Regarding the legitimacy of TCM Globals forex brokers, it provides CYSEC, FSCA and WikiBit, .

Is TCM Globals safe?

Business

License

Is TCM Globals markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Trade Capital Markets (TCM) Ltd

Effective Date:

2014-02-17Email Address of Licensed Institution:

info@tradecapitalmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.tradecapitalmarkets.com, www.trade.com, www.heromarkets.comExpiration Time:

--Address of Licensed Institution:

Λεωφόρος Στροβόλου 148, 1ος Όροφος, Στρόβολος 2048, Λευκωσία ΚύπροςPhone Number of Licensed Institution:

+357 22 030 446Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TRADE CAPITAL MARKETS (TCM) LTD

Effective Date:

2019-02-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

329 MAIN STREETGX11 1AAGIBRAL TAR0Phone Number of Licensed Institution:

+357 22 030 446Licensed Institution Certified Documents:

Is TCM Globals Safe or a Scam?

Introduction

TCM Globals is a forex broker that positions itself as a provider of comprehensive trading services, including forex, commodities, stocks, and indices. Operating primarily from Cyprus, TCM Globals has garnered attention in the financial trading community. However, the dynamic nature of the forex market necessitates that traders exercise caution when evaluating brokers. With numerous reports of fraudulent activities and unregulated operations, it becomes imperative for traders to scrutinize the legitimacy of brokers like TCM Globals. This article aims to investigate whether TCM Globals is a safe trading option or if it raises red flags that suggest it may be a scam. Our investigation draws on various online reviews, regulatory reports, and user experiences to form a well-rounded assessment.

Regulation and Legitimacy

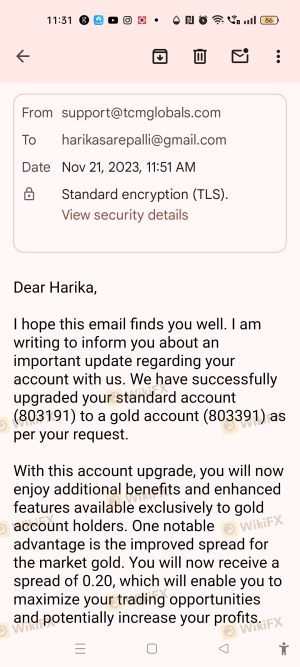

The regulatory status of a broker is a critical factor in determining its legitimacy. In the case of TCM Globals, the company claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) in South Africa. However, investigations reveal inconsistencies regarding these claims.

Regulatory Information Table

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 227/14 | Cyprus | Suspicious Clone |

| FSCA | 47857 | South Africa | Suspicious Clone |

The CySEC has issued warnings regarding TCM Globals, indicating that the broker operates without the necessary authorization. Furthermore, the FSCA has similarly flagged TCM Globals as a suspicious entity, suggesting that it may be misusing regulatory information from compliant firms. The lack of genuine regulatory oversight raises significant concerns about the safety of trading with TCM Globals. Given these findings, it is clear that TCM Globals does not meet the regulatory standards expected from a legitimate broker, leading to the conclusion that TCM Globals is not safe.

Company Background Investigation

TCM Globals was established in 2022, which raises concerns due to its relatively short operational history. The company claims to have a solid foundation and aims to provide superior trading experiences. However, upon further investigation, details about the ownership structure and management team are sparse.

The absence of transparent information about the company's history and leadership raises doubts about its credibility. A reliable broker typically offers clear insights into its operational framework, including the qualifications and experience of its management team. Unfortunately, TCM Globals does not provide this level of transparency, which is a significant red flag for potential investors.

Furthermore, the company's registered address is in Nicosia, Cyprus, yet there is no verifiable information linking TCM Globals to the claims made on its website. This lack of transparency and accountability further contributes to the perception that TCM Globals may not be safe for trading.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its reliability. TCM Globals claims to offer competitive trading conditions, including low spreads and various account types. However, the fee structure appears to be inconsistent with industry standards.

Trading Costs Comparison Table

| Fee Type | TCM Globals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.5% |

While the spreads may seem competitive, the variability in the commission model raises concerns. A lack of clarity regarding commissions can lead to unexpected costs for traders, potentially impacting their profitability. Additionally, the overnight interest rates appear to be higher than average, which could deter long-term positions. This lack of consistency in trading conditions suggests that TCM Globals may not provide a safe trading environment.

Client Fund Security

The safety of client funds is paramount when assessing a broker's reliability. TCM Globals states that it implements various security measures, including fund segregation and negative balance protection. However, the effectiveness of these measures is questionable given the broker's regulatory status.

TCM Globals claims to keep client funds in separate accounts, which is a standard practice among reputable brokers. However, without proper regulatory oversight, the assurance of fund security becomes tenuous. The absence of an investor compensation scheme further exacerbates the risks associated with trading on this platform. Historical complaints regarding fund withdrawals have surfaced, indicating that clients have encountered difficulties in accessing their funds. Such issues raise serious concerns about the safety of funds held with TCM Globals, suggesting that traders should be cautious.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of TCM Globals reveal a pattern of negative experiences, particularly regarding fund withdrawals and customer service.

Complaint Types and Severity Assessment Table

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Moderate |

Many users have reported being unable to withdraw their funds, which is a significant concern for any trader. Moreover, the quality of customer support has been criticized, with users stating that their inquiries often go unanswered. This lack of responsiveness is alarming and suggests that TCM Globals may not prioritize customer satisfaction, further indicating that it may not be a safe trading option.

Platform and Trade Execution

The trading platform is another crucial aspect of a broker's service. TCM Globals offers a proprietary trading platform that claims to provide a user-friendly experience. However, reviews indicate that the platform may suffer from performance issues, including slow execution and slippage.

Traders have reported instances of delayed order execution, which can significantly impact trading outcomes. Additionally, there have been allegations of platform manipulation, further undermining trust in TCM Globals. A reliable broker should provide a stable and efficient trading environment, but the reported issues suggest that trading with TCM Globals may expose traders to unnecessary risks.

Risk Assessment

In light of the aforementioned factors, it is essential to summarize the overall risk associated with trading with TCM Globals.

Risk Rating Card

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of genuine regulation raises concerns. |

| Fund Security | High | Issues with withdrawals and lack of investor protection. |

| Customer Support | Medium | Reports of poor responsiveness to inquiries. |

| Platform Reliability | High | Performance issues and potential manipulation. |

Given the high-risk levels across multiple categories, it is evident that trading with TCM Globals poses significant challenges. To mitigate these risks, traders are advised to conduct thorough due diligence and consider alternative brokers with established regulatory frameworks and positive user experiences.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that TCM Globals exhibits several characteristics indicative of a potentially fraudulent operation. The lack of proper regulation, combined with numerous complaints regarding fund withdrawals and customer support, raises serious concerns about the broker's legitimacy. Additionally, the trading conditions and platform reliability further contribute to the perception that TCM Globals is not a safe option for traders.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with a proven track record of transparency and customer satisfaction. Brokers such as [Alternative Broker 1], [Alternative Broker 2], and [Alternative Broker 3] offer robust regulatory oversight and positive user feedback, making them safer choices for trading in the forex market. Always prioritize safety and due diligence when selecting a broker to protect your investments.

Is TCM Globals a scam, or is it legit?

The latest exposure and evaluation content of TCM Globals brokers.

TCM Globals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TCM Globals latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.