Maxi-O Review 1

I withdrew my profits but all the investment disappeared. I lost my deposit of 880 and I called their telephone. But there was no one answered.

Maxi-O Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I withdrew my profits but all the investment disappeared. I lost my deposit of 880 and I called their telephone. But there was no one answered.

Maxi O, a forex and CFD broker, has garnered mixed reviews from users and experts alike. Established in 2009 and headquartered in Malawi, the broker offers a range of trading products, including forex, commodities, indices, stocks, and cryptocurrencies. However, its unregulated status raises concerns about the safety and reliability of trading with them. Notably, the broker operates under various regional entities, which can complicate jurisdictional accountability.

Note: It is essential to be aware of the different entities operating under the Maxi O brand, as this can impact user experience and regulatory oversight. Our analysis is based on a variety of sources to ensure fairness and accuracy in presenting the broker's features and user feedback.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 5 |

| Tools and Resources | 6 |

| Customer Service and Support | 4 |

| Trading Setup (Experience) | 5 |

| Trustworthiness | 3 |

| User Experience | 4 |

We rate brokers based on a comprehensive analysis of user experiences, expert opinions, and factual data.

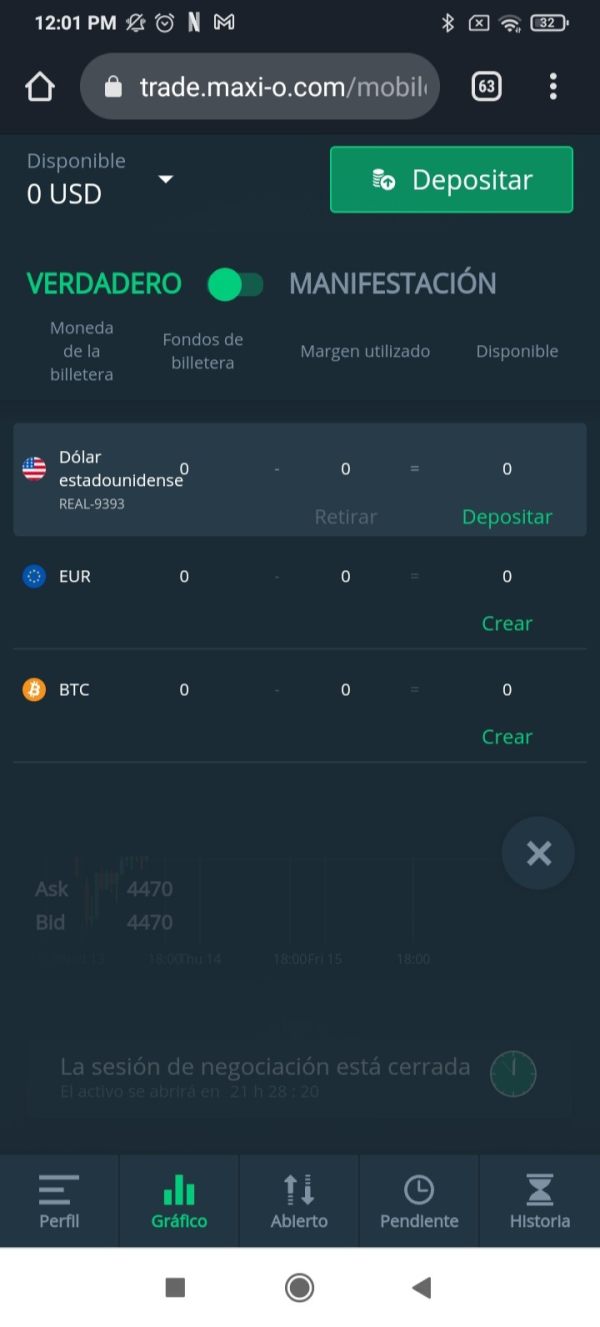

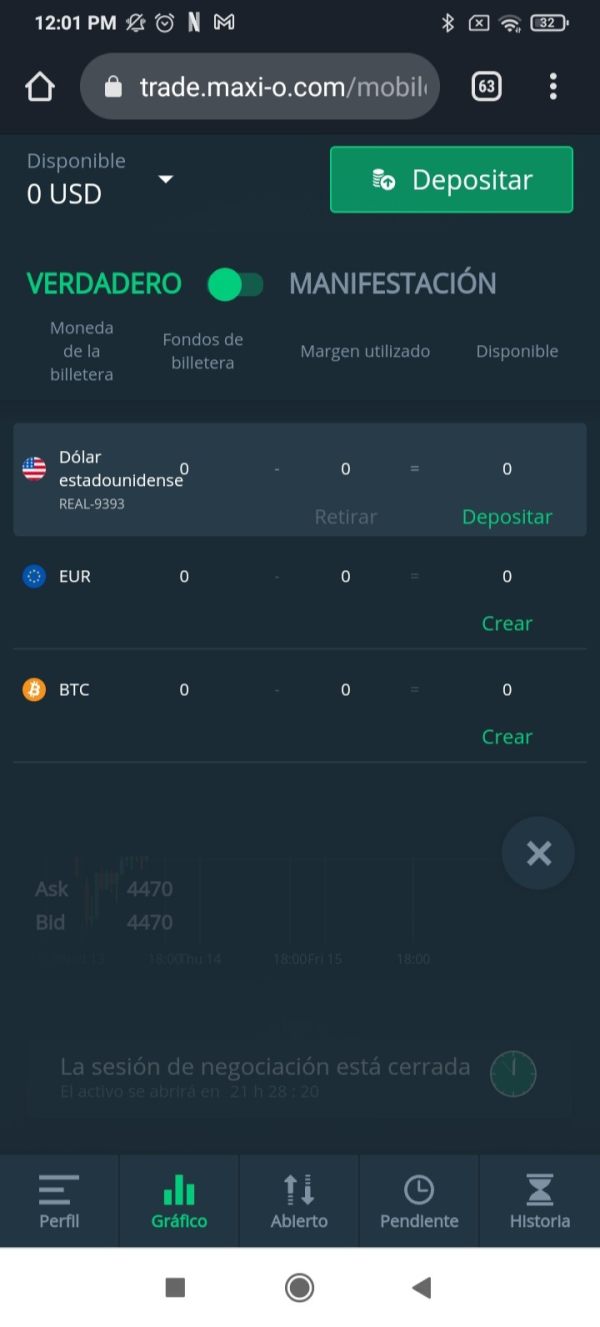

Founded in 2009, Maxi O operates as an unregulated forex and CFD broker. It offers trading on popular platforms such as MetaTrader 4 and MetaTrader 5, providing users with access to a wide range of assets. However, the lack of regulatory oversight is a significant drawback, as it limits investor protection and raises concerns about the broker's reliability.

Regulatory Regions: Maxi O operates without any valid regulatory licenses, which raises significant concerns about its trustworthiness. The broker is registered in Malawi, which does not have stringent financial regulations.

Deposit/Withdrawal Options: The broker accepts a variety of deposit and withdrawal methods, including credit/debit cards, bank wire transfers, and PayPal. However, there are reports of issues with withdrawals, leading to concerns about the broker's reliability.

Minimum Deposit: The minimum deposit required to open an account with Maxi O is $100, which is relatively low compared to other brokers, making it accessible for new traders.

Bonuses/Promotions: There is limited information regarding any ongoing promotions or bonuses, which may be a disadvantage for traders looking for added incentives.

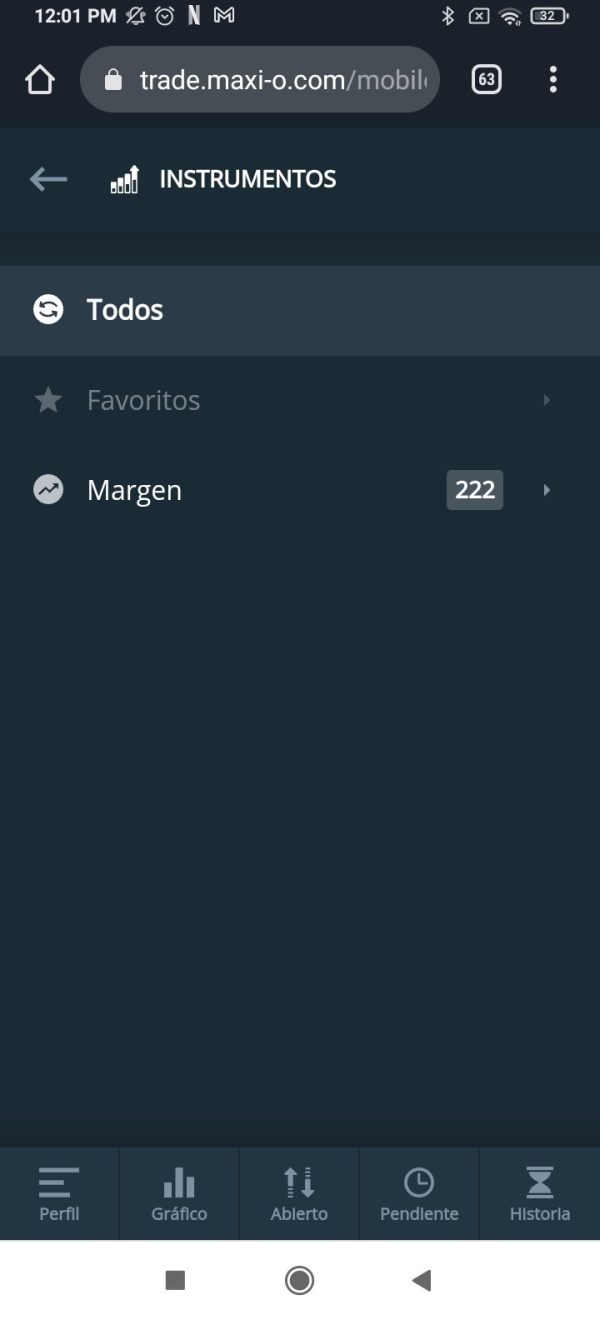

Tradable Asset Classes: Maxi O offers a diverse range of tradable assets, including over 60 currency pairs, commodities like gold and oil, stock indices, and various cryptocurrencies. This variety allows traders to diversify their portfolios.

Costs (Spreads, Fees, Commissions): The spreads on Maxi O start from 1 pip for standard accounts and 0.1 pips for ECN accounts, with a commission of $0.5 per lot for ECN accounts. While competitive, the costs may vary based on market conditions.

Leverage: The broker offers a maximum leverage of 100:1, which can amplify both profits and losses. Traders should be cautious when using high leverage, as it increases the risk of significant losses.

Allowed Trading Platforms: Maxi O supports MetaTrader 4 and MetaTrader 5, both of which are popular trading platforms known for their user-friendly interface and advanced features.

Restricted Regions: There is no clear information regarding specific regions where trading is restricted, but the broker's unregulated status may deter traders from certain jurisdictions.

Available Customer Service Languages: Customer support is available in English, but users have reported limited availability and responsiveness, which can be frustrating for traders seeking assistance.

Account Conditions (5/10): The low minimum deposit requirement makes it accessible, but the lack of regulatory oversight raises concerns about the security of funds.

Tools and Resources (6/10): Maxi O offers educational resources, including webinars and ebooks, which can be beneficial for traders looking to improve their skills.

Customer Service and Support (4/10): Users have reported difficulties in reaching customer support, which is a significant drawback for a trading platform.

Trading Setup (5/10): The trading experience is average, with competitive spreads but the potential for withdrawal issues.

Trustworthiness (3/10): The unregulated status of Maxi O is a major concern, as it limits investor protection and raises questions about the broker's reliability.

User Experience (4/10): Overall, user experiences have been mixed, with some reporting successful trades while others have faced challenges, particularly with withdrawals.

In conclusion, while Maxi O offers a range of trading options and features, its unregulated status and mixed user reviews suggest that potential traders should proceed with caution. It is advisable to thoroughly assess the risks involved before engaging with this broker. If you are considering trading with Maxi O, it is crucial to weigh the benefits against the potential drawbacks highlighted in this Maxi O review.

FX Broker Capital Trading Markets Review