Spacemarket 2025 Review: Everything You Need to Know

Summary: Spacemarket has garnered significant attention, but the overall sentiment is largely negative. Users report issues with withdrawals and a lack of transparency, while experts have flagged it as an unregulated broker with ties to potentially fraudulent activities.

Note: It is crucial to be aware that Spacemarket operates under different entities across regions, which may affect its legitimacy and regulatory compliance.

Ratings Overview

How We Rated the Broker: Our ratings are based on a comprehensive analysis of user experiences, expert opinions, and factual data regarding Spacemarket's operations.

Broker Overview

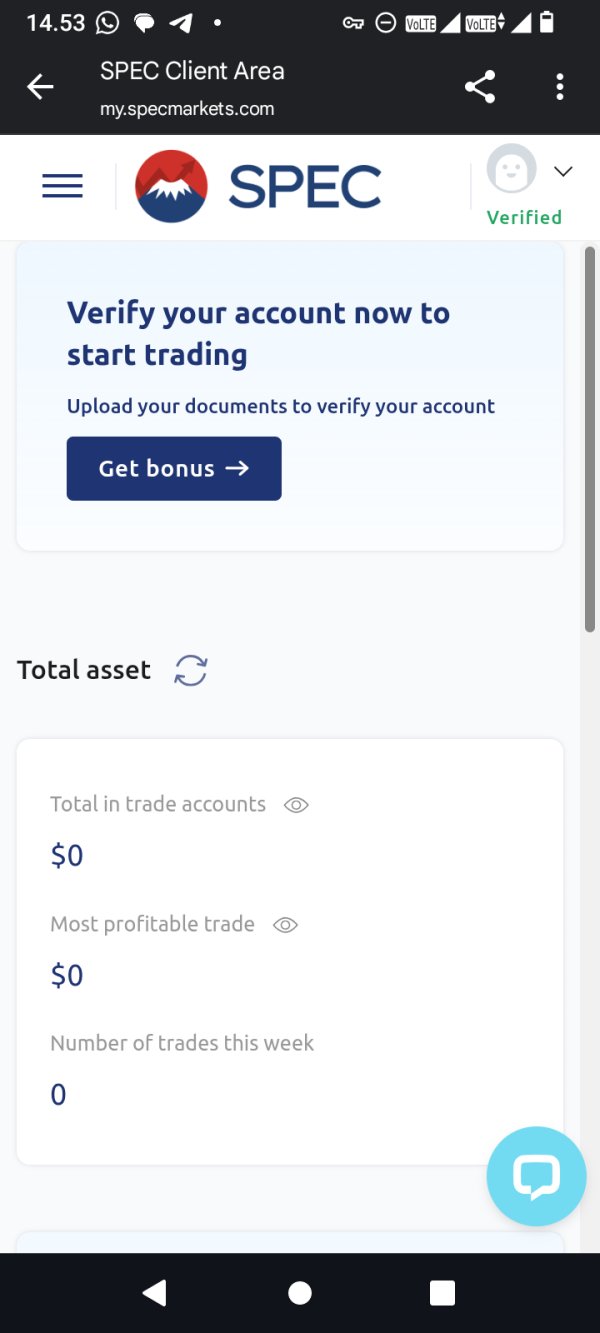

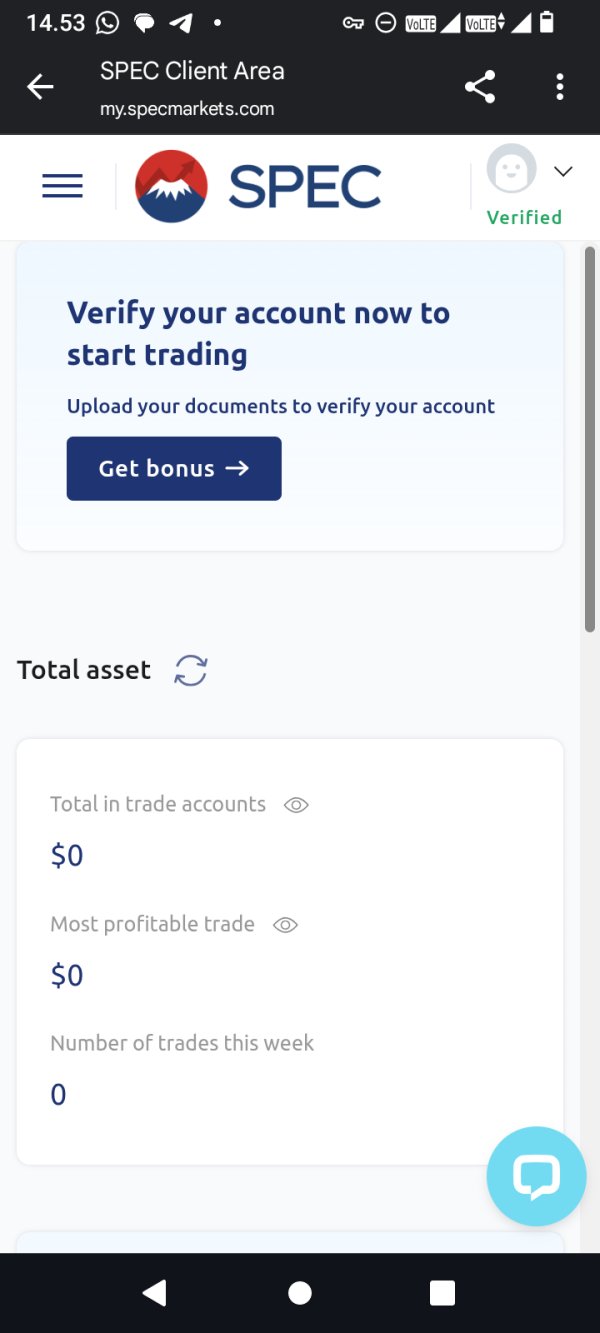

Spacemarket is an offshore forex broker reportedly owned by Widdershins Group Ltd, a company registered in Dominica. Despite its claims of providing a robust trading platform, the lack of regulatory oversight raises significant concerns about its legitimacy. The broker operates its proprietary trading platform, known simply as the "Space Platform," which is accessible via modern web browsers without the need for additional software installations. Spacemarket claims to offer over 100 tradable assets, including more than 60 currency pairs, metals, indices, and shares. However, the absence of a reputable regulatory body overseeing its operations makes it a risky choice for traders.

Detailed Breakdown

Regulated Areas/Regions:

Spacemarket operates in an unregulated environment, primarily in Dominica, which is notorious for its lax financial regulations. This lack of oversight means that traders are exposed to higher risks without any safety nets in place.

Deposit/Withdrawal Currencies/Cryptocurrencies:

The broker accepts deposits in USD, GBP, and EUR, with a minimum deposit requirement of $250 for the basic account. However, the specifics regarding withdrawal methods and any associated fees are not clearly disclosed, leading to further skepticism.

Minimum Deposit:

To open a basic account with Spacemarket, traders must deposit a minimum of $250. Other account types, such as the optimal, individual, and strategic accounts, require minimum deposits of $2,000, $10,000, and $25,000, respectively.

Bonuses/Promotions:

Currently, Spacemarket does not offer any bonuses or promotional incentives, which is a common practice among many unregulated brokers.

Tradable Asset Categories:

Spacemarket claims to provide access to a diverse range of trading instruments, including forex pairs, commodities, indices, and shares. However, the actual availability of these assets is contingent upon the account type.

Costs (Spreads, Fees, Commissions):

The spreads offered by Spacemarket vary by account type, starting from 1 pip for the basic account. Users have reported high spreads compared to industry standards, which can significantly impact trading profitability.

Leverage:

Spacemarket offers a maximum leverage of up to 1:300, which is considerably high and poses substantial risks, especially for inexperienced traders.

Allowed Trading Platforms:

The broker operates on its proprietary Space Platform, which lacks many advanced features found in popular platforms like MetaTrader 4 or 5. This has led to criticism regarding its usability and functionality.

Restricted Regions:

Due to its unregulated status, Spacemarket may not be legally allowed to operate in certain jurisdictions, particularly in regions with stringent financial regulations.

Available Customer Service Languages:

Customer support is available in multiple languages, but the lack of direct contact methods (such as phone support) raises concerns about the reliability of their service.

Final Ratings Overview

Detailed Rating Analysis

-

Account Conditions (Rating: 4/10):

The account conditions are somewhat competitive, with a low minimum deposit of $250. However, the high minimum deposits required for higher-tier accounts may deter many potential traders.

Tools and Resources (Rating: 5/10):

While Spacemarket claims to provide a range of tools, the lack of a demo account and advanced trading features on its platform leaves much to be desired. Users have noted that the platform is not as robust as competitors.

Customer Service and Support (Rating: 3/10):

Customer support options are limited, primarily relying on email communication without direct phone support. Many users have reported slow response times and a lack of helpful information.

Trading Experience (Rating: 4/10):

The trading experience is hampered by the low functionality of the Space Platform and high spreads, which can lead to less favorable trading conditions.

Trustworthiness (Rating: 2/10):

The lack of regulation and numerous red flags regarding its parent company, Widdershins Group Ltd, significantly undermine its trustworthiness. Reports of withdrawal issues and negative user experiences further exacerbate this concern.

User Experience (Rating: 3/10):

Overall user experiences have been negative, with many traders expressing frustration over withdrawal processes and transparency issues.

In conclusion, while Spacemarket may present itself as a viable trading option, the overwhelming consensus from user reviews and expert analyses suggests that it poses significant risks. Traders are advised to exercise caution and consider more reputable alternatives.