Soyam 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Soyam Trade Limited, established in November 2021 and based in Hong Kong, presents itself as a forex brokerage offering high-leverage trading across a variety of asset classes, including forex, metals, futures, and cryptocurrencies. With potential leverage reaching up to 1:400, it aims to attract experienced traders who appreciate the opportunity for significant returns. However, this allure comes with substantial risks, primarily stemming from its lack of regulatory oversight which fundamentally raises concerns about fund safety and withdrawal reliability.

Traders contemplating Soyam must weigh these enticing features against potential dangers. Many users have reported substantial challenges with withdrawals, leading to assertions of the broker being potentially untrustworthy, with its regulatory status classified as "no license" by several sources. This analysis endeavors to elucidate the advantages and pitfalls of Soyam Trade Limited, ensuring prospective users can make informed decisions regarding their trading activities.

⚠️ Important Risk Advisory & Verification Steps

Caveat Emptor: Before engaging with Soyam Trade Limited, it's crucial to acknowledge the following risk factors:

- Lack of Regulatory Oversight: Soyam operates without supervision by any recognized regulatory authority, which significantly increases the risk for traders.

- Withdrawal Issues: Past reports reveal difficulties faced by users attempting to withdraw funds, heightening concerns over fund safety.

- High Leverage Risks: Leveraging up to 1:400 has the potential to amplify both gains and losses, presenting a double-edged sword for traders.

Verification Steps for Due Diligence:

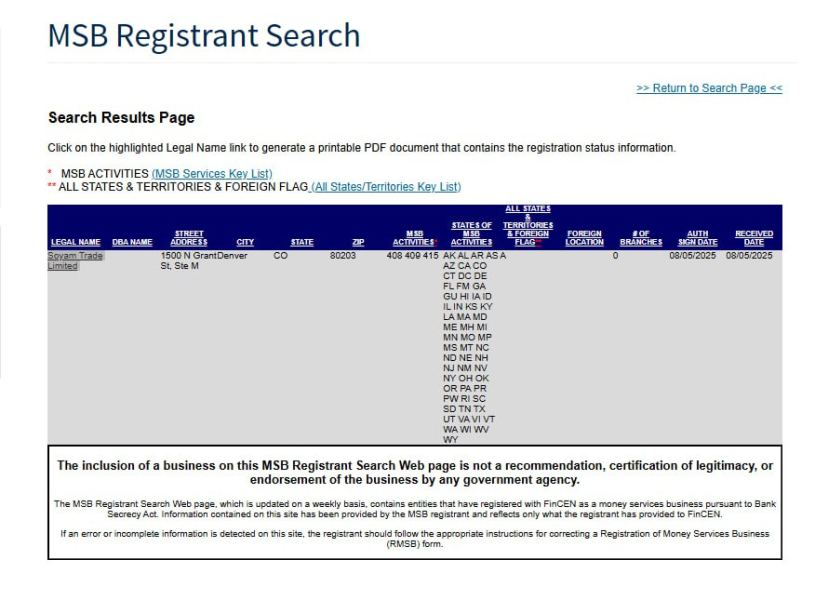

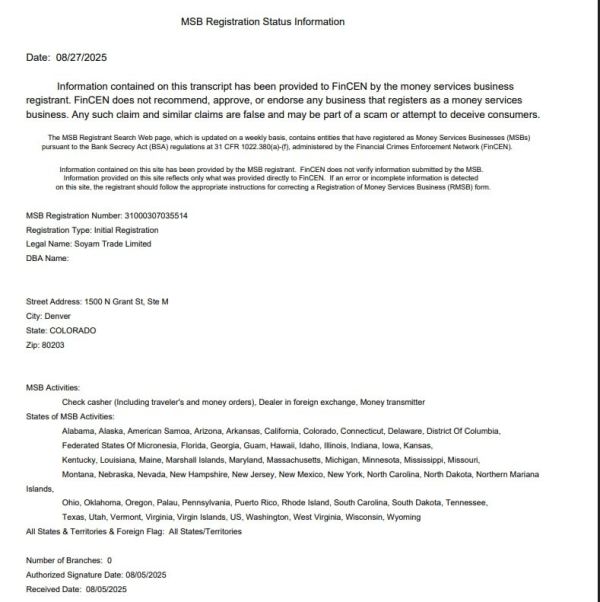

- Check Regulatory Status:

- Visit reputable financial authority websites to confirm the broker's license status.

- Search User Reviews:

- Look for feedback on forums and review websites to gain insights into the experiences of current and previous clients.

- Investigate Transparency:

- Evaluate the broker's transparency in terms of fees, commissions, and withdrawal policies.

Rating Framework

Broker Overview

Company Background and Positioning

Soyam Trade Limited was incorporated on November 26, 2021, as a private entity in Hong Kong, a region known for its financial services sector. Despite its recent establishment, the firm aims to provide a diverse range of trading options to global clients. However, its classification as unregulated raises red flags about its operational integrity and accountability.

Core Business Overview

Soyam caters to a wide array of trading interests with access to various asset classes, including:

- Forex: Major currency pairs.

- Precious Metals: Gold and Silver.

- Futures: Commodities and indexes.

- Cryptocurrencies: Various digital assets.

The platform operates primarily on the MT5 system, facilitating advanced trading capabilities such as automated trading strategies and comprehensive charting tools. This places Soyam in position to attract both novice traders interested in a demo account and experienced traders looking to capitalize on volatile markets.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The absence of regulatory oversight for Soyam poses a significant risk for investors. The firm is classified with a regulatory status of "no license," with a low overall score of 1.15 out of 10 according to sources such as WikiFX.

Analysis of Regulatory Information Conflicts:

The lack of reliable licensing information raises concerns about the broker's operating legitimacy. Without regulatory oversight, theres an inherent risk to fund safety and compliance with industry standards.

User Self-Verification Guide:

- Step 1: Check the broker on regulatory authority websites (e.g. ASIC, FCA).

- Step 2: Review independent platforms like WikiFX for additional insights.

- Step 3: Explore industry forums for user experiences and feedback relating to security and withdrawal issues.

- Step 4: Confirm if the broker has a history of changing websites or names, which can be indicative of further risks.

- Industry Reputation and Summary:

The overall sentiment surrounding Soyam is alarmingly negative, with users citing experiences involving withdrawal difficulties, lack of access to funds, and unresponsive customer support. These issues contribute to an impression of Soyam as a high-risk option in the trading market.

Trading Costs Analysis

The financial dynamics at play can either benefit or harm a trader's investment.

Advantages in Commissions:

Potentially competitive commission rates can attract traders; however, detailed disclosures regarding their structuring are lacking, which leaves many question marks surrounding actual costs.

The "Traps" of Non-Trading Fees:

Reports indicate hidden fees that can emerge during transactions. Many users have claimed frustrating experiences regarding withdrawal fees, which often aren't transparent until withdrawal requests are initiated.

"Soyam offers great trading opportunities until you try to withdraw your profits, where they introduce hidden fees and complex rules."

- Cost Structure Summary:

For active traders, these opaque fees can accumulate, offsetting any advantages gained through trading. The unclear commission structure further adds to the caution warranted when engaging with this broker.

The technology behind a trading platform can significantly influence user experience.

Platform Diversity:

Soyam provides access to MT5, a leading trading platform known for its robust features and support for automated trading. However, the implementation may vary based on user needs and expectations, as experiences suggest some limitations in usability compared to other platforms like MT4.

Quality of Tools and Resources:

While features such as advanced charting and automated solutions enhance trading, user feedback indicates the availability of educational resources might not meet beginner trader needs.

Platform Experience Summary:

Users have expressed mixed experiences with MT5, noting its depth of features but also encountering a learning curve that may discourage novice traders.

User Experience Analysis

User experience can dictate overall satisfaction within a trading platform.

Ease of Use:

Numerous reviews mention dissatisfaction due to withdrawal complications, which overshadow any operational efficiencies present in the platform.

Accessibility:

The absence of direct support channels like phone communications is noted by users, leading to delays in problem resolution and contributing to a negative trading experience.

Overall User Sentiment:

The prevailing mood among Soyam users often reflects frustration particularly centered around withdrawal processes, resulting in a poor user experience.

Customer Support Analysis

Effective customer service can bolster a trader's confidence in a broker.

Support Channels:

Soyam only provides email support and lacks live chat or telephone options. Delays in email responses have been commonly cited, indicating a need for improvements.

User Feedback on Responsiveness:

Users often report long wait times for resolution, which poses a significant drawback for traders needing timely support particularly during active trading sessions.

Customer Experience Summary:

The inadequacies in customer support further compound the questions raised about overall trust in Soyam, leading many to hesitate in committing to long-term trading relationships.

Account Conditions Analysis

The rules governing account management can produce significant implications on a trader's strategy.

Account Types and Terms:

Soyam offers varied account types but lacks transparency about minimum deposit requirements and associated trading conditions.

Implications of Terms and Conditions:

The vague descriptions of account management rules can lead to unexpected complications, particularly concerning withdrawal conditions.

Account Management Summary:

The overall lack of clarity surrounding account conditions often leaves traders feeling insecure about their decisions, underlining the need for further transparency.

Quality Control

Handling Information Conflicts: Given the confusion surrounding Soyams legitimacy, it is imperative to employ personal research. Utilize regulatory websites and review forums to verify claims made by the broker.

Potential Information Gaps:

- Specific fee structures and policies may need confirmation, along with concrete details regarding withdrawal processes that can vary widely.

- Access to user testimonials or specific case studies could add qualitative insights to augment the quantitative ratings discussed.

- Recent updates on the overall regulatory status or operational revisions would help current and prospective traders understand the business's direction.

In summary, while Soyam Trade Limited offers several enticing trading options with high leverage opportunities, it is critically important to consider the inherent risks rooted in its lack of regulation and documented withdrawal issues. Traders should exercise due diligence and ensure they are fully aware of the nature of their association with this brokerage before proceeding.