PrimeX Capital 2025 Review: Everything You Need to Know

Executive Summary

This primex capital review gives you a complete look at a multi-asset investment firm that has caught attention in the CFD markets. PrimeX Capital says it's a global, award-winning leader that serves over 250,000 clients around the world. The broker lets you start with just $10, which makes it easy for beginners and small investors to get started. You can trade forex, stocks, indices, CFDs, and precious metals on their platform.

Our review shows mixed results. PrimeX Capital does well with customer service and low costs to start trading, but there are serious concerns about regulation and trust that you should think about carefully. The broker seems to focus on retail traders who want modern tools and support in different languages, though we don't have many details about their actual platform. This review uses all available information and user feedback to help you decide if this broker is right for you.

Important Disclaimers

You should know that rules and oversight for PrimeX Capital change a lot between different countries. The broker's legal status and services might be different where you live, so always check your local financial rules before you open an account.

This review uses public information, user feedback, and industry reports that were available when we wrote it. We haven't tested their platform services ourselves. Market conditions, rule changes, and company policies might make this information less accurate over time, so you should check everything directly with the broker and do your own research before you make any trading decisions.

Rating Framework

Broker Overview

PrimeX Capital started in 2021 and quickly became a multi-asset investment firm with big goals. The company says its main office is in the United Arab Emirates and claims to serve over 250,000 clients worldwide. They present themselves as an award-winning leader in CFD markets, focusing on new and reliable trading solutions for both regular and professional traders.

The broker's business focuses on CFD trading across many different types of assets. PrimeX Capital gives you access to forex pairs, individual stocks, market indices, contracts for difference, and precious metals trading. According to tradingbrokers.com, the platform has attracted traders from many backgrounds by focusing on new technology and flexible account options. The company's fast growth and focus on modern trading tools have made it visible in the competitive online trading world, though this growth has also brought questions about following rules and being transparent.

Regulatory Jurisdiction: PrimeX Capital works under the Mauritius Financial Services Commission with license number GB23202141. But the lack of clear regulatory information in different areas raises questions about complete oversight.

Deposit and Withdrawal Methods: We don't have specific information about how you can deposit and withdraw money, which might worry traders who want to know about funding options.

Minimum Deposit Requirements: The broker sets a very low minimum deposit of just $10, making it one of the easiest options for new traders and those with limited starting money.

Bonus and Promotional Offers: Current promotions and bonus structures aren't clearly explained in available materials, suggesting either limited promotional offers or not enough transparency in marketing.

Tradeable Assets: The platform gives you access to many financial instruments including major and minor forex pairs, individual stocks, global market indices, various CFDs, and precious metals like gold and silver.

Cost Structure: Available information says PrimeX Capital offers competitive spreads, though specific commission structures and extra fees aren't clearly detailed in public documentation.

Leverage Ratios: Specific leverage offerings aren't mentioned in available materials, which is concerning since this information is important for managing risk.

Platform Options: The exact trading platforms available through PrimeX Capital aren't specified in current documentation, limiting traders' ability to judge technological capabilities.

Geographic Restrictions: Specific regional limitations or restricted areas aren't clearly outlined in available information.

Customer Support Languages: While multilingual support is mentioned, the specific languages offered aren't detailed in current materials.

This primex capital review shows significant information gaps that potential clients should address directly with the broker before moving forward.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

PrimeX Capital's account conditions show a mixed picture that earns a solid but not perfect rating. The best feature is the very low minimum deposit requirement of just $10, which makes it much easier for new traders to start. This accessibility makes the broker especially attractive to beginners who want to test live trading without spending a lot of money.

However, our evaluation is limited because we don't have detailed information about specific account types and their features. Available documentation doesn't clearly explain whether the broker offers different account levels, Islamic accounts for Muslim traders, or professional accounts with better features. The lack of detailed information about how to open accounts and verification requirements also affects our overall assessment.

While competitive spreads are mentioned, the lack of transparency about commission structures and additional fees creates uncertainty about the real cost of trading. The broker's focus on CFD markets suggests sophisticated account features, but without specific details about margin requirements, position sizing, or risk management tools, traders can't fully evaluate the account conditions.

User feedback about account conditions is limited in available sources, making it hard to assess real-world experiences with account functionality and management. This primex capital review recommends that potential clients ask for detailed account specifications directly from the broker before making commitments.

The tools and resources offered by PrimeX Capital get a moderate rating because we have limited specific information about what the platform can do. According to tradingbrokers.com, the broker emphasizes modern trading tools and new technology, but detailed descriptions of these tools aren't easily available in public documentation.

The platform seems to focus on providing modern trading solutions, though specific features like advanced charting, technical analysis tools, or automated trading support aren't clearly outlined. This lack of detail makes it challenging for traders to assess whether the platform meets their specific analytical and execution needs.

Educational resources, which are crucial for trader development, aren't mentioned in available materials. The absence of information about market analysis, economic calendars, trading guides, or webinar programs suggests either limited educational offerings or poor communication of available resources.

Research and analysis capabilities are similarly unclear, with no specific mention of fundamental analysis tools, market commentary, or professional research reports. For traders who rely on comprehensive market analysis, this information gap is concerning.

The moderate rating reflects the potential for adequate tools based on the broker's technology focus, but the lack of transparency and detailed information prevents a higher assessment.

Customer Service and Support Analysis (8/10)

Customer service emerges as one of PrimeX Capital's stronger areas, earning a notably high rating based on available user feedback. According to user reviews, the broker shows good customer service quality with representatives who are described as professional and helpful rather than showing poor attitudes or unprofessional behavior.

User testimonials specifically mention positive experiences with customer service representatives, noting that staff members are "nice" and provide adequate support without negative attitudes. This positive feedback suggests that the broker has invested in training customer service personnel and maintaining service quality standards.

The broker claims to offer multilingual customer support, which would be valuable for its international client base of over 250,000 traders. However, specific details about available languages, support channels, and operating hours aren't clearly documented in available materials.

Response times and service availability aren't specifically mentioned in user feedback, though the generally positive tone of customer service reviews suggests reasonable accessibility. The lack of detailed information about support channels (phone, email, live chat) and escalation procedures prevents a perfect rating.

The high rating reflects consistently positive user experiences with customer service interactions, though more detailed information about support infrastructure would strengthen the assessment.

Trading Experience Analysis (6/10)

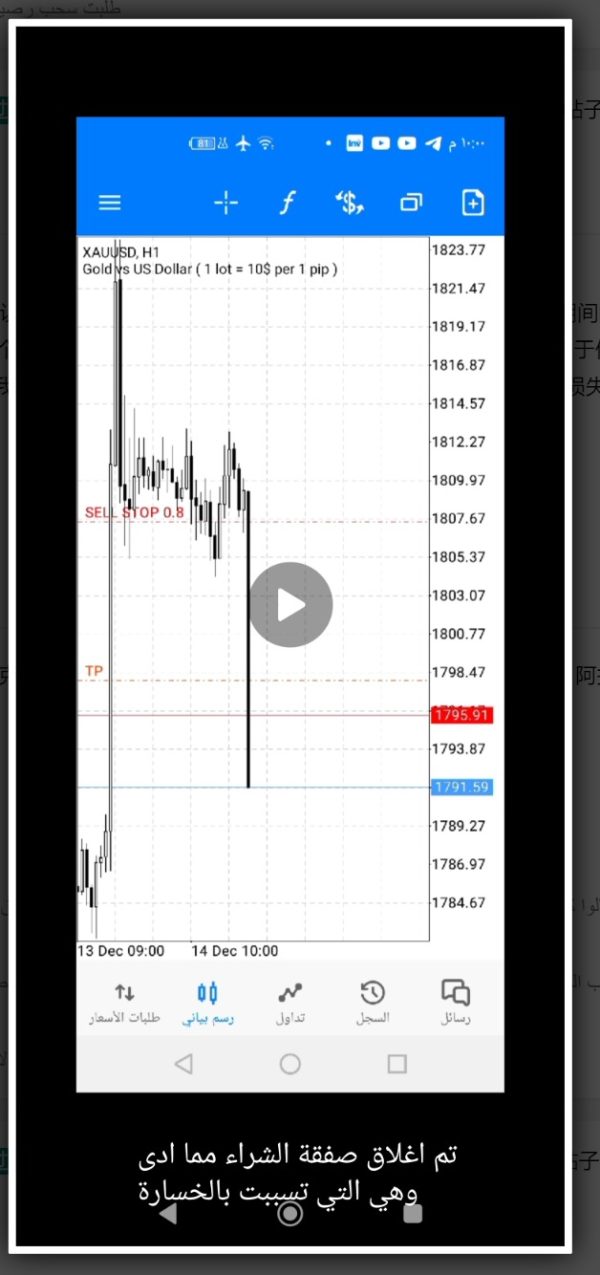

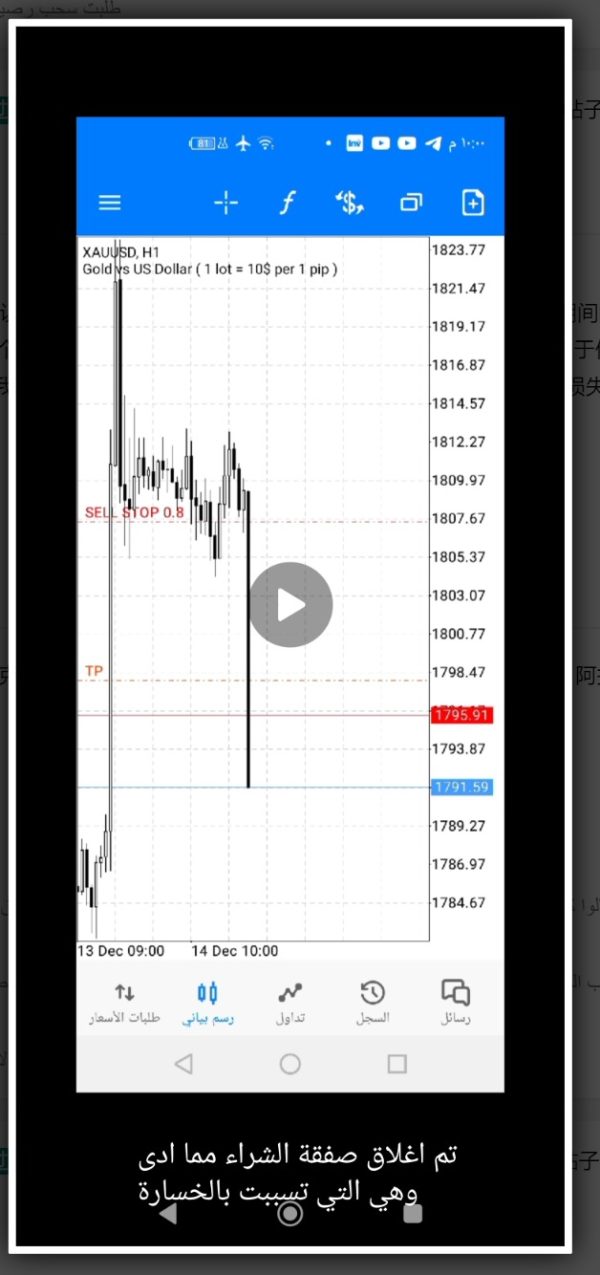

The trading experience evaluation for PrimeX Capital is limited by insufficient specific information about platform functionality and execution quality. While the broker positions itself as offering modern trading solutions, detailed assessments of platform stability, execution speed, and overall user experience aren't readily available in public documentation.

Order execution quality, a critical factor for trading success, lacks specific documentation about slippage rates, requote frequency, or execution speed metrics. This absence of performance data makes it difficult for traders to assess whether the platform can meet their execution requirements, especially for active trading strategies.

Platform functionality details are notably absent from available materials. Information about mobile trading capabilities, advanced order types, risk management tools, and platform customization options isn't clearly provided. This primex capital review finds this lack of detail concerning for traders who require specific platform features.

The competitive spreads mentioned by the broker suggest potentially favorable trading conditions, though without information about liquidity providers or market depth, traders can't fully assess the trading environment quality. Real-world user feedback about trading experience is limited in available sources.

The moderate rating reflects the potential for adequate trading conditions based on the broker's focus on modern technology, but the significant information gaps prevent a higher assessment until more detailed platform specifications become available.

Trust and Credibility Analysis (4/10)

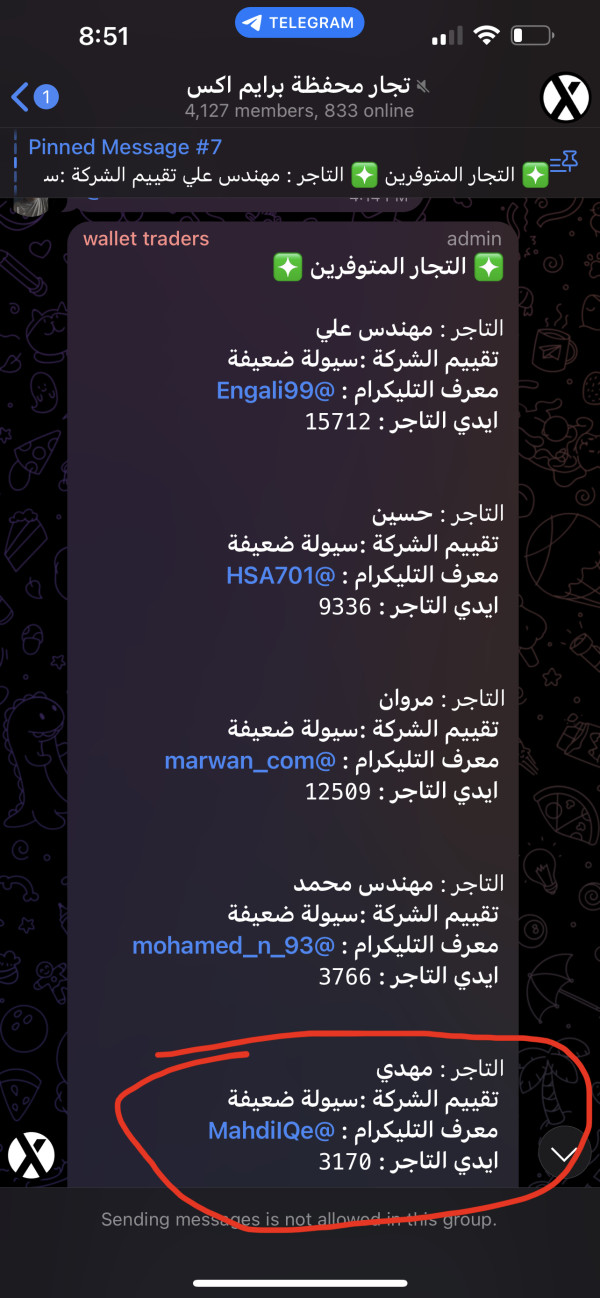

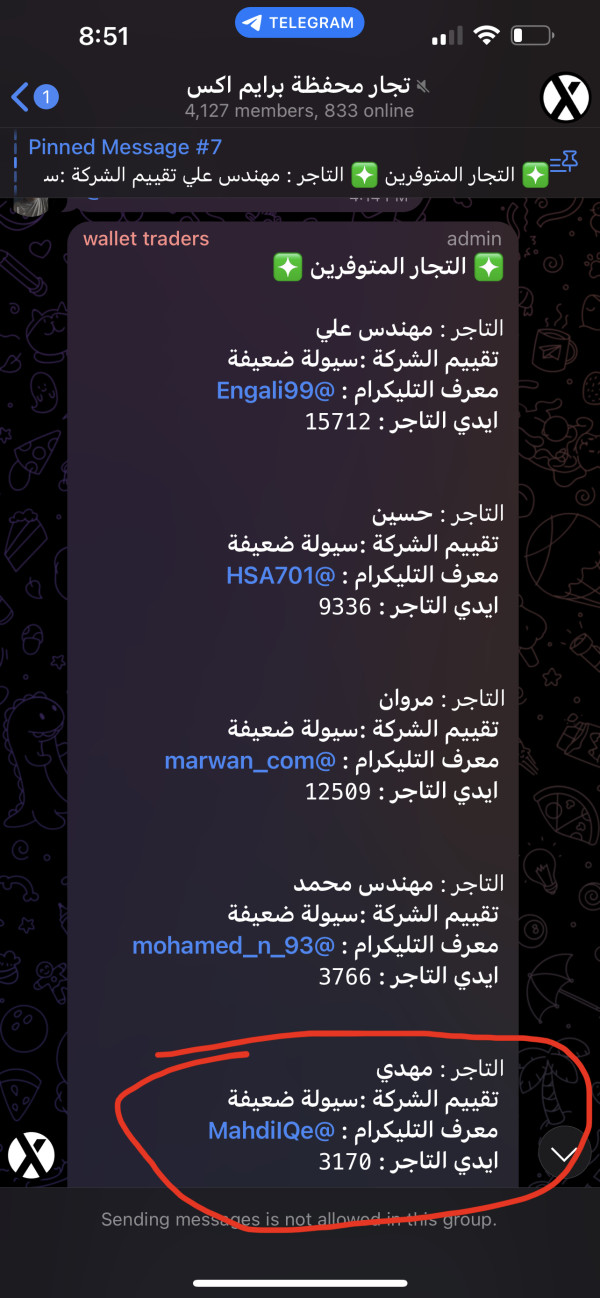

Trust and credibility represent significant concerns for PrimeX Capital, resulting in the lowest rating among all evaluated categories. The broker holds a license from the Mauritius Financial Services Commission (license number GB23202141), but this single regulatory jurisdiction may not provide the comprehensive oversight that many traders expect from international brokers.

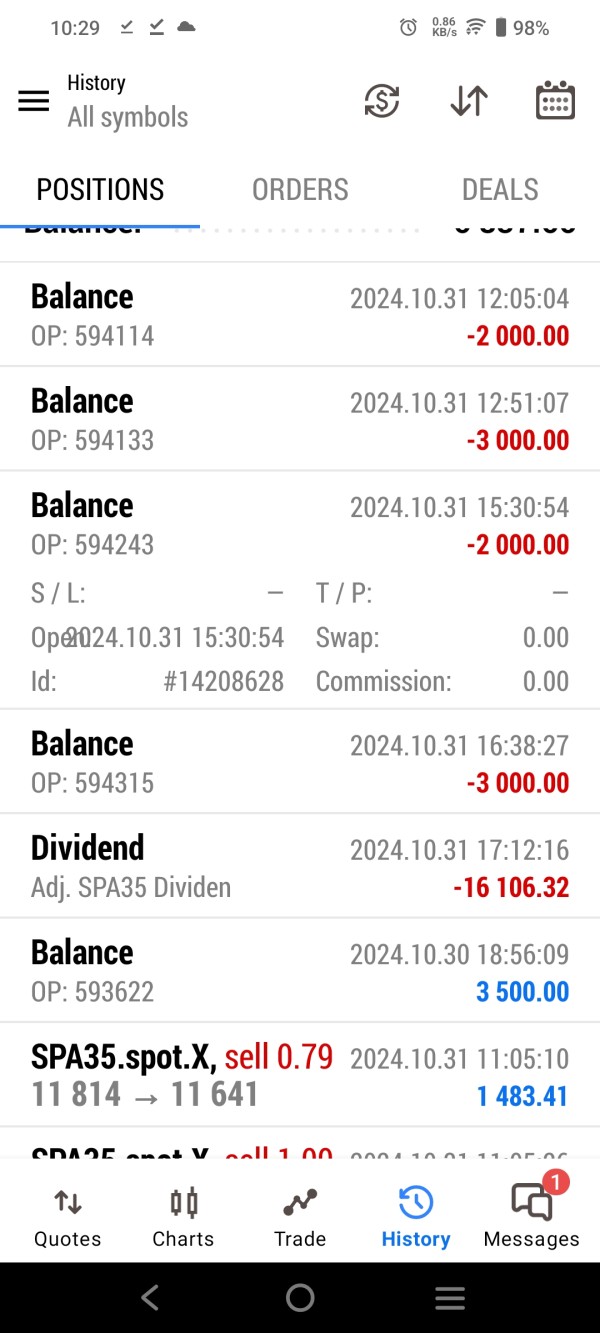

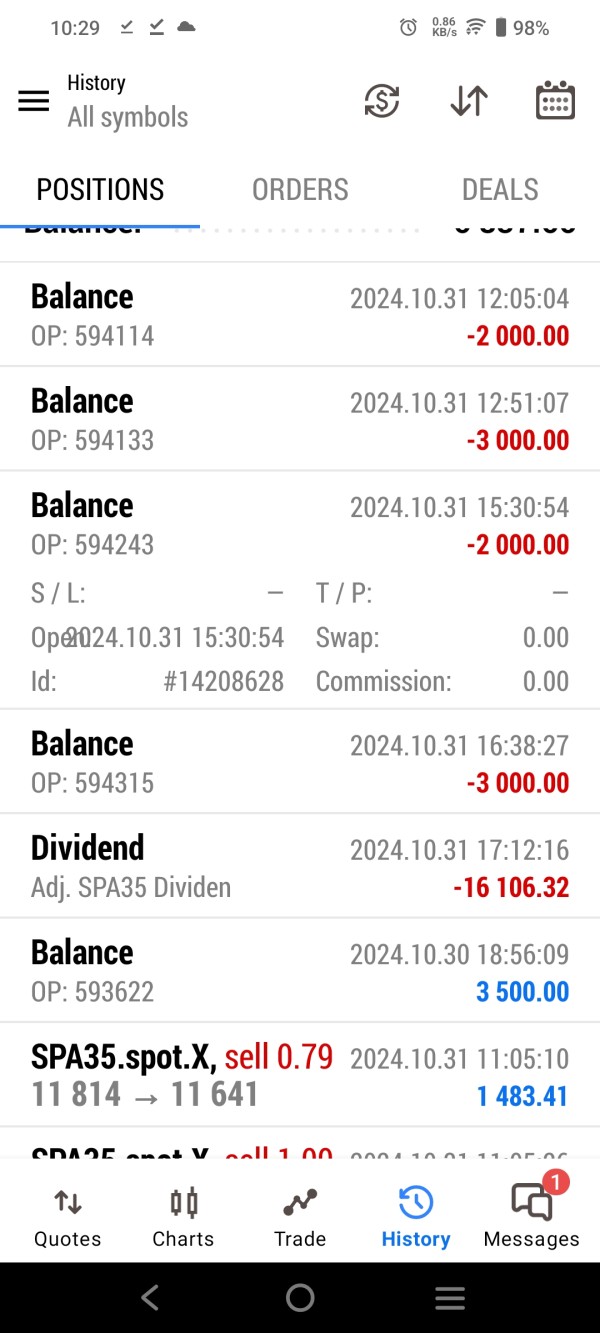

According to available information, there have been negative reports and concerns about the broker's credibility. User complaints about reliability have been noted, which directly impacts the trust assessment. These credibility issues are particularly concerning given the broker's relatively recent establishment in 2021 and rapid claimed growth.

The lack of clear regulatory information across multiple jurisdictions raises questions about the broker's commitment to comprehensive compliance. Many established brokers maintain licenses in multiple regulatory environments to demonstrate their commitment to regulatory standards and client protection.

Fund safety measures, segregation of client funds, and investor protection schemes aren't clearly detailed in available documentation. This transparency gap is significant for traders concerned about the security of their deposits and the broker's financial stability.

The regulatory status with the Mauritius Financial Services Commission provides some oversight, but the jurisdiction's regulatory framework may not offer the same level of protection as more established financial centers. Combined with negative credibility reports, this creates substantial trust concerns that potential clients should carefully consider.

User Experience Analysis (5/10)

User experience evaluation reveals a mixed picture that results in a middle-ground rating. Available feedback presents both positive and negative aspects of the PrimeX Capital experience, creating an overall neutral assessment that reflects the broker's inconsistent performance across different user touchpoints.

Positive user feedback primarily centers on customer service interactions, where users report satisfactory experiences with support staff. The low minimum deposit requirement of $10 also contributes positively to user accessibility, particularly for beginning traders who appreciate the low barrier to entry.

However, negative feedback about the broker's reliability and credibility significantly impacts the overall user experience assessment. Complaints about trustworthiness create uncertainty about long-term relationships with the broker and may affect user confidence in platform reliability.

The broker's target demographic appears to be beginners and small-scale investors, based on the low minimum deposit and accessible account structure. This positioning aligns with the needs of traders seeking entry-level opportunities, though more experienced traders may find the platform lacking in advanced features.

Interface design and platform usability information isn't detailed in available documentation, preventing assessment of the technical user experience. Similarly, registration and verification processes aren't clearly outlined, making it difficult to evaluate the onboarding experience.

The moderate rating reflects the balance between positive customer service experiences and concerning credibility issues, suggesting that while some aspects of the user experience may be satisfactory, significant concerns remain about overall reliability and trustworthiness.

Conclusion

This primex capital review reveals a broker with notable strengths in accessibility and customer service, but significant concerns about credibility and transparency. PrimeX Capital's extremely low $10 minimum deposit requirement and reported quality customer service make it potentially attractive to beginners and small-scale investors seeking entry into CFD trading.

However, the credibility concerns, limited regulatory oversight, and lack of detailed platform information create substantial risks that traders must carefully consider. The broker may be suitable for new traders willing to start with minimal capital while accepting higher regulatory and credibility risks, but experienced traders seeking comprehensive oversight and transparency may find better options elsewhere.

Potential clients should conduct thorough due diligence, verify all information directly with the broker, and consider starting with minimal deposits while carefully monitoring their experience before committing significant capital.