Highness 2025 Review: Everything You Need to Know

Executive Summary

This highness review looks at a trading platform that has gained attention in the forex and CFD market. Highness presents itself as a trading service that started in 2009, with its main office in Mauritius and branches in the United States and United Kingdom. The platform reportedly received the "Most Trusted Broker" award in 2023. This shows some level of industry recognition.

The broker sets itself up with a minimum deposit requirement of just $20. This makes it accessible for new traders entering the forex market. The low barrier to entry appeals to beginners seeking flexible trading conditions. The platform focuses on serving high-risk tolerance investors and those new to trading who prefer adaptable market conditions.

However, our analysis reveals significant information gaps about regulatory oversight, specific trading platforms offered, and detailed operational procedures. While the company claims international presence through its multi-jurisdictional setup, concrete regulatory details remain unclear. The target demographic appears to be risk-oriented traders and newcomers seeking accommodating trading environments with minimal initial investment requirements.

Important Notice

Regional Entity Differences: Highness operates across multiple jurisdictions, but specific regulatory information for different regions has not been detailed in available sources. Investors should exercise caution and verify regulatory status in their respective jurisdictions before engaging with the platform.

Review Methodology: This evaluation is based on high-level information summaries available at the time of writing. Comprehensive user reviews and detailed market feedback have not been extensively collected for this assessment. Potential clients should conduct additional due diligence before making investment decisions.

Rating Framework

Broker Overview

Highness emerged in the forex and CFD brokerage landscape in 2009. The company established its headquarters in Mauritius while expanding operations through branches in the United States and United Kingdom. This multi-jurisdictional approach suggests an intention to serve diverse global markets and comply with varying regulatory environments. The company positions itself as a comprehensive trading service provider, focusing on delivering forex and CFD trading opportunities to international clients.

The broker's business model centers on providing accessible trading conditions. This is particularly evident in its $20 minimum deposit requirement. The low entry threshold indicates a strategic focus on attracting new traders and those with limited initial capital. The company's longevity in the market, spanning over fifteen years, suggests some level of operational stability and market adaptation capabilities.

Regarding trading offerings, Highness concentrates on forex and CFD instruments. However, specific details about asset variety, trading platforms, and execution models remain unclear from available information. The company's recognition through the 2023 "Most Trusted Broker" award indicates some industry acknowledgment, though the criteria and awarding body for this recognition require further verification. This highness review notes that while the broker presents an established presence, comprehensive operational details need additional clarification.

Regulatory Regions: Specific regulatory information has not been detailed in available sources, despite the company's claimed presence in multiple jurisdictions including Mauritius, the United States, and United Kingdom.

Deposit and Withdrawal Methods: Available information does not specify the payment methods accepted for deposits and withdrawals. This represents a significant information gap for potential clients.

Minimum Deposit Requirements: The platform requires a minimum deposit of $20. This positions it as accessible for traders with limited initial capital.

Bonus Promotions: Current promotional offers and bonus structures have not been detailed in available information sources.

Tradeable Assets: The broker focuses on forex and CFD trading. However, specific currency pairs, indices, commodities, and other CFD instruments available have not been comprehensively listed.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs has not been provided in available sources. This makes cost comparison difficult.

Leverage Ratios: Specific leverage offerings for different account types and asset classes have not been disclosed in available information.

Platform Options: Trading platform details, including whether the broker offers MetaTrader, proprietary platforms, or web-based solutions, remain unspecified.

Regional Restrictions: Geographic limitations and restricted countries have not been clearly outlined in available documentation.

Customer Support Languages: Supported languages for customer service have not been specified in available information.

This highness review emphasizes that while basic operational information exists, comprehensive details necessary for informed decision-making require additional research and direct broker contact.

Detailed Rating Analysis

Account Conditions Analysis

The account structure at Highness demonstrates accessibility through its $20 minimum deposit requirement. This is significantly lower than many industry competitors who typically require $100-$500 minimum deposits. The positioning clearly targets new traders and those testing trading strategies with limited capital exposure. The low entry barrier removes financial obstacles that often prevent newcomers from experiencing live market conditions.

However, available information lacks details about different account tiers, whether premium accounts offer enhanced features, or if Islamic accounts accommodate religious trading requirements. The absence of information about account verification procedures, required documentation, and approval timeframes creates uncertainty for potential clients planning their trading timeline.

Account funding and withdrawal processes remain unclear, with no specified payment methods, processing times, or associated fees. This information gap particularly affects international clients who need clarity about cross-border transaction capabilities and currency conversion policies.

The broker's account conditions receive a moderate rating due to the attractive minimum deposit but lose points for insufficient transparency about account varieties, features, and operational procedures. This highness review recommends potential clients request detailed account information directly from the broker before proceeding with registration.

Trading tools and resources represent a critical component for trader success. Yet available information about Highness's offerings remains limited. The absence of details about charting capabilities, technical analysis tools, market research provision, and trading indicators creates significant uncertainty about the platform's analytical capabilities.

Educational resources, essential for the new traders the broker appears to target, have not been described in available information. Given the $20 minimum deposit clearly aims at beginners, the lack of educational content details raises questions about the broker's commitment to trader development and success.

Market analysis provision, economic calendars, news feeds, and expert commentary availability remain unspecified. These resources significantly impact trading decisions, particularly for less experienced traders who rely on broker-provided market insights and analysis.

Automated trading support, including Expert Advisors, copy trading, or algorithmic trading capabilities, has not been detailed. Modern traders increasingly expect these features, and their absence or presence significantly affects platform attractiveness.

The tools and resources category receives a below-average rating due to insufficient information about analytical capabilities, educational support, and trading enhancement features that contemporary traders expect from their brokers.

Customer Service and Support Analysis

Customer service quality directly impacts trader satisfaction and problem resolution effectiveness. Yet specific information about Highness's support structure remains largely unavailable. Contact methods, whether including phone, email, live chat, or social media support, have not been detailed in available sources.

Response time expectations, crucial for traders facing urgent issues during market hours, lack specification. Given the global nature of forex markets operating 24/5, support availability during major trading sessions becomes particularly important for international clients.

Service quality metrics, user satisfaction ratings, and problem resolution effectiveness have not been documented in available information. These factors significantly influence trader experience, especially during account issues, technical problems, or withdrawal concerns.

Multilingual support capabilities, essential for the international client base suggested by the broker's multi-jurisdictional presence, remain unspecified. Language barriers can significantly impact support effectiveness and user satisfaction.

Customer service receives a neutral rating due to the complete absence of detailed information about support channels, availability, quality metrics, and language capabilities. Potential clients should verify support arrangements before committing to the platform.

Trading Experience Analysis

Trading experience encompasses platform stability, execution quality, and overall usability. Yet available information provides limited insight into Highness's performance in these areas. Platform reliability during high-volatility periods, crucial for maintaining trading continuity, lacks documentation through user feedback or performance testing.

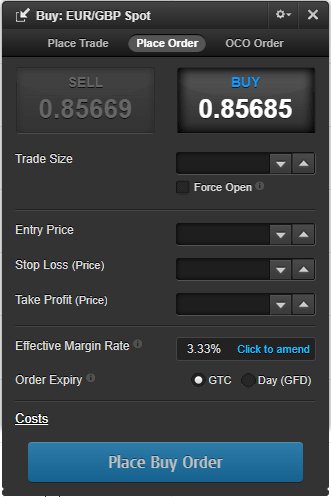

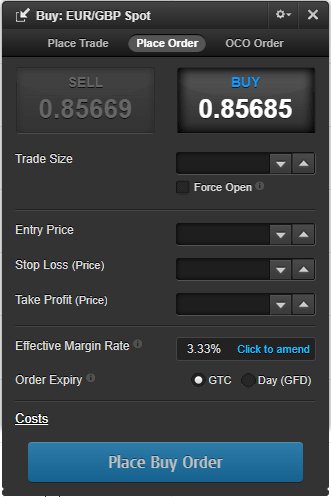

Order execution quality, including slippage rates, rejection frequencies, and fill speeds, has not been detailed in available sources. These factors directly impact trading profitability and user satisfaction, particularly for scalpers and high-frequency traders.

Platform functionality, including order types available, risk management tools, and interface customization options, remains unspecified. Modern traders expect sophisticated order management capabilities and user-friendly interfaces that adapt to individual trading styles.

Mobile trading experience, increasingly important as traders seek flexibility and mobility, has not been described in available information. Mobile app functionality, synchronization with desktop platforms, and mobile-specific features significantly influence contemporary trading decisions.

The trading experience receives a moderate rating due to the absence of detailed user feedback and performance metrics. This highness review emphasizes the need for potential clients to test platform functionality through demo accounts before live trading.

Trust Rating Analysis

Trust represents the foundation of broker-client relationships. Highness demonstrates some positive indicators through its reported industry recognition. The 2023 "Most Trusted Broker" award, while requiring verification of awarding criteria and authority, suggests some level of industry acknowledgment and peer recognition.

The company's established presence since 2009 indicates operational longevity and market survival through various economic cycles. This includes the 2008 financial crisis aftermath, European debt crisis, and recent global uncertainties. The longevity suggests some level of business model sustainability and client retention capability.

However, specific regulatory licensing details remain unclear despite claims of operations in multiple jurisdictions. Regulatory oversight provides crucial client protections, including compensation schemes, segregated client funds, and dispute resolution mechanisms. The absence of clear regulatory information creates uncertainty about available protections.

Fund safety measures, including client money segregation, insurance coverage, and bank-level security protocols, have not been detailed in available information. These protections critically impact client confidence and actual fund security during broker operational difficulties.

The trust rating receives a favorable score primarily due to the industry award and operational longevity. However, regulatory transparency improvements would strengthen overall credibility assessment.

User Experience Analysis

User experience encompasses the entire client journey from registration through ongoing trading activities. Yet comprehensive feedback about Highness's performance in this area remains limited. Overall user satisfaction metrics, crucial for understanding real-world platform performance, have not been documented in available sources.

Interface design and usability, particularly important for the new traders targeted through the low minimum deposit, lack detailed description. User-friendly design significantly impacts learning curves and trading effectiveness for inexperienced market participants.

Registration and verification processes, including required documentation, approval timeframes, and potential complications, have not been specified in available information. Smooth onboarding experiences significantly influence initial user impressions and platform adoption rates.

Funding operations experience, including deposit processing times, withdrawal procedures, and associated fees, remains unclear. These practical considerations directly impact user satisfaction and platform usability for regular trading activities.

Common user complaints and recurring issues have not been documented in available sources. This prevents identification of potential problem areas or platform weaknesses that might affect user experience.

The user experience rating remains neutral due to insufficient feedback and detailed information about practical platform usage, onboarding procedures, and ongoing operational satisfaction levels.

Conclusion

This highness review reveals a broker with some positive indicators, including industry recognition and accessible entry requirements. However, significant information gaps require careful consideration. Highness appears suitable for new traders seeking low-barrier market entry, particularly those with limited initial capital who can benefit from the $20 minimum deposit requirement.

The platform's strengths include its established market presence since 2009, multi-jurisdictional operations suggesting international reach, and industry award recognition indicating some level of peer acknowledgment. These factors provide a foundation for potential credibility and operational stability.

However, the lack of detailed information about regulatory oversight, trading platforms, cost structures, and user experiences creates uncertainty that potential clients must address through direct broker contact and additional research. The absence of comprehensive user feedback and detailed operational procedures represents significant evaluation challenges for informed decision-making.