JinDao 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive jindao review reveals a concerning picture for potential traders considering this broker. Based on available market information and user feedback analysis, JinDao presents significant red flags. The broker was established in 2017 and operates from Hong Kong, garnering attention for all the wrong reasons in the forex trading community.

JinDao positions itself as a forex and CFD broker. The company offers trading services through the popular MetaTrader 4 platform. The broker claims to provide access to various financial instruments including forex pairs, precious metals, and energy commodities, but the lack of proper regulatory oversight and mounting user complaints paint a troubling picture.

According to WikiBit reports, JinDao has received multiple customer complaints regarding their financial services. This raises serious questions about their operational integrity. The broker primarily targets traders in Hong Kong and the United States, though their regulatory status remains questionable at best, and for traders seeking reliable and trustworthy forex brokers, this jindao review suggests looking elsewhere.

Important Notice

Regional Entity Differences: JinDao operates primarily in Hong Kong and the United States markets. Specific information regarding different regulatory entities in these regions is not clearly detailed in available documentation. Traders should be aware that the lack of transparent regulatory information poses significant risks to their investments.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, industry reports from WikiBit, and publicly available information about JinDao's services. All assessments are made using standardized criteria applied consistently across broker evaluations.

Rating Framework

Broker Overview

JinDao entered the forex trading market in 2017. The company established its operations base in Hong Kong and presents itself as a financial services provider specializing in forex, metals, and energy trading through the widely recognized MetaTrader 4 platform. However, the broker's operational transparency and regulatory compliance remain highly questionable.

Specific information regarding proper licensing and oversight is not clearly detailed in available documentation. The broker's business model appears to focus on providing basic trading services without the comprehensive regulatory framework that characterizes reputable financial institutions, and this jindao review has identified significant concerns regarding the company's operational practices. The absence of clear regulatory information suggests that JinDao may be operating without proper authorization.

JinDao's target market includes primarily Hong Kong and United States traders. The specific legal frameworks governing their operations in these jurisdictions remain unclear, but the broker claims to offer competitive trading conditions. The lack of detailed information about their fee structures, account types, and operational policies raises additional red flags for potential clients seeking transparency.

Regulatory Status: Specific information regarding JinDao's regulatory compliance and licensing is not clearly detailed in available documentation. This represents a significant concern for potential traders.

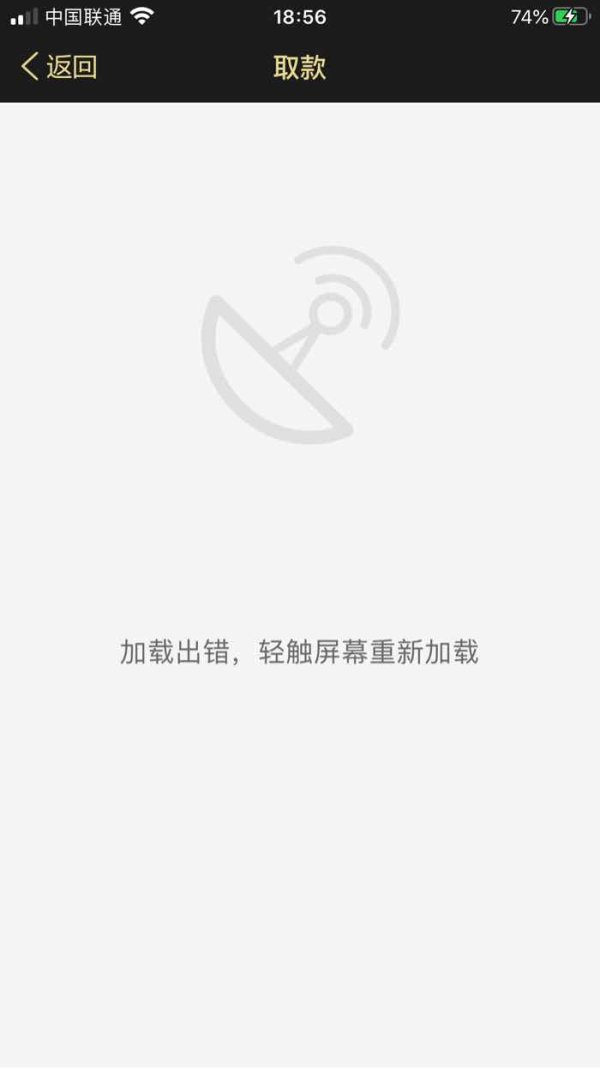

Deposit and Withdrawal Methods: Available documentation does not provide comprehensive details about supported payment methods. Processing times and associated fees for funding and withdrawal operations are also unclear.

Minimum Deposit Requirements: Specific minimum deposit amounts and account funding requirements are not detailed in available documentation. This lack of transparency makes it difficult for traders to plan their investments.

Bonuses and Promotions: Information about promotional offers, welcome bonuses, or ongoing trading incentives is not available in current documentation. Traders cannot assess potential benefits or promotional opportunities.

Tradeable Assets: JinDao offers trading opportunities in forex currency pairs, precious metals including gold and silver, and energy commodities such as crude oil and natural gas. The range of available instruments appears limited compared to established brokers.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not comprehensively available. This makes it impossible for traders to calculate their potential trading expenses accurately.

Leverage Ratios: Specific leverage offerings and margin requirements for different asset classes are not detailed in available documentation. Traders cannot assess their potential exposure and risk levels.

Platform Options: The broker provides access to the MetaTrader 4 trading platform. This platform offers basic charting tools and automated trading capabilities for users.

Geographic Restrictions: JinDao primarily serves clients in Hong Kong and the United States. Specific regional limitations are not clearly outlined in their documentation.

Customer Support Languages: Available documentation does not specify the languages supported by their customer service team. This jindao review highlights the concerning lack of transparency in many fundamental areas that traders typically require.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

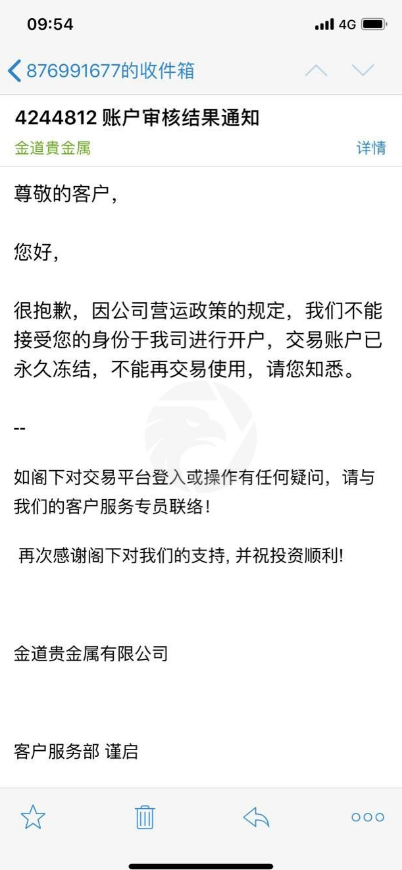

The account conditions offered by JinDao represent one of the most problematic aspects of this broker's service offering. Available documentation fails to provide clear information about account types, minimum deposit requirements, or the specific features available to different client categories, and this lack of transparency is particularly concerning for traders who need to understand the financial commitments and benefits associated with their chosen account level. The absence of detailed information about account opening procedures, verification requirements, and ongoing account maintenance fees suggests poor operational organization.

Reputable brokers typically provide comprehensive account information to help traders make informed decisions. JinDao's documentation lacks these essential details, and the broker does not appear to offer specialized account types such as Islamic accounts or professional trader accounts. This limits options for diverse trading communities seeking specific account features.

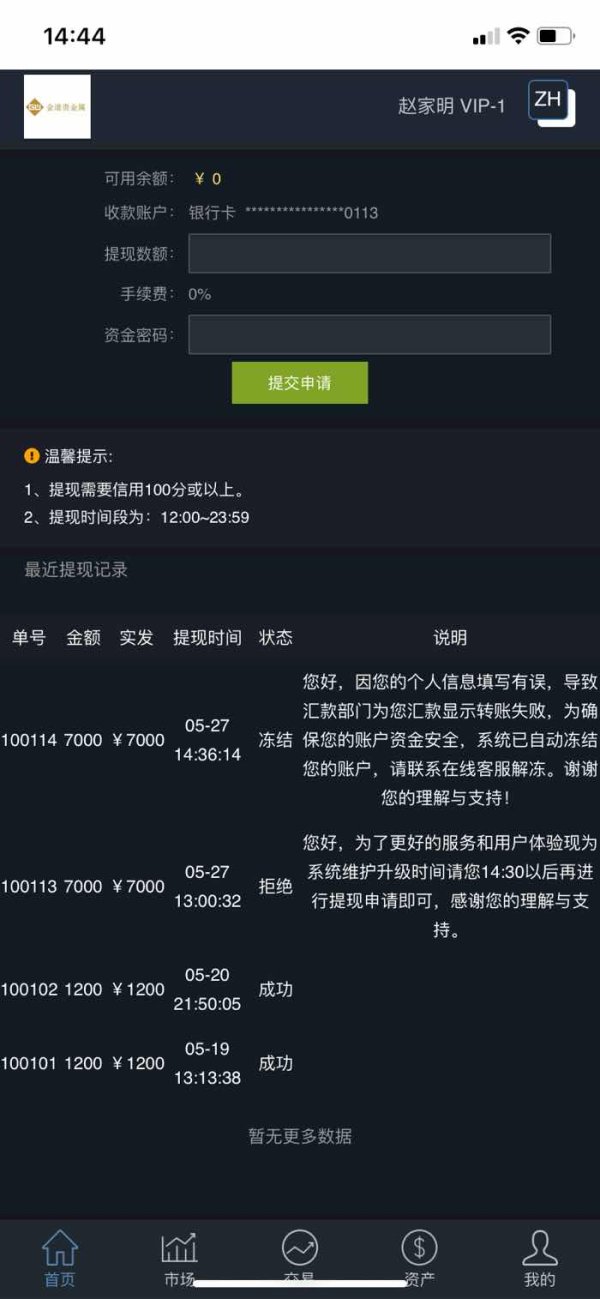

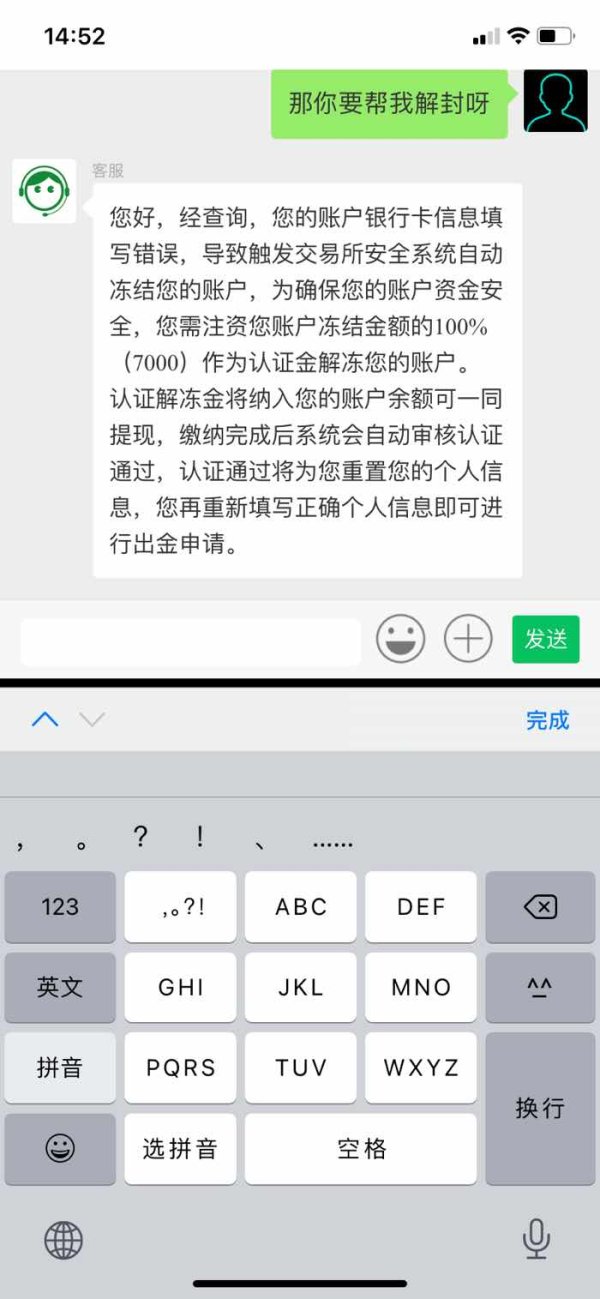

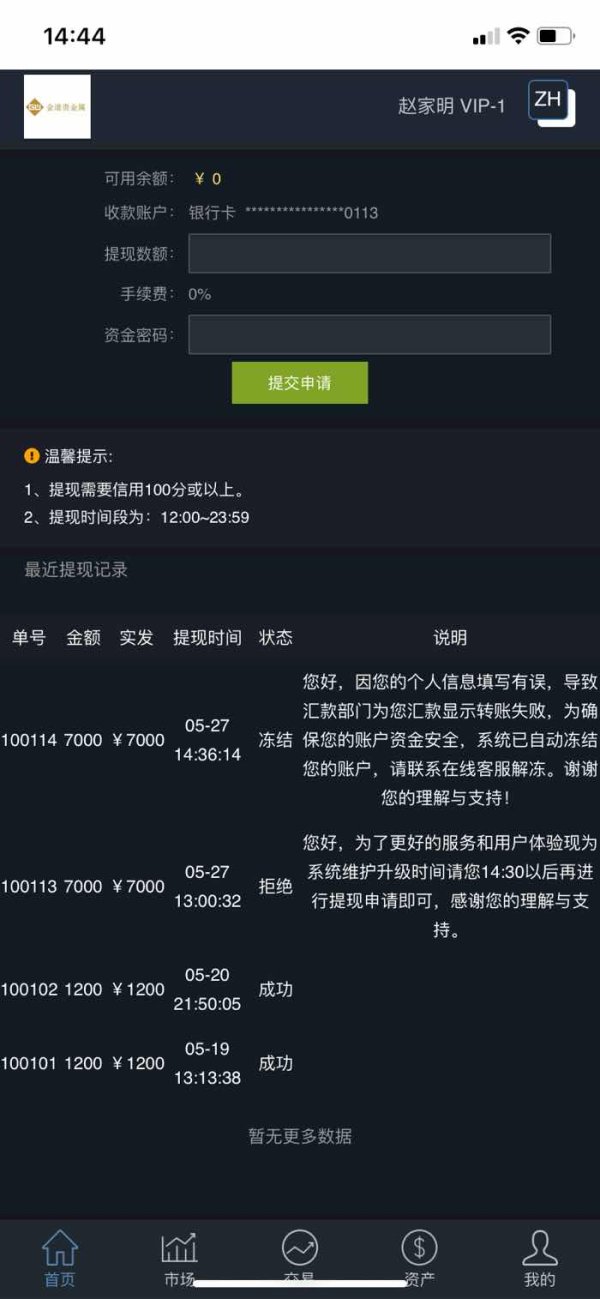

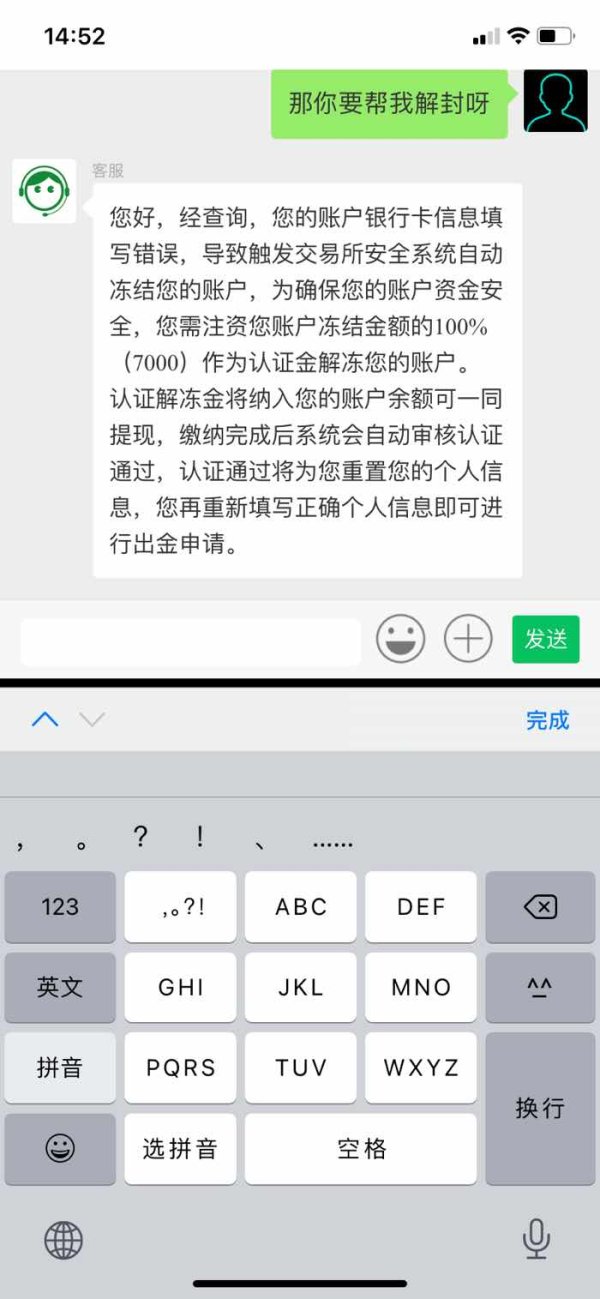

User feedback indicates confusion about account terms and conditions. Several complaints note unexpected fees and unclear account policies, making it difficult for traders to accurately assess the true cost of trading with JinDao. This jindao review finds that the broker's account conditions fall significantly short of industry standards.

JinDao's trading tools and resources offering centers around the MetaTrader 4 platform. This platform provides basic functionality for forex and CFD trading, and while MT4 is a widely respected platform in the industry, JinDao's implementation appears to lack the additional tools and resources that enhance the trading experience. The platform offers standard charting capabilities, technical indicators, and automated trading support through Expert Advisors.

However, the broker's educational resources and market analysis tools are notably limited based on available documentation. Reputable brokers typically provide comprehensive educational materials, daily market analysis, economic calendars, and trading webinars to support their clients' trading development, but JinDao appears to offer minimal educational content. This particularly disadvantages novice traders who require guidance and learning resources.

The research and analysis resources available to JinDao clients are not well-documented. This suggests limited support for fundamental and technical analysis beyond basic MT4 functionality, and advanced trading tools, such as sentiment indicators, advanced charting packages, or proprietary analysis software, do not appear to be part of JinDao's offering. While the MT4 platform provides adequate basic functionality, the overall tools and resources package falls below expectations.

Customer Service and Support Analysis (Score: 2/10)

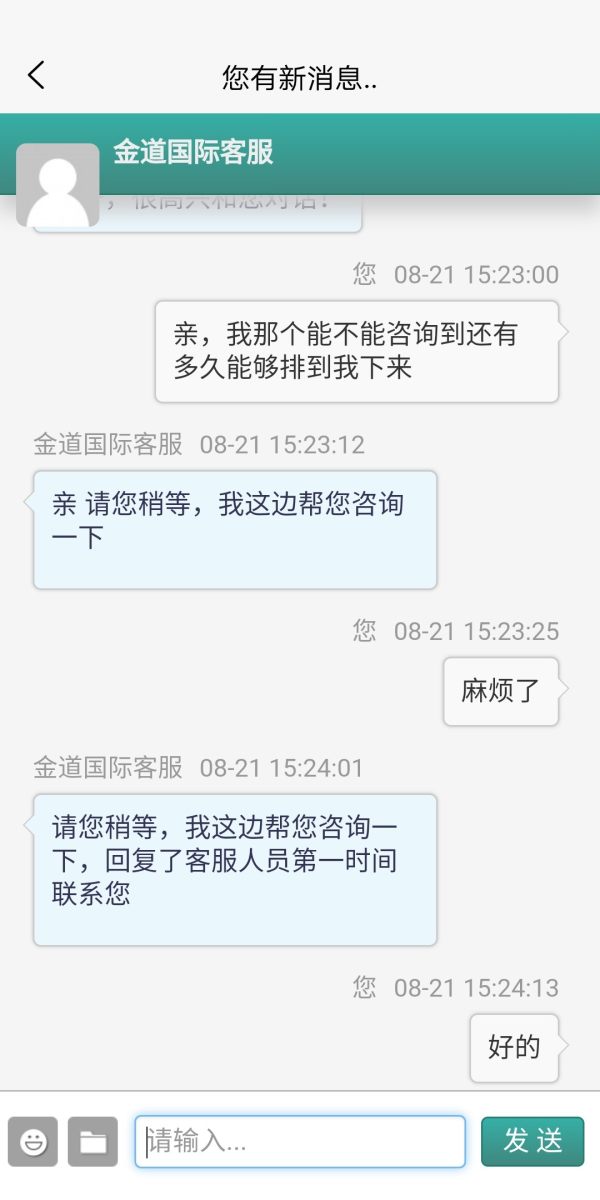

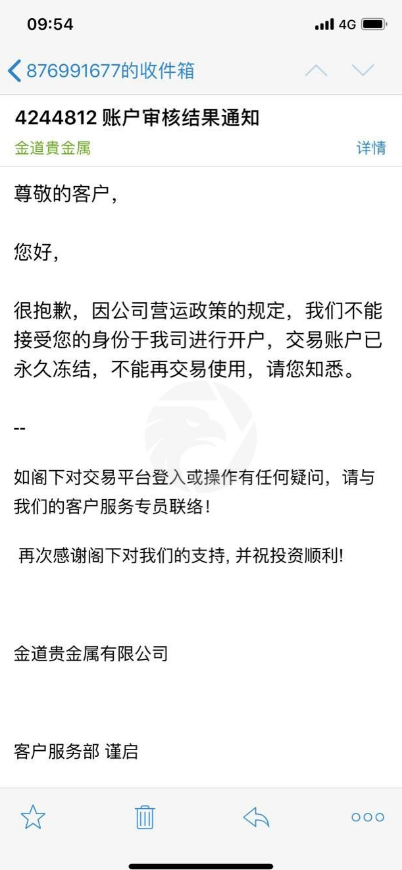

Customer service represents one of JinDao's most significant weaknesses. Multiple user complaints highlight poor support quality and responsiveness, and according to WikiBit reports, the broker has received numerous customer complaints regarding their financial services. These complaints indicate systemic issues with client support and problem resolution.

The available documentation does not provide clear information about customer support channels, operating hours, or response time commitments. Professional brokers typically offer multiple contact methods including live chat, phone support, and email assistance with clearly defined service level agreements, but JinDao's apparent lack of transparent customer service policies raises concerns about their commitment to client support. User feedback indicates frustration with slow response times and inadequate problem resolution when issues arise.

The accumulation of customer complaints suggests that JinDao struggles to maintain professional customer service standards. This is particularly problematic in the financial services industry where timely support is crucial, and the broker's poor customer service performance significantly undermines trader confidence and operational reliability.

Trading Experience Analysis (Score: 3/10)

The trading experience with JinDao appears to be hampered by various operational and technical limitations that affect overall user satisfaction. While the broker offers the MetaTrader 4 platform, which provides reliable basic trading functionality, user feedback suggests issues with order execution and platform stability, and these problems detract from the overall trading experience for users.

Available documentation does not provide specific information about execution speeds, slippage rates, or requote frequencies. These are critical factors in evaluating trading quality, and professional brokers typically publish execution statistics and maintain transparent policies about order handling. JinDao lacks this level of operational transparency, making it difficult for traders to assess the quality of trade execution they can expect.

Mobile trading capabilities through MT4 mobile apps are presumably available. Specific information about mobile platform optimization and functionality is not detailed in available documentation, and the overall trading environment appears to lack the sophisticated features and reliable execution quality that characterize reputable forex brokers. User complaints about various trading issues suggest that the platform may experience technical difficulties.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent JinDao's most critical weaknesses. Fundamental concerns exist about regulatory compliance and operational transparency, and the broker's regulatory status remains unclear with available documentation failing to provide specific information about licensing, regulatory oversight, or compliance with financial services regulations. This lack of regulatory clarity poses significant risks to client funds and trading security.

The absence of clear information about client fund segregation, deposit protection schemes, or regulatory reporting requirements raises serious concerns about financial security. Reputable brokers operate under strict regulatory frameworks that protect client interests, but JinDao appears to lack these essential safeguards, and the WikiBit reports indicating multiple customer complaints further undermine confidence in the broker's reliability and operational integrity.

Third-party evaluations and industry ratings consistently highlight concerns about JinDao's operational practices and client treatment. The accumulation of negative feedback and complaints suggests systematic issues with business practices that extend beyond isolated incidents, and for traders prioritizing security and regulatory protection, this jindao review strongly indicates that JinDao fails to meet acceptable standards.

User Experience Analysis (Score: 2/10)

The overall user experience with JinDao is significantly compromised by multiple operational deficiencies and poor service quality. User feedback consistently highlights frustration with various aspects of the broker's services, from account management to customer support interactions, and the lack of transparent information about basic operational procedures creates confusion and uncertainty for traders attempting to use the platform effectively.

Website usability and information accessibility appear to be problematic. Users report difficulty finding essential information about trading conditions, fees, and account policies, and professional brokers typically maintain user-friendly websites with comprehensive information sections. JinDao's online presence lacks the clarity and organization that facilitate positive user experiences.

The registration and account verification processes are not well-documented. This suggests potential complications for new users attempting to open accounts, and combined with poor customer service quality and operational transparency issues, the overall user experience falls significantly below industry standards. The accumulation of user complaints and negative feedback indicates that JinDao consistently fails to meet client expectations.

Conclusion

This comprehensive jindao review reveals significant concerns about JinDao's suitability as a forex trading broker. With an overall rating of 2.3/10, the broker demonstrates fundamental deficiencies in critical areas including regulatory compliance, customer service, and operational transparency, and the lack of clear regulatory oversight represents a particularly serious risk for potential clients.

While JinDao offers access to the MetaTrader 4 platform and claims to provide forex, metals, and energy trading, these limited advantages are overshadowed by substantial operational and service quality issues. The broker is not recommended for novice traders who require educational support and reliable customer service, nor for experienced traders who prioritize regulatory protection and operational transparency in their trading relationships.

For traders seeking reliable forex trading services, this analysis strongly suggests considering well-regulated alternatives with established track records of client service and regulatory compliance. JinDao's poor performance across multiple evaluation criteria indicates significant risks that outweigh any potential benefits of their limited service offering.