Regarding the legitimacy of MINSHENG FUTURES forex brokers, it provides CFFEX and WikiBit, .

Is MINSHENG FUTURES safe?

Risk Control

Software Index

Is MINSHENG FUTURES markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

民生期货有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Minsheng Futures Safe or Scam?

Introduction

Minsheng Futures, a prominent player in the forex and futures trading market, has garnered attention for its comprehensive trading services and educational resources. Established in 1996 and headquartered in Beijing, China, Minsheng Futures operates under the regulatory oversight of the China Financial Futures Exchange (CFFEX). As the forex market continues to attract traders from all backgrounds, it is crucial for potential investors to carefully evaluate the reliability and safety of their chosen brokers. The vast landscape of online trading is fraught with risks, including scams and fraudulent practices, making it essential for traders to conduct thorough due diligence before entrusting their funds. This article aims to provide an objective analysis of Minsheng Futures, assessing its safety, legitimacy, and overall trading conditions based on a comprehensive review of available information and user feedback.

Regulation and Legitimacy

A key factor in determining whether Minsheng Futures is safe lies in its regulatory framework. The company is regulated by the China Financial Futures Exchange (CFFEX), which enforces strict compliance standards to ensure fair trading practices and protect investors' interests. Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| China Financial Futures Exchange (CFFEX) | N/A | China | Verified |

CFFEX is known for its rigorous oversight of financial instruments traded within its jurisdiction, which includes futures and derivatives. The quality of regulation is paramount in safeguarding client funds and ensuring operational transparency. Minsheng Futures has maintained compliance with CFFEX regulations, which include client protection measures such as anti-money laundering (AML) policies and Know Your Customer (KYC) requirements. This regulatory environment fosters a sense of security, suggesting that Minsheng Futures is safe for traders. However, it is important to note that regulatory standards can vary significantly across different jurisdictions, and potential investors should remain vigilant.

Company Background Investigation

Minsheng Futures has a rich history dating back to its establishment in 1996, positioning itself as a reputable trading platform in China. The company's ownership structure is primarily private, and it has evolved over the years to adapt to the changing dynamics of the financial markets. The management team comprises seasoned professionals with extensive experience in finance and trading, contributing to the firm's credibility and operational efficacy.

Transparency is another critical aspect of Minsheng Futures' operations. The company provides comprehensive information about its services, trading conditions, and educational resources on its website. This level of disclosure is essential for building trust with clients, as it allows them to make informed decisions regarding their investments. Overall, the company's historical performance and commitment to transparency indicate that Minsheng Futures is safe for traders seeking a reliable broker.

Trading Conditions Analysis

When assessing whether Minsheng Futures is safe, it is essential to analyze its trading conditions and fee structure. The broker offers a variety of account types, including standard, ECN, and Islamic accounts, catering to different trading preferences and strategies. The overall fee structure is competitive, with spreads starting at 0.10 points for equity futures and no commission on standard accounts. However, ECN accounts may incur commissions, which could be a consideration for high-frequency traders.

The following table summarizes key trading costs associated with Minsheng Futures:

| Fee Type | Minsheng Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.10 points | 0.20 points |

| Commission Model | None for Standard, Commission for ECN | Varies widely |

| Overnight Interest Range | Varies | Varies widely |

While the trading costs appear favorable compared to industry averages, potential clients should be cautious of any hidden fees or charges that may arise, particularly during volatile market conditions. A thorough understanding of the fee structure is crucial for evaluating whether Minsheng Futures is safe for long-term trading.

Client Funds Safety

The safety of client funds is a significant concern for traders, and Minsheng Futures implements several measures to safeguard investor assets. The broker adheres to strict regulations regarding fund segregation, ensuring that client funds are held separately from the company's operational accounts. This practice is essential for protecting clients in the event of financial difficulties faced by the broker.

Additionally, Minsheng Futures has policies in place for negative balance protection, which prevents clients from losing more than their invested capital. This feature is particularly beneficial for traders utilizing leverage, as it mitigates the risk of substantial losses. Despite these protective measures, it is crucial to remain aware of any historical issues related to fund security or disputes. Current assessments indicate that Minsheng Futures is safe, but potential clients should continuously monitor for updates regarding the broker's financial practices.

Client Experience and Complaints

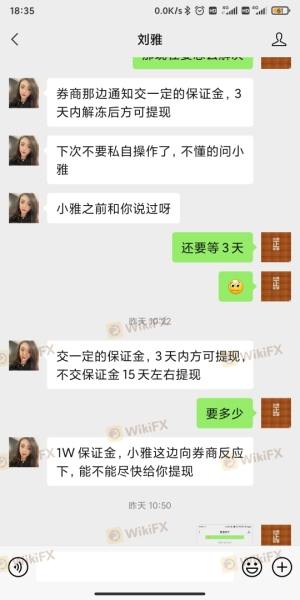

Analyzing customer feedback is vital in determining whether Minsheng Futures is safe. Overall, user reviews indicate a mixed experience, with many traders praising the broker's customer support and educational resources. However, there have been reports of withdrawal issues, with some clients experiencing delays or restrictions on their accounts.

The following table highlights the primary complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Varied |

| Account Restrictions | Medium | Generally responsive |

| Customer Support Issues | Low | Generally positive |

Typical cases involve clients who have faced challenges when attempting to withdraw funds, leading to frustration and concerns about the broker's reliability. While Minsheng Futures has generally responded to inquiries, the effectiveness of their solutions may vary. This inconsistency raises questions about the overall client experience, suggesting that potential traders should proceed with caution.

Platform and Execution

The trading platform offered by Minsheng Futures is a critical component of the overall trading experience. The broker provides access to popular trading platforms, including MetaTrader 4 and 5, which are known for their user-friendly interfaces and robust analytical tools. Traders have reported satisfactory performance regarding platform stability and execution speed, although some have noted instances of slippage during high volatility periods.

Concerns about potential platform manipulation have been raised, particularly in relation to order execution quality. Traders should remain vigilant and conduct thorough testing of the platform to ensure that their trading experience aligns with their expectations. Overall, the platform appears to be reliable, contributing to the assessment that Minsheng Futures is safe for traders who prioritize execution quality.

Risk Assessment

Evaluating the risks associated with trading through Minsheng Futures is essential for making informed decisions. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Low | Strong regulatory oversight |

| Fund Security | Medium | Adequate measures but historical issues |

| Trading Costs | Medium | Competitive but potential hidden fees |

| Customer Support | Medium | Mixed feedback on responsiveness |

To mitigate these risks, potential clients should consider several recommendations. First, they should thoroughly review the broker's terms and conditions, focusing on fee structures and withdrawal policies. Second, utilizing demo accounts can help traders familiarize themselves with the platform and its functionalities before committing real funds. Finally, remaining informed about regulatory updates and market conditions will further enhance trading safety.

Conclusion and Recommendations

In conclusion, the evidence suggests that Minsheng Futures is safe for traders, particularly due to its regulatory oversight by CFFEX and its commitment to client fund security. However, potential clients should remain vigilant about the mixed customer feedback, particularly concerning withdrawal issues. Traders are advised to conduct thorough research and consider their individual trading needs before opening an account.

For those seeking alternatives, brokers with strong regulatory frameworks and positive customer reviews, such as IG Group or OANDA, may provide additional options worth exploring. Ultimately, the decision to trade with Minsheng Futures should be based on a careful consideration of the risks and benefits associated with their services.

Is MINSHENG FUTURES a scam, or is it legit?

The latest exposure and evaluation content of MINSHENG FUTURES brokers.

MINSHENG FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MINSHENG FUTURES latest industry rating score is 7.81, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.81 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.