ScoreCM 2025 Review: Everything You Need to Know

Executive Summary

This detailed scorecm review looks at a forex broker registered in Dominica. The broker shows both good and bad points for traders who might want to use their services. ScoreCM calls itself an education-focused broker that offers high leverage up to 1:1000 and uses the popular MetaTrader 5 trading platform. The broker has good trading conditions in some areas, but there are concerns about how clear they are about rules and how good their customer support is.

The broker mainly targets traders who want high leverage trading and those who like educational resources. ScoreCM supports many asset types including currencies, indices, precious metals, and energy products. However, the lack of clear rule information and mixed user feedback about customer service create problems that future clients should think about carefully.

Based on available information and user feedback, ScoreCM gets a neutral overall rating. The broker has strengths in trading platform features and leverage offers, but has weaknesses in being clear and providing support services that potential traders should carefully check.

Important Disclaimer

ScoreCM operates with registration in Dominica and Mowali. The specific details about who watches over them remain unclear in available documents. The rule environment in these places may be very different from major financial centers, and traders should carefully think about the legal protections available in their areas.

This review uses publicly available information and user feedback from various sources. Limited information means some parts of the broker's services may not be fully shown in this analysis. Future clients should do their own research and think about their individual trading needs and risk comfort before making any decisions.

Scoring Framework

Broker Overview

ScoreCM works as a forex broker with registration in Dominica and Mowali. The specific dates when the company started are not clearly written in available sources. The company focuses on trader education, though detailed information about company headquarters and corporate structure stays limited in public documents.

This lack of complete background information is a notable gap for traders seeking full openness about their broker's corporate foundation. The broker's focus on educational resources suggests they want to support trader development. However, specific details about these educational programs are not widely documented.

ScoreCM uses the MetaTrader 5 platform. This gives traders access to advanced trading tools and analytical abilities. The broker offers multiple tradeable asset classes including currencies, indices, precious metals, and energy products, creating a diverse trading environment suitable for various investment strategies.

However, the absence of clear oversight information from major financial authorities raises questions about investor protection available to clients.

Regulatory Status: ScoreCM is registered in Dominica and Mowali. Specific regulatory authority details and license numbers are not clearly documented in available sources.

Deposit and Withdrawal Methods: Specific information about funding methods and withdrawal processes is not detailed in available documentation.

Minimum Deposit Requirements: Minimum deposit amounts are not specified in publicly available information.

Bonus and Promotions: Current promotional offerings and bonus structures are not documented in available sources.

Tradeable Assets: The broker supports trading in currencies, indices, precious metals, and energy products. This provides diverse market exposure opportunities.

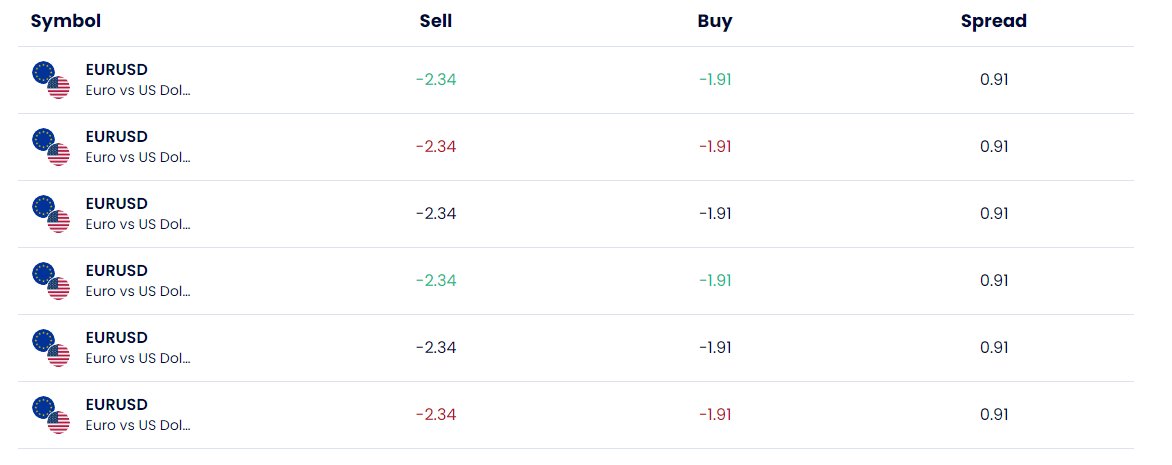

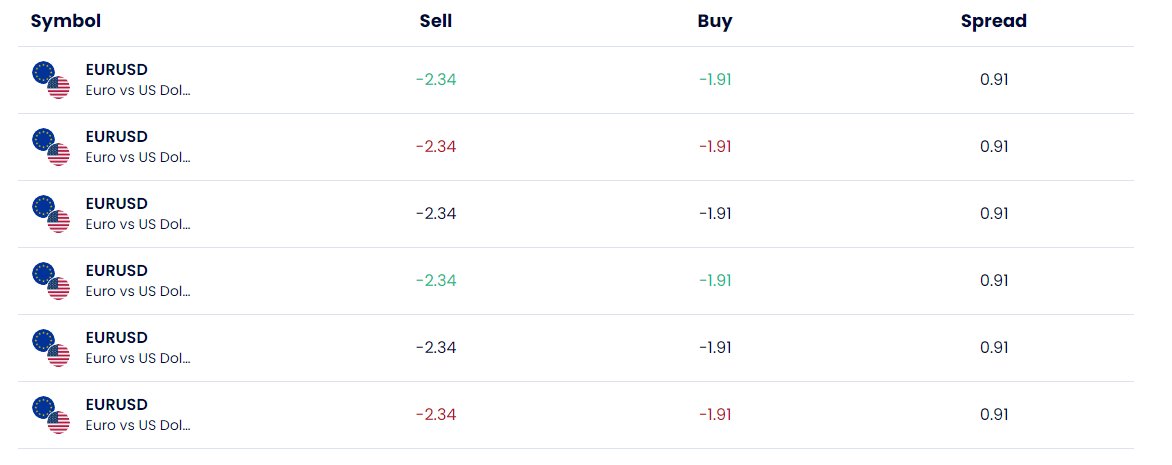

Cost Structure: According to available information, ScoreCM offers competitive spreads. However, specific spread values and commission structures are not detailed in current documentation.

Leverage Ratios: Maximum leverage reaches up to 1:1000. This provides significant amplification opportunities for qualified traders.

Platform Options: ScoreCM uses MetaTrader 5. The platform offers comprehensive trading tools, technical indicators, and analytical capabilities for various trading strategies.

Geographic Restrictions: Specific regional limitations are not documented in available sources.

Customer Service Languages: Available customer support languages are not specified in current documentation.

This scorecm review notes that while basic service information is available, many specific operational details require direct inquiry with the broker for complete clarity.

Account Conditions Analysis

ScoreCM's account structure information stays limited in publicly available documentation. This creates challenges for traders seeking comprehensive account details. While the broker offers high leverage up to 1:1000, specific account types and their distinctive features are not clearly outlined in current sources.

This information gap makes it difficult for potential clients to understand the full range of account options available. User feedback suggests that the account opening process is relatively straightforward. However, detailed verification requirements and timelines are not extensively documented.

The absence of specific minimum deposit information in available sources means traders must contact the broker directly to understand funding requirements for different account levels. The high leverage offering of 1:1000 represents a significant feature for traders seeking amplified market exposure, though this also increases risk levels substantially. However, without clear information about risk management tools, margin requirements, and account protection measures, traders cannot fully assess the complete account conditions package.

Specialized account features such as Islamic accounts, VIP services, or institutional offerings are not mentioned in available documentation. This scorecm review finds that while basic account functionality appears operational, the lack of comprehensive account condition details represents a significant limitation for informed decision-making.

ScoreCM's use of the MetaTrader 5 platform provides traders with access to a robust and widely-recognized trading environment. MT5 offers comprehensive charting capabilities, technical indicators, and automated trading support, making it suitable for various trading strategies from scalping to long-term positioning. The platform's multi-asset support aligns well with ScoreCM's offering of currencies, indices, metals, and energy products.

While the broker emphasizes trader education as a core focus, specific details about educational content, webinars, market analysis, or training materials are not extensively documented in available sources. This represents a notable gap between the stated educational commitment and publicly available information about actual resources provided to clients. User feedback indicates satisfaction with the variety of trading tools available through the MT5 platform, suggesting that the technical infrastructure supports effective trading activities.

However, information about proprietary tools, research resources, or additional analytical services beyond the standard MT5 offering is not detailed in current documentation. The absence of specific information about automated trading support, custom indicators, or advanced analytical resources limits the ability to fully assess the broker's tool ecosystem. While MT5 provides a solid foundation, additional value-added services that distinguish ScoreCM from other MT5 brokers are not clearly documented.

Customer Service and Support Analysis

Customer service represents a significant concern area for ScoreCM based on available user feedback. Multiple sources indicate that response times are slower than industry standards, with users reporting delays in receiving support for both technical and account-related inquiries. This performance gap affects overall user satisfaction and potentially impacts trading activities when timely support is needed.

Available documentation does not specify the customer service channels offered, such as live chat, email, phone support, or ticket systems. The absence of clear information about support availability hours, multilingual capabilities, or specialized support teams makes it difficult for potential clients to understand the level of service they can expect. User feedback suggests that while support staff demonstrate professional knowledge when contacted, the primary issue lies in accessibility and response timing rather than competency.

This pattern indicates systemic support capacity issues rather than individual service quality problems. The lack of comprehensive customer service information in publicly available sources, combined with negative user feedback regarding response times, positions customer support as a notable weakness in ScoreCM's service offering. Prospective clients should consider this limitation when evaluating their support needs and expectations.

Trading Experience Analysis

The trading experience with ScoreCM receives generally positive feedback from users, particularly regarding order execution speed and platform stability. User reports indicate satisfaction with the MetaTrader 5 platform's performance, noting that orders execute quickly under normal market conditions. This positive execution experience is crucial for traders implementing time-sensitive strategies or operating in volatile market conditions.

However, users have reported occasional technical issues that can disrupt trading activities. While these incidents appear to be intermittent rather than systemic, they represent potential concerns for traders who require consistent platform reliability. The nature and frequency of these technical problems are not extensively detailed in available feedback.

The competitive spread environment mentioned in available sources suggests that trading costs remain reasonable, though specific spread comparisons or commission structures are not detailed. This cost competitiveness contributes positively to the overall trading experience, particularly for active traders who are sensitive to transaction costs. Mobile trading experience and advanced platform features beyond standard MT5 functionality are not specifically addressed in available user feedback.

This scorecm review notes that while core trading functionality appears satisfactory, comprehensive platform performance data and detailed user experience metrics would provide a more complete assessment.

Trust and Reliability Analysis

Trust and reliability concerns represent the most significant challenges in this scorecm review. The registration in Dominica and Mowali, while legitimate, lacks the regulatory oversight and investor protection frameworks typically associated with major financial centers. This regulatory environment creates uncertainty about the level of client protection and recourse available in case of disputes.

The absence of clear regulatory license numbers, supervisory authority details, or compliance frameworks in publicly available information raises transparency concerns. Major regulated brokers typically provide comprehensive regulatory information, including license numbers, regulatory body contacts, and compliance reporting, none of which are readily available for ScoreCM. Financial transparency measures such as segregated client funds, insurance coverage, audit reports, or third-party verification are not documented in available sources.

These protections are standard in well-regulated environments and their absence represents a significant trust consideration for potential clients. Industry recognition, awards, or third-party ratings that could bolster credibility are not mentioned in available documentation. The combination of unclear regulatory status, limited transparency measures, and absence of independent validation creates substantial trust concerns that potential clients must carefully weigh against other broker benefits.

User Experience Analysis

Overall user satisfaction with ScoreCM presents a mixed picture, with positive feedback concentrated on platform interface and trading functionality, while negative experiences focus primarily on customer support and transparency issues. Users generally express satisfaction with the MetaTrader 5 interface, finding it intuitive and well-suited to their trading activities. The registration and account verification process receives moderate feedback, with users indicating that the procedure is relatively straightforward, though specific timelines and documentation requirements are not extensively detailed.

This accessibility in account opening contributes positively to the initial user experience. Funding and withdrawal experiences are not comprehensively documented in available user feedback, representing an information gap for potential clients seeking to understand the complete account management experience. Transaction processing times, fees, and available methods require direct inquiry with the broker.

Common user complaints center on customer support responsiveness and the lack of comprehensive information about broker operations. These concerns align with the trust and transparency issues identified in other analysis areas. The user profile that appears best suited to ScoreCM includes traders who prioritize high leverage access and platform functionality while being comfortable with limited regulatory oversight and support availability.

Conclusion

ScoreCM presents a mixed profile as a forex broker with notable strengths in trading platform functionality and leverage offerings, but significant concerns regarding regulatory transparency and customer support quality. The broker's use of MetaTrader 5 and competitive trading conditions provide a solid foundation for trading activities, particularly for users seeking high leverage opportunities up to 1:1000. However, the lack of clear regulatory oversight information and documented transparency measures creates substantial trust considerations that potential clients must carefully evaluate.

The combination of slower customer support response times and limited publicly available operational information further compounds these concerns. ScoreCM may be suitable for experienced traders who prioritize platform functionality and high leverage access while being comfortable with limited regulatory oversight and support availability, but is not recommended for traders seeking comprehensive regulatory protection and responsive customer service.