Regarding the legitimacy of RockGlobal forex brokers, it provides FMA, ASIC and WikiBit, (also has a graphic survey regarding security).

Is RockGlobal safe?

Software Index

Risk Control

Is RockGlobal markets regulated?

The regulatory license is the strongest proof.

FMA Inst Market Making (MM)

Financial Markets Authority

Financial Markets Authority

Current Status:

RegulatedLicense Type:

Inst Market Making (MM)

Licensed Entity:

ROCKFORT MARKETS LIMITED

Effective Date:

2016-07-16Email Address of Licensed Institution:

accounts@rockfortmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 17, 55 Shortland Street, Auckland Central, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

022 569 6789Licensed Institution Certified Documents:

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

ROCKGLOBAL CAPITAL MARKETS PTY LTD

Effective Date: Change Record

2005-02-18Email Address of Licensed Institution:

diana.medina68@hotmail.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.rockglobal.com.au/Expiration Time:

--Address of Licensed Institution:

C W SPITTAL & ASSOCIATES PTY LTD U 902 9 YARRA ST SOUTH YARRA VIC 3141Phone Number of Licensed Institution:

0414665380Licensed Institution Certified Documents:

Is RockGlobal A Scam?

Introduction

RockGlobal is a forex broker that has positioned itself in the online trading market, offering a variety of financial instruments, including forex, commodities, and indices. Established in New Zealand, RockGlobal claims to provide competitive trading conditions and a user-friendly platform. However, the forex market is notorious for its risks, and traders must exercise caution when selecting a broker. With numerous reports of scams and fraudulent activities in the industry, it is crucial for traders to thoroughly evaluate the credibility and reliability of any brokerage firm before committing their funds. This article will investigate RockGlobal's regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks to determine whether it operates as a legitimate broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical aspect that influences its legitimacy. RockGlobal is regulated by the Financial Markets Authority (FMA) of New Zealand, which is a reputable regulatory body in the financial sector. Regulation is vital as it provides a framework for ensuring that brokers adhere to specific standards, protecting traders from fraud and malpractice.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FMA | FSP 509766 | New Zealand | Verified |

The FMA is responsible for overseeing financial market participants, ensuring that they comply with laws and regulations designed to maintain the integrity of the financial system. RockGlobal's regulatory history shows that it has faced scrutiny, particularly regarding its marketing practices, which have been flagged for misleading claims. Despite these issues, the presence of regulation suggests a certain level of oversight, which is generally a positive indicator for potential investors.

However, the quality of regulation is also essential. The FMA has a robust reputation, but the fact that RockGlobal has been subject to warnings raises concerns about its compliance with regulatory standards. Traders should consider these factors when assessing the broker's legitimacy.

Company Background Investigation

RockGlobal, previously known as Rockfort Markets, was established in 2018 and has since developed a presence in the online trading community. The company operates from New Zealand, and its ownership structure includes Rockfort Markets Limited and Rock Global International LLC. The management team comprises individuals with experience in finance and trading, although specific details about their backgrounds are not extensively disclosed.

The transparency of a broker is crucial for building trust with clients. RockGlobal's website provides limited information about its management and operational practices, which can be a red flag for potential investors. Transparency in terms of ownership, management, and operational practices is essential for ensuring that traders know who they are dealing with and can hold the broker accountable.

Furthermore, the company claims to maintain high standards of customer service and operational integrity. However, the lack of detailed information about its management team and business practices may lead to skepticism among potential clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential, as they directly impact a trader's profitability. RockGlobal offers various account types, including standard and ECN accounts, with competitive spreads and leverage options. The fee structure is designed to attract both novice and experienced traders.

| Fee Type | RockGlobal | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.0 pips | 1.0 - 2.0 pips |

| Commission Structure | $0 - $5 per lot | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

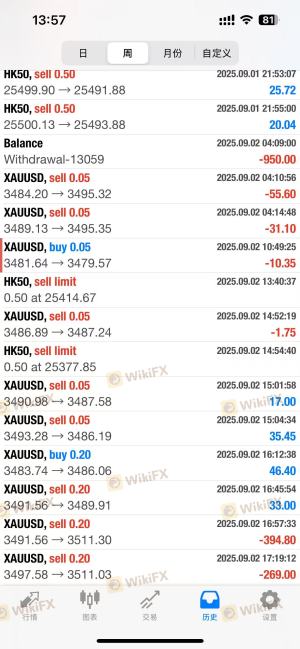

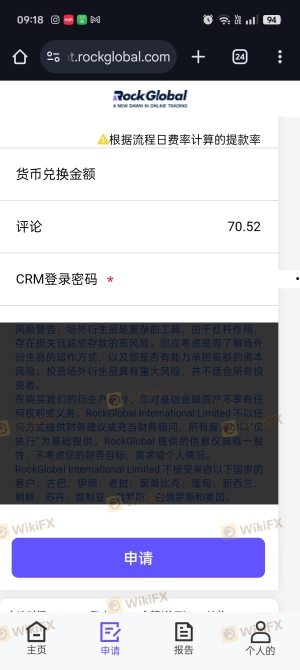

While the spreads appear competitive, there are potential concerns regarding hidden fees and withdrawal policies. Some reviews indicate that clients have experienced difficulty when attempting to withdraw their funds, which could be indicative of a problematic fee structure. Additionally, traders should be aware of any inactivity fees and other charges that may apply, as these can significantly affect overall trading costs.

The commission model is relatively straightforward, but the variability in overnight interest rates can lead to unexpected costs for traders holding positions overnight. Overall, while RockGlobal offers appealing trading conditions, potential clients should conduct thorough research to ensure they fully understand the fee structure and any associated risks.

Client Fund Security

The safety of client funds is paramount when choosing a broker. RockGlobal claims to implement several security measures, including segregated accounts to protect client deposits. This means that client funds are kept separate from the company's operational funds, reducing the risk of loss in case of financial difficulties.

However, the absence of comprehensive investor protection schemes raises concerns. While the FMA regulates RockGlobal, it does not provide the same level of investor protection as some other jurisdictions, such as the United Kingdom or Australia. Traders should be cautious, as the lack of robust protection may expose them to risks, especially in cases of insolvency or mismanagement.

Additionally, there have been historical complaints regarding the withdrawal process, which can further erode trust in the broker's ability to safeguard client funds. Traders should weigh these considerations carefully before investing with RockGlobal.

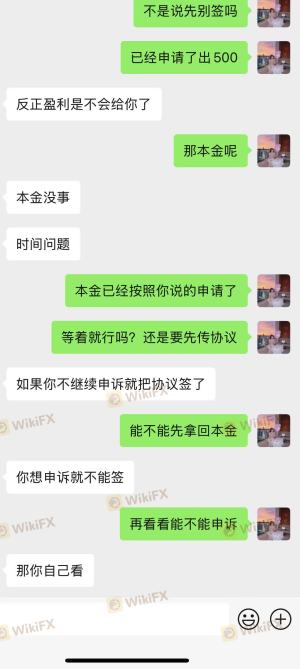

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. RockGlobal has received mixed reviews from clients, with several complaints focusing on withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Unresponsive |

| Misleading Advertising | High | No clear response |

Common complaints include difficulties in accessing funds, delays in processing withdrawals, and a lack of transparency regarding account management. A few users have reported that their withdrawal requests were ignored or met with excessive delays, raising concerns about the broker's operational integrity.

One notable case involved a trader who deposited funds but later faced challenges when attempting to withdraw them. This case highlights the importance of evaluating a broker's withdrawal policies and customer service responsiveness before committing funds.

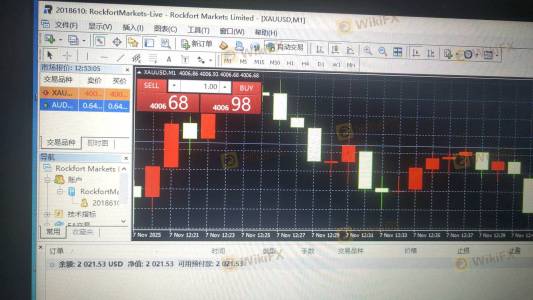

Platform and Execution

The trading platform is a critical component of the trading experience. RockGlobal offers the widely used MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust features. However, reviews indicate that some users have experienced issues with platform stability and execution quality.

The quality of order execution, including slippage and rejection rates, is vital for traders seeking to capitalize on market movements. While RockGlobal claims to provide fast execution speeds, some traders have reported instances of slippage during volatile market conditions, which can significantly impact trading outcomes.

Traders should assess whether the platform meets their specific needs and whether any signs of manipulation or unfair practices are present. Ensuring that the platform provides a reliable trading environment is essential for successful trading.

Risk Assessment

Using RockGlobal carries inherent risks, as is the case with any broker. Traders should be aware of the following risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited regulatory oversight may expose traders to risks. |

| Withdrawal Risk | High | Complaints about withdrawal difficulties raise concerns. |

| Platform Reliability | Medium | Some users report issues with execution and platform stability. |

Traders are advised to implement risk management strategies, including setting stop-loss orders and diversifying their investments. Additionally, it is essential to stay informed about any changes in the broker's policies or regulatory status.

Conclusion and Recommendations

In conclusion, while RockGlobal is a regulated broker with a variety of trading instruments and competitive conditions, several red flags warrant caution. The complaints regarding withdrawal issues, lack of transparency, and mixed customer feedback suggest that potential clients should proceed with care.

For traders considering RockGlobal, it is advisable to conduct thorough research and perhaps start with a smaller investment to gauge the broker's reliability. If concerns persist, traders might explore alternative brokers with stronger regulatory frameworks and better customer feedback, such as those regulated by the FCA or ASIC, which offer more robust investor protections.

Ultimately, the decision to trade with RockGlobal should be based on a careful assessment of the risks involved and the broker's overall credibility in the forex market.

Is RockGlobal a scam, or is it legit?

The latest exposure and evaluation content of RockGlobal brokers.

RockGlobal Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RockGlobal latest industry rating score is 5.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.