements: Minimum deposit requirements and account tier structures are not specified in publicly available information. This itself represents a transparency concern. Legitimate brokers typically provide clear information about account requirements and associated benefits.

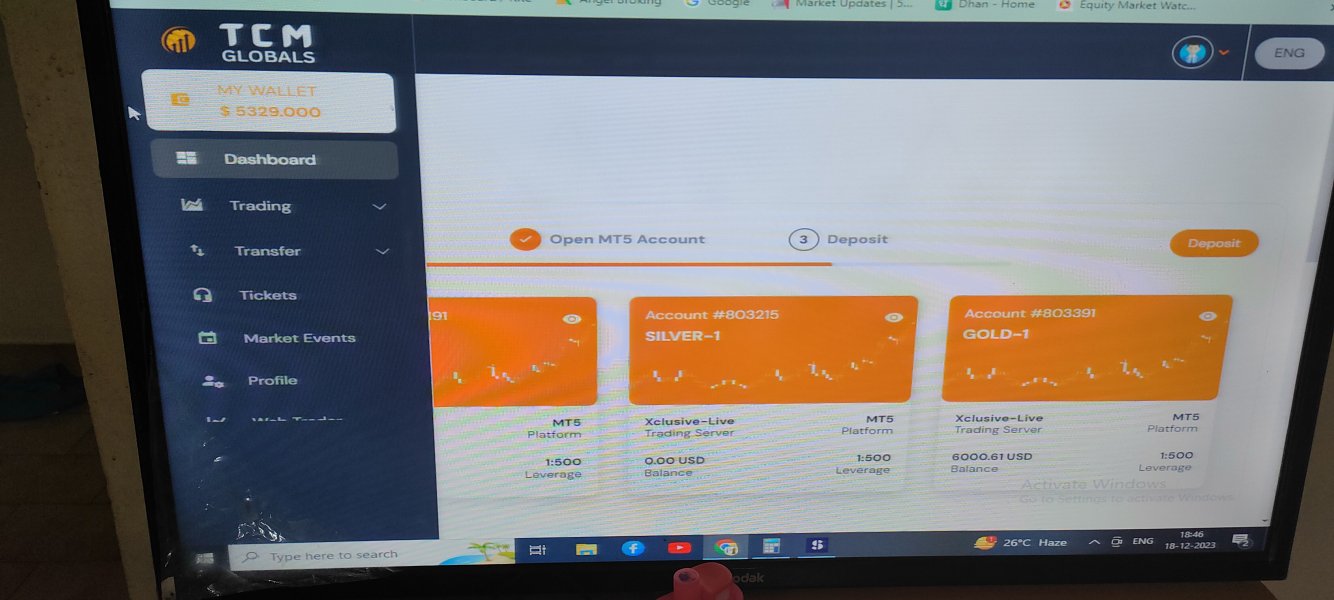

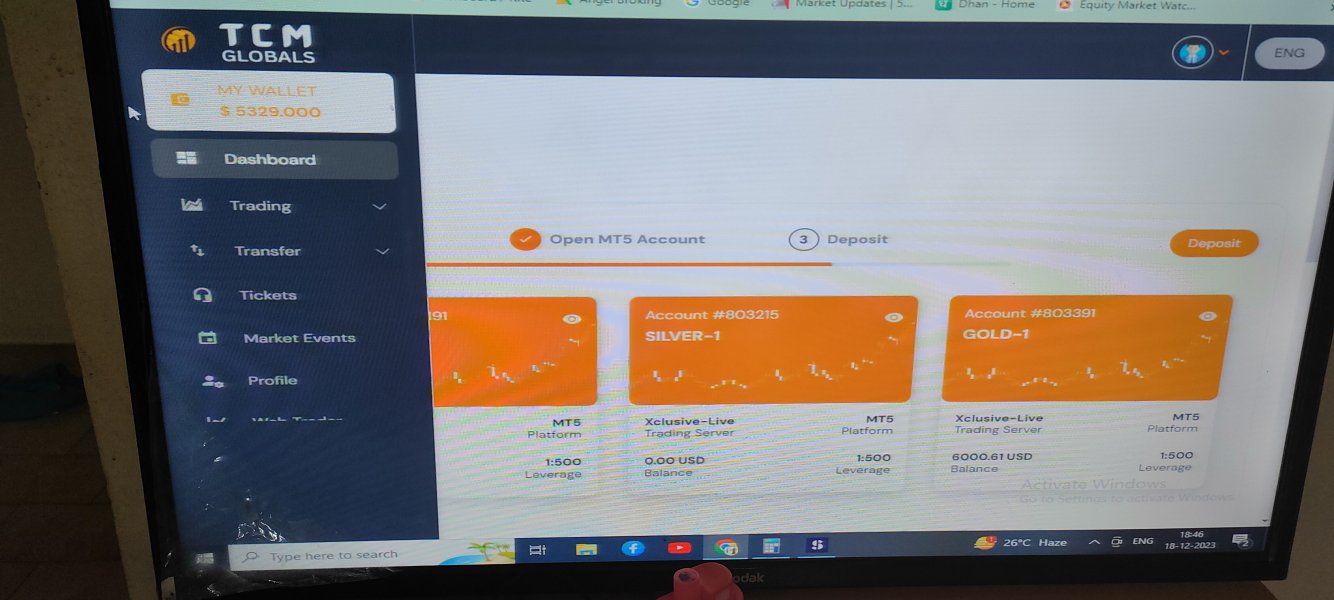

Trading Platforms: The specific trading platforms offered by TCM Globals are not detailed in available sources. This lack of clarity about such a fundamental aspect of the trading experience raises additional questions about the broker's operational transparency.

This tcm globals review reveals that many essential details about the broker's operations remain unclear or entirely undisclosed. This is itself a significant concern for potential clients seeking transparency and reliability.

Account Conditions Analysis

The evaluation of TCM Globals' account conditions faces significant limitations due to the lack of publicly available detailed information. The missing information includes account structures, minimum deposit requirements, and specific account features. This absence of transparency is particularly concerning in an industry where legitimate brokers typically provide comprehensive details about their account offerings to help potential clients make informed decisions.

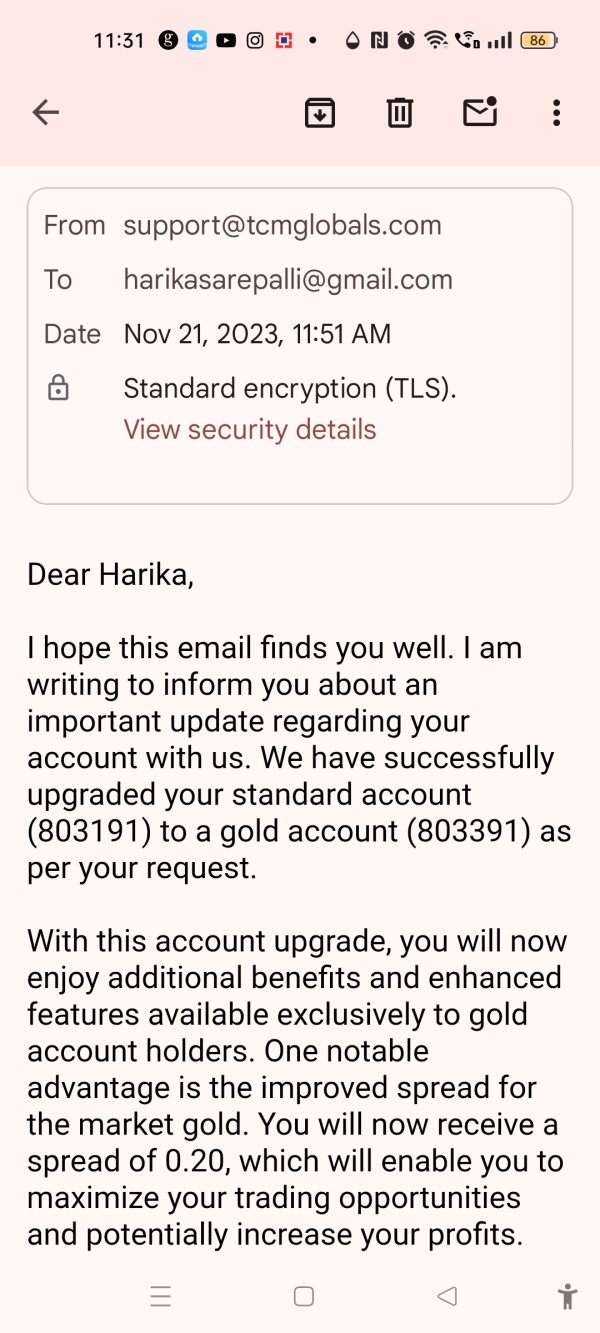

Without specific information about account types, it becomes impossible to assess whether TCM Globals offers differentiated services for various trader categories. These might include beginner accounts with educational support, professional accounts with enhanced features, or Islamic accounts complying with Sharia law requirements. The lack of clear account condition disclosure suggests either poor marketing transparency or deliberate obfuscation of terms that might not be competitive.

The absence of clearly stated minimum deposit requirements is particularly problematic. This fundamental information helps traders determine accessibility and plan their trading capital allocation. Legitimate brokers understand that transparency in account requirements builds trust and helps establish appropriate client relationships from the outset.

Furthermore, the account opening process details are not readily available. This raises questions about the broker's verification procedures, documentation requirements, and timeline for account activation. These procedural elements are crucial for traders planning their entry into the markets and managing their expectations about when they can begin trading activities.

Given the documented issues with fund withdrawals reported by users, the unclear account conditions become even more concerning. Traders cannot properly assess what they are agreeing to when opening accounts with tcm globals review findings suggest significant transparency deficits.

TCM Globals' approach to trading tools and resources presents a mixed picture that requires careful examination. The broker's primary strength lies in offering access to multiple asset classes, including forex, stocks, commodities, futures, bonds, and cryptocurrencies. This diversification can theoretically provide traders with opportunities to spread risk across different market sectors and potentially capitalize on various economic conditions affecting different asset types.

However, the quality and depth of these offerings remain questionable due to limited available information. The missing details include specific instruments, trading conditions, and execution quality. While having access to multiple asset classes sounds appealing, the actual trading experience depends heavily on factors such as spreads, execution speed, available liquidity, and platform stability – none of which are clearly documented in publicly available sources.

The absence of detailed information about research and analysis resources is particularly concerning for traders who rely on fundamental and technical analysis to make informed trading decisions. Legitimate brokers typically provide market commentary, economic calendars, technical analysis tools, and educational content to support their clients' trading activities.

Educational resources appear to be either limited or entirely absent based on available information. This deficiency is significant because responsible brokers recognize their role in helping traders develop skills and understanding necessary for successful trading. The lack of educational support may indicate that TCM Globals is more focused on rapid client acquisition than on fostering long-term trading success.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, is not mentioned in available sources. This may limit options for traders seeking to implement systematic trading strategies or utilize advanced trading technologies.

Customer Service and Support Analysis

The evaluation of TCM Globals' customer service capabilities faces significant challenges. These challenges stem from the scarcity of detailed information about their support infrastructure and the concerning nature of available user feedback. While specific details about customer service channels, operating hours, and response times are not readily available in public sources, the user complaints and negative experiences documented by various monitoring platforms paint a troubling picture of the support experience.

User reports suggest that rather than providing genuine customer support, TCM Globals representatives may be actively involved in misleading clients. This involves false profit displays and persistent demands for additional deposits. This represents a fundamental perversion of the customer service concept, where support staff should be helping clients navigate the platform and resolve legitimate issues rather than facilitating fraudulent activities.

The absence of clear information about available communication channels is itself a red flag in an industry where responsive customer service is essential. These channels include phone support, live chat, email response times, or ticket systems. Professional brokers understand that markets move quickly and traders sometimes need immediate assistance with technical problems, account issues, or trading questions.

Multi-language support capabilities are not documented in available sources. This may limit accessibility for international traders. However, given the more serious concerns about the broker's legitimacy, language support becomes a secondary consideration compared to the fundamental question of whether any customer service interaction can be trusted.

The lack of documented customer service success stories or positive resolution cases, combined with multiple negative reports, suggests that the customer support function may be designed more to facilitate continued deposits rather than to genuinely assist traders. This contrasts with helping traders with their legitimate needs and concerns.

Trading Experience Analysis

Assessing the trading experience offered by TCM Globals proves challenging due to limited available information about platform performance, execution quality, and technical capabilities. However, the available user feedback and regulatory concerns provide important insights into what traders might expect when engaging with this broker's services.

Platform stability and execution speed are critical factors for successful trading. Yet specific performance data or user testimonials about these technical aspects are notably absent from publicly available sources. This lack of transparency about fundamental platform capabilities raises questions about whether TCM Globals can provide the reliable trading environment that serious traders require for effective market participation.

Order execution quality, including factors such as slippage, requotes, and fill rates, remains undocumented in available sources. These elements directly impact trading profitability and are typically highlighted by legitimate brokers as key competitive advantages. The absence of such information suggests either poor performance that the broker prefers not to publicize or a lack of focus on providing genuine trading services.

Mobile trading capabilities and platform accessibility across different devices are not detailed in available sources. This is particularly concerning given the modern trading environment where mobile access is often essential for managing positions and responding to market developments while away from desktop computers.

The user complaints focusing on withdrawal difficulties and fraudulent activities suggest that even if the basic trading functionality operates adequately, the overall trading experience is fundamentally compromised by the inability to access profits or withdraw funds successfully. This tcm globals review indicates that technical platform performance becomes irrelevant if traders cannot ultimately access their money.

Trust and Reliability Analysis

The trust and reliability assessment of TCM Globals reveals deeply concerning findings that should serve as clear warning signals for potential clients. According to WikiFX and other regulatory monitoring platforms, TCM Globals operates without proper regulatory authorization, which immediately places it in the high-risk category for financial service providers. This unregulated status means the broker is not subject to the capital adequacy requirements, client fund segregation rules, and operational standards that regulated brokers must maintain.

The absence of regulatory oversight creates an environment where standard investor protections are simply not available. Regulated brokers typically must participate in compensation schemes that protect client funds up to certain limits in case of broker insolvency, maintain segregated client accounts, and submit to regular audits of their financial condition and business practices. None of these protections exist with unregulated brokers like TCM Globals.

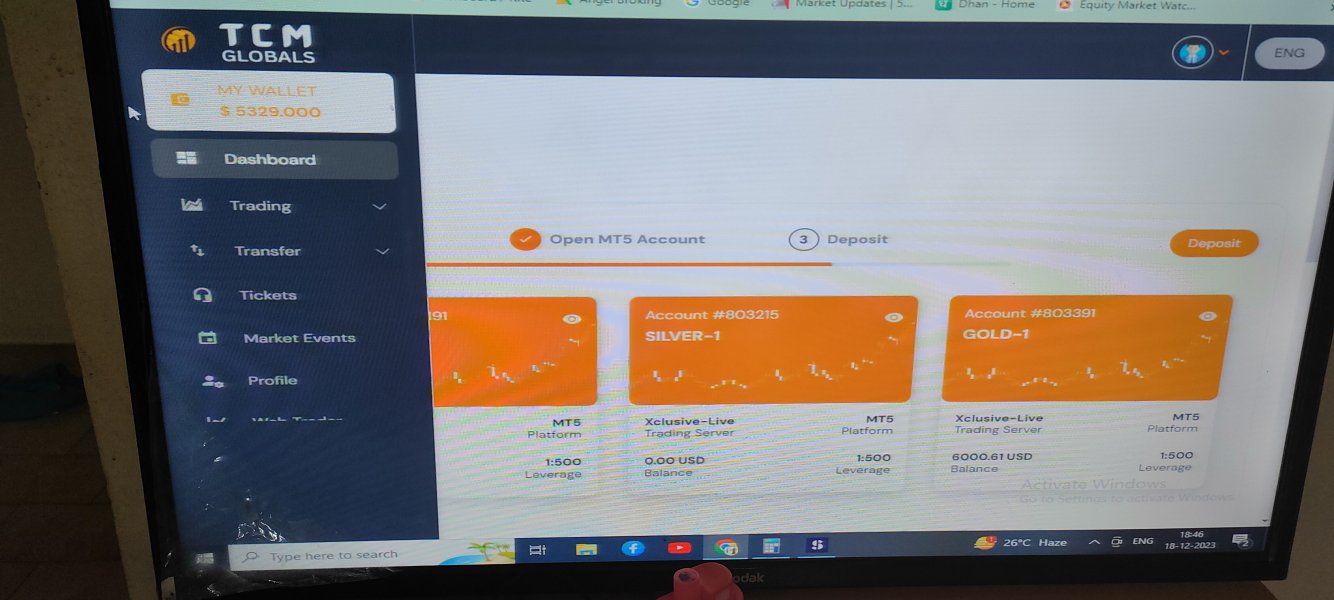

User reports documented by various sources describe systematic fraudulent activities. These include manipulation of account displays to show false profits, persistent demands for additional deposits under various pretexts, and ultimate inability to withdraw funds. These reports follow consistent patterns that suggest organized deceptive practices rather than isolated incidents or misunderstandings.

The company's transparency regarding its operations, management, and financial condition appears to be minimal based on publicly available information. Legitimate brokers typically provide detailed information about their corporate structure, management team, financial backing, and operational procedures to build confidence among potential clients.

The handling of negative publicity and user complaints appears to be non-existent based on available sources. There is no evidence of efforts to address legitimate concerns or provide satisfactory resolutions to disputed cases. Professional brokers understand that reputation management and client satisfaction are essential for long-term success and typically maintain active programs to address client concerns.

User Experience Analysis

The user experience analysis for TCM Globals reveals a predominantly negative landscape characterized by serious complaints and documented issues. These extend far beyond typical broker-client disputes. User feedback consistently highlights experiences that suggest systematic deceptive practices rather than legitimate trading services, creating an environment where client satisfaction appears to be irrelevant to the broker's operational model.

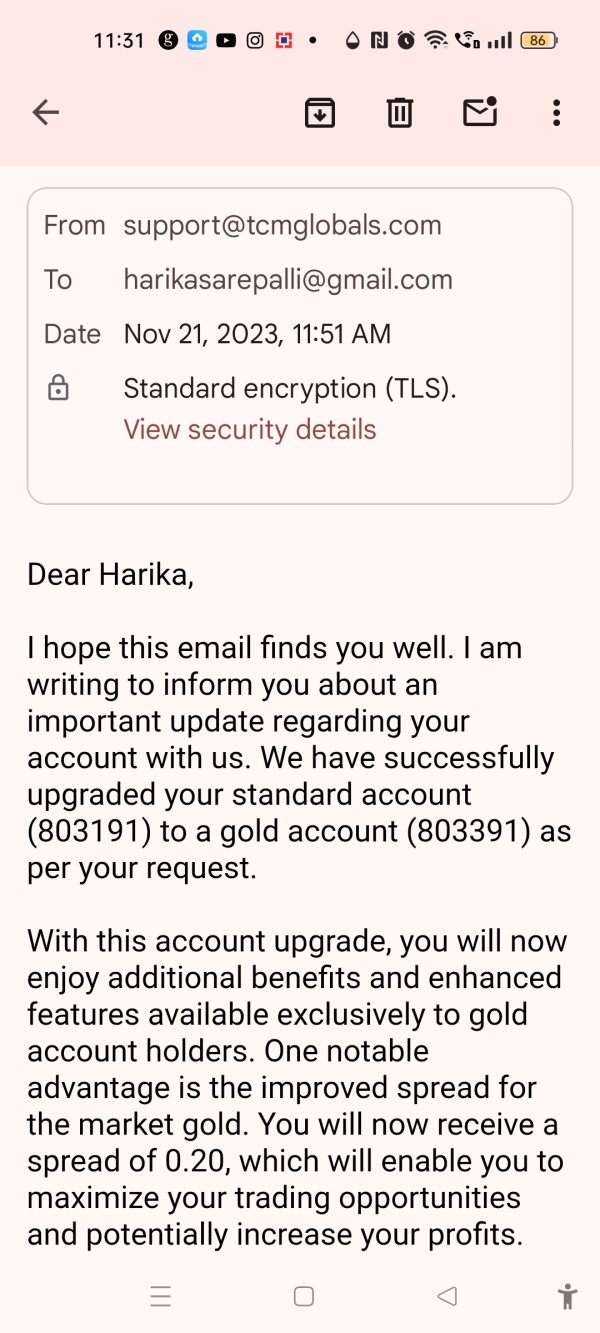

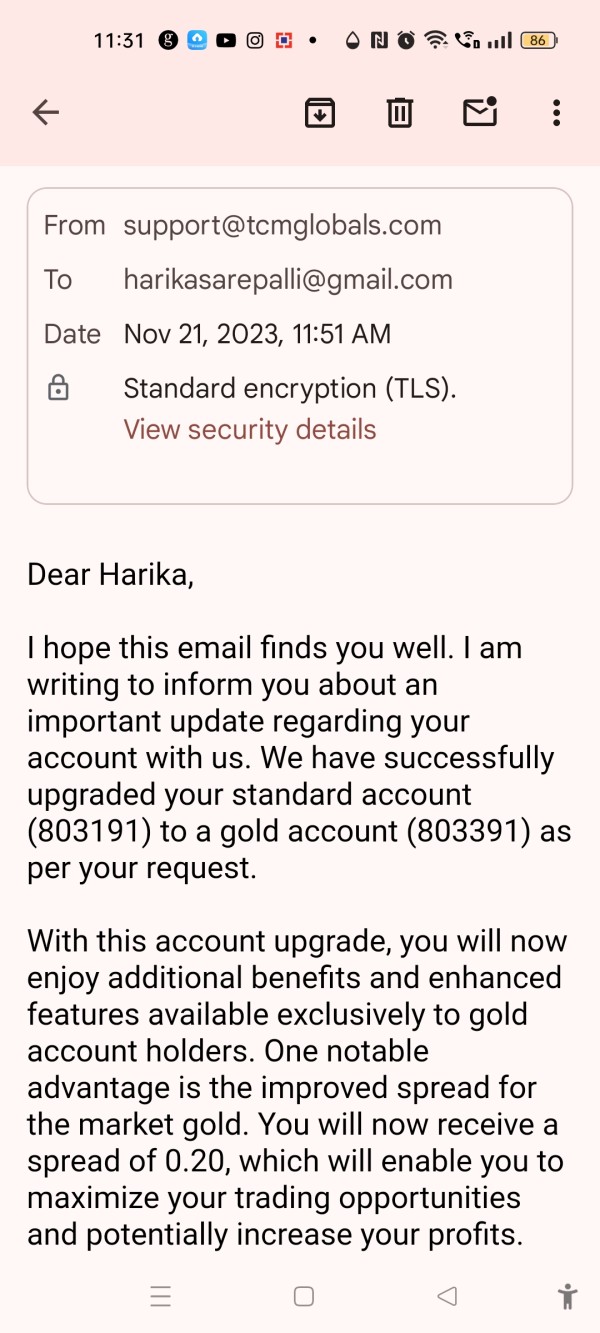

Multiple user reports describe experiences beginning with seemingly attractive trading conditions and initial profits. These are followed by persistent pressure to make additional deposits to "unlock" higher profit levels or access "premium" services. This pattern suggests a deliberate strategy designed to maximize deposit amounts before implementing withdrawal restrictions that ultimately result in complete loss of invested funds.

The registration and account verification processes are not well-documented in available sources. However, user experiences suggest that initial account setup may be deliberately streamlined to encourage quick deposit decisions without adequate time for due diligence. This approach contrasts sharply with legitimate brokers who implement thorough know-your-customer procedures and often provide educational resources to help new traders understand the risks involved.

Fund management experiences represent the most critical area of user dissatisfaction. There are consistent reports of withdrawal difficulties that escalate into complete inability to access deposited funds. These experiences suggest that the platform may be designed to facilitate deposits while systematically preventing withdrawals, which represents a fundamental breach of the basic broker-client relationship.

Interface design and platform usability details are not extensively documented in user feedback. This is possibly because technical platform issues become secondary concerns when users discover they cannot access their funds. However, the lack of positive user feedback about any aspect of the platform experience is itself significant in an industry where satisfied clients typically share their positive experiences.

The absence of documented positive user experiences or successful long-term trading relationships raises serious questions about whether TCM Globals operates as a legitimate broker. It may primarily operate as a scheme designed to collect deposits with no intention of facilitating genuine trading activities.

Conclusion

This comprehensive tcm globals review leads to a clear and unambiguous recommendation. Traders should avoid TCM Globals entirely due to significant regulatory and operational concerns that pose substantial risks to client funds and trading success. The combination of unregulated status, documented user complaints about fraudulent activities, and lack of transparency creates an environment where traders face potential total loss of their invested capital with minimal recourse options.

The broker's apparent strength in offering multiple asset classes is completely overshadowed by fundamental deficiencies in regulatory compliance, operational transparency, and client fund protection. While asset diversity can be valuable for portfolio management, it becomes irrelevant when the underlying broker cannot be trusted to handle client funds appropriately or provide legitimate trading services.

No trader category should consider TCM Globals as a viable option for their trading activities. Whether beginners seeking their first broker experience or experienced traders looking for additional platform options, the documented risks and regulatory concerns make this broker unsuitable for any serious trading endeavor. The potential for complete fund loss, combined with the absence of regulatory recourse, creates a risk-reward profile that is unacceptable for responsible trading activities.