Panthera Trade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive panthera trade review examines a broker that operates without proper regulatory oversight from its base in Saint Vincent and the Grenadines. Panthera Trade was established in 2017 under the LegoMarket LLC group. The platform presents significant safety concerns for potential investors due to its unregulated status and lack of transparency in crucial operational areas.

The platform offers trading opportunities across 32 currency pairs, precious metals including gold, silver, and platinum, plus popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. This asset diversity may appeal to traders seeking varied market exposure. However, the absence of regulatory protection and transparent operational practices raises serious red flags about the platform's legitimacy and safety.

Multiple industry sources and user feedback consistently highlight concerns about the broker's trustworthiness. Several reports suggest potential fraudulent activities. The lack of clear information regarding spreads, commissions, minimum deposits, and leverage ratios further compounds transparency issues that experienced traders typically consider essential when evaluating a broker's credibility.

Important Notice

Panthera Trade operates as an unregulated forex broker. This means its activities lack legal safeguards typically provided by recognized financial authorities. Investors should exercise extreme caution when considering this platform, particularly given the jurisdictional challenges that may arise in cross-border trading disputes.

This review is based on publicly available information and user feedback from various sources. The analysis has not involved direct testing of the platform's services. Readers should conduct their own due diligence before making any investment decisions.

Overall Rating Framework

Broker Overview

Company Background and Establishment

Panthera Trade entered the forex brokerage market in 2017. The company positioned itself as part of the LegoMarket LLC group. The company operates from Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment for financial services. According to available information, the broker employs ECN and STP execution models. However, specific details about their implementation remain unclear.

The broker's relatively recent establishment in the competitive forex market raises questions about its commitment to regulatory compliance and client protection. Its choice of jurisdiction also creates concerns. Saint Vincent and the Grenadines, while legitimate, does not provide the same level of investor protection as major financial centers like the UK, Cyprus, or Australia.

Trading Platform and Asset Coverage

This panthera trade review reveals that the platform focuses on three main asset categories. The forex offering includes 32 currency pairs, covering major, minor, and some exotic pairs. However, the specific pairs available are not detailed in publicly accessible information. The precious metals section encompasses traditional safe-haven assets including gold, silver, and platinum, appealing to traders seeking portfolio diversification during market volatility.

The cryptocurrency offering includes popular digital assets such as Bitcoin, Ethereum, and Litecoin. This reflects the growing demand for crypto trading opportunities. However, the absence of detailed information about trading conditions, platform features, and execution quality makes it difficult for potential clients to make informed comparisons with established competitors in the market.

Regulatory Status and Jurisdiction

Panthera Trade operates without oversight from major financial regulatory bodies such as the FCA, CySEC, or ASIC. The Saint Vincent and the Grenadines jurisdiction provides minimal investor protection compared to established financial centers.

Deposit and Withdrawal Methods

Specific information regarding funding options, processing times, and associated fees is not available in the accessible documentation. This represents a significant transparency gap.

Minimum Deposit Requirements

The platform has not disclosed minimum deposit thresholds for different account types. This makes it impossible for potential clients to assess accessibility and account tier structures.

Promotional Offers and Bonuses

Available information does not include details about welcome bonuses, deposit incentives, or ongoing promotional programs. These might be available to traders.

Tradeable Assets Portfolio

The broker offers forex trading across 32 currency pairs. It also provides precious metals trading including gold, silver, and platinum, and cryptocurrency trading featuring Bitcoin, Ethereum, and Litecoin. However, specific contract specifications and trading conditions remain undisclosed.

Cost Structure and Fees

Critical pricing information including spreads, commission structures, overnight financing rates, and withdrawal fees are not transparently disclosed. This makes cost comparison with competitors impossible.

Leverage and Margin Requirements

Information regarding maximum leverage ratios, margin requirements, and risk management tools is notably absent from available documentation.

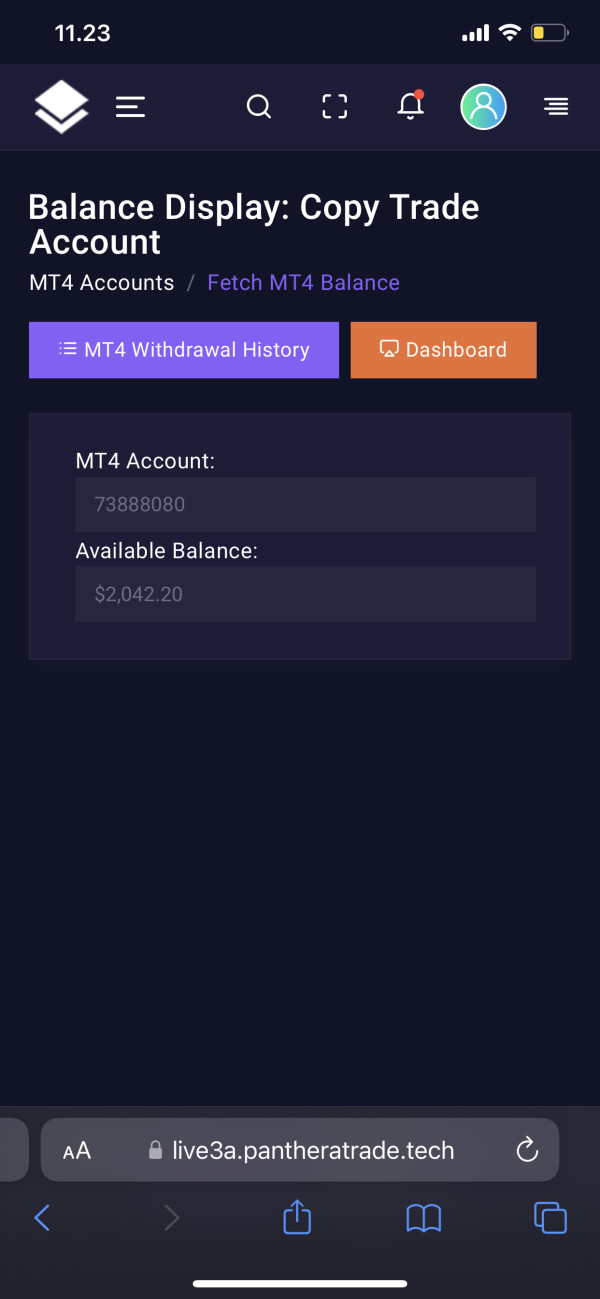

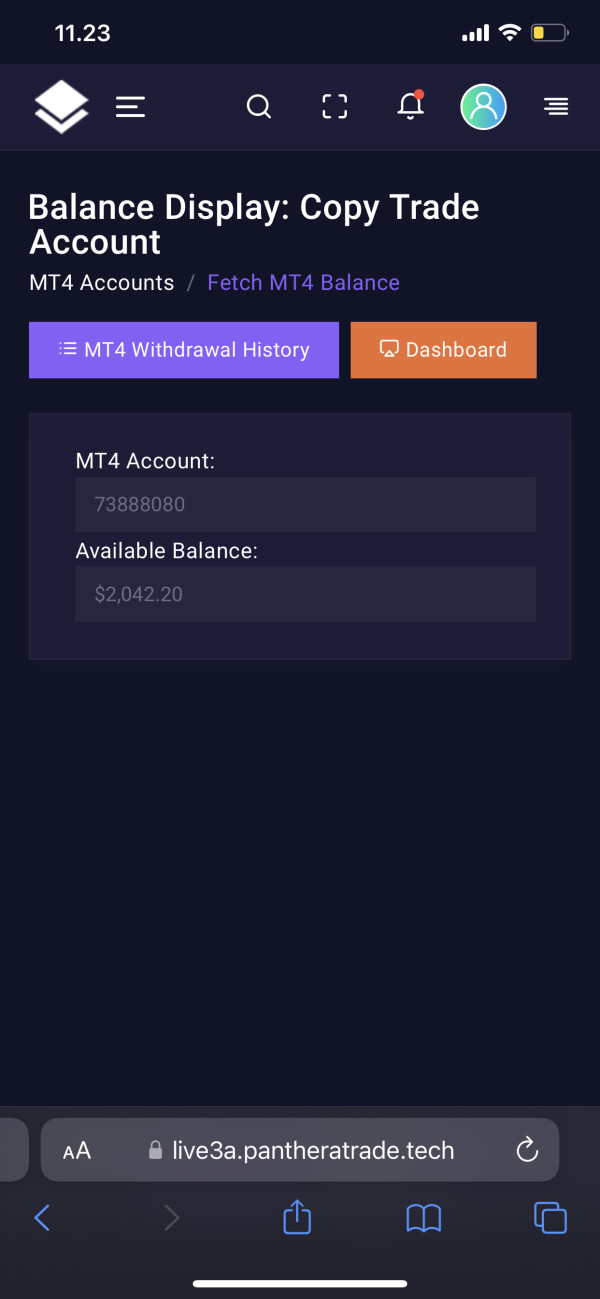

Platform Technology

Specific trading platform details remain unspecified in the panthera trade review materials. This includes whether MT4, MT5, or proprietary platforms are offered.

Geographic Restrictions

The broker has not clearly outlined which jurisdictions are restricted from accessing their services. This creates potential legal compliance issues for international clients.

Customer Support Languages

Available customer service languages and support channels are not specified in the accessible information.

Detailed Scoring Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions evaluation reveals significant deficiencies in transparency and competitive positioning. Panthera trade review sources consistently highlight the absence of fundamental account information that professional traders require for informed decision-making. The platform fails to disclose account type variations, minimum deposit requirements, or tier-based benefits that are standard industry practices.

Most concerning is the complete lack of information regarding spreads, commission structures, and leverage options. Established brokers typically provide detailed pricing schedules and account specifications upfront. This allows traders to calculate potential costs and compare offerings. The absence of this information suggests either poor operational transparency or potentially unfavorable terms that the broker prefers not to disclose publicly.

User feedback indicates frustration with unclear account terms and unexpected costs that only become apparent after funding accounts. The account opening process reportedly lacks clarity. Some users report difficulty understanding what services they are actually purchasing. Compared to regulated competitors who must maintain transparent fee structures, Panthera Trade's opaque approach to account conditions represents a significant disadvantage and potential red flag for serious traders.

The tools and resources assessment shows mixed results. The platform earns points for asset diversity but loses ground on analytical capabilities. The broker offers a reasonable selection of trading instruments across forex, precious metals, and cryptocurrencies. This provides traders with opportunities for portfolio diversification across different market sectors.

However, detailed information about research tools, market analysis resources, educational materials, and trading aids remains largely unavailable. Professional traders typically rely on economic calendars, technical analysis tools, market commentary, and automated trading support to enhance their trading effectiveness. The absence of clear information about these resources suggests either limited offerings or poor marketing communication.

User feedback regarding available tools is sparse. Most comments focus on basic trading functionality rather than advanced analytical capabilities. The lack of educational resources is particularly concerning for newer traders who might be attracted to the platform's cryptocurrency offerings but require guidance on risk management and market analysis techniques.

Customer Service and Support Analysis (Score: 3/10)

Customer service evaluation reveals significant concerns based on available user feedback and industry reports. The platform appears to lack comprehensive support channels. Limited information is available about contact methods, response times, and service quality standards that clients can expect.

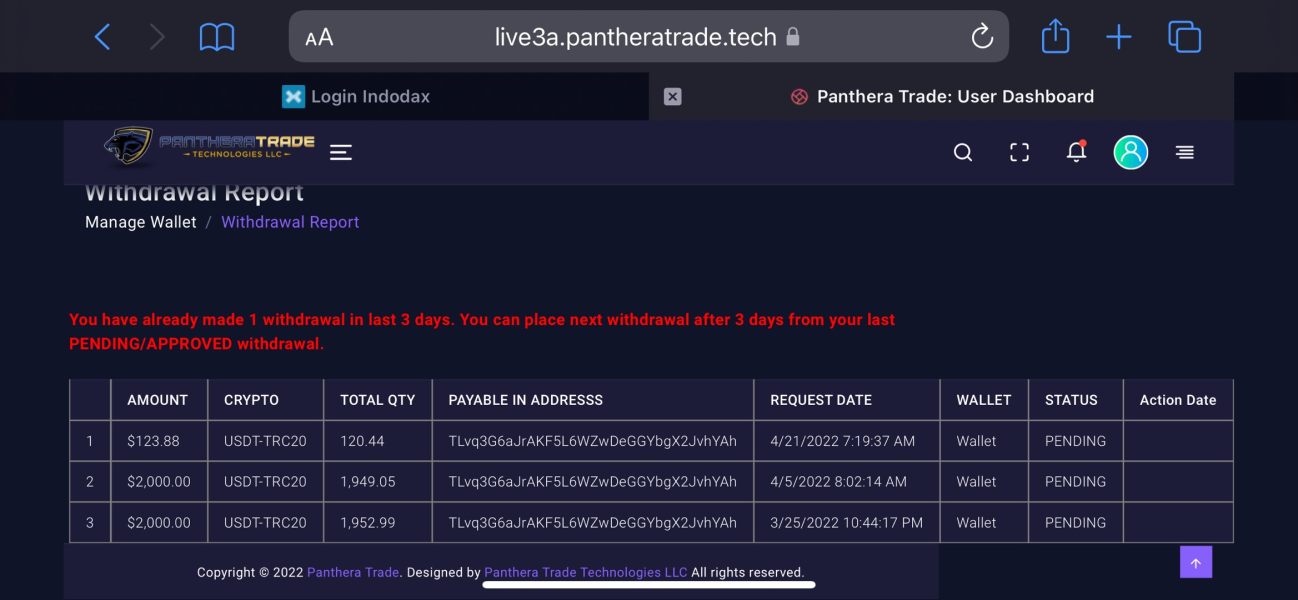

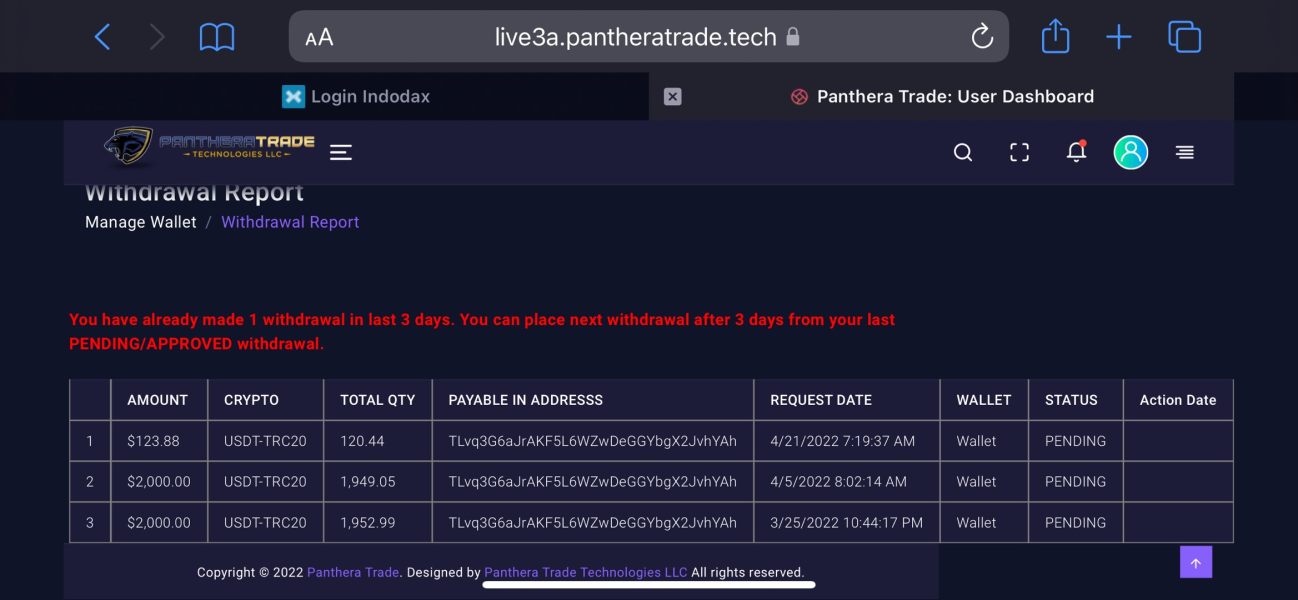

User testimonials consistently highlight poor customer service experiences. These include delayed responses to inquiries, difficulty reaching support representatives, and unsatisfactory resolution of account-related issues. Several reports suggest that customer service quality deteriorates significantly when clients attempt to withdraw funds or dispute trading conditions. This raises serious concerns about the broker's commitment to client satisfaction.

The absence of detailed customer service information further compounds these concerns. This includes operating hours, available languages, and escalation procedures. Professional brokers typically maintain multiple support channels including live chat, phone support, and email assistance with clearly defined response time commitments. The lack of such transparency in Panthera Trade's customer service approach represents a significant operational weakness.

Trading Experience Analysis (Score: 4/10)

The trading experience evaluation suffers from limited reliable user feedback and insufficient technical performance data. Available information suggests that users have encountered various issues with platform stability, order execution quality, and overall trading environment reliability. However, specific technical details remain scarce.

Several user reports mention concerns about order execution speeds and potential slippage during volatile market conditions. The lack of comprehensive performance metrics makes it difficult to assess whether these issues represent systemic problems or isolated incidents. Professional traders typically require detailed information about execution statistics, platform uptime, and server performance to evaluate a broker's technical capabilities.

The absence of mobile trading information and platform feature descriptions further limits the assessment of trading experience quality. Modern traders expect seamless functionality across desktop and mobile platforms, with advanced charting capabilities and efficient order management tools. This panthera trade review cannot adequately assess these crucial elements due to insufficient available information about the platform's technical infrastructure and user interface design.

Trust and Safety Analysis (Score: 1/10)

The trust and safety evaluation reveals the most concerning aspects of Panthera Trade's operations. The broker's unregulated status represents the primary risk factor. Clients lack the protection typically provided by established financial regulatory authorities. This absence of oversight means that standard safeguards such as segregated client funds, compensation schemes, and regulatory oversight of business practices are not guaranteed.

Multiple industry sources have raised fraud allegations and warnings about the platform's legitimacy. These concerns are compounded by the broker's poor transparency regarding operational practices, fund security measures, and dispute resolution procedures. The choice to operate from Saint Vincent and the Grenadines, while legal, provides minimal investor protection compared to major financial jurisdictions.

User feedback consistently emphasizes trust concerns. Several reports describe difficulties withdrawing funds and unresolved account issues. The combination of regulatory absence, fraud allegations, and negative user experiences creates a high-risk environment that experienced traders would typically avoid. Professional investors generally prioritize regulatory protection and operational transparency, both of which appear to be lacking in Panthera Trade's current operational model.

User Experience Analysis (Score: 3/10)

User experience assessment reveals predominantly negative feedback across multiple touchpoints of the client journey. Available user testimonials consistently highlight frustrations with account management, customer service interactions, and overall platform usability. However, specific interface and functionality details remain limited.

The registration and verification process reportedly lacks clarity. Users experience confusion about required documentation and account approval timelines. This initial negative experience often sets the tone for subsequent interactions with the platform, contributing to overall user dissatisfaction.

Common user complaints center around fund management difficulties, unclear fee structures, and poor communication from the broker regarding account changes or market conditions. The absence of positive user testimonials or success stories in available sources suggests widespread dissatisfaction with the platform's service delivery. Professional brokers typically maintain strong user experience standards through intuitive interfaces, clear communication, and responsive support systems. These are areas where Panthera Trade appears to fall significantly short of industry standards.

Conclusion

This comprehensive panthera trade review reveals a broker that poses significant risks to potential investors due to its unregulated status and numerous operational transparency issues. The platform offers a diverse range of trading assets including forex, precious metals, and cryptocurrencies. However, these benefits are overshadowed by serious concerns about safety, reliability, and trustworthiness.

The broker may only be suitable for highly experienced traders with substantial risk tolerance who understand the implications of trading with an unregulated entity. Even risk-tolerant investors should carefully consider whether the potential benefits justify the significant safety and transparency concerns identified in this analysis.

The primary advantages include asset diversity and cryptocurrency trading opportunities. The critical disadvantages encompass regulatory absence, poor transparency, negative user feedback, and potential fraud risks. Based on this evaluation, most traders would be better served by choosing established, regulated brokers that provide comprehensive investor protection and transparent operational practices.