Unfxb 2025 Review: Everything You Need to Know

Executive Summary

Unfxb presents itself as a Mauritius-based forex brokerage offering NDD trading services through the MT5 platform. This Unfxb review reveals a broker that positions itself as providing transparent trading conditions with access to over 300 cryptocurrency symbols, more than 100 currency pairs, and various CFD instruments including indices and precious metals. The broker's standout features include an extremely low minimum deposit requirement of 0.1 USDT. It also offers up to 30 levels of market depth and negative balance protection for traders.

According to available information, Unfxb targets both novice and experienced traders seeking cost-effective entry into forex and cryptocurrency markets. The broker offers a $100 non-deposit bonus and supports futures trading with leverage, copy trading functionality, and essential risk management tools including stop-loss and take-profit levels. However, regulatory information remains unclear in available documentation. This may concern traders who prioritize regulatory oversight. The platform emphasizes speed, reliability, and transparency in its trading environment, making it potentially suitable for traders who value low barriers to entry and diverse asset offerings.

Important Notice

This review is based on publicly available information and user feedback accessible at the time of writing. Unfxb's regulatory status and compliance requirements may vary across different jurisdictions. Traders should independently verify the broker's legal standing in their respective regions before opening accounts. The information presented may not reflect the complete user experience, and individual trading results can vary significantly. Traders are advised to conduct their own due diligence and consider their risk tolerance before engaging with any forex broker. This evaluation does not constitute investment advice or a recommendation to trade with Unfxb.

Rating Framework

Broker Overview

Unfxb operates as a forex and CFD brokerage headquartered in Mauritius. It positions itself as an NDD broker committed to providing transparent trading conditions. According to available information, the company operates under Unicorn Brokers Holding LTD and emphasizes creating optimal service bridges to forex, stocks, commodities, and futures markets. The broker's business model focuses on eliminating conflicts of interest through its NDD approach. This allows traders to access interbank liquidity directly.

The company's leadership includes management with claimed extensive experience in international stock exchanges and technical analysis. Historical information suggests involvement in financial market analysis and training dating back to 2004. The company has established various capital-related entities over the years. Unfxb markets itself as a trusted and reputable broker, though specific licensing details and international awards mentioned in promotional materials require independent verification.

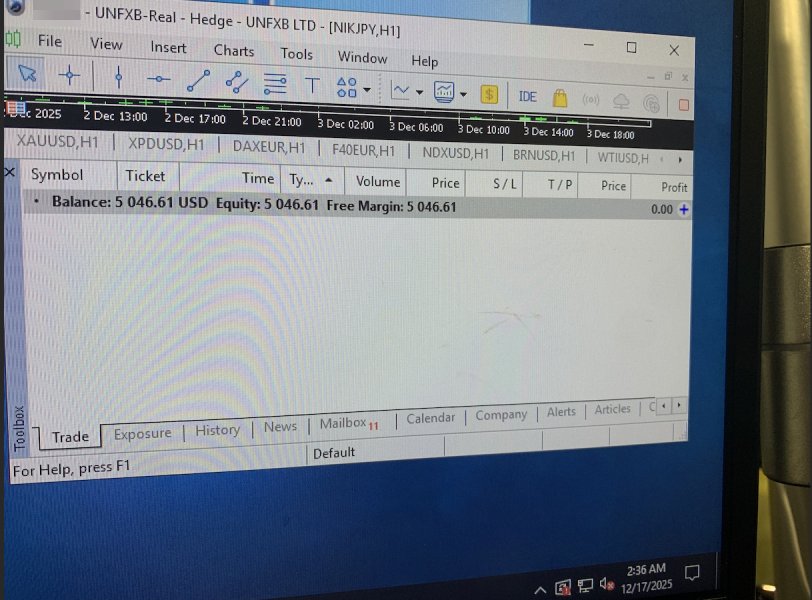

The broker's platform infrastructure centers around the MT5 trading platform. It supports web-based and mobile trading applications. Asset coverage spans multiple markets including forex with over 100 currency pairs on ECN and STP accounts, more than 300 cryptocurrency symbols for spot and futures trading, precious metals, and market indices available as CFDs. This Unfxb review finds the broker's asset diversity appealing to traders seeking exposure across multiple financial markets from a single platform.

Regulatory Status: Specific regulatory information and licensing details are not clearly detailed in available documentation. This may concern traders prioritizing regulatory oversight.

Deposit and Withdrawal Methods: Detailed information about specific deposit and withdrawal methods is not comprehensively outlined in available materials. Cryptocurrency deposits appear supported given the USDT minimum deposit requirement.

Minimum Deposit: The broker offers an exceptionally low minimum deposit requirement of 0.1 USDT. This makes it accessible to traders with limited initial capital.

Bonuses and Promotions: Unfxb provides a $100 non-deposit bonus. This allows traders to begin trading without initial capital investment, subject to terms and conditions.

Tradable Assets: The platform supports an extensive range of instruments including over 300 cryptocurrency symbols, more than 100 forex currency pairs, precious metals, market indices, and various CFD products.

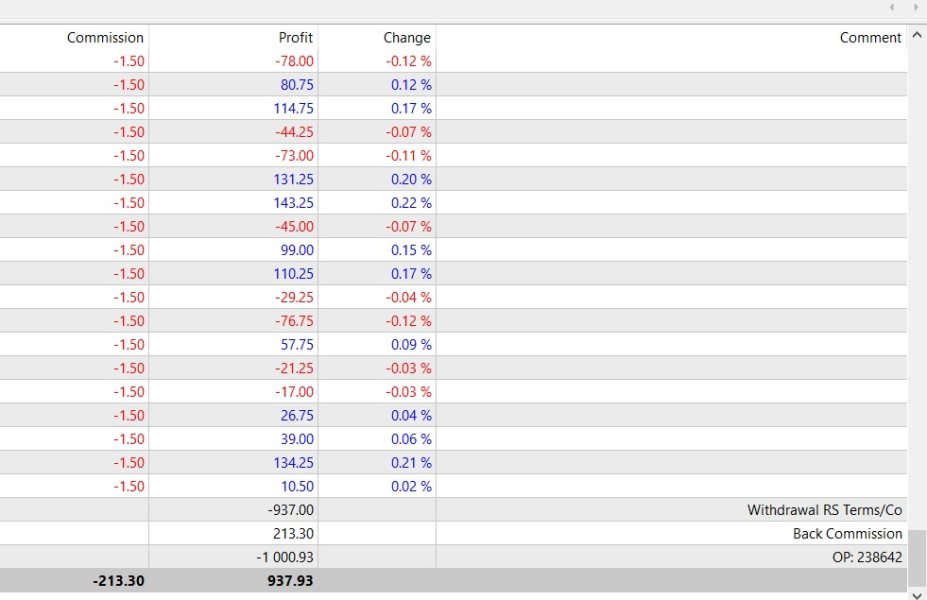

Cost Structure: Specific information about spreads, commissions, and other trading costs is not detailed in available documentation. This requires direct inquiry with the broker.

Leverage Options: Futures trading with leverage is supported. Specific leverage ratios are not specified in available information.

Platform Options: Trading is conducted through the MT5 platform via web-based interfaces and mobile applications. This provides comprehensive charting and analysis tools.

Geographic Restrictions: Specific regional limitations are not detailed in available materials.

Customer Support Languages: Supported languages for customer service are not specified in available documentation.

This Unfxb review notes that many operational details require direct verification with the broker due to limited publicly available information.

Account Conditions Analysis

Unfxb's account structure centers around its remarkably low entry barrier with a minimum deposit of just 0.1 USDT. This positions it among the most accessible brokers for new traders. This minimal requirement allows virtually anyone to test the platform's capabilities without significant financial commitment. However, the lack of detailed information about different account tiers limits our ability to assess the full range of trading conditions available.

The broker mentions offering both ECN and STP account types for forex trading. This suggests different execution methods may be available to suit various trading styles. ECN accounts typically provide direct market access with potentially tighter spreads but may include commission charges, while STP accounts often feature wider spreads but no separate commissions. Unfortunately, specific details about spread ranges, commission structures, or account-specific benefits are not clearly outlined in available materials.

Account opening procedures and verification requirements are not detailed in accessible documentation. The cryptocurrency-friendly approach suggests the process may accommodate digital asset traders. The platform's support for futures trading with leverage indicates sophisticated account capabilities, but specific margin requirements and position sizing rules require direct clarification from the broker.

Special account features such as Islamic accounts for Sharia-compliant trading are not mentioned in available information. The Unfxb review process reveals that while the low minimum deposit is attractive, traders seeking comprehensive account condition details should contact the broker directly for specific terms and conditions.

Unfxb provides a comprehensive suite of trading instruments spanning multiple asset classes. This makes it attractive for diversified trading strategies. The platform's cryptocurrency offering stands out with over 300 symbols available for both spot and futures trading, catering to the growing demand for digital asset exposure. This extensive crypto selection positions Unfxb competitively in the increasingly important cryptocurrency trading segment.

The forex offering includes access to more than 100 currency pairs through ECN and STP execution. This provides traders with major, minor, and exotic currency options. Additional CFD instruments cover market indices and precious metals, allowing portfolio diversification across traditional and alternative assets. The platform's support for futures trading with leverage expands strategic possibilities for experienced traders seeking enhanced market exposure.

Technical trading features include copy trading functionality. This enables less experienced traders to mirror successful strategies from seasoned professionals. Essential risk management tools such as stop-loss and take-profit orders are supported, providing crucial position protection capabilities. The MT5 platform foundation ensures access to advanced charting tools, technical indicators, and automated trading through Expert Advisors.

Market depth information up to 30 levels provides valuable insight into liquidity and potential price movements. This is particularly beneficial for scalping and short-term trading strategies. However, specific educational resources, market analysis, or research materials are not detailed in available documentation, potentially limiting support for trader development and market understanding.

Customer Service and Support Analysis

Customer service information for Unfxb is notably limited in available documentation. This makes it difficult to assess the quality and accessibility of support services. The absence of clearly outlined contact methods, response time commitments, or service availability hours represents a significant information gap for potential traders evaluating the broker's support infrastructure.

Professional forex brokers typically provide multiple communication channels including live chat, email support, and telephone assistance with clearly defined operating hours. The lack of such details in Unfxb's available materials suggests traders may need to register or contact the broker directly to understand available support options. This opacity around customer service could be concerning for traders who prioritize responsive support.

Language support capabilities are not specified. The broker's international positioning suggests multilingual services may be available. Response time expectations, escalation procedures, and problem resolution processes are similarly undocumented in accessible materials. The absence of user testimonials or service quality feedback makes it challenging to gauge actual support experiences.

Account management services, educational support, and technical assistance availability remain unclear without direct broker contact. For traders who value comprehensive customer support, this lack of transparent service information represents a notable limitation in the overall offering. The broker would benefit from providing clearer communication about available support channels and service standards.

Trading Experience Analysis

The MT5 platform foundation provides Unfxb traders with a robust and feature-rich trading environment known for stability and comprehensive functionality. MT5's advanced charting capabilities, extensive technical indicator library, and support for automated trading through Expert Advisors create a professional trading experience suitable for both manual and algorithmic strategies. The platform's multi-timeframe analysis and depth of market features enhance trading decision-making capabilities.

Execution quality details, including typical spreads, slippage rates, and order fill speeds, are not specified in available documentation. This makes it difficult to assess actual trading conditions. The NDD model suggests direct market access without dealer intervention, potentially improving execution transparency and reducing conflicts of interest. However, without specific performance metrics, traders cannot fully evaluate execution quality expectations.

The provision of up to 30 levels of market depth offers valuable insight into order book dynamics. This is particularly beneficial for scalping strategies and understanding market liquidity. Negative balance protection provides crucial account safety, preventing traders from owing money beyond their deposited funds during volatile market conditions. This risk management feature is especially important in leveraged trading environments.

Mobile trading capabilities through dedicated applications extend platform access beyond desktop environments. This enables position monitoring and trade execution from anywhere. Copy trading functionality adds social trading dimensions, allowing strategy diversification through professional trader replication. This Unfxb review notes that while platform features appear comprehensive, actual performance metrics and user experience feedback would strengthen the assessment.

Trust and Safety Analysis

Unfxb's trust profile presents mixed signals that require careful consideration by potential traders. While the broker promotes itself as "trusted and reputable" and claims to be licensed with prestigious international awards, specific regulatory details and licensing information are not clearly documented in available materials. This lack of transparent regulatory disclosure represents a significant concern for traders prioritizing oversight and protection.

The provision of negative balance protection demonstrates some commitment to trader safety by preventing account balances from falling below zero during adverse market conditions. This feature protects traders from owing money beyond their initial deposits, particularly important in leveraged trading scenarios. However, this single safety measure cannot compensate for the absence of clear regulatory oversight information.

Company transparency regarding ownership structure, financial backing, and operational history remains limited in accessible documentation. While Unicorn Brokers Holding LTD is mentioned as the operating entity, detailed corporate information and regulatory compliance status require independent verification. The claimed management experience and historical involvement in financial markets need substantiation through verifiable sources.

Fund segregation practices, client money protection measures, and dispute resolution mechanisms are not detailed in available information. Professional regulatory bodies typically mandate such protections, but without clear regulatory status, these safeguards remain uncertain. Traders concerned about fund security should seek explicit clarification about client money handling and protection measures before depositing significant amounts.

User Experience Analysis

User experience assessment for Unfxb is hampered by limited available feedback and interface documentation. This makes it challenging to evaluate actual user satisfaction levels. The low minimum deposit requirement of 0.1 USDT suggests an attempt to create accessible entry conditions, potentially appealing to new traders testing the platform without significant financial commitment.

Platform accessibility through web-based and mobile applications indicates efforts to provide flexible trading access across different devices and environments. The MT5 foundation typically ensures familiar interface elements for experienced traders while providing comprehensive functionality for various trading approaches. However, specific interface customization options, execution speeds, and platform stability reports are not available in accessible materials.

Registration and account verification processes are not detailed. The cryptocurrency-friendly approach may indicate streamlined onboarding procedures. The absence of user testimonials or experience reports makes it difficult to gauge satisfaction levels with account opening, platform performance, or overall service quality. This lack of user voice represents a significant information gap.

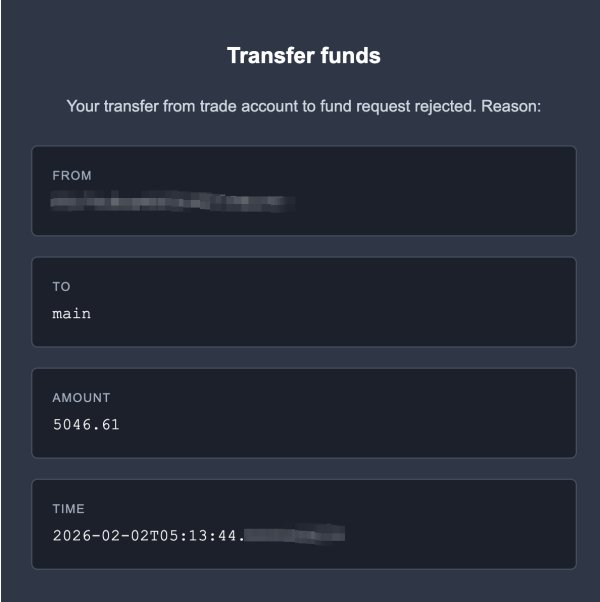

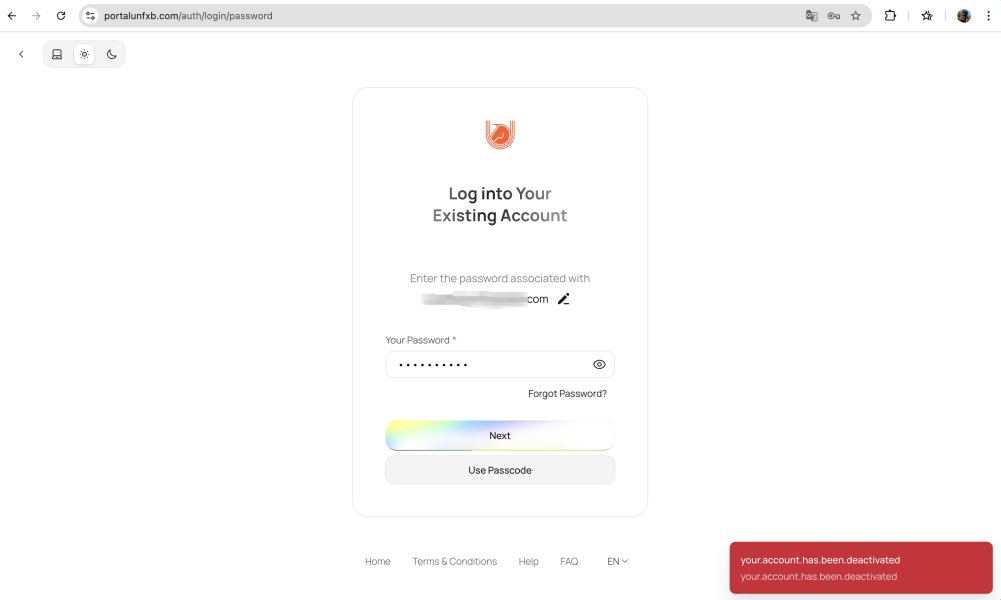

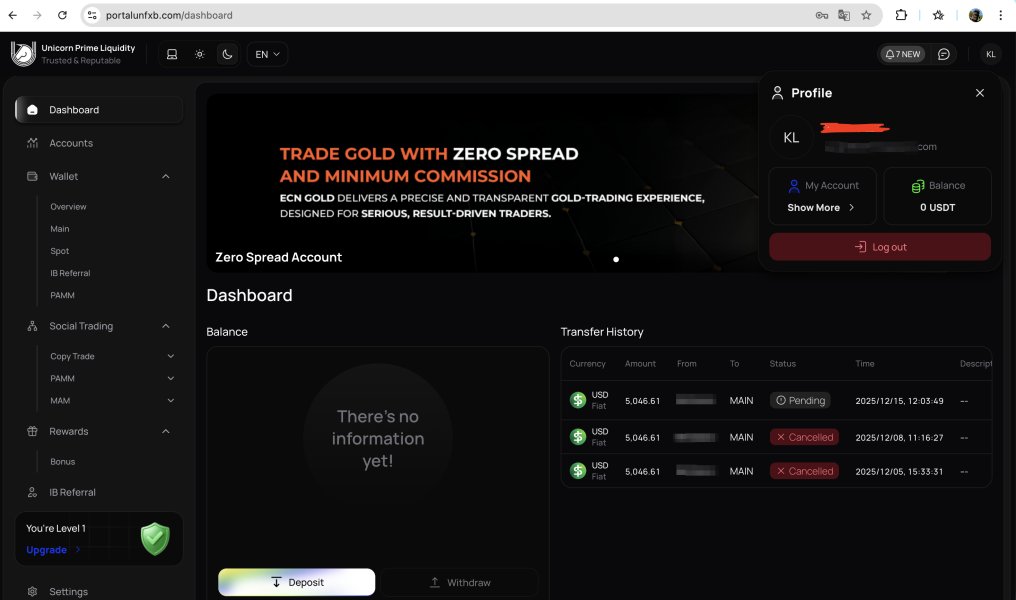

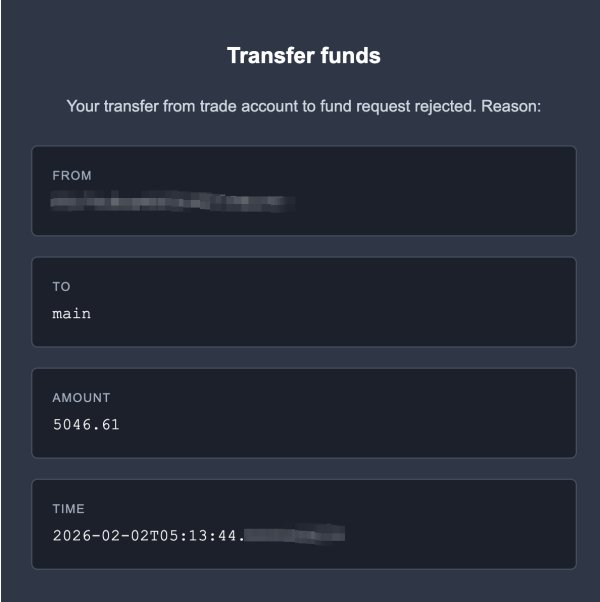

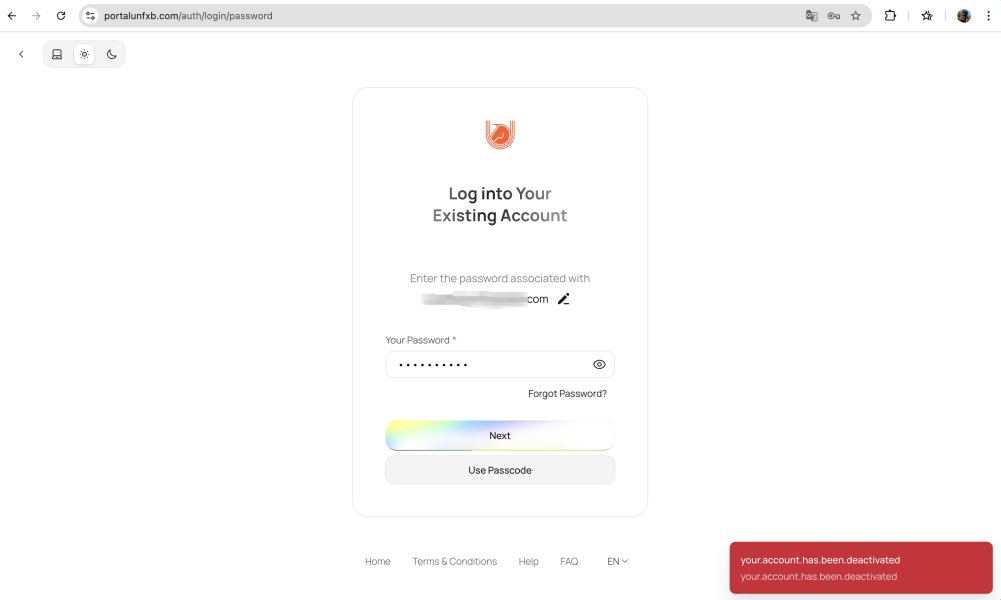

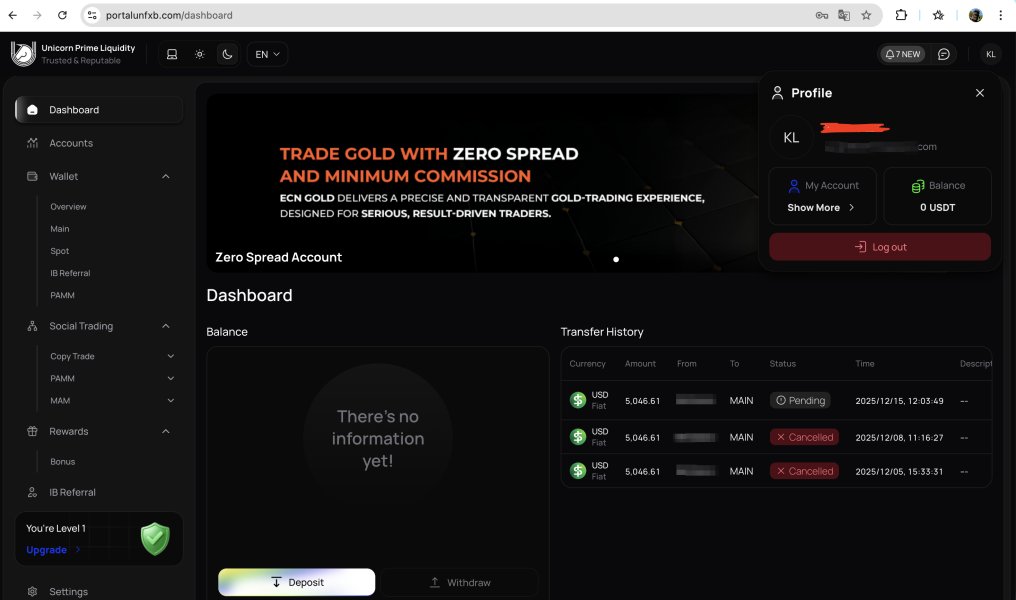

Deposit and withdrawal experience details, including processing times, fees, and available methods, require direct broker inquiry due to limited public documentation. The $100 non-deposit bonus may provide initial trading opportunities, but terms and conditions for bonus utilization and withdrawal are not clearly outlined. Traders value transparency in bonus terms to avoid unexpected restrictions or requirements.

Conclusion

This Unfxb review reveals a broker with both attractive features and notable limitations that potential traders must carefully consider. The platform's strengths include an exceptionally low minimum deposit requirement of 0.1 USDT, extensive cryptocurrency and forex asset selection, and comprehensive MT5 platform capabilities. The NDD execution model and negative balance protection demonstrate some commitment to transparent and safe trading conditions.

However, significant information gaps regarding regulatory status, detailed trading costs, and customer service capabilities create uncertainty about the broker's overall reliability and professionalism. The absence of clear licensing information and limited user feedback make it difficult to fully assess trustworthiness and service quality. These factors may concern traders who prioritize regulatory oversight and transparent operational practices.

Unfxb may suit traders seeking low-cost market entry and diverse asset exposure, particularly those interested in cryptocurrency trading alongside traditional forex instruments. However, the lack of comprehensive public information suggests potential users should conduct thorough due diligence and consider starting with minimal deposits while evaluating the platform's suitability for their trading needs.