Option Securities 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Option Securities, an unregulated broker operating from Argentina since its establishment in 2021, caters primarily to cost-sensitive traders across Latin America. Its low commission trading platform is designed to allure those willing to accept the substantial risks that accompany such cost-saving measures. As a financial entity that lacks regulatory oversight, potential investors should be wary about fund safety and operational integrity. With reports indicating withdrawal difficulties and customer service deficiencies, investors must assess their risk tolerance before engaging with this broker. Cost-conscious traders may find the appeal of lower commissions hard to resist, but the associated risks raise crucial questions about the brokers reliability for both new and seasoned investors.

⚠️ Important Risk Advisory & Verification Steps

- High risk of fraud: Option Securities is not regulated by any known financial authority, raising concerns about fund safety and investor protection.

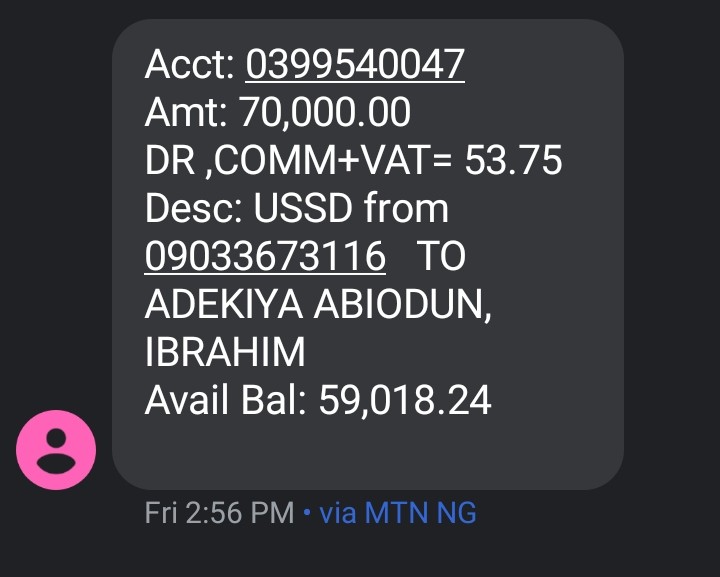

- Withdrawal issues: Users have reported delays and complications when trying to access or withdraw their funds.

- Negative customer feedback: There are multiple complaints regarding the broker's operational integrity and low customer service ratings.

To verify the legitimacy of Option Securities, follow these steps:

- Check for licensing and regulation on credible financial authority sites.

- Review customer feedback on independent platforms.

- Be vigilant about any uncertainties, especially concerning withdrawal processes.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2021, Option Securities operates out of Argentina, deliberately positioning itself as a low-cost alternative for traders looking to capitalize on commission savings. However, its lack of regulatory oversight raises red flags about its reliability and the safety of client funds, as highlighted by an overall score of 1.38 out of 10 from WikiFX. This rating underscores the potential dangers traders might face by engaging with an unregulated broker.

Core Business Overview

Option Securities primarily offers a trading platform that includes forex and CFD options. Despite its marketing as an accessible trading option, critical aspects such as regulatory compliance, operational transparency, and trustworthiness remain unanswered. The absence of established regulatory bodies monitoring the broker adds to the overall apprehension surrounding its integrity.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The unregulated status of Option Securities poses serious risks for traders. This lack of oversight compromises the safety of funds, as investors have limited recourse in the event of disputes or unethical conduct.

Analysis of Regulatory Information Conflicts: The absence of regulation by recognized authorities means that Option Securities does not adhere to the stringent standards expected of licensed brokers. This can result in higher risks for traders, including fraud and fund mismanagement.

User Self-Verification Guide:

Visit the websites of reputable financial regulatory bodies to check for broker licensing.

Read through user reviews on independent review sites to assess the brokers operational history.

Verify withdrawal processes and responsiveness to user inquiries.

Industry Reputation and Summary: User feedback suggests a troubling trend of withdrawal issues and inadequate customer support, indicating that potential traders must exercise extreme caution when dealing with Option Securities.

Trading Costs Analysis

The allure of low-cost trading can often obscure the hidden traps within the fee structure.

Advantages in Commissions: Option Securities promotes itself by offering competitive commissions, appealing directly to cost-sensitive traders. However, specific fee structures remain largely undisclosed, which is a cause for concern.

The "Traps" of Non-Trading Fees:

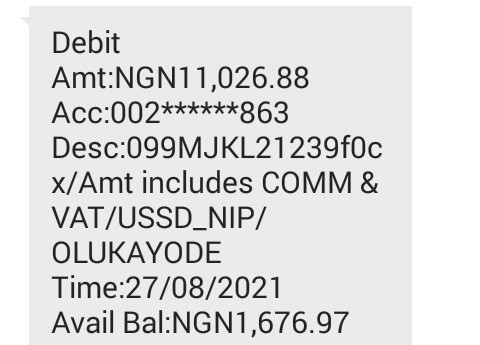

"Users have reported withdrawal fees and operational costs that were significantly higher than initially advertised, with complaints of fees reaching upwards of $50."

- Cost Structure Summary: While lower commissions may attract fledgling traders, the lack of transparency regarding additional fees could lead to unexpected expenses that negate any perceived advantages.

The focus on platform usability is critical, especially for preventing operational mishaps.

Platform Diversity: While Option Securities claims to offer a diverse trading platform, reviews indicate a lack of advanced tools or features that are crucial for more experienced traders.

Quality of Tools and Resources: Limited availability of educational materials further hinders the ability of novices to navigate the trading environment effectively.

Platform Experience Summary: Feedback points toward a significant gap in user satisfaction, particularly regarding the reliability and functionality of the platform.

User Experience Analysis

User experience is central to trading success, yet glaring shortcomings have been reported.

Design and Usability: Users have commented on the platform's design but often report significant frustration with its reliability and performance, impacting their trading experience.

Satisfaction Ratings: A general consensus indicates that user experiences have been hindered by operational issues and delays in response from the support staff, leading to dissatisfaction.

User Insights Summary: The overwhelming negative feedback on user experience highlights a systemic problem within Option Securities, suggesting that this platform may not meet the needs of its traders effectively.

Customer Support Analysis

Customer support can profoundly affect investor confidence and satisfaction.

Support Channels: Option Securities provides customer service through phone and email, yet reports indicate slow response times and unfulfilled support requests.

Customer Feedback: A pattern of unresolved complaints about poor customer support has been observed, further eroding trust in the broker.

Service Level Summary: The existing issues in customer support necessitate a reassessment of its viability, particularly for traders who might rely on timely assistance.

Account Conditions Analysis

The conditions under which accounts are opened and maintained significantly influence trading effectiveness.

Transparency in Conditions: The details regarding account conditions remain vague, which can create ambiguity for potential clients.

Minimum Deposit Requirements: The lack of clear information about minimum deposits can deter traders wary of hidden stipulations.

Overall Assessment: Options Securities' ambiguous account conditions may not appeal to prudent investors seeking clarity and security.

Conclusion and Recommendations

In summary, Option Securities presents an opportunity that is fraught with risks. While low trading costs may seem beneficial, the broker's unregulated status, withdrawal complications, and poor customer service record overshadow these potential gains. Traders are highly advised to conduct thorough research and consider alternative, better-regulated brokers that can provide both robust trading opportunities and enhanced security for their investments. It is paramount for investors to prioritize regulatory safety and transparent operational practices when selecting a trading partner.