RockGlobal 2025 Review: Everything You Need to Know

Executive Summary

This rockglobal review gives you a complete look at RockGlobal (once called Rockfort Markets). This forex broker from New Zealand has faced serious regulatory problems that should worry any trader thinking about using their services.

RockGlobal lets you trade many different types of assets. You can trade over 140 currency pairs, precious metals, commodities, indices, and cryptocurrency CFDs. The broker only requires a $50 minimum deposit, which makes it easy for new traders to start. But our research shows major regulatory problems, including the loss of their license from the New Zealand Financial Markets Authority (FMA).

Many sources show that RockGlobal has received lots of negative reviews and fraud complaints. This has seriously hurt their reputation in the forex trading world. The broker seems to target traders who don't mind taking big risks, especially those who want to trade many different assets even when regulations are unclear.

Evidence from trading review sites and regulatory databases shows this broker has serious risks. These risks are much bigger than any small benefits they might offer, making them a poor choice for most retail traders who want reliable trading conditions.

Important Disclaimers

Regional Entity Differences: RockGlobal lost their license, so your rights and protections change a lot depending on where you live. You should be very careful and check their current regulatory status before you start trading with them. Without proper regulatory oversight, you won't have the standard protections that investors usually get.

Review Methodology: We based this review on public information, user feedback from many review sites, regulatory filings, and market data from 2025. The broker doesn't share much information themselves, so we had to rely on third-party sources and what users reported about their experiences.

Rating Framework

Broker Overview

RockGlobal started in 2018 as an online forex broker in New Zealand, originally called Rockfort Markets. The company wanted to provide forex and CFD trading services to regular traders who needed access to global financial markets. They changed their name from Rockfort Markets to RockGlobal, but regulatory problems have overshadowed this change.

The company focuses on providing internet-based trading services for forex and other financial tools. RockGlobal works mainly as a market maker, offering trading services across many asset types while dealing directly with individual retail clients. However, their ability to operate has become questionable because New Zealand authorities took regulatory action against them.

RockGlobal says they offer access to over 140 currency pairs plus trading in precious metals, commodities, major global indices, and cryptocurrency CFDs. The broker claims to serve clients around the world, though it's unclear where they can actually operate given their regulatory problems.

Their trading system reportedly supports both standard and ECN account types. However, detailed information about platform features, how they execute trades, and where they get their liquidity is hard to find in public documents. The New Zealand Financial Markets Authority (FMA) used to regulate the broker, but they ended this relationship by revoking the license.

Regulatory Jurisdiction: The New Zealand Financial Markets Authority (FMA) used to regulate RockGlobal, but reports show they revoked this license. This is a major concern for potential clients because the broker now operates without proper regulatory oversight, which greatly increases risks for traders.

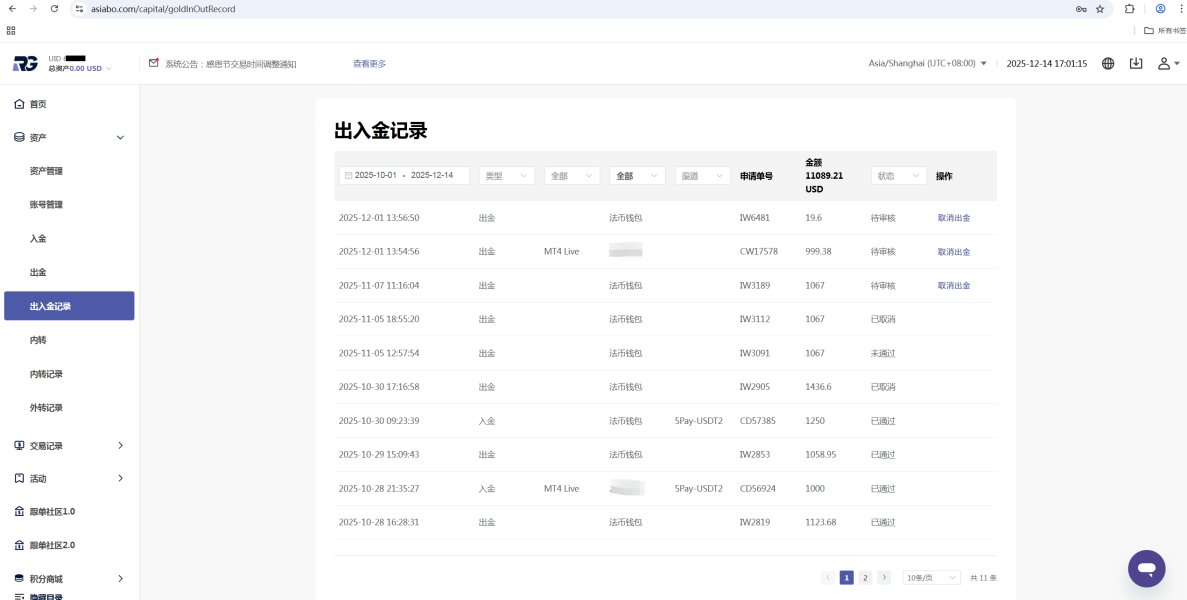

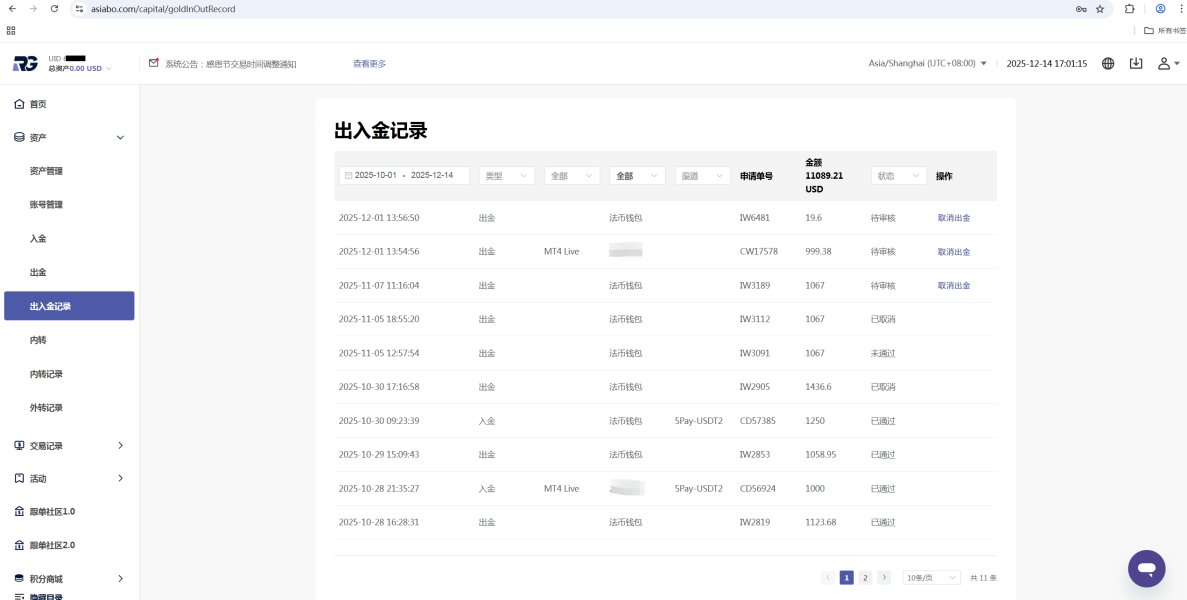

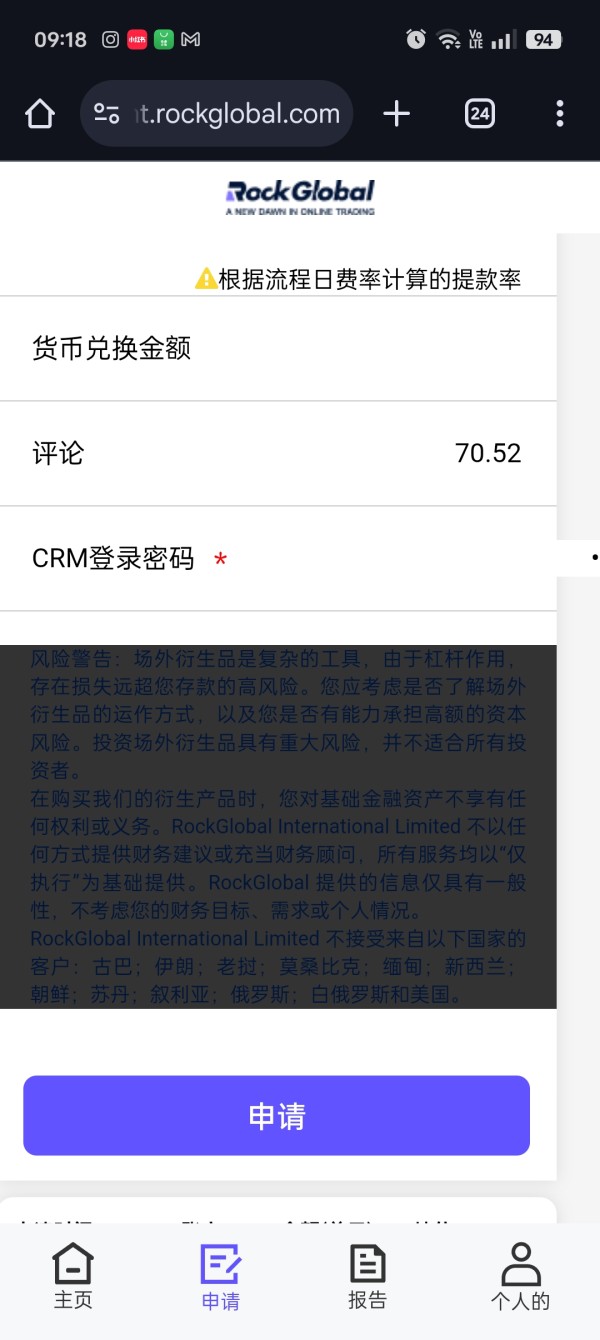

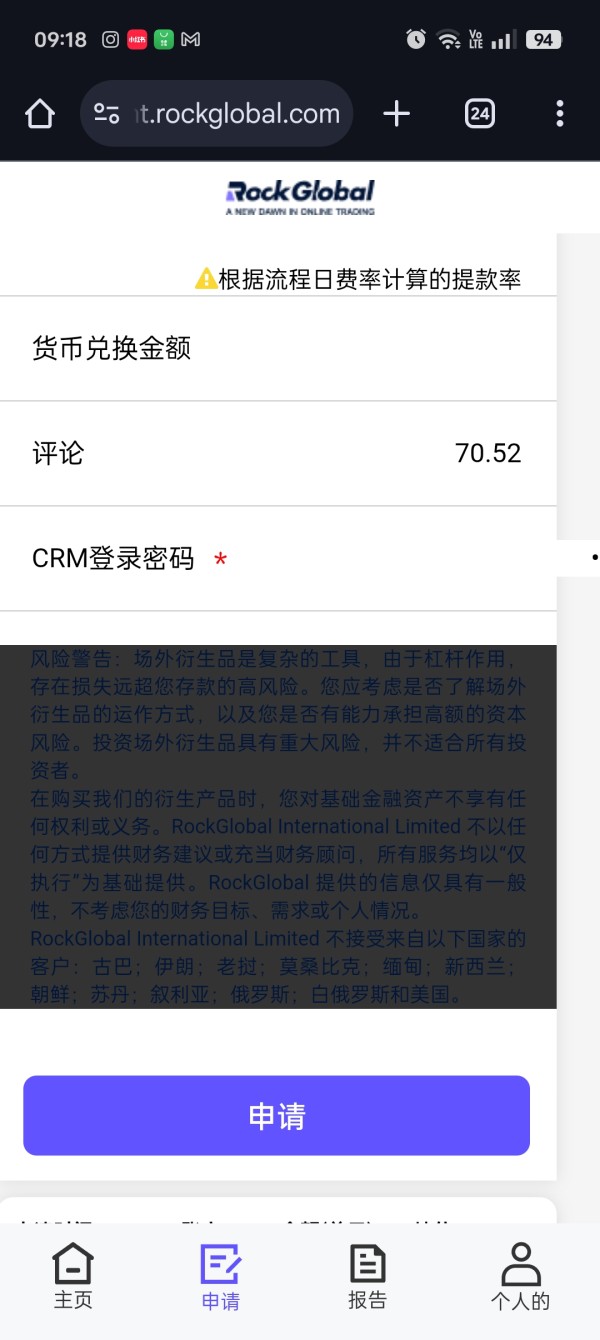

Deposit and Withdrawal Methods: We couldn't find specific information about what deposit and withdrawal methods they accept. This lack of transparency about payment processing is another warning sign for potential clients who need reliable funding options.

Minimum Deposit Requirements: The broker requires a minimum deposit of $50, which is pretty low compared to industry standards. This makes the platform accessible to new traders who don't have much money to start with.

Promotional Offers: Current information doesn't mention any bonus programs or special offers for new or existing clients. The lack of detailed promotional information might mean they have limited marketing activities or operational problems.

Available Trading Assets: RockGlobal gives you access to many different tradeable instruments, including over 140 forex currency pairs, precious metals (gold, silver), various commodities, major global stock indices, and cryptocurrency CFDs. This variety of assets is one of the few good things about what the broker offers.

Cost Structure: Available information shows EUR/USD spreads starting from 0 pips. However, they don't clearly explain their commission structures, overnight financing rates, and additional fees in public documents. This lack of fee transparency makes you worry about hidden costs.

Leverage Ratios: The sources we reviewed don't mention specific leverage information. This is concerning because leverage details are crucial for managing risk and checking regulatory compliance.

Trading Platform Options: The review sources don't give specific information about which trading platforms RockGlobal offers. This represents a big information gap for potential clients who want to evaluate execution capabilities.

Geographic Restrictions: Available documentation doesn't specify current geographical limitations and restricted territories. However, regulatory issues may affect service availability in various places around the world.

Customer Support Languages: We couldn't find information about what languages customer service supports in the reviewed sources. This shows limited transparency about support capabilities.

This rockglobal review shows major information gaps that potential clients should see as warning signs when evaluating this broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

RockGlobal's account conditions show a mixed picture with concerning problems that seriously hurt the overall trading experience. The broker offers both standard and ECN account types, though the differences between these account levels aren't clear in available documents.

The $50 minimum deposit requirement is one of the few competitive things about RockGlobal's offering. This makes the platform accessible to traders who don't have much money to start with. However, user feedback consistently shows dissatisfaction with overall account conditions, suggesting that the low entry barrier might be offset by poor service quality and bad trading terms.

They don't clearly document account opening procedures and verification processes in available sources. This creates uncertainty about onboarding requirements and how long you should expect things to take. This lack of transparency also applies to account maintenance fees, inactivity charges, and other potential costs that could affect account holders.

User reports suggest problems with account management, including issues with account changes, currency switches, and access to account features. The lack of detailed information about special account features, such as Islamic accounts, managed accounts, or institutional services, further reduces appeal for different types of traders.

The poor rating for account conditions reflects both the lack of transparency in available information and negative user experiences reported across multiple review platforms. According to various sources, clients have expressed frustration with account-related policies and procedures, which contributes to the overall negative assessment in this rockglobal review.

Our evaluation of RockGlobal's tools and resources shows significant problems that hurt the broker's ability to compete in today's forex trading world. Available information doesn't specify the trading tools, technical analysis features, or research resources they provide to clients, which is a major concern for traders who need comprehensive market analysis capabilities.

They don't mention educational resources in available documentation, which are essential for helping traders improve and for making a platform stand out. The absence of webinars, tutorials, market commentary, or educational materials suggests limited commitment to client development and support, which is especially concerning for new traders who rely on broker-provided education.

Research and analysis resources, including economic calendars, market news feeds, fundamental analysis reports, and technical analysis tools, aren't detailed in public information. This lack of analytical support significantly hurts traders' ability to make informed decisions and develop effective trading strategies.

Available sources don't specify automated trading support, including Expert Advisor (EA) compatibility, algorithmic trading features, and API access. Modern traders increasingly rely on automated solutions, and the lack of clear information about these capabilities puts them at a competitive disadvantage.

User feedback about tools and resources has been generally negative. Traders have expressed dissatisfaction with the limited analytical and educational support the platform provides. The mediocre rating reflects both the apparent lack of comprehensive tools and the negative user experiences reported across various review platforms.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of RockGlobal's biggest weaknesses, with widespread user complaints about support quality, responsiveness, and effectiveness. Available information doesn't specify what customer service channels they offer, such as live chat, phone support, email assistance, or help desk ticketing systems.

Response times seem to be a major problem based on user feedback. Multiple reports indicate slow or inadequate responses to client questions. This is especially problematic in forex trading, where timely support can be crucial for resolving urgent trading issues or technical problems that could affect your money.

Users have extensively criticized service quality, with reports of unhelpful responses, lack of expertise among support staff, and failure to solve client issues effectively. These service quality problems have contributed to the overall negative perception of the broker and have been mentioned in numerous negative reviews.

Available documentation doesn't specify multilingual support capabilities. This could limit accessibility for international clients who need help in languages other than English. The lack of clear information about support hours and availability also raises concerns about accessibility during different trading sessions.

Problem resolution effectiveness seems to be particularly poor based on user reports. Many clients have expressed frustration about unresolved issues and inadequate follow-up from support teams. The poor rating reflects the consistent pattern of negative customer service experiences that users have reported across multiple review platforms.

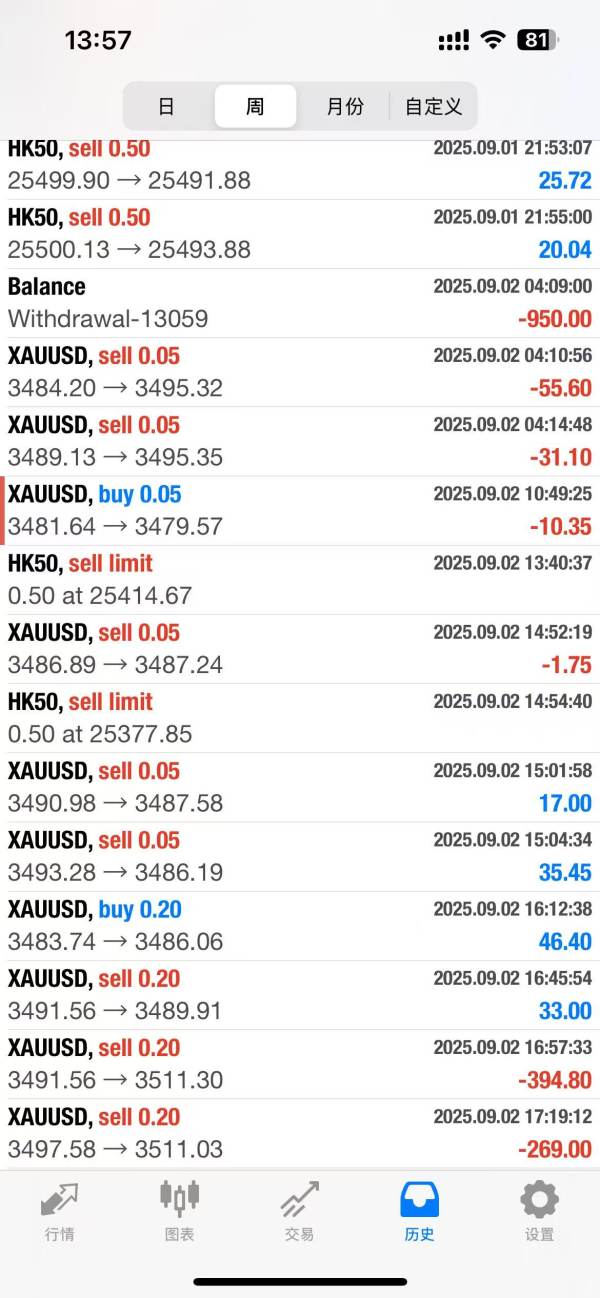

Trading Experience Analysis (Score: 4/10)

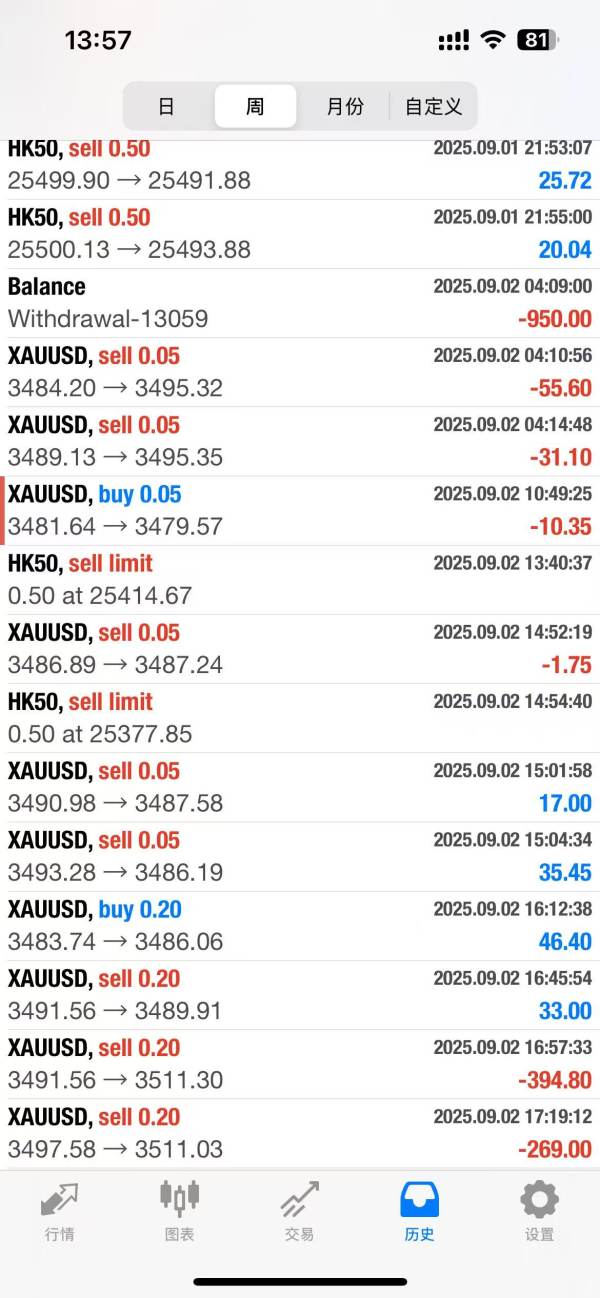

The trading experience that RockGlobal offers seems to be significantly hurt by various technical and operational problems that affect order execution quality and overall platform performance. Available information doesn't provide specific details about platform stability, execution speeds, or system reliability, which are crucial factors for effective forex trading.

User feedback has questioned order execution quality, with reports suggesting concerns about fill rates, slippage, and execution delays that could negatively affect trading results. These execution issues are particularly concerning for scalpers and day traders who rely on precise order handling for their strategies.

We can't adequately assess platform functionality completeness because there's limited information about the specific trading platforms RockGlobal offers. The absence of detailed platform specifications makes it difficult for potential clients to evaluate whether the available tools meet their trading requirements.

Reviewed sources don't have mobile trading experience details available. This is concerning given how important mobile access is in modern forex trading. Traders increasingly need reliable mobile platforms for managing positions and monitoring markets when they're away from their main trading setups.

The trading environment seems to be problematic based on user feedback. There are concerns about spread stability, liquidity provision, and overall market conditions. Users have expressed dissatisfaction with trading conditions, which contributes to the poor overall assessment of the trading experience in this rockglobal review.

Trust and Reliability Analysis (Score: 2/10)

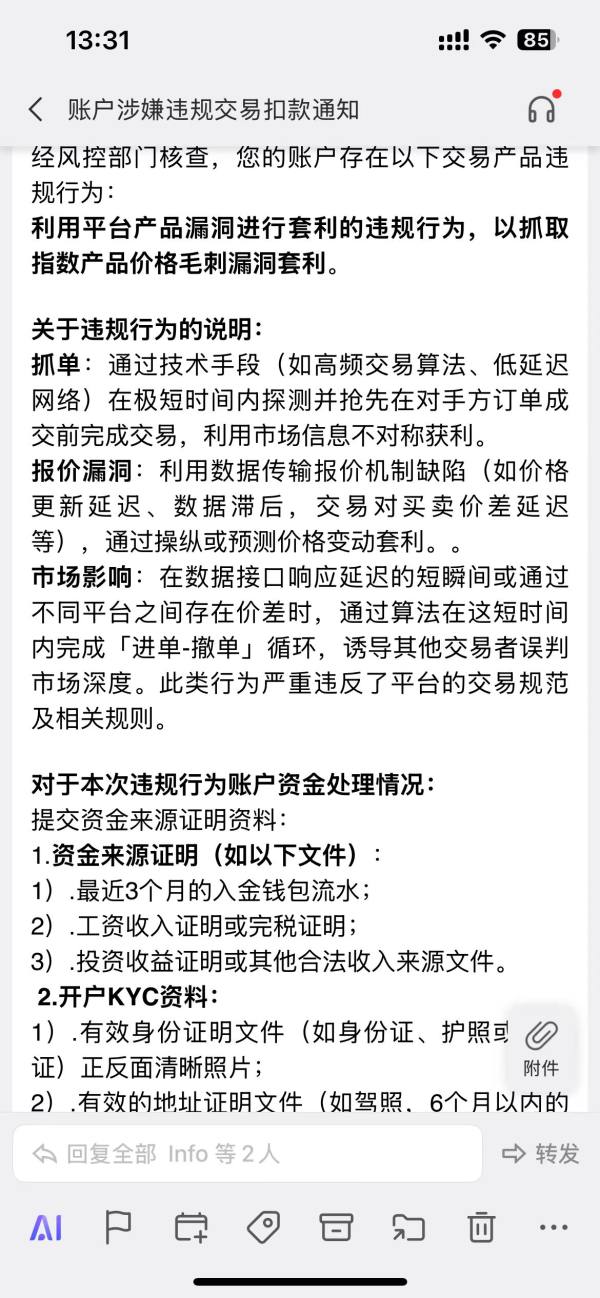

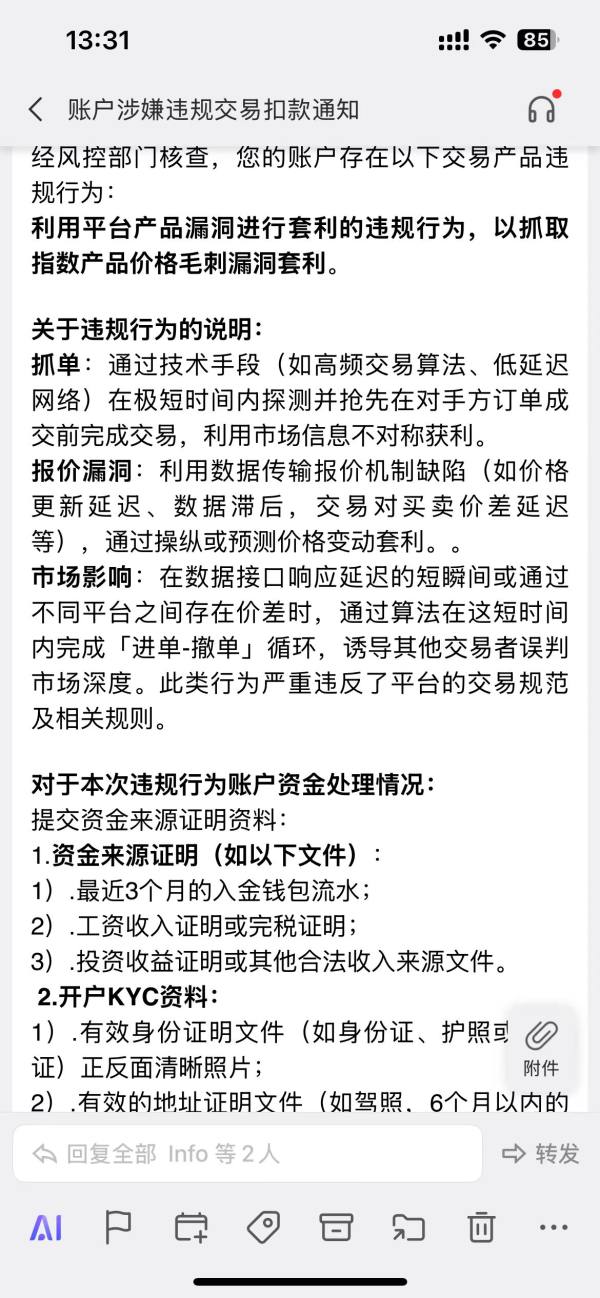

Trust and reliability represent RockGlobal's most significant weaknesses, with serious regulatory issues that fundamentally hurt the broker's credibility. The New Zealand Financial Markets Authority (FMA) revoked the broker's license, which represents a critical red flag that should concern any potential client considering this broker.

Regulatory compliance failures have resulted in the loss of official oversight. This means that clients no longer benefit from the protections typically associated with regulated forex brokers. This regulatory breakdown significantly increases the risks of trading through this platform and eliminates standard ways to resolve disputes.

Available documentation doesn't clearly specify fund safety measures, and the lack of regulatory oversight means that client fund protection schemes may not apply. This represents a fundamental risk to trader capital, as unregulated brokers may not maintain segregated client accounts or adequate capital reserves.

Company transparency is notably poor, with limited information available about management structure, financial reporting, ownership details, or operational procedures. This lack of transparency doesn't match industry standards and raises questions about the broker's commitment to accountability.

Multiple fraud complaints and negative user experiences reported across various review platforms have severely damaged their industry reputation. The broker has received warnings from the FMA, and the subsequent license revocation has further damaged its standing in the forex trading community. These factors combine to create a very poor trust rating that should serve as a warning to potential clients.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with RockGlobal is notably poor, with negative reviews significantly outnumbering positive feedback across multiple review platforms. The predominance of negative user experiences suggests systematic issues with the broker's service delivery and operational capabilities.

Reviewed sources don't have interface design and usability information available. This makes it impossible to assess the quality of the user interface or how easy it is to navigate for different types of traders. This lack of information itself represents a concern about the broker's transparency and marketing approach.

Available documentation doesn't detail registration and verification processes. This creates uncertainty about account opening requirements, what documentation you need, and timeline expectations for new clients. Clear onboarding processes are essential for positive user experiences, and the lack of information in this area is concerning.

Funding and withdrawal experiences aren't specifically documented, though user complaints suggest potential issues with money management processes. Efficient and reliable deposit and withdrawal procedures are crucial for user satisfaction, and any problems in this area significantly impact overall user experience.

Common user complaints focus on customer service quality, trading conditions, and resolution of account-related issues. The pattern of negative feedback suggests that users frequently encounter problems that the broker's support systems don't adequately address.

User demographic analysis suggests that only traders with very high risk tolerance might consider using this broker. Even then, the risks may outweigh any potential benefits. The poor user experience rating reflects the consistent pattern of negative feedback and the absence of positive testimonials that would indicate satisfied clients.

Conclusion

This comprehensive rockglobal review reveals significant concerns that make RockGlobal unsuitable for most forex traders. The broker's overall poor performance across all evaluation criteria, particularly the critical regulatory issues and widespread user complaints, present risks that far outweigh any potential benefits.

The New Zealand FMA revoked their regulatory licensing, which represents a fundamental red flag that eliminates standard investor protections and oversight mechanisms. Combined with numerous fraud complaints and consistently negative user feedback, these factors create an environment of significant risk for potential clients.

The low minimum deposit requirement of $50 and diverse asset selection might initially seem attractive. However, these limited advantages are overshadowed by poor customer service, questionable trading conditions, and the absence of regulatory protection. We strongly advise traders to consider well-regulated alternatives that offer better security, transparency, and service quality for their forex trading activities.