rubix fx 2025 Review: Everything You Need to Know

1. Abstract

The rubix fx review shows a broker with mixed reviews in online forex trading. Rubix FX was founded in 2014 and is regulated by Gleneagle Securities Pty Limited, offering traders high leverage up to 1:400 with many different asset classes including over 55 forex pairs, major stock indices, and select commodities. The broker uses the MetaTrader 4 trading platform. However, Rubix FX has no compensation scheme, and many user reports raise concerns about fund safety, making the platform appealing for traders willing to take higher risks for potentially larger rewards while warning risk-averse investors. While Rubix FX provides advanced trading features, regulatory gaps and user feedback on fund security remain key concerns.

2. Caveats

Rubix FX's regulatory oversight is only managed by an Australian authority, Gleneagle Securities Pty Limited, which leaves traders outside Australia with additional regulatory risks. This review uses available data from multiple sources and reported user experiences, without any onsite evaluations or firsthand user testing, and critical details such as deposit and withdrawal procedures, account verifications, and bonus promotions are not fully outlined in the available information. This review is provided for informational purposes and should be supplemented with personal research.

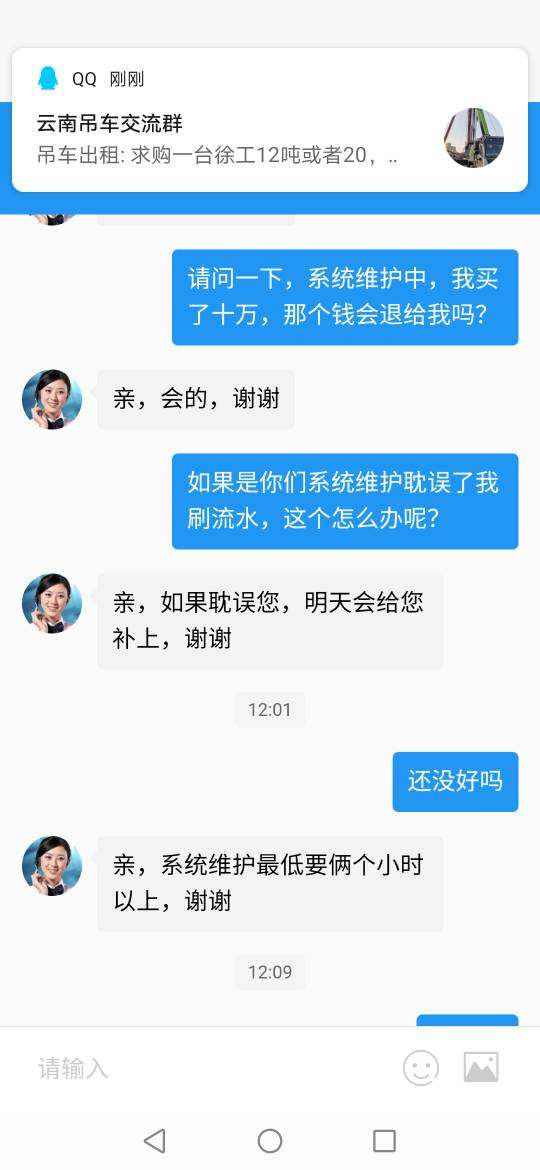

3. Score Framework

4. Broker Overview

Company Background and Business Model

Rubix FX was founded in 2014 as an online forex trading platform based in Australia. The company is registered under Gleneagle Securities Pty Limited and targets traders looking for advanced trading opportunities, focusing mainly on experienced traders and those who prefer higher risk through leveraged trading. The firm offers trading instruments including forex, stock indices, and commodities, and has added features such as social trading and automated trading strategies to its business model. Potential users should know that key details about account offerings and additional account features remain unclear in the available information.

Rubix FX operates mainly on the MetaTrader 4 platform, giving traders a familiar and strong interface known for its analytical tools and automated trading capabilities. The broker offers over 55 forex pairs, several stock indices, and multiple commodities, providing significant market exposure, and the main regulatory oversight comes from Gleneagle Securities Pty Limited. However, like many Australian brokers, Rubix FX is not covered by any compensation or guarantee system. This regulatory setup, combined with user feedback about fund security, creates cautious feelings among potential clients.

Regulatory Regions

Rubix FX is regulated by Gleneagle Securities Pty Limited, an Australian regulatory authority. The broker is not covered by any compensation system, which increases concerns about fund protection, meaning that while the broker meets basic regulatory requirements, traders outside of Australia or those seeking additional investor protection should be more careful.

Deposit and Withdrawal Methods

The available information does not specify detailed deposit or withdrawal methods for Rubix FX. Investors must rely on direct inquiries or personal research before committing funds.

Minimum Deposit Requirement

The minimum deposit requirement is reported as either $200 or $500, depending on the source. This relatively high entry threshold might limit access for new, smaller-scale traders.

No bonus or promotional packages have been clearly outlined in the gathered data. This lack of information may suggest that Rubix FX does not heavily focus on promotions as part of its marketing strategy, or that such details remain undisclosed.

Tradable Assets

Rubix FX offers a diverse selection of tradable instruments, notably over 55 forex currency pairs, various major stock indices, and key commodities. This variety gives traders the potential to diversify their portfolios across different asset classes.

Cost Structure

Specifics about trading costs, including spreads and commission fees, are not clearly disclosed by Rubix FX. While the broker promotes competitive conditions through its high-leverage offerings, traders lack transparent details about the fee structure, making cost comparison with other brokers challenging.

Leverage Ratio

The broker offers a maximum leverage of up to 1:400, which may attract traders looking to maximize their market exposure. This high-leverage environment comes with elevated risk and is more suited to experienced traders who fully understand the potential downsides.

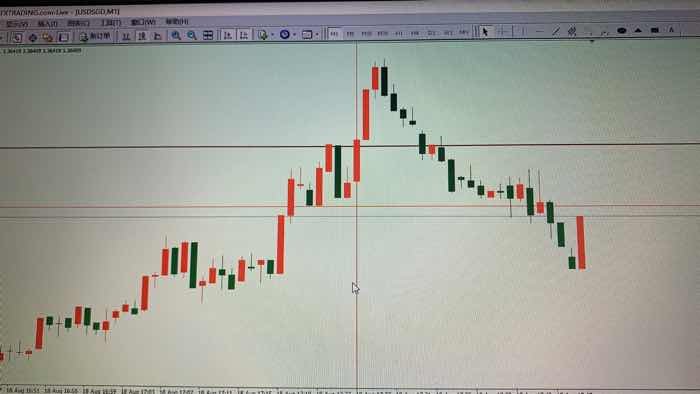

Rubix FX exclusively uses the MetaTrader 4 platform, a globally recognized and strong solution for executing various trading strategies. Its selection provides access to advanced charting tools, expert advisors, and a secure trading environment, although it may limit users who prefer more modern or mobile-focused platforms.

Regional Restrictions

No specific information on regional trading restrictions is provided in the available sources, leaving it unclear whether any particular regions are prohibited from accessing the platform.

Customer Service Languages

Details about the available languages for customer support are not specified in the information summary, leaving uncertainty about the level of localized service for international traders.

6. Detailed Score Analysis

6.1 Account Conditions Analysis

The account conditions at Rubix FX are mixed. The broker provides access to the market via the well-known MetaTrader 4 platform, but there are notable gaps in information about account types and their features, and with a minimum deposit requirement that ranges between $200 and $500 based on different reports, this threshold may serve as a barrier for new or small-scale traders. More concerning is the lack of clarity about the range of account options—there is no detailed description of different account types or the specific benefits they might offer. There is also insufficient information available about the account opening and verification process, and this lack of transparency, combined with recurring user discussions on restrictive deposit terms, suggests that potential clients may face difficulties in navigating the account registration procedure. Compared to other brokers with clearly defined account tiers and lower entry barriers, Rubix FX's account conditions could be seen as less accommodating.

Rubix FX primarily relies on the MetaTrader 4 platform, a well-established tool in the industry known for its advanced charting capabilities, automated trading options, and strong technical indicators. Beyond this core tool, the broker falls short in providing additional research or educational resources that many modern brokers offer, and there is little mention of proprietary tools or supplementary resources such as advanced market analysis modules, webinars, or detailed economic calendars that could help traders make informed decisions. While the availability of social trading and automated strategy functions is positive, these features are broadly common among many brokers in this segment. The absence of explicit information about educational content means that new traders may miss out on supportive learning initiatives during their early trading experiences, and the reliance on a single platform—albeit a well-respected one—limits the comprehensive support that advanced traders might seek. While Rubix FX does offer the functional advantages of MetaTrader 4, the broker's overall suite of tools and resources leaves room for improvement.

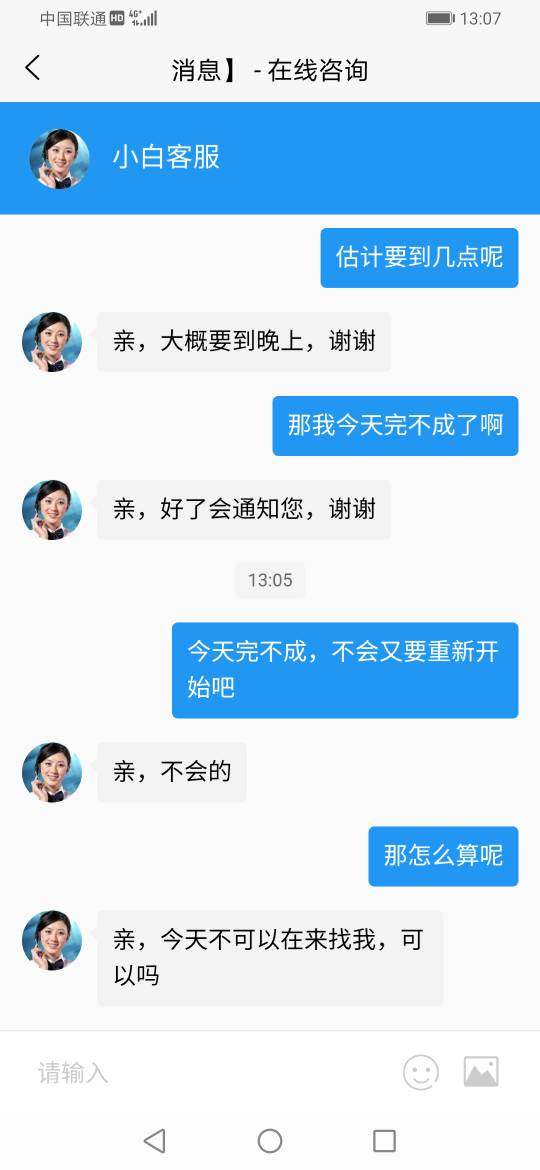

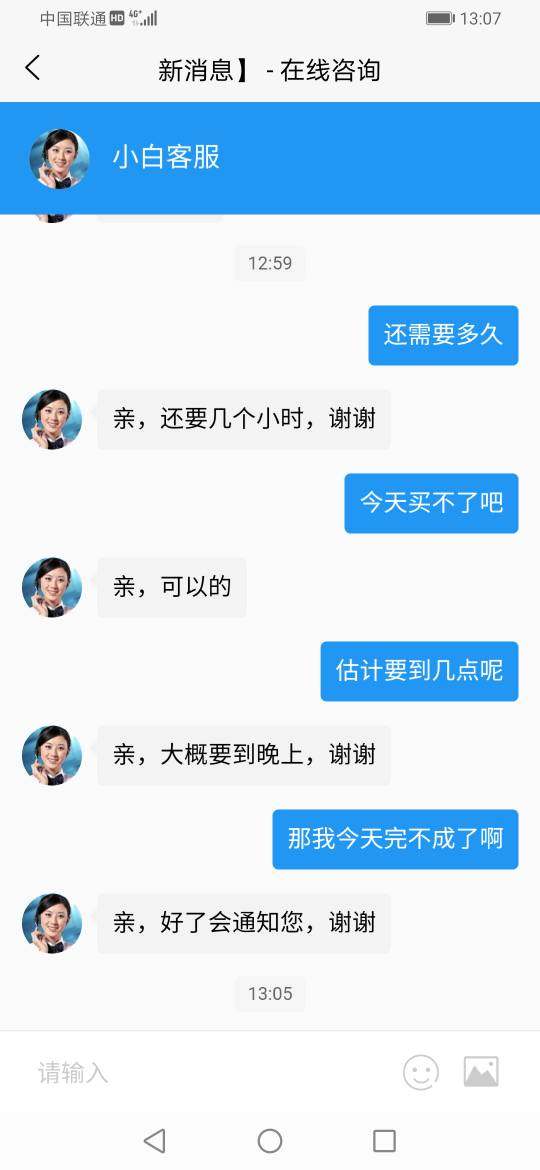

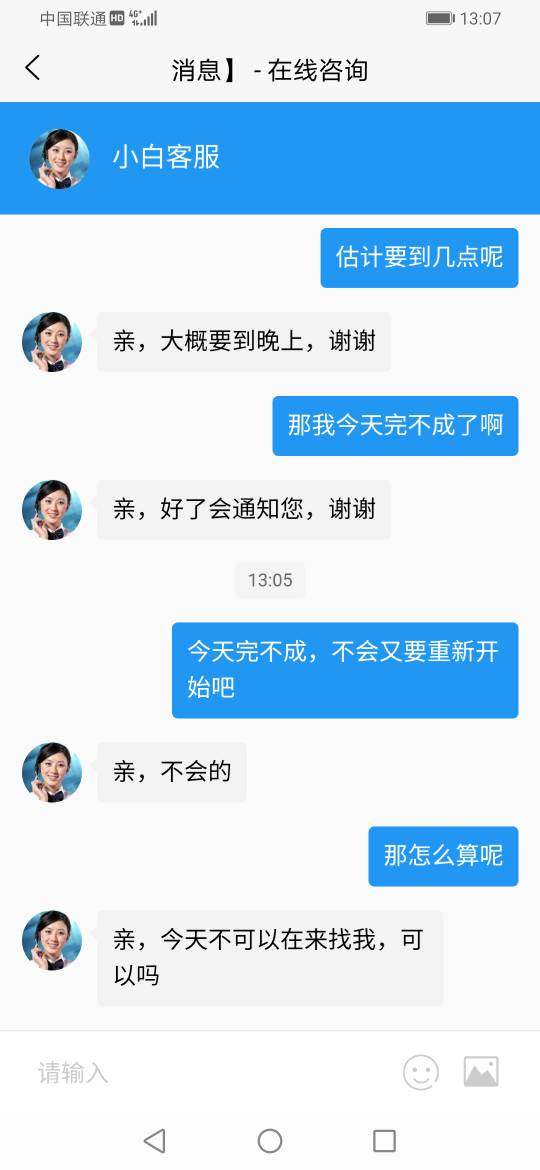

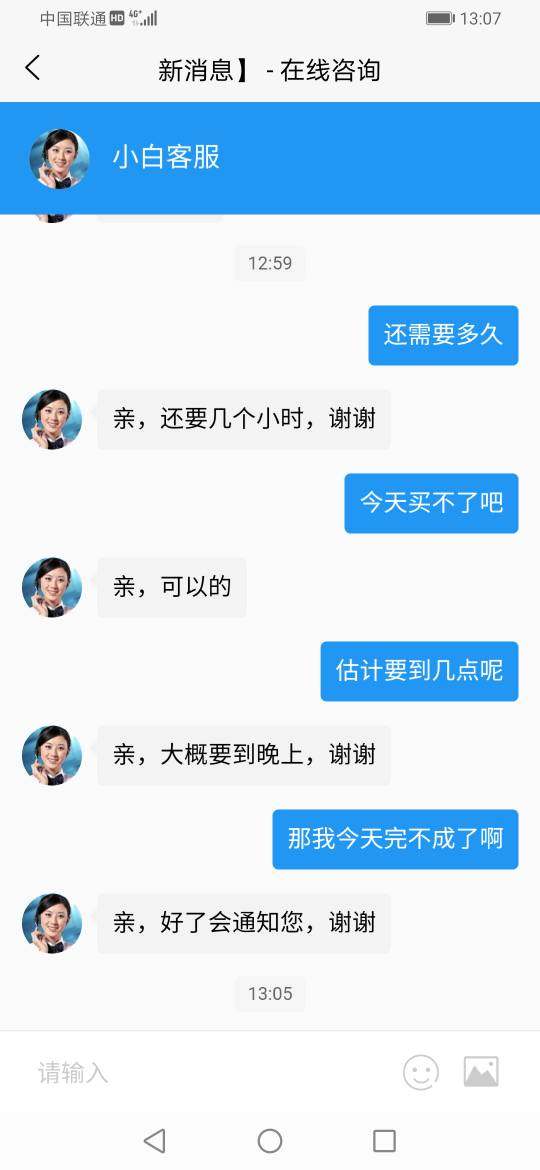

6.3 Customer Service and Support Analysis

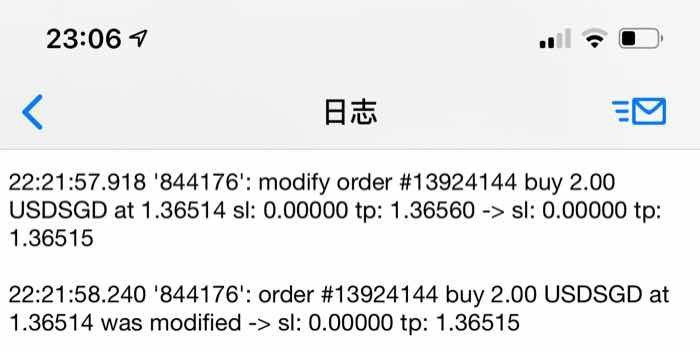

Customer support is a critical component for any broker, and here Rubix FX appears to fall short. User feedback and independent rubix fx review reports show that many traders have faced significant delays in receiving responses from the support team, and there are reports of unresolved issues, including difficulties in managing fund withdrawals and disputes about fund safety. The absence of detailed information about the specific customer support channels—whether live chat, phone, or email—adds to the uncertainty; potential clients are left without a clear understanding of the communication avenues available for problem resolution. Further adding to these concerns is the lack of clarity about support operating hours or the availability of multilingual support, which is often a key consideration for an international clientele, and given that timely and effective customer service is essential in a fast-paced trading environment, these deficiencies cast a shadow on Rubix FX's ability to serve its user base effectively. The reported slow response times and unresolved fund issues suggest that the broker's support infrastructure requires significant improvement to meet industry standards.

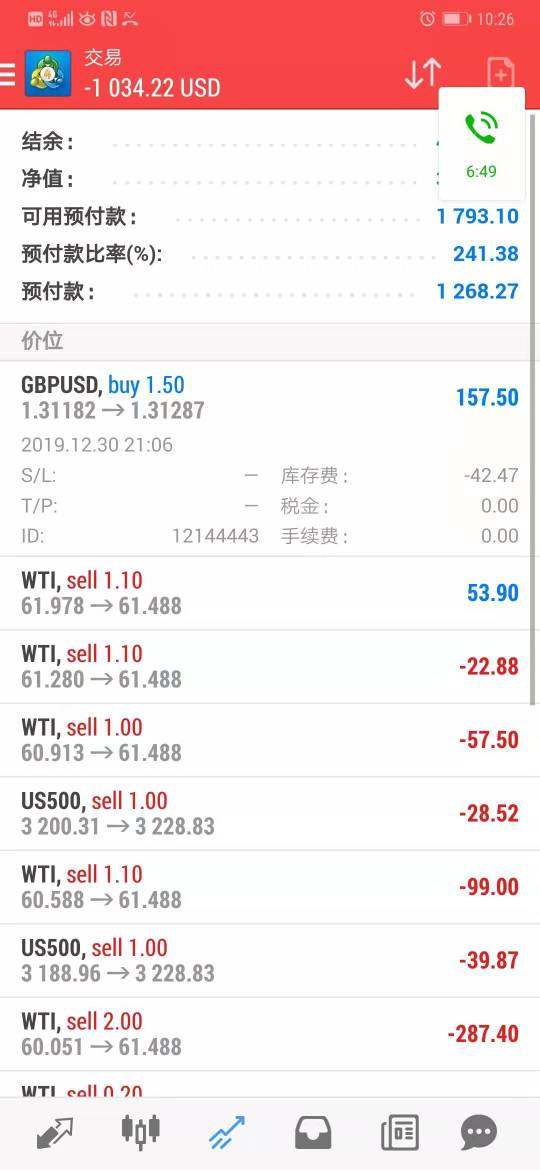

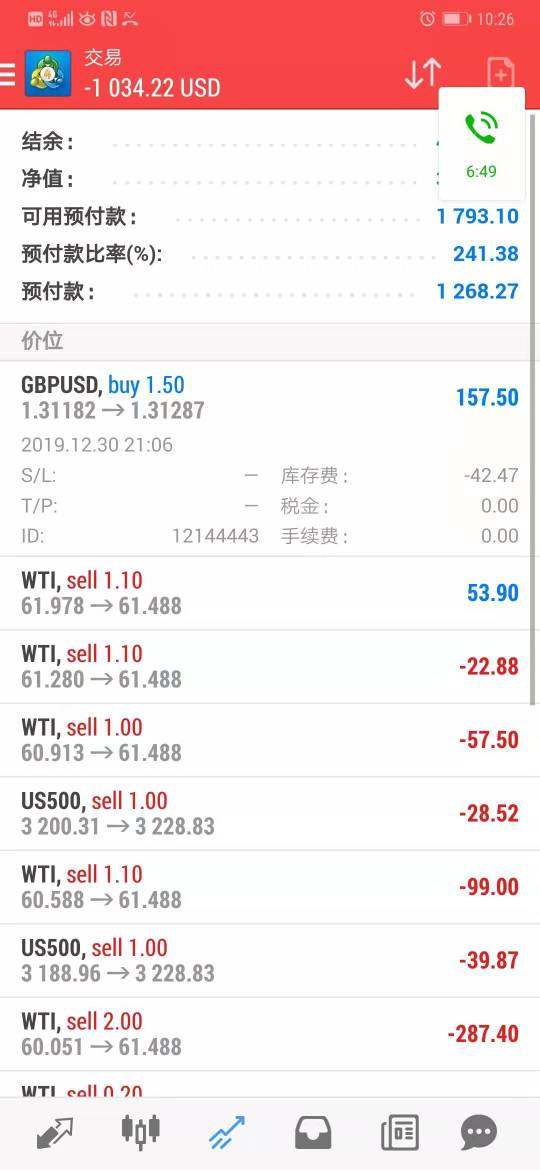

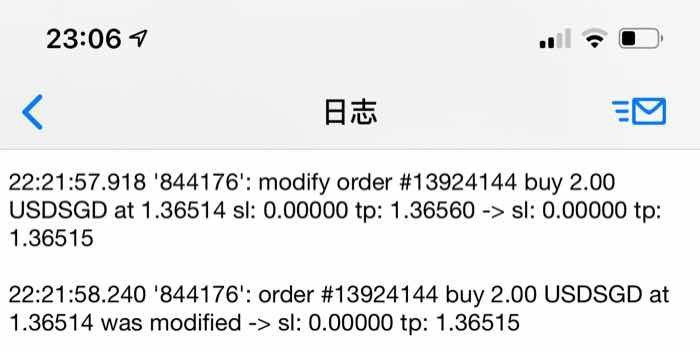

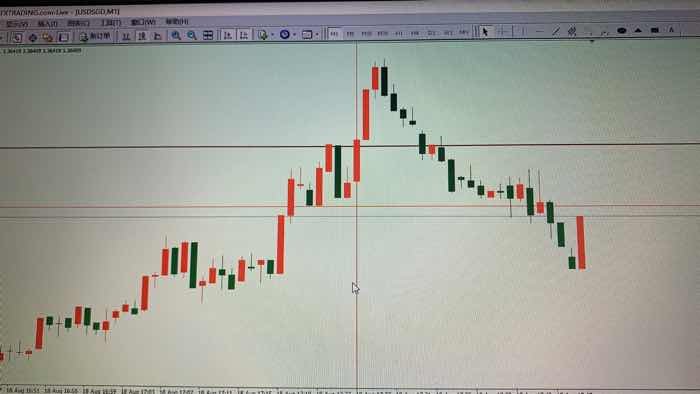

6.4 Trading Experience Analysis

Trading experience at Rubix FX, centered on the MetaTrader 4 platform, shows a mixture of strong technological capability and certain unaddressed concerns. MT4 is well-known for its reliability, familiarity among traders, and comprehensive range of technical analysis tools, but while the platform offers a solid foundation, users have not provided enough detail on issues such as platform stability during volatile market conditions, execution speed, or the frequency of slippage and re-quotes. Some traders have highlighted concerns about the overall quality of order execution, though specifics are sparse, and the absence of detailed feedback on the mobile trading experience means that we lack insight into how well the MT4 platform performs on portable devices—a significant factor in today's trading environment. Despite these gaps, the available data suggest that while Rubix FX's overall trading platform functions adequately, it leaves traders wanting more in terms of transparency about performance metrics and operational reliability during high-stress trading scenarios. This highlights the need for the broker to provide more detailed performance reporting and to address any technical shortcomings to enhance the overall trading experience.

6.5 Trust Analysis

Trust is the foundation of any successful broker relationship, and in the case of Rubix FX, several red flags have emerged. Although regulated by Gleneagle Securities Pty Limited, the broker's exclusion from any compensation system has led to recurring concerns among traders about the security of their funds, and this regulatory shortfall is a significant drawback, particularly when many leading brokers provide access to protective investor compensation schemes. There is also limited publicly available information about the broker's internal risk management practices or financial transparency, which further increases concerns. The presence of discussions online questioning whether Rubix FX might be involved in questionable practices—such as difficulties in fund retrieval—has worsened the perception of a riskier trading environment, and while the firm's longevity since 2014 offers some assurance, the ongoing issues highlighted by users, combined with inadequate transparency, suggest that trust remains a weak point for Rubix FX. In comparison with other brokers that maintain strict security measures and comprehensive investor protection mechanisms, Rubix FX shows a significant gap in this essential area.

6.6 User Experience Analysis

The user experience at Rubix FX appears to be poor when assessed through trader feedback and detailed rubix fx review reports. Overall user satisfaction is hurt by a combination of operational hurdles and perceived deficiencies in service quality, and many traders have voiced dissatisfaction with aspects such as deposit and withdrawal procedures—with numerous reports citing delays, unclear processes, and difficulties in fund recovery. The registration and account verification processes also remain unclear, contributing to a less-than-smooth onboarding experience. While the MetaTrader 4 interface is widely respected for its functionality, there is little evidence of improvements in areas such as modern user interface design or enhanced mobile functionalities that are now standard within the industry, and these cumulative issues have resulted in a mainly negative perception among users, particularly those who place a high value on operational efficiency and transparent client service. Users looking for an intuitive and reliably supportive trading environment might find these shortcomings particularly challenging, casting doubt on Rubix FX's overall commitment to delivering an excellent user experience.

7. Conclusion

In summary, Rubix FX offers a diverse selection of tradable instruments and high leverage options through the reputable MetaTrader 4 platform. However, significant concerns about regulatory limitations, specifically the lack of a compensation system, and numerous user reports on fund safety cannot be ignored, and this rubix fx review highlights that while the broker's high-risk, high-leverage trading opportunities may be attractive to experienced traders, those with a lower risk tolerance should consider alternative platforms. The advantages of multi-asset access and sophisticated trading tools are balanced by the critical shortcomings in customer support, account transparency, and overall trustworthiness. Prospective traders are strongly advised to conduct thorough independent research before proceeding.