MIEX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive miex review presents a detailed analysis of MIEX. MIEX is an online investment and trading platform that has been operating since 2011, offering services across multiple asset classes including forex, stocks, indices, precious metals, commodities, and cryptocurrencies through the MetaTrader 5 platform. Our evaluation reveals significant concerns regarding regulatory oversight and customer satisfaction.

The platform's primary appeal lies in its diverse asset offerings. It utilizes the widely-recognized MT5 trading platform, positioning itself as a multi-asset broker catering to traders seeking variety in their investment portfolio. Despite these potential advantages, substantial red flags emerge from user complaints regarding poor customer support and allegations of fraudulent practices.

Our analysis indicates that while MIEX may attract traders interested in diverse asset classes, potential users should exercise extreme caution. The platform lacks clear regulatory information and has numerous negative user experiences. The platform appears suitable for experienced traders who understand the associated risks, but newcomers to forex trading should consider more established and regulated alternatives.

Important Notice

Readers should be aware that MIEX operates from multiple jurisdictions. The company has headquarters listed in the United Kingdom but actual operational activities are potentially subject to different regional legal frameworks. The company's registered address appears to be at Vistra Corporate Services Centre in Seychelles, which may impact the applicable regulatory environment and investor protections.

This evaluation is based primarily on publicly available information and user feedback collected from various sources. The assessment has not been verified through direct testing or on-site verification. Given the limited regulatory information available and concerning user reports, potential clients should conduct thorough due diligence before engaging with this broker.

Rating Framework

Broker Overview

MIEX established its presence in the online trading industry in 2011. The company positions itself as a comprehensive investment platform serving global markets, operating under a business model that emphasizes multi-asset trading capabilities and offers clients access to diverse financial instruments through a single platform. According to available company information, MIEX maintains its headquarters in the United Kingdom while conducting operations through various international jurisdictions.

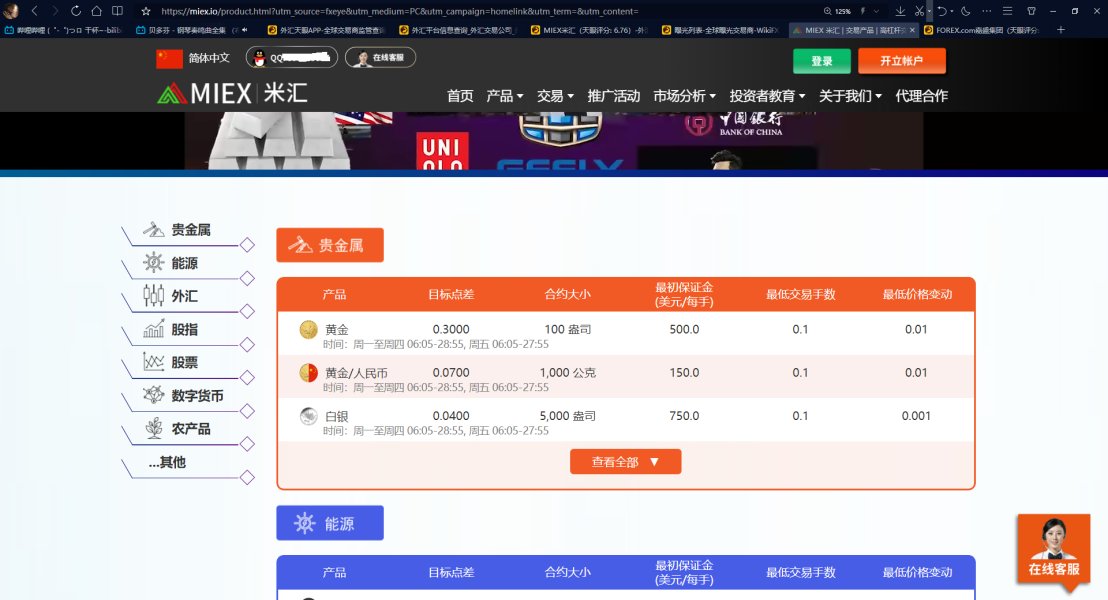

The broker's operational framework centers on providing retail and institutional clients with access to major financial markets. This access comes through the MetaTrader 5 platform, with MIEX's business approach focusing on delivering trading services across six primary asset categories: foreign exchange pairs, individual stocks, market indices, precious metals, commodities, and cryptocurrency instruments. This broad spectrum of offerings suggests the platform targets traders seeking portfolio diversification opportunities.

However, the regulatory landscape surrounding MIEX remains unclear based on available documentation. The absence of prominent regulatory disclosures raises questions about investor protection measures and compliance standards. This miex review emphasizes the importance of regulatory clarity for trader confidence and fund security, areas where the broker appears to fall short of industry standards.

Regulatory Status: Current available information does not specify clear regulatory oversight from major financial authorities. This represents a significant concern for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information regarding funding options and withdrawal procedures is not detailed in available documentation. Potential clients must make direct inquiry with the broker for this information.

Minimum Deposit Requirements: The platform's entry-level funding requirements are not specified in accessible materials. This indicates potential clients must contact customer service for account opening details.

Promotional Offers: Information about bonus structures, promotional campaigns, or incentive programs is not readily available. Public documentation does not include details about current offers or special programs.

Tradeable Assets: MIEX supports trading across multiple asset classes including forex currency pairs, individual equity stocks, major market indices, precious metals, various commodities, and cryptocurrency instruments. This provides substantial market exposure for traders seeking diversification.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs is not specified. Available materials require direct broker consultation for pricing details.

Leverage Ratios: Maximum leverage offerings and margin requirements are not detailed in accessible documentation. Traders must contact the broker directly to understand available leverage options.

Platform Options: The primary trading interface utilizes MetaTrader 5. This is a widely-recognized platform supporting automated trading, technical analysis, and multi-asset capabilities.

Geographic Restrictions: Specific information about regional limitations or restricted territories is not available. Current documentation does not specify which countries or regions may face trading restrictions.

Customer Support Languages: Available support languages and regional service options are not specified in accessible materials. This miex review notes communication concerns from user feedback regarding language support and regional availability.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by MIEX present several areas of concern. The broker does not provide transparent details about account types, tier structures, or specific benefits associated with different funding levels, making it difficult for potential clients to understand what services they will receive based on their investment level. This lack of clarity forces prospective traders to engage directly with sales representatives to obtain basic account information.

Minimum deposit requirements remain unspecified in public documentation. This approach often indicates either poor transparency practices or aggressive sales tactics that may not serve client interests effectively, and the account opening process appears to lack the streamlined efficiency found with more established brokers based on user reports of complicated procedures and unclear documentation requirements. Additionally, there is no mention of specialized account types such as Islamic accounts for Sharia-compliant trading.

User feedback regarding account conditions consistently points to dissatisfaction with fee structures, hidden charges, and unexpected costs. These complaints suggest that MIEX may not provide adequate upfront disclosure of all account-related expenses, creating unpleasant surprises for new clients. This miex review concludes that the account conditions category receives a low rating due to transparency issues, unclear pricing structures, and negative user experiences regarding account management and associated costs.

MIEX demonstrates reasonable capability in the tools and resources category primarily through its adoption of the MetaTrader 5 platform. The MT5 platform provides traders with a comprehensive suite of technical analysis tools, automated trading capabilities, and multi-asset support that offers advanced charting functionality, numerous technical indicators, and algorithmic trading support meeting professional trading requirements. The broker's multi-asset approach provides traders with access to diverse markets through a single platform.

This consolidation can simplify trading operations and potentially reduce overall costs for active traders managing positions across different asset classes. However, the evaluation reveals significant gaps in educational resources and market research materials, and unlike leading brokers that provide comprehensive educational programs, market analysis, and trading guides, MIEX appears to offer limited support for trader development and market understanding. This deficiency particularly impacts novice traders who require structured learning materials to develop trading skills.

The absence of proprietary research tools, market commentary, or economic calendar integration further limits the platform's value proposition. Advanced traders may find the analytical resources insufficient for sophisticated trading strategies requiring detailed market insights, and there is no clear information about mobile trading applications or web-based platform alternatives. This may restrict trading flexibility for clients requiring access across multiple devices or operating systems.

Customer Service and Support Analysis

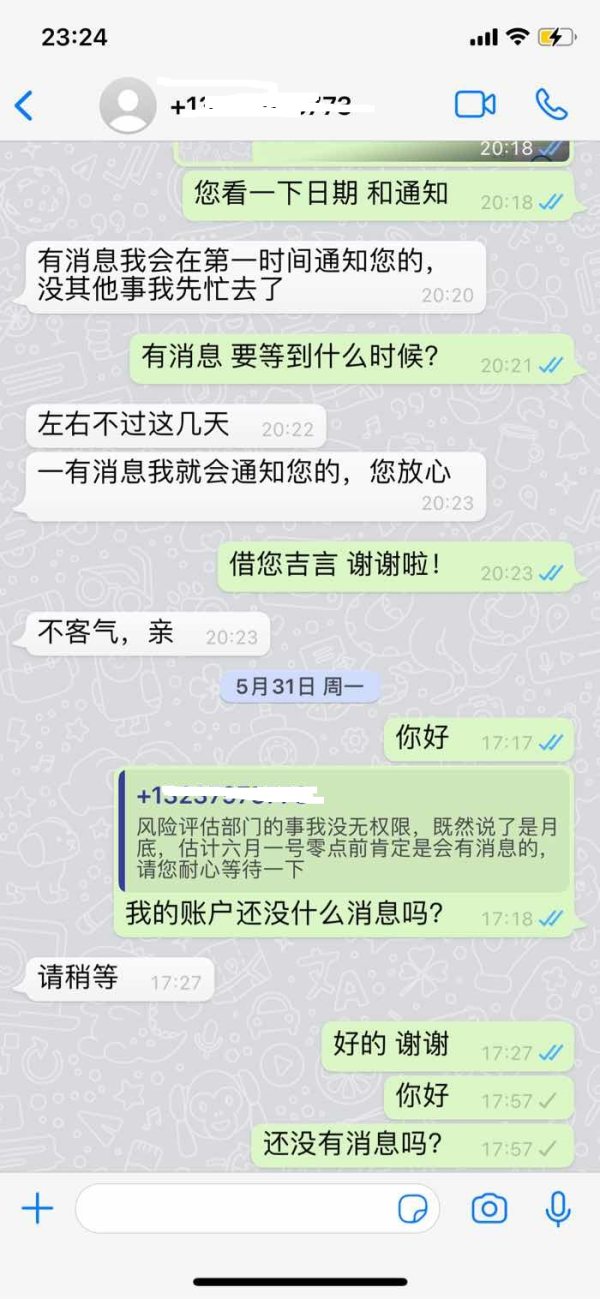

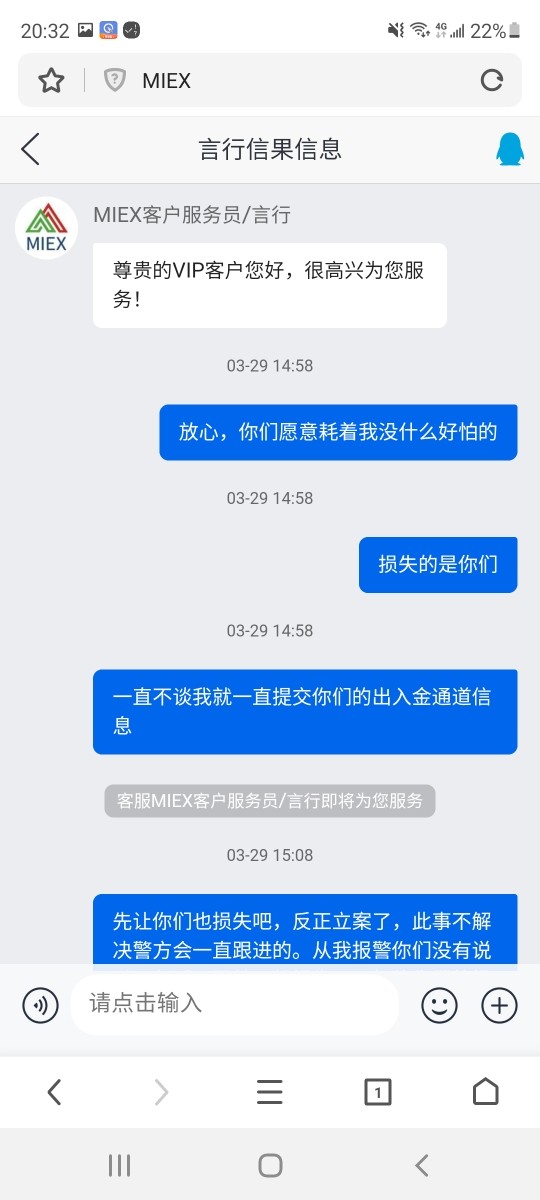

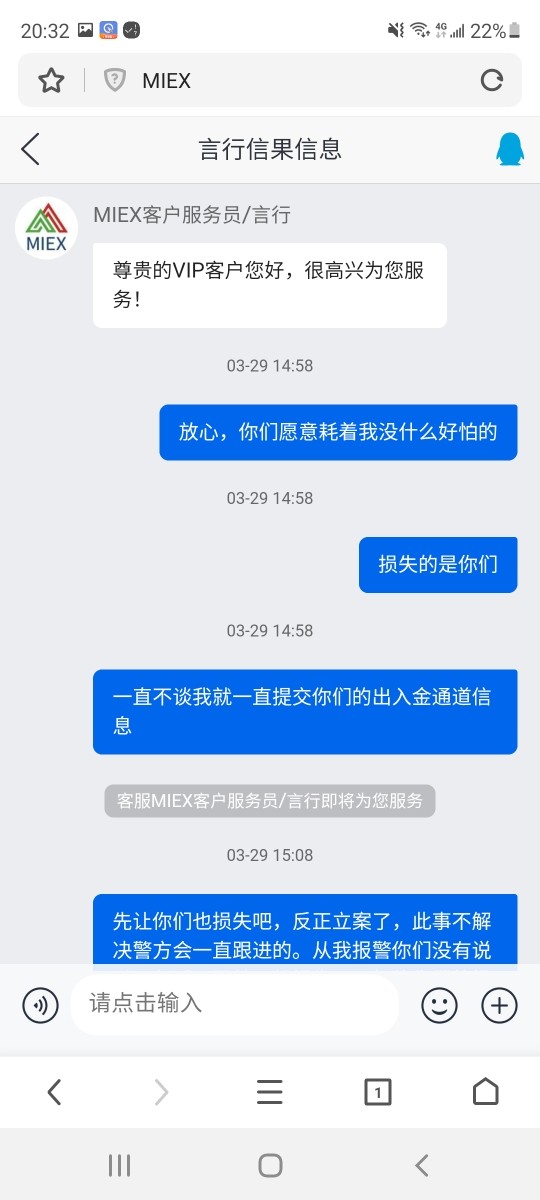

Customer service represents one of MIEX's most significant weaknesses based on extensive user feedback and complaint patterns. Multiple reports indicate substantial problems with support responsiveness, with clients experiencing extended delays in receiving assistance for account issues, technical problems, and withdrawal requests, and the quality of customer service interactions appears consistently poor with users reporting unhelpful responses, lack of expertise among support staff, and inadequate resolution of legitimate concerns. These service deficiencies create frustrating experiences for clients requiring timely assistance with trading-related issues.

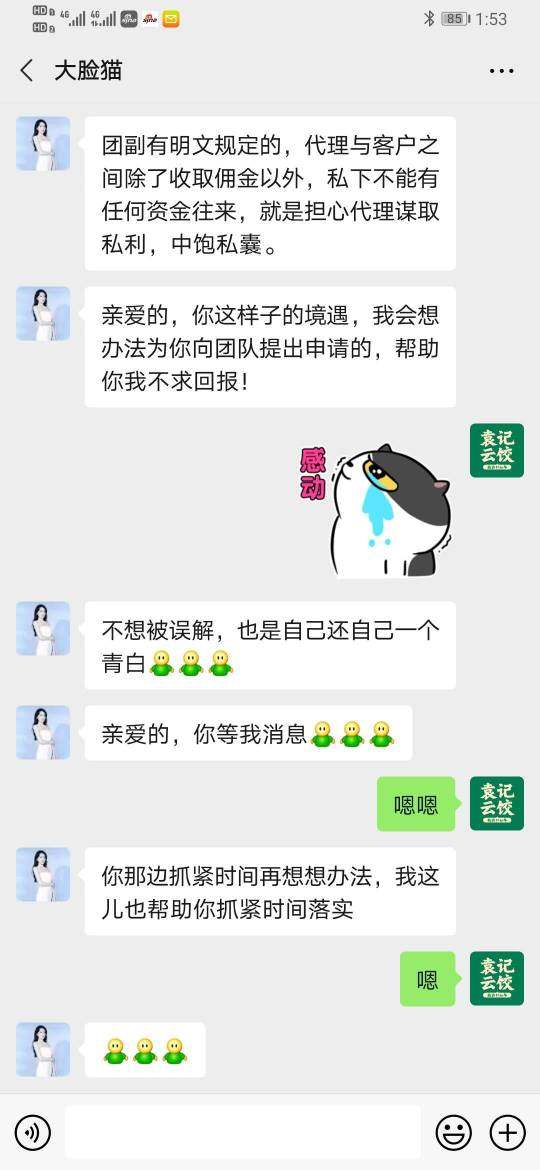

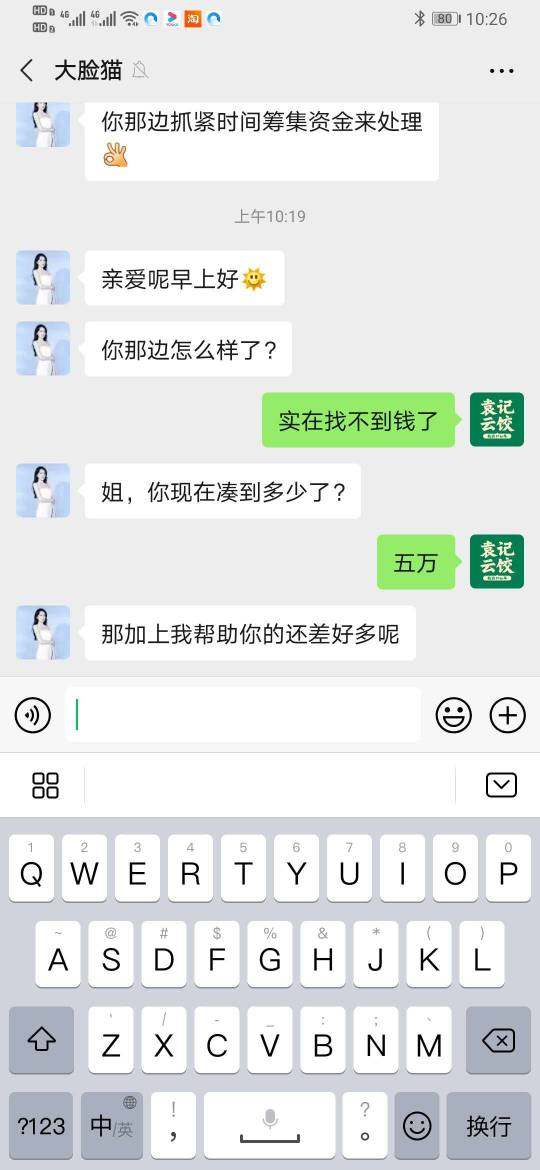

Communication channels and availability hours are not clearly specified in available documentation. This suggests limited accessibility options for international clients operating across different time zones, and the absence of comprehensive multilingual support may further restrict service quality for non-English speaking traders. Most concerning are numerous allegations of fraudulent practices and deliberate obstruction of withdrawal requests by customer service representatives.

These reports suggest systematic issues rather than isolated incidents, indicating potential operational problems that extend beyond simple service quality concerns. The lack of escalation procedures or senior management accessibility compounds these problems, leaving frustrated clients with limited recourse when standard support channels fail to resolve legitimate issues. This pattern of poor service delivery significantly undermines client confidence and platform reliability.

Trading Experience Analysis

The trading experience on MIEX presents a mixed picture, with some positive elements offset by significant concerns based on user feedback. The MetaTrader 5 platform provides a solid foundation for trading activities, offering professional-grade functionality including advanced order types, algorithmic trading support, and comprehensive charting capabilities that meet most trader requirements, though platform stability appears adequate for basic trading operations with user reports suggesting occasional connectivity issues and execution delays during high-volume market periods. The absence of proprietary platform alternatives limits options for traders who prefer different interface designs or specialized functionality.

Order execution quality remains unclear due to limited transparency about liquidity providers, execution speeds, and slippage statistics. Professional traders typically require detailed execution data to evaluate broker performance, information that MIEX does not readily provide, and a significant limitation is the apparent lack of mobile trading applications, restricting platform access to desktop and web-based interfaces. This limitation significantly impacts trading flexibility for clients requiring market access while traveling or away from primary trading setups.

The multi-asset trading environment provides opportunities for portfolio diversification, though the quality of pricing and liquidity across different asset classes varies based on user reports. Forex trading appears to receive primary focus, with other asset classes potentially offering less competitive conditions. This miex review notes that while the basic trading infrastructure functions adequately, the overall experience suffers from transparency issues and limited platform options that restrict trader flexibility and confidence.

Trust and Reliability Analysis

Trust and reliability represent critical weaknesses in MIEX's service offering, with multiple factors contributing to significant concerns about platform safety and operational integrity. The absence of clear regulatory oversight from recognized financial authorities creates substantial uncertainty about investor protection measures and compliance standards, and regulatory transparency is fundamental to broker evaluation, as proper oversight provides legal recourse and operational standards that protect client interests. MIEX's unclear regulatory status raises questions about fund segregation, compensation schemes, and dispute resolution mechanisms that regulated brokers typically provide.

Company transparency issues extend beyond regulatory matters to include limited disclosure about corporate structure, management team, and operational procedures. Established brokers typically provide comprehensive corporate information to build client confidence, areas where MIEX appears deficient, and multiple fraud allegations and user complaints about fund security create additional concerns about operational integrity. While individual complaints may not represent systematic issues, the volume and consistency of negative reports suggest potential problems with business practices and client treatment.

The absence of third-party audits, financial reporting, or independent verification of business practices further undermines confidence in platform reliability. Professional traders typically require evidence of sound financial management and operational controls before committing significant capital. Risk management for clients appears inadequate given the regulatory uncertainty and negative feedback patterns, making MIEX unsuitable for traders prioritizing capital protection and regulatory compliance.

User Experience Analysis

Overall user satisfaction with MIEX appears significantly below industry standards based on available feedback and complaint patterns. The platform attracts traders interested in multi-asset trading capabilities but frequently disappoints in execution and service delivery, creating frustrating experiences for many clients, and interface design through the MetaTrader 5 platform provides adequate functionality, though the absence of platform alternatives limits customization options for traders with specific preferences. The learning curve for new MT5 users may present challenges for novice traders without adequate educational support.

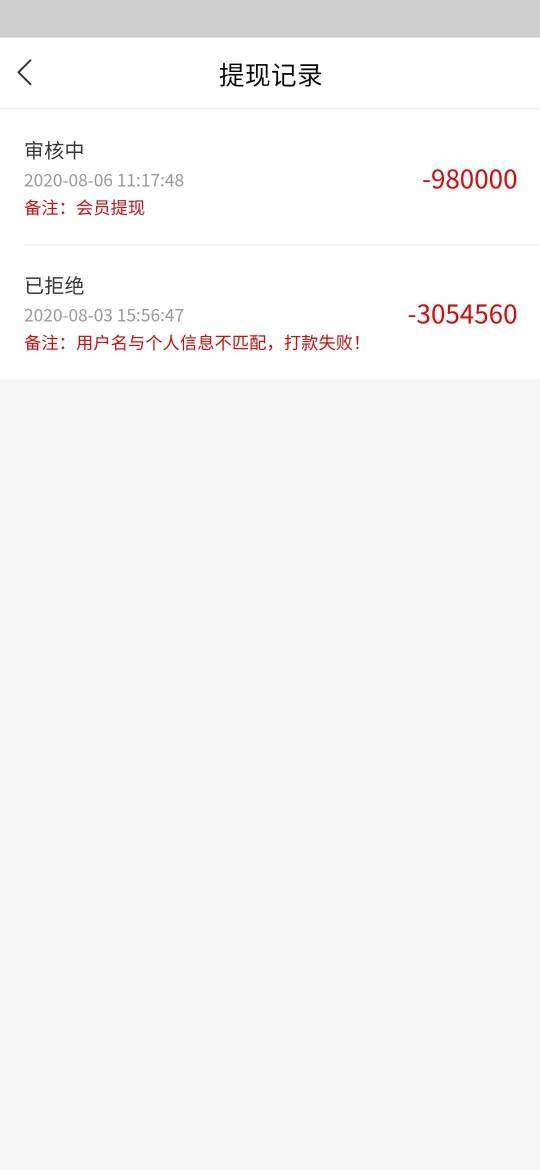

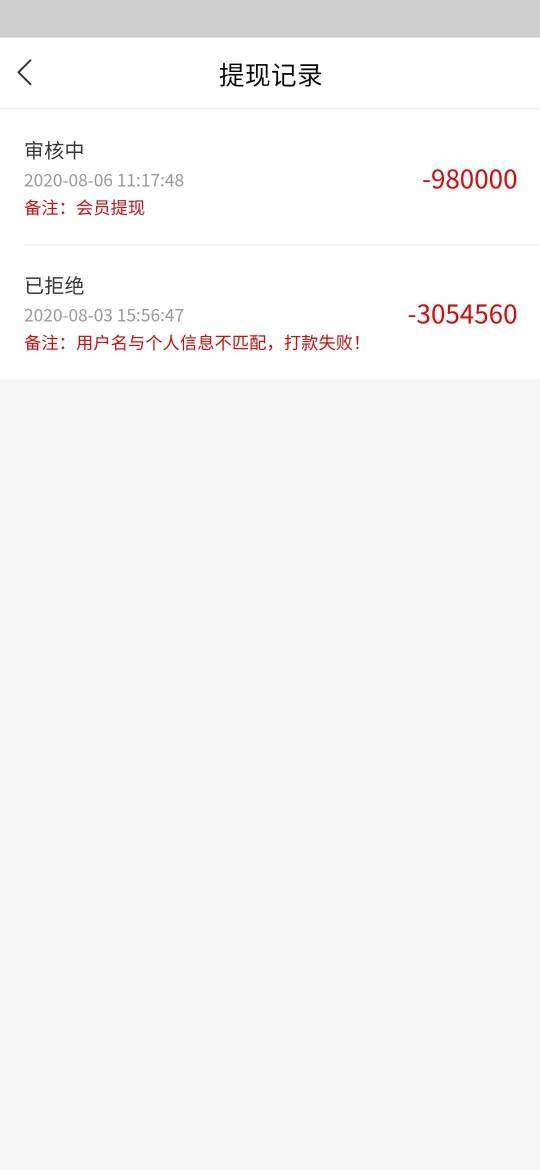

Registration and verification processes appear complicated based on user reports, with unclear documentation requirements and extended approval times that delay account activation. Streamlined onboarding is essential for positive initial experiences, an area where MIEX appears to struggle, and fund management operations present significant concerns based on user complaints about withdrawal difficulties, unexpected fees, and poor communication regarding account transactions. These issues create anxiety and frustration for clients attempting to access their capital.

Common user complaints center on customer service quality, hidden fees, withdrawal problems, and lack of transparency in business operations. The consistency of these complaints across multiple feedback sources suggests systematic issues rather than isolated incidents. The platform may suit experienced traders who understand associated risks and can navigate potential service challenges, but newcomers to online trading would likely benefit from choosing more established and regulated alternatives that prioritize user experience and client protection.

Conclusion

This comprehensive miex review reveals a trading platform with mixed characteristics that present both opportunities and significant risks for potential clients. While MIEX offers multi-asset trading capabilities through the respected MetaTrader 5 platform, substantial concerns about regulatory oversight, customer service quality, and operational transparency overshadow these potential benefits, and the broker appears most suitable for experienced traders who understand the risks associated with unregulated platforms and can navigate potential service challenges independently. However, the numerous user complaints, unclear regulatory status, and poor customer service record make MIEX unsuitable for novice traders or those prioritizing capital protection and regulatory compliance.

Primary advantages include diverse asset class offerings and professional trading platform access, while major disadvantages encompass regulatory uncertainty, poor customer support, and concerning user feedback patterns. Potential clients should carefully consider these factors and explore regulated alternatives before committing capital to this platform.