Regarding the legitimacy of PRIMEX forex brokers, it provides FSC and WikiBit, .

Is PRIMEX safe?

Pros

Cons

Is PRIMEX markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

PrimeX Capital LTD

Effective Date:

2023-12-29Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

20 Edith Cavell Street Port Louis Level 6 Ken Lee Building, Mauritius / 20, Edith Cavell Street Port Louis Level 6 Ken Lee Building, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is PrimeX Capital A Scam?

Introduction

PrimeX Capital, a relatively new player in the forex market, was established in 2022 and is based in South Africa. As the forex trading landscape continues to expand, traders are increasingly faced with an array of options, making it essential for them to evaluate brokers carefully. The need for due diligence stems from the prevalence of scams and fraudulent activities in the industry. This article aims to provide a comprehensive analysis of PrimeX Capital, examining its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and associated risks. Our investigation is based on various online sources, including reviews, regulatory disclosures, and user feedback, ensuring an objective and thorough evaluation.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and the safety of client funds. PrimeX Capital claims to be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. However, it is important to note that the broker has received negative disclosures from the FSCA, raising concerns about its compliance with regulatory standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 51864 | South Africa | Exceeded |

The FSCA is known for its stringent regulations, designed to protect traders and ensure fair practices. However, PrimeX Capital has faced scrutiny due to its lack of transparency and the negative feedback it has received. The presence of complaints regarding fund withdrawals and customer service further complicates its regulatory standing. Traders should be aware that operating under a regulatory authority does not guarantee safety if the broker fails to comply with the rules.

Company Background Investigation

PrimeX Capital, operating under PrimeX Broker (Pty) Ltd, has a short history since its inception in 2022. The company is registered in Saint Vincent and the Grenadines, a region often associated with lax regulatory oversight. This offshore registration raises red flags about the broker's legitimacy and operational practices.

The management team behind PrimeX Capital comprises professionals with varying degrees of experience in the financial industry. However, the lack of detailed information about their backgrounds and qualifications leaves room for skepticism regarding the firm's operational integrity. Transparency is crucial in building trust, and the absence of comprehensive disclosures about the company's ownership structure and team can lead to concerns among potential clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. PrimeX Capital offers various account types with differing minimum deposit requirements, spreads, and leverage options. However, a closer examination reveals some concerning aspects of its fee structure.

| Fee Type | PrimeX Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 0.5 - 1.0 pips |

| Commission Model | No commissions | $5 - $10 per lot |

| Overnight Interest Range | Variable | Variable |

While the spreads may appear competitive, the overall fee structure lacks clarity. Traders should be cautious of hidden fees or unfavorable terms that may arise during trading. Additionally, the absence of negative balance protection leaves traders exposed to the risk of losing more than their initial investment, which is a significant concern for risk-averse individuals.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. PrimeX Capital claims to implement various security measures; however, the specifics remain vague. The broker does not provide clear information regarding the segregation of client funds or investor protection schemes.

The FSCA's regulations typically require brokers to maintain segregated accounts to protect client funds in case of insolvency. However, the negative disclosures against PrimeX Capital raise questions about whether these practices are being followed. Furthermore, the absence of negative balance protection means that traders may find themselves liable for debts incurred during trading, which is a significant risk.

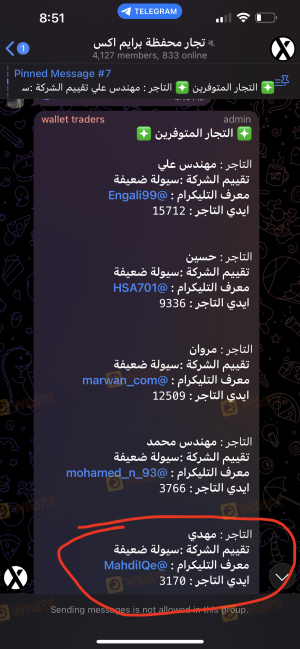

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reliability. PrimeX Capital has received numerous complaints regarding issues such as withdrawal delays, poor customer service, and account restrictions. These complaints highlight potential operational inefficiencies and a lack of responsiveness from the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow to respond |

| Customer Service | Medium | Inconsistent |

| Account Restrictions | High | Unresolved |

Typical cases involve clients reporting difficulties in accessing their funds or receiving inadequate support when addressing their concerns. Such patterns of complaints can indicate systemic issues within the company, warranting caution for potential traders.

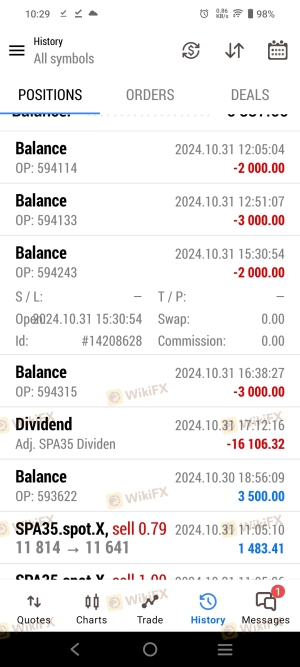

Platform and Execution

PrimeX Capital utilizes the MetaTrader 5 platform, which is widely regarded for its user-friendly interface and robust features. However, user experiences indicate that the platform may suffer from performance issues, including slippage and order rejections.

Traders have reported instances of experiencing delays during high volatility periods, which can significantly impact trading outcomes. Furthermore, allegations of potential platform manipulation have surfaced, leading to concerns about the integrity of the trading environment.

Risk Assessment

Engaging with PrimeX Capital comes with a set of risks that potential traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of credible regulation and negative disclosures. |

| Fund Security | High | Unclear fund segregation and absence of investor protection. |

| Customer Service | Medium | Numerous complaints regarding responsiveness and resolution. |

| Platform Reliability | Medium | Reports of execution issues and potential manipulation. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers with established reputations. Additionally, implementing sound risk management strategies is crucial when trading with any broker.

Conclusion and Recommendations

In conclusion, while PrimeX Capital presents itself as a competitive forex broker, the evidence suggests that potential traders should approach with caution. The combination of negative regulatory disclosures, numerous customer complaints, and concerns regarding fund security raises significant red flags.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternatives with proper regulatory oversight, transparent fee structures, and proven track records of customer satisfaction. Brokers regulated by reputable authorities, such as the FCA, ASIC, or CySEC, should be prioritized to ensure a safer trading experience. Always remember to conduct due diligence before committing funds to any trading platform.

Is PRIMEX a scam, or is it legit?

The latest exposure and evaluation content of PRIMEX brokers.

PRIMEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PRIMEX latest industry rating score is 6.12, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.12 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.