Regarding the legitimacy of TurboForex forex brokers, it provides FSPR and WikiBit, .

Is TurboForex safe?

Business

License

Is TurboForex markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

TURBO TRADING LIMITED

Effective Date:

2013-12-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.turboforex.comExpiration Time:

2015-04-15Address of Licensed Institution:

C/- Acura AdMinisTraTion, Level 1, 1 Dickens STreeT,, Napier, 4140, New ZealandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is TurboForex Safe or a Scam?

Introduction

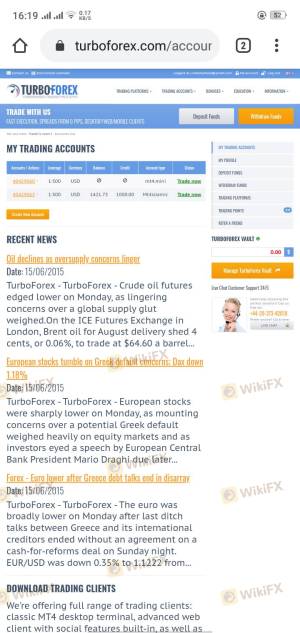

TurboForex is a forex broker that has positioned itself within the competitive landscape of online trading, offering services across various financial instruments, including currencies, commodities, and indices. Established in 2010 and operating under the name Turbo Trading Ltd., the broker primarily targets retail traders looking for a platform to engage in forex trading. However, the forex market is rife with risks, and choosing the right broker is critical for traders seeking to protect their investments. Is TurboForex safe? This question is paramount as traders must navigate a landscape that includes both reputable and potentially fraudulent brokers.

To address this concern, this article employs a comprehensive evaluation framework that examines TurboForexs regulatory status, company background, trading conditions, client safety measures, customer feedback, platform performance, and overall risk assessment. Through this structured analysis, we aim to provide a balanced view of whether TurboForex can be considered a safe trading environment or if it poses significant risks to its users.

Regulation and Legitimacy

The regulatory landscape for forex brokers is crucial in assessing their legitimacy and the safety of clients' funds. TurboForex claims to be registered with the Financial Service Providers Register (FSPR) in New Zealand. However, it is important to note that the credibility of this registration has been called into question.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 332266 | New Zealand | Revoked |

The FSPR has revoked TurboForex's license, which raises significant concerns about the broker's regulatory compliance and operational legitimacy. The lack of a valid regulatory framework means that TurboForex is not subject to the same rigorous oversight that regulated brokers must adhere to, increasing the risk for traders. Furthermore, several regulatory bodies, including Spain's National Securities Market Commission (CNMV), have issued warnings against TurboForex, stating that it is not authorized to provide investment services.

The absence of regulation from reputable entities such as the UK‘s FCA or Australia’s ASIC further underscores the potential risks associated with trading with TurboForex. As a general rule, unregulated brokers are often considered high-risk, and traders should exercise extreme caution when dealing with such entities. Is TurboForex safe? The evidence suggests that the broker's regulatory status is a significant red flag.

Company Background Investigation

TurboForex was established in 2010 and is operated by Turbo Trading Ltd., a company whose ownership and management structure raise further concerns. The broker claims to have a presence in New Zealand; however, the transparency regarding its actual operations and ownership is limited.

The management teams backgrounds are not readily available, which is a common issue among brokers that lack proper regulation. Transparency in ownership and management is a crucial factor for traders, as it allows them to assess the experience and credibility of those handling their funds. The lack of information regarding the team behind TurboForex leads to questions about their expertise and accountability.

Moreover, the company's communication channels, while available, do not provide sufficient insights into its operations or customer service quality. This lack of transparency can be a significant deterrent for potential clients. In evaluating Is TurboForex safe, the limited disclosure of vital company information is a concerning aspect that traders should consider.

Trading Conditions Analysis

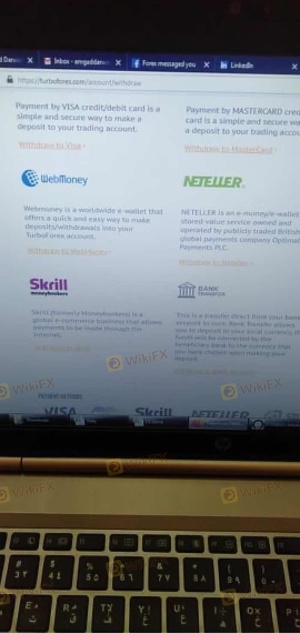

When considering a forex broker, the trading conditions, including fees and spreads, play a vital role in the overall trading experience. TurboForex offers several account types, with a minimum deposit requirement of $250, which is relatively accessible for new traders. However, the overall cost structure is a critical factor in determining whether trading with TurboForex is financially viable.

| Fee Type | TurboForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 - 3.0 pips | 0.5 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by TurboForex range from 1.0 to 3.0 pips, which is significantly higher than the industry average. This could indicate that trading costs may be less favorable for traders compared to other brokers. Additionally, the absence of a clear commission structure raises questions about potential hidden fees, which could further impact profitability.

While TurboForex markets itself as providing competitive trading conditions, the reality may be less favorable, especially for high-frequency traders or those relying on tight spreads. Therefore, when evaluating Is TurboForex safe, traders should consider the potential impact of these trading conditions on their overall trading strategy and profitability.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. TurboForex claims to implement measures for the protection of client funds, including segregated accounts and investor protection schemes. However, given the revoked regulatory status, the effectiveness of these measures is questionable.

The broker does not provide clear information about negative balance protection, which is a critical feature for safeguarding traders from losing more than their initial investment. Moreover, historical issues regarding fund withdrawals and complaints from users raise further concerns about the actual safety of funds held with TurboForex.

In light of these factors, it is prudent for traders to question Is TurboForex safe regarding the security of their investments. The lack of robust regulatory oversight and the ambiguous nature of the brokers fund protection measures create a precarious situation for potential clients.

Customer Experience and Complaints

User feedback is an essential component in assessing a brokers reliability. Reviews and complaints about TurboForex reveal a pattern of dissatisfaction among traders, particularly regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow or Unresponsive |

| Poor Customer Support | Medium | Inconsistent |

Common complaints include difficulties in withdrawing funds, with reports of delays and outright refusals to process withdrawal requests. Additionally, customer service has been criticized for being slow to respond or failing to provide adequate support.

One notable case involved a trader who deposited $2,000 and faced significant challenges when attempting to withdraw funds, leading to frustration and loss of trust in the broker. Such experiences highlight the potential risks associated with trading through TurboForex and raise the question of Is TurboForex safe for traders looking to secure their investments.

Platform and Execution

The performance of a trading platform is crucial for successful trading. TurboForex utilizes the widely used MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust analytical tools. However, user experiences suggest that the platform may suffer from stability issues, including connectivity problems and execution delays.

Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes, especially in volatile market conditions. The reliability of the platform is a critical factor in evaluating Is TurboForex safe, as technical issues can lead to substantial financial losses.

Risk Assessment

Considering the various aspects of TurboForex, a comprehensive risk assessment is warranted.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation |

| Fund Safety | High | Unclear protection measures |

| Customer Service | Medium | Frequent complaints |

| Trading Conditions | Medium | Higher than average costs |

The overall risk profile for trading with TurboForex leans towards the high side, primarily due to regulatory concerns and the lack of transparency regarding fund safety. Potential traders should approach this broker with caution and consider alternative options that offer better security and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that TurboForex may not be a safe choice for traders. The revoked regulatory status, coupled with numerous customer complaints regarding fund withdrawals and service quality, raises significant red flags. Is TurboForex safe? The answer appears to be no, as the broker's operational practices and customer feedback indicate a high level of risk.

For traders seeking a reliable and secure trading environment, it is advisable to consider well-regulated alternatives such as brokers licensed by the FCA or ASIC. These brokers typically offer greater transparency, better customer support, and more robust fund protection measures. Ultimately, traders should conduct thorough research and exercise caution when choosing a broker, particularly one like TurboForex that has multiple warning signs.

Is TurboForex a scam, or is it legit?

The latest exposure and evaluation content of TurboForex brokers.

TurboForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TurboForex latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.