smartfx 2025 Review: Everything You Need to Know

Abstract

Smartfx is a regulated forex broker under the Vanuatu Financial Services Commission . The broker offers high leverage and competitive spreads that attract traders worldwide. In this smartfx review, we see that commission fees are moderate. However, the broker makes up for this with a strong trading environment built on the MetaTrader 5 platform. This platform supports many asset types, including forex and CFDs, and provides an easy-to-use interface with advanced technical analysis tools. Clients have praised their client relationship managers. They express satisfaction with the personal support and expect long-term partnerships. Smartfx is designed mainly for medium and small investors who want to engage in high-leverage forex and CFD trading. The broker's model focuses on direct market access through an STP system. The broker's global offering comes with regulatory oversight from VFSC, ensuring some funding security and legal operation. However, some details on commission structures and minimum deposit requirements are missing.

Cautions

Smartfx accepts clients from almost all countries except for a few such as the United States and Canada. Traders should check their local laws and regulatory guidelines before opening an account. This review is based only on publicly available information and user feedback collected from multiple sources, ensuring a balanced and complete perspective. Differences exist regarding deposit methods, minimum deposit amounts, and bonus promotions. Users should seek more clarity from the official website before engaging. The evaluation aims to provide a deep understanding of smartfx's offerings. We acknowledge that certain critical details were not disclosed in the available data.

Ratings Framework

Broker Overview

Smartfx is a broker based in Vanuatu. The company has positioned itself as a specialist in the forex and CFD markets through an STP business model. The exact founding year remains unclear in the available information. However, the firm has built a notable presence by targeting a diverse global client base. Its structure is designed to serve mainly medium and small investors seeking high-leverage trading opportunities. The broker's commitment to offering competitive trading conditions is clear in its focus on providing a platform that supports direct market access while maintaining regulatory oversight from the VFSC.

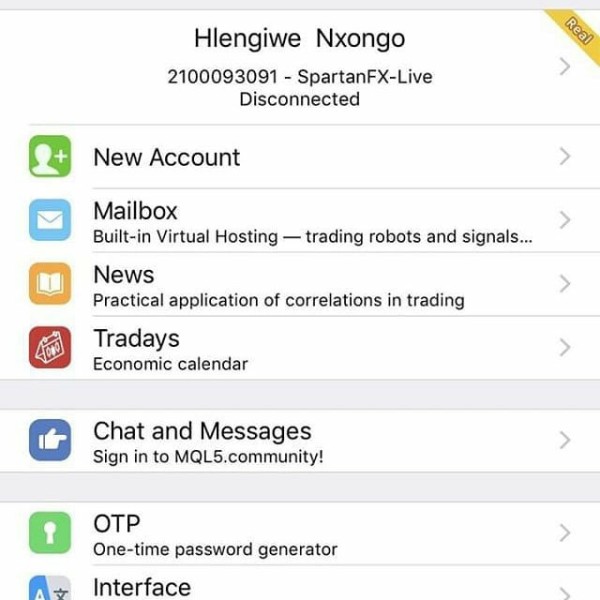

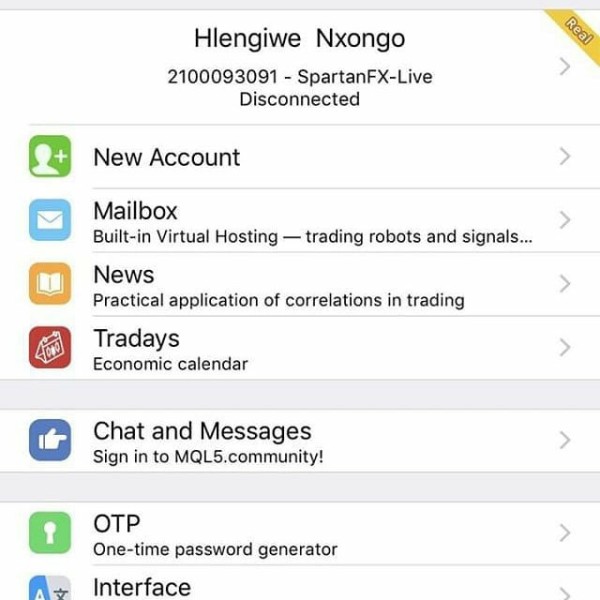

Smartfx uses the MetaTrader 5 platform for trading technology and available instruments. This is a well-regarded system in the industry known for its user-friendly interface and complete suite of trading tools. The broker supports various asset classes, such as forex pairs and contracts for difference . This ensures that traders have access to diverse market opportunities. As a fully regulated entity under VFSC , smartfx works to assure its clients of a secure trading environment. This smartfx review shows that while some important details such as minimum deposit requirements and specific commission information have not been fully disclosed, the overall integrity and operational focus remain strong. This makes it an option worth considering for traders focused on using the strengths of modern trading platforms.

Smartfx operates under the careful oversight of the Vanuatu Financial Services Commission . This makes regulatory transparency a cornerstone of its business practice. The VFSC's regulation is meant to protect client funds and enforce financial discipline within the brokerage operations. This offers traders an added layer of security. This regulatory framework serves as a primary factor in building trust, though it should be noted that the specific performance metrics remain only moderately rated.

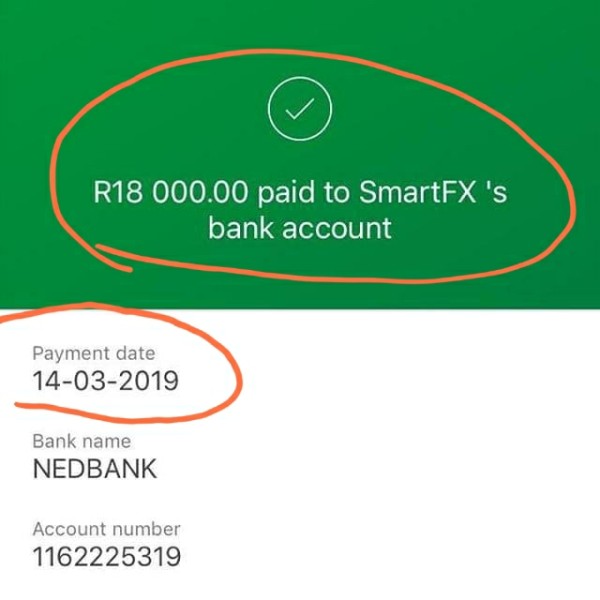

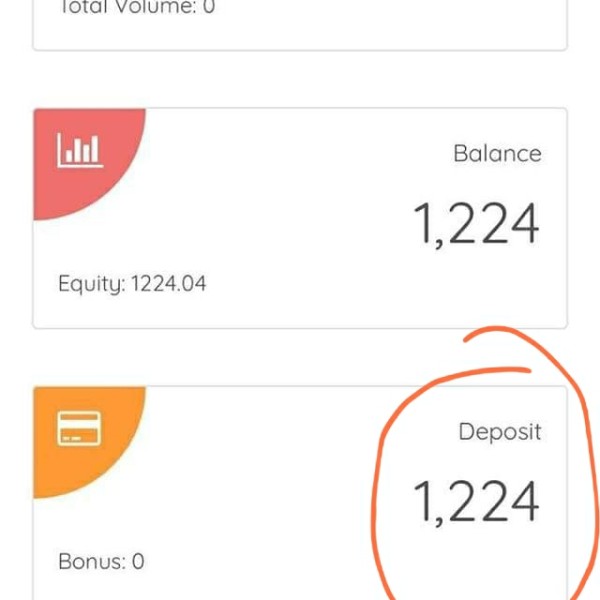

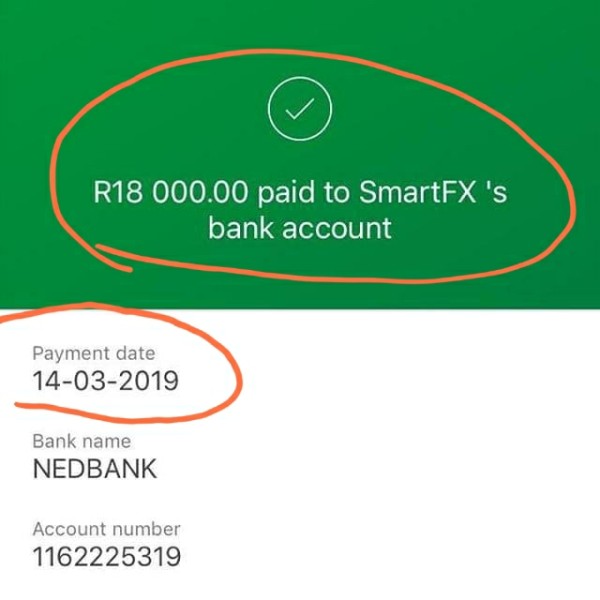

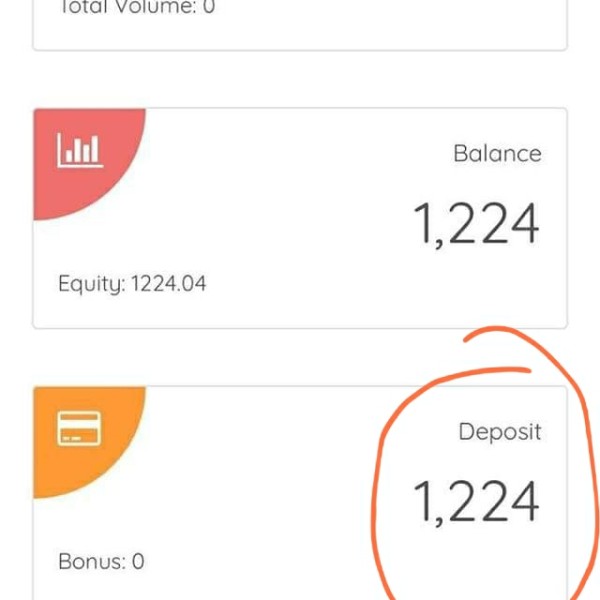

The detailed information about deposit and withdrawal methods, as well as the minimum deposit requirement, is limited in the available sources. These details have not been clearly outlined in public documents. This leaves potential clients to inquire directly for further clarity. Similarly, the availability of bonus promotions or loyalty programs is not addressed clearly in the current disclosures. This suggests that either such offers are minimal or not actively promoted.

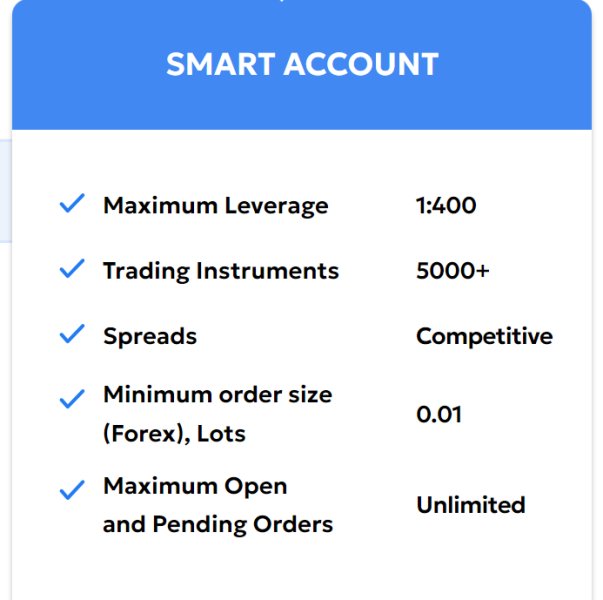

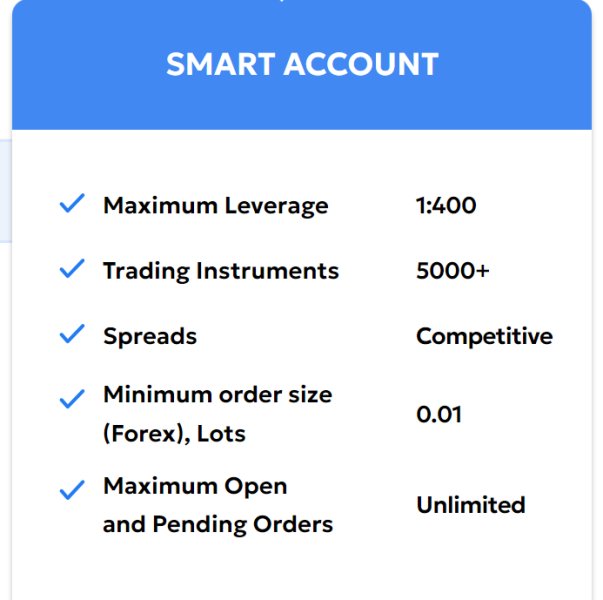

The tradable assets at smartfx include a varied range of instruments such as forex pairs and CFDs. This allows traders to diversify their market exposure. Regarding the cost structure, while commission fees are described as moderate, spreads remain competitive though no concrete figures have been provided. This means that traders might need to evaluate trading costs based on changing market conditions. Furthermore, smartfx offers high leverage across its instruments. However, the exact leverage ratios are not listed in the available literature.

Smartfx supports the MetaTrader 5 environment for its platform. This feature is praised for its advanced charting tools, complete technical indicators, and reliability. This makes it suitable for both new and experienced traders. While the broker appears to be quite inclusive geographically, regional restrictions apply. Specifically, traders from countries such as the United States, Canada, and a few others are limited from accessing its services. Finally, while details regarding customer service language options are limited, the overall emphasis remains on personalized support and transparency in trading operations. This section of the smartfx review shows that while the broker offers a strong core trading service, some operational details require further clarification to ensure complete transparency.

Detailed Ratings Analysis

1. Account Conditions Analysis

In this section, we evaluate smartfx's account conditions. These form a crucial part of its overall trading proposition. The available data shows that while the broker provides competitive commission rates, the associated cost structure is deemed moderate. The absence of clearly defined minimum deposit amounts and account types prevents a complete evaluation of the account conditions. Moreover, there is no detailed outline regarding the account opening procedure or available features such as Islamic accounts. These may be relevant to specific trading segments. Users have expressed mixed feedback on the commission structure. Although competitive in theory, it does not fully make up for the lack of complete transparency on other account parameters. Other brokers in the market that clearly outline their account funding requirements and special account functions tend to build greater confidence among their clients. According to user reviews cited in various forums, the moderate assessment of smartfx's account conditions indicates that while the trading environment has competitive elements, there remains room for enhanced clarity and improvement. This smartfx review emphasizes that clarity in account features is an aspect that could be enhanced for better market competitiveness.

Smartfx supports the MetaTrader 5 platform. This platform is widely recognized for its advanced trading tools and strong analytical capabilities. The MT5 environment provides an extensive suite of charting tools, technical indicators, and automated trading functions. Users have received this well. In this analysis, traders have appreciated the platform's user-friendly interface and the diversity of resource options that cater to both technical and fundamental analysis. While smartfx does offer mobile trading support, specific details regarding the breadth of educational materials and real-time research resources were not explained in the available resources. As such, while the technological foundation appears strong, there is an evident opportunity for smartfx to strengthen its educational and research segments. Expert opinions suggest that a more integrated research and news feed could further enhance the overall trading toolkit for customers. In summary, the tools and resources provided by smartfx offer a solid foundation for technical traders. However, a more complete suite of educational materials could raise the service level even higher. This section of our smartfx review highlights that although the platform is technically capable, further improvements in research support may contribute to better long-term trading success.

3. Customer Service and Support Analysis

Smartfx's customer service and support have been praised by many traders. This is primarily due to the hands-on approach provided by their dedicated account managers. Clients have reported timely and effective support responses, noting that the personal assistance offered adds significant value to the overall trading experience. This analysis reflects that even though smartfx does not extensively detail its customer service channels—such as live chat or telephone support—the feedback indicates a high level of satisfaction among users. Many traders have praised the professionalism and responsiveness of the support team. They highlight that they felt adequately supported during both routine and complex trading scenarios. Furthermore, in cases where issues arose, customer support was quick to provide solutions. This reinforces the broker's commitment to client engagement. Although certain details such as multi-language support and detailed service hours remain unclear, the overall impression based on user feedback is overwhelmingly positive. This strong support network significantly contributes to the broker's usability. It ensures that even those new to forex or CFDs feel guided through the trading process. Overall, smartfx's proactive customer service framework is a key contributor to its high rating in this dimension.

4. Trading Experience Analysis

The trading experience on smartfx is mainly characterized by its use of the MetaTrader 5 platform. This platform is synonymous with reliability and efficiency in order execution. Traders have benefited from the platform's stability, quick execution times, and complete functionality—from advanced charting to customizable indicators. However, despite these advantages, there are areas that call for improvement. For instance, while the spreads offered by smartfx are described as competitive, the lack of clear spread values leaves some traders without a complete picture of trading costs under different market conditions. There are also no detailed reports on the impact of potential market slippage or re-quotes during volatile trading sessions. Trading on a high-leverage basis introduces inherent risks. The absence of specific details regarding these aspects might pose concerns for risk management. User feedback generally shows that the overall experience is positive. The technical performance of the MT5 platform serves as a key asset. Nonetheless, this smartfx review points out that additional transparency regarding order execution metrics and spread variability would provide traders with greater confidence and clarity. This would ultimately lead to an improved overall trading experience.

5. Trustworthiness Analysis

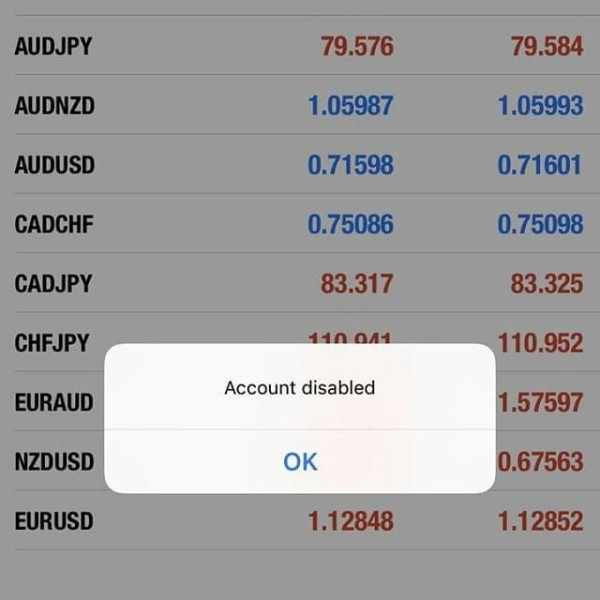

Trustworthiness in the forex brokerage industry is fundamentally linked to regulatory oversight and operational transparency. Smartfx operates under the regulation of the Vanuatu Financial Services Commission , with a license number of 40491. This offers a basic level of credibility. This regulatory affiliation, however, only partially reduces concerns as the details of the broker's internal risk management practices and fund protection measures are not extensively disclosed. Publicly available data indicates a moderate trust score of 66. This reflects a generally stable yet somewhat cautious perception among traders. While some users appreciate the fact that smartfx operates in a regulated environment, others note that more complete disclosure on topics such as capital adequacy and third-party audits would enhance confidence further. Compared to brokers in regions with stricter regulatory frameworks, smartfx's trustworthiness may be seen as only moderate. This is especially true for traders prioritizing the highest standards of security and transparency. Consequently, while the VFSC regulation remains a positive signal, the absence of detailed safety protocols and operational transparency remains a drawback. Prospective clients should consider this carefully when evaluating their risk management strategies.

6. User Experience Analysis

User experience is a critical factor for the long-term success of any trading platform. Smartfx appears to strike a reasonable balance in this regard. Traders have generally expressed satisfaction with the overall user interface. They cite the intuitive and streamlined design of the MT5 platform as a major advantage. The account registration and verification processes, though not described in detail in available sources, are implied to be straightforward. This contributes to a positive initial impression. In addition, the ease of navigation, coupled with the responsiveness of the platform during active trading sessions, has resonated well with both new and experienced traders alike. Feedback indicates that while most users are pleased with the functional aspects of smartfx's website and trading environment, the experiences concerning fund management and withdrawal processes remain less documented. Nonetheless, the general sentiment is that smartfx's user experience is strong. This reflects thoughtful integration of essential trading tools with a clear emphasis on usability and client satisfaction. This section of our review consolidates the view that, despite certain operational details being less transparent, the positive feedback on interface design and overall ease-of-use outweighs the negatives. This makes smartfx an attractive option for traders seeking a reliable trading partner.

Conclusion

To summarize, smartfx is a VFSC-regulated broker that serves well medium and small investors looking to engage in high-leverage forex and CFD trading. The use of the MetaTrader 5 platform and responsive customer service are among its key strengths, as noted by several users. However, the moderate commission structure, coupled with gaps in critical operational details such as minimum deposits and fund management specifics, prevent it from achieving top-tier ratings. This smartfx review ultimately recommends smartfx for traders who value a strong trading platform and personalized support. We advise a cautious approach regarding some of the less transparent elements of its service model.