Profiforex 2025 Review: Everything You Need to Know

Executive Summary

Profiforex started in 2010. It works as an offshore STP broker that is registered in Seychelles. The company does not have mandatory regulatory oversight, but it has gained attention for its user-friendly interface and diverse trading opportunities that serve both new and experienced traders. This profiforex review shows a platform that has earned a notable user rating of 10.4 out of 10 based on available feedback. This suggests strong client satisfaction despite regulatory concerns.

The broker mainly offers MT4 trading platform access with support for various trading assets including major currency pairs, CFDs, and precious metals. The company's STP model aims to provide direct market access, which could offer competitive execution speeds. However, traders should carefully consider the risks of trading with an unregulated entity, as this creates inherent risks regarding fund security and dispute resolution. The platform appears particularly suited for traders seeking straightforward access to forex markets without complex account structures. Specific details about trading conditions remain limited in publicly available information.

Important Notice

Profiforex operates as a company registered in Seychelles without mandatory regulatory oversight from major financial authorities. This regulatory status means that client funds may not benefit from the same protection mechanisms available with regulated brokers. Traders should exercise enhanced due diligence and risk management when considering this platform. The evaluation presented in this review is based on publicly available information, user feedback, and observable platform features. Given the limited transparency regarding specific trading conditions, potential clients should conduct thorough research and consider their risk tolerance before opening accounts.

Rating Framework

Broker Overview

Profiforex emerged in the forex trading landscape in 2010. The company positioned itself as a specialized STP broker focused on providing direct market access to retail traders. The company's registration in Seychelles reflects a common offshore approach among forex brokers seeking operational flexibility while serving international clients. The broker's business model centers on straight-through processing, which theoretically allows client orders to be passed directly to liquidity providers without dealer intervention.

This approach potentially reduces conflicts of interest. The platform has built its reputation around accessibility and user-friendliness, evidenced by its high user rating of 10.4. This rating suggests that despite regulatory concerns, clients have generally positive experiences with the platform's functionality and service delivery. The company's focus on the STP model indicates an emphasis on execution quality and transparency. Specific details about liquidity providers and execution statistics are not readily available in public documentation.

Profiforex offers trading access through the widely recognized MetaTrader 4 platform. This provides traders with familiar tools and functionality. The broker's asset coverage spans traditional forex pairs, contracts for difference, and precious metals trading, offering diversification opportunities for different trading strategies. The platform's design philosophy appears to prioritize simplicity and accessibility. This makes it potentially suitable for traders across different experience levels who value straightforward trading environments over complex feature sets.

Regulatory Status: Profiforex operates under Seychelles registration without mandatory regulatory oversight from major financial authorities such as the FCA, CySEC, or ASIC. This regulatory framework provides operational flexibility but offers limited client protection compared to regulated alternatives.

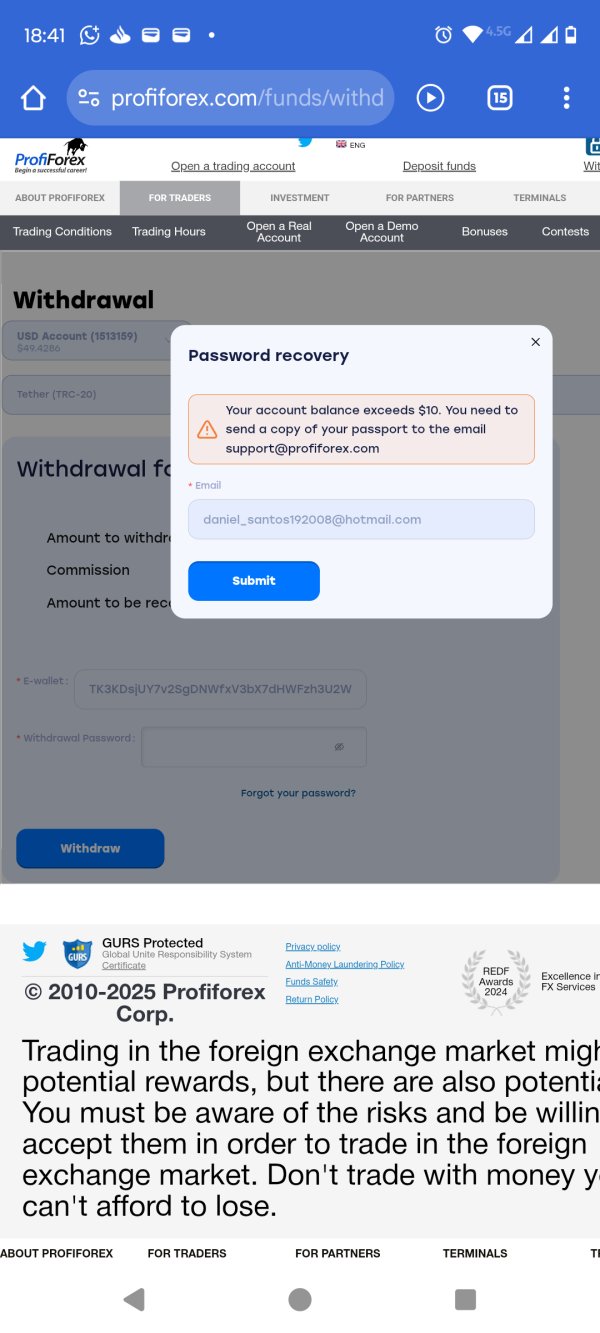

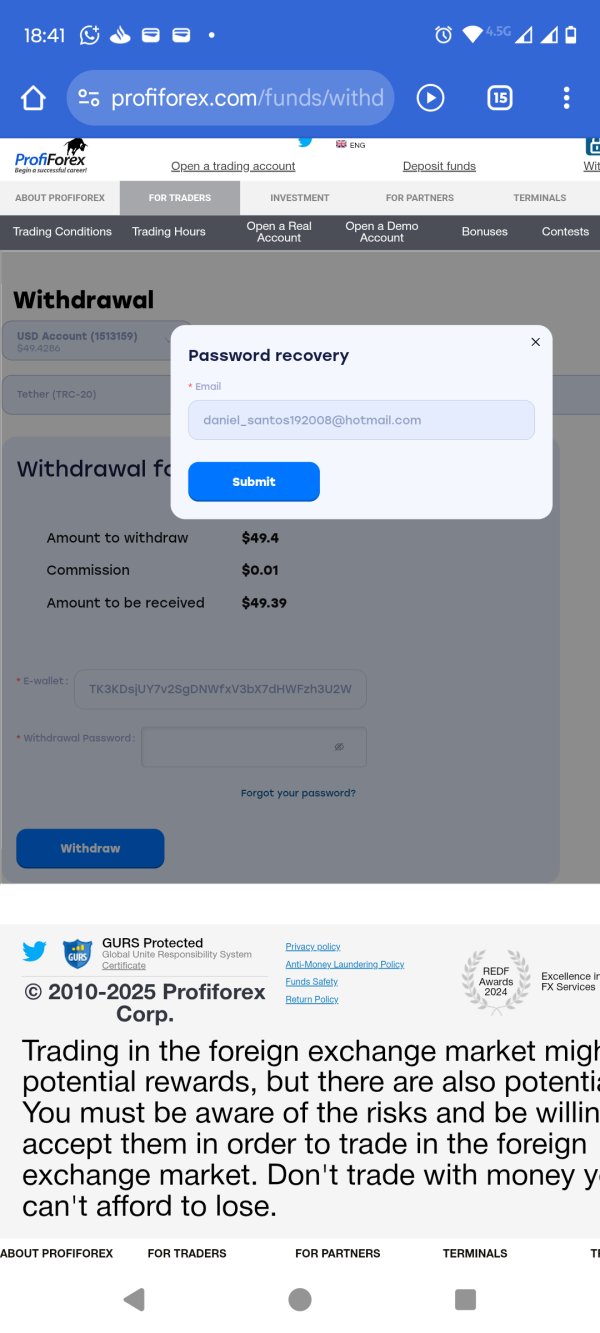

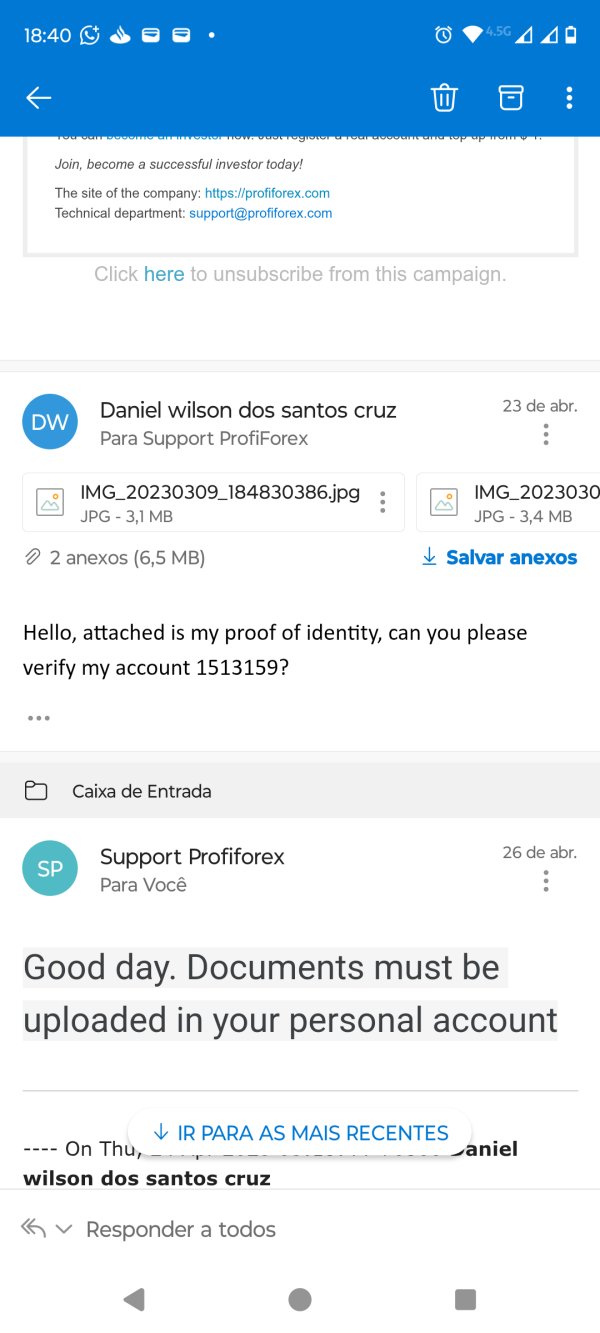

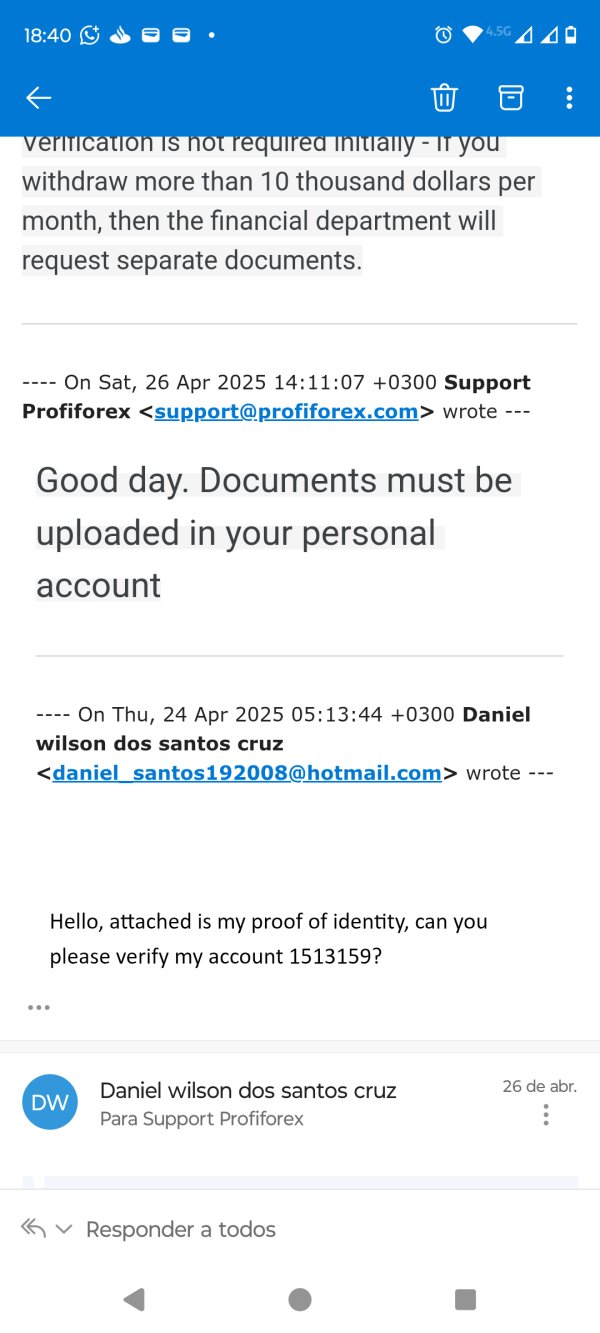

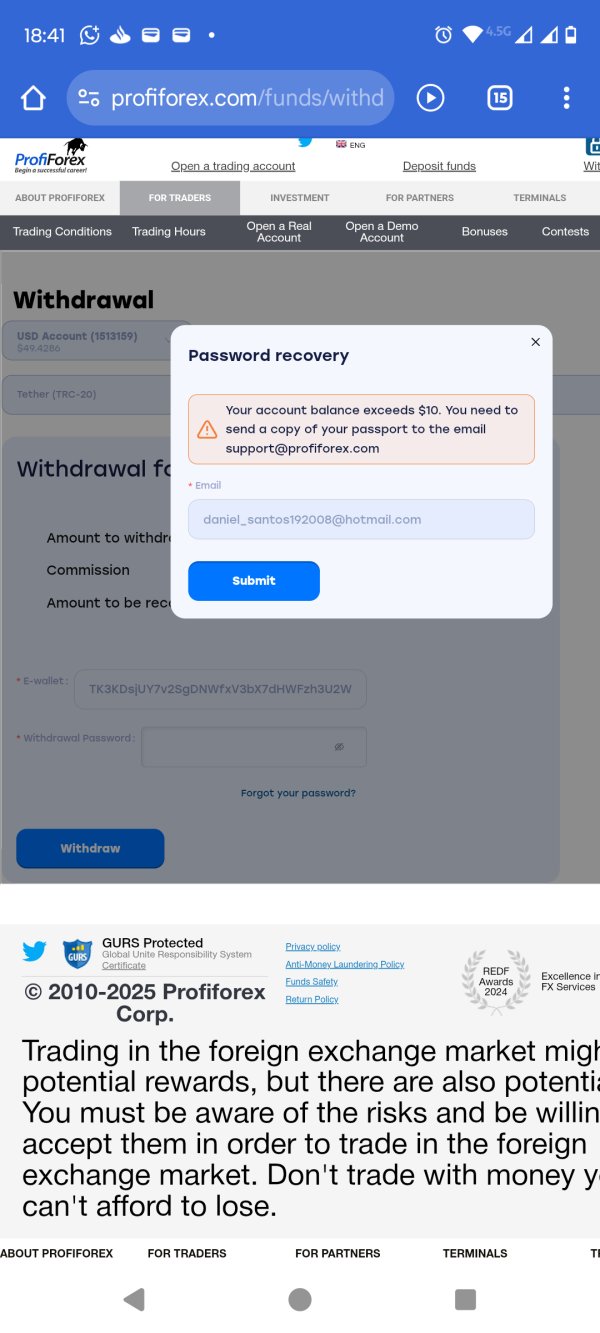

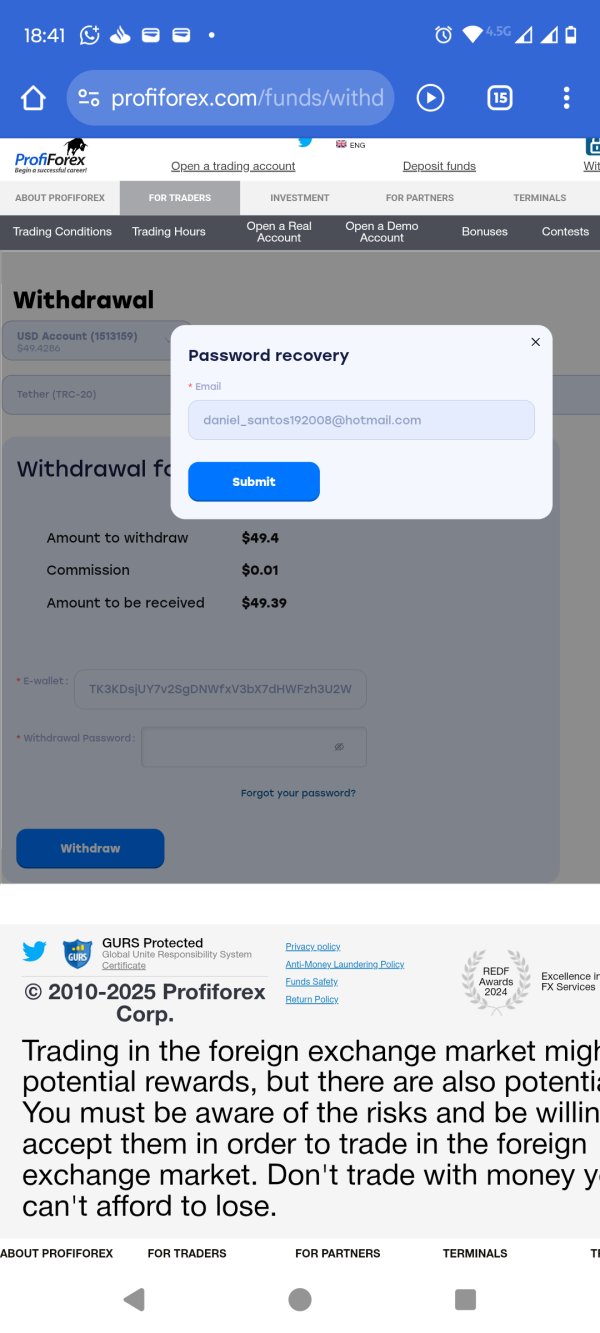

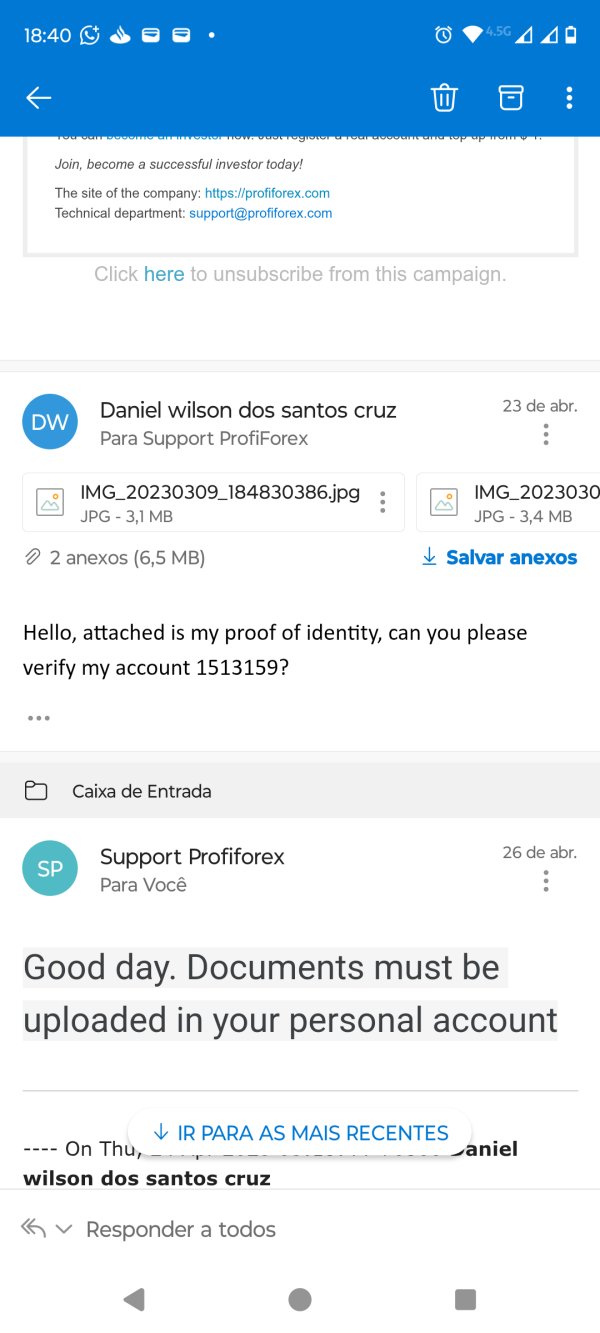

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in available public materials. Prospective clients should inquire directly about supported payment systems and processing timeframes.

Minimum Deposit Requirements: The minimum deposit threshold for account opening is not specified in publicly available documentation. This information gap requires direct communication with the broker for clarification.

Bonus and Promotions: Available materials do not detail specific bonus programs or promotional offerings. The absence of promotional information may indicate a focus on core trading services rather than marketing incentives.

Tradeable Assets: The platform supports trading in major currency pairs, contracts for difference, and precious metals. This asset selection covers fundamental forex market segments while providing exposure to commodity markets through precious metals trading.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not comprehensively available in public materials. The STP model typically involves variable spreads with potential commission structures, but specific pricing details require direct inquiry.

Leverage Options: Leverage ratios offered by Profiforex are not specified in available documentation. Given the offshore regulatory status, leverage options may vary from those available through regulated brokers.

Platform Options: The broker primarily offers MetaTrader 4 platform access. This provides traders with industry-standard charting, analysis tools, and automated trading capabilities through Expert Advisors.

Geographic Restrictions: Specific geographic limitations or service restrictions are not detailed in available public information.

Customer Support Languages: The range of languages supported by customer service is not specified in publicly available materials.

Account Conditions Analysis

The evaluation of Profiforex's account conditions faces significant limitations due to the lack of publicly available detailed information about account structures, minimum deposits, and trading terms. This transparency gap represents a notable concern for potential clients seeking to make informed decisions about their trading environment. Without clear documentation of account types, fee structures, and trading conditions, traders cannot adequately assess whether the platform meets their specific requirements.

The absence of detailed account information in this profiforex review highlights a broader issue with the broker's public communication strategy. Professional forex brokers typically provide comprehensive details about their account offerings, including different tier structures, minimum deposit requirements, and associated benefits. The limited availability of such information may indicate either a simplified account structure or insufficient transparency in client communication.

From a practical standpoint, the lack of clear account condition details creates challenges for traders attempting to budget for their trading activities or compare Profiforex with alternative brokers. Standard industry practice involves publishing comprehensive fee schedules, spread information, and account requirements to enable informed decision-making. The current information gap suggests potential clients should engage in direct communication with the broker to obtain essential account details before making commitments.

The scoring of 6/10 for account conditions reflects these transparency concerns while acknowledging that the actual trading conditions may be competitive once disclosed. The rating primarily penalizes the lack of readily available information rather than the quality of undisclosed conditions.

Profiforex's tool and resource offering centers around the MetaTrader 4 platform. This provides a solid foundation for forex trading activities. MT4's comprehensive feature set includes advanced charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and customizable indicators. This platform choice demonstrates the broker's commitment to providing traders with industry-standard functionality that supports both manual trading strategies and algorithmic approaches.

The platform's technical analysis capabilities through MT4 include access to numerous timeframes, drawing tools, and a wide range of built-in technical indicators. These features support various trading methodologies from scalping to long-term position trading. The automated trading support allows experienced traders to implement sophisticated strategies through Expert Advisors, while the platform's scripting capabilities enable custom tool development.

However, the evaluation reveals limitations in publicly available information about additional research resources, educational materials, or proprietary analytical tools that might complement the MT4 platform. Many competitive brokers enhance their MT4 offerings with daily market analysis, economic calendars, trading signals, or educational content designed to support trader development and decision-making.

The absence of detailed information about supplementary research resources, market analysis, or educational support materials limits the overall tool and resource evaluation. While MT4 provides excellent core functionality, the lack of visible additional resources may disadvantage traders who benefit from comprehensive market research and educational support in their trading activities.

Customer Service and Support Analysis

The assessment of Profiforex's customer service capabilities faces constraints due to limited publicly available information about support channels, response times, and service quality metrics. While user feedback suggests generally positive experiences with the platform, specific details about customer support infrastructure are not comprehensively documented in available materials.

The high user rating of 10.4 implies that client interactions with the broker, including support experiences, have been largely satisfactory. However, without detailed information about available communication channels such as live chat, phone support, email response times, or support desk hours, it becomes difficult to provide a comprehensive evaluation of the customer service framework.

Professional forex brokers typically offer multiple support channels including real-time chat, telephone support, email assistance, and sometimes video calling capabilities. The availability and quality of these services often correlate with overall client satisfaction and can significantly impact the trading experience, particularly during volatile market conditions when timely support becomes crucial.

The absence of detailed multilingual support information also presents a limitation in the evaluation. Given the international nature of forex trading, language support capabilities often determine accessibility for traders from different geographic regions. Without clear documentation of supported languages and regional support availability, potential international clients cannot adequately assess service accessibility.

The 7/10 rating reflects the positive user feedback while acknowledging the information gaps regarding specific support infrastructure and capabilities.

Trading Experience Analysis

The trading experience evaluation for Profiforex benefits from the notably high user rating of 10.4. This suggests that clients generally find the platform's execution and functionality satisfactory. The MetaTrader 4 platform foundation provides a stable and familiar trading environment that many forex traders prefer due to its reliability and comprehensive feature set.

The STP business model potentially contributes to trading experience quality by facilitating direct market access without dealer intervention. This approach can theoretically result in faster execution speeds and reduced conflicts of interest compared to market maker models, though specific execution statistics and performance metrics are not publicly available for verification.

Platform stability appears to be a strength based on user feedback. The high satisfaction rating suggests minimal technical issues or system downtime that could disrupt trading activities. The MT4 platform's proven track record for stability and performance likely contributes to this positive assessment, as the platform has demonstrated reliability across various broker implementations.

However, the evaluation lacks specific data about critical trading experience factors such as average execution speeds, slippage rates, requote frequency, or spread stability during volatile market conditions. These technical performance metrics significantly impact actual trading results and overall client satisfaction. Additionally, information about mobile trading capabilities and platform customization options is not detailed in available materials.

The 8/10 rating reflects the positive user feedback and MT4's proven capabilities while acknowledging the absence of specific performance data that would enable a more comprehensive assessment.

Trust and Reliability Analysis

The trust and reliability assessment for Profiforex reveals significant concerns primarily stemming from the absence of mandatory regulatory oversight. Operating under Seychelles registration without supervision from major financial authorities such as the FCA, CySEC, or ASIC creates inherent risks regarding fund security, dispute resolution, and operational oversight that potential clients must carefully consider.

Regulatory protection typically provides essential safeguards including segregated client fund requirements, compensation scheme participation, and standardized dispute resolution mechanisms. The absence of such protections means that clients must rely primarily on the broker's internal policies and business practices for fund security and fair treatment. This may not offer the same level of assurance as regulated alternatives.

The lack of publicly available information about fund segregation practices, insurance coverage, or third-party auditing further compounds trust-related concerns. Professional regulated brokers typically provide detailed information about client fund protection measures, including segregated account arrangements with tier-one banks and professional indemnity insurance coverage.

Additionally, the limited transparency regarding company ownership, financial statements, or operational history makes it difficult for potential clients to assess the broker's long-term stability and commitment to the forex industry. The absence of industry awards, regulatory recognition, or third-party certifications also limits external validation of the company's operational standards.

Despite the high user rating suggesting positive client experiences, the fundamental regulatory and transparency limitations result in a 5/10 trust rating. This reflects the elevated risks associated with unregulated forex trading.

User Experience Analysis

The user experience evaluation for Profiforex benefits significantly from the exceptional user rating of 10.4. This represents notably high client satisfaction levels. This rating suggests that despite regulatory concerns and information limitations, clients generally find the platform's functionality, interface design, and overall service delivery to meet or exceed their expectations.

The platform's emphasis on user-friendliness appears to resonate well with its target audience of both novice and experienced traders. The MetaTrader 4 platform's intuitive interface and comprehensive functionality likely contribute to positive user experiences, as MT4's familiar layout and extensive customization options accommodate various trading preferences and skill levels.

The broker's apparent focus on simplicity and accessibility may particularly benefit newer traders who might find complex platform structures overwhelming. The straightforward approach to trading access, combined with the STP model's transparency benefits, could contribute to the positive user feedback reflected in the high rating.

However, the user experience assessment faces limitations due to the absence of detailed feedback about specific platform features, registration processes, or fund management experiences. Comprehensive user experience evaluation typically includes assessment of account opening procedures, verification processes, deposit and withdrawal experiences, and ongoing platform usability.

The lack of detailed information about common user complaints, feature requests, or areas for improvement also limits the depth of user experience analysis. Professional brokers often publish client feedback summaries or platform development roadmaps that provide insights into user experience priorities and continuous improvement efforts.

The 7/10 rating acknowledges the strong user satisfaction indicators while recognizing the need for more comprehensive feedback data to support a complete user experience assessment.

Conclusion

This profiforex review reveals a broker that achieves strong user satisfaction ratings despite significant regulatory and transparency limitations. While the platform appears to deliver satisfactory trading experiences through its MT4-based offering and STP execution model, the absence of mandatory regulatory oversight and limited public information about trading conditions present considerable concerns for potential clients.

Profiforex may appeal to traders who prioritize platform functionality and execution quality over regulatory protection. This particularly applies to those comfortable with elevated risk levels associated with unregulated brokers. The high user rating suggests that existing clients find value in the platform's offerings, though the lack of detailed feedback limits understanding of specific strengths and weaknesses.

The primary advantages include apparent execution quality, user-friendly interface design, and access to standard forex trading tools through MT4. However, significant disadvantages encompass regulatory risks, limited transparency regarding trading conditions, and insufficient public information about fund protection measures. Potential clients should carefully weigh these factors against their individual risk tolerance and trading requirements before considering Profiforex as their trading platform.