Orient Futures 2025 Review: Everything You Need to Know

Summary: The overall evaluation of Orient Futures is mixed, with significant concerns regarding its regulatory status and user experience. While some reviews highlight its user-friendly interface and range of trading instruments, many sources warn of its dubious regulatory claims and potential risks associated with trading through this broker.

Note: It is crucial to recognize that Orient Futures operates under different entities across regions, which may affect its regulatory compliance and user experience. This review consolidates information from various sources to provide a balanced view.

Rating Box

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding broker services.

Broker Overview

Orient Futures, established in 2019, is a Singapore-based forex and futures broker operating under the name Orient Futures International Singapore Pte. Ltd. It claims to be regulated by the Monetary Authority of Singapore (MAS), although several reviews indicate that its license may be a suspicious clone. The broker offers various trading platforms, including MT5, and provides access to a range of asset classes, including forex, commodities, and stock indices.

Detailed Section

Regulatory Regions

Orient Futures claims to operate under the regulatory oversight of the Monetary Authority of Singapore (MAS). However, multiple sources, including WikiFX, have raised red flags about the legitimacy of its regulatory claims, labeling it a "clone broker" with no valid regulation. This raises concerns for potential investors regarding the safety of their funds and the broker's operational legitimacy.

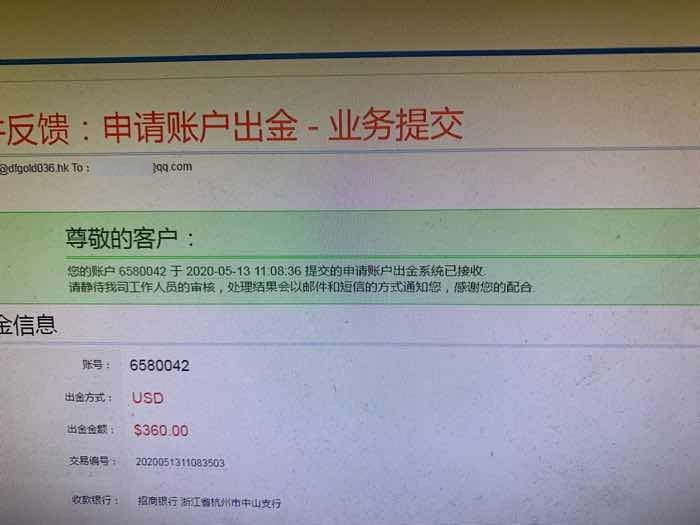

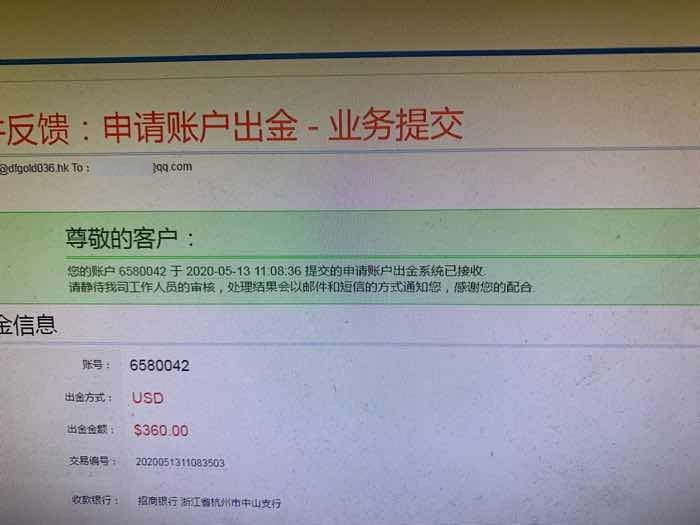

Deposit/Withdrawal Currencies/Cryptocurrencies

The broker facilitates deposits and withdrawals primarily through bank transfers and cheques. However, users have reported issues with the clarity of the withdrawal process, and there are concerns over potential hidden fees that may apply during transactions. As for cryptocurrencies, there is no mention of direct trading options available through Orient Futures.

Minimum Deposit

The minimum deposit required to open an account with Orient Futures is not explicitly stated across all sources, but some reviews suggest it could be around $3,000. This high barrier to entry may deter new traders from engaging with the platform.

Orient Futures does not prominently advertise bonuses or promotions, which may be a positive aspect compared to other brokers that use bonuses as a lure. However, the lack of promotional offers may also indicate a more conservative approach to attracting new clients.

Tradable Asset Classes

The broker offers a variety of tradable assets, including forex pairs, commodities, and stock indices. However, the exact range of available instruments is not clearly defined in most reviews, leading to uncertainty about the breadth of trading options.

Costs (Spreads, Fees, Commissions)

The commission structure at Orient Futures is somewhat opaque, with reports indicating that commissions can be negotiated based on the amount deposited. A general commission of $3.88 per lot is mentioned for deposits under $50,000, but there are warnings about additional costs that may not be immediately apparent to users.

Leverage

Specific leverage ratios are not detailed in the reviews, which is a critical factor for traders looking to maximize their positions. The absence of this information could be a drawback for experienced traders who rely on leverage.

Orient Futures provides access to multiple trading platforms, including MT5. However, user reviews indicate potential issues with accessing these platforms without prior approval, which could hinder the trading experience.

Restricted Regions

While Orient Futures operates primarily in Singapore, there is no comprehensive list of restricted regions available in the reviewed sources. This lack of clarity may pose challenges for international traders seeking to engage with the broker.

Available Customer Service Languages

Customer service support appears limited, with English being the primary language of communication. Some reviews indicate slow response times from customer support, which could be a significant drawback for users requiring prompt assistance.

Repeated Rating Box

Detailed Breakdown

-

Account Conditions: The account conditions at Orient Futures are rated low primarily due to the lack of transparency regarding minimum deposits and potential hidden fees associated with withdrawals. The absence of a clear structure for account types further complicates the user experience.

Tools and Resources: While Orient Futures offers access to MT5 and other trading tools, user feedback suggests that the platforms may not be easily accessible without approval, which can be frustrating for traders.

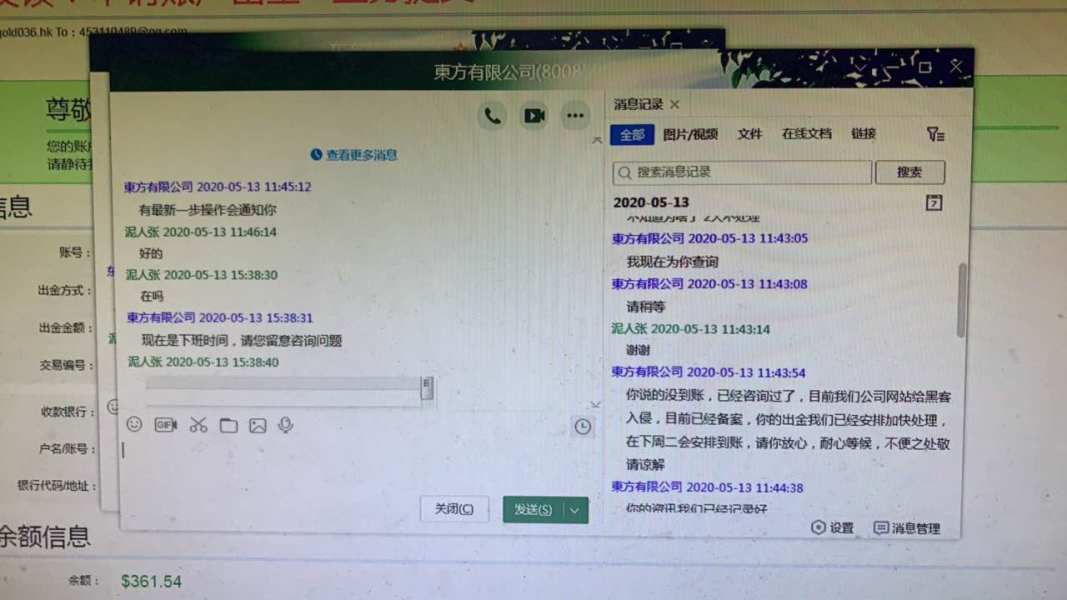

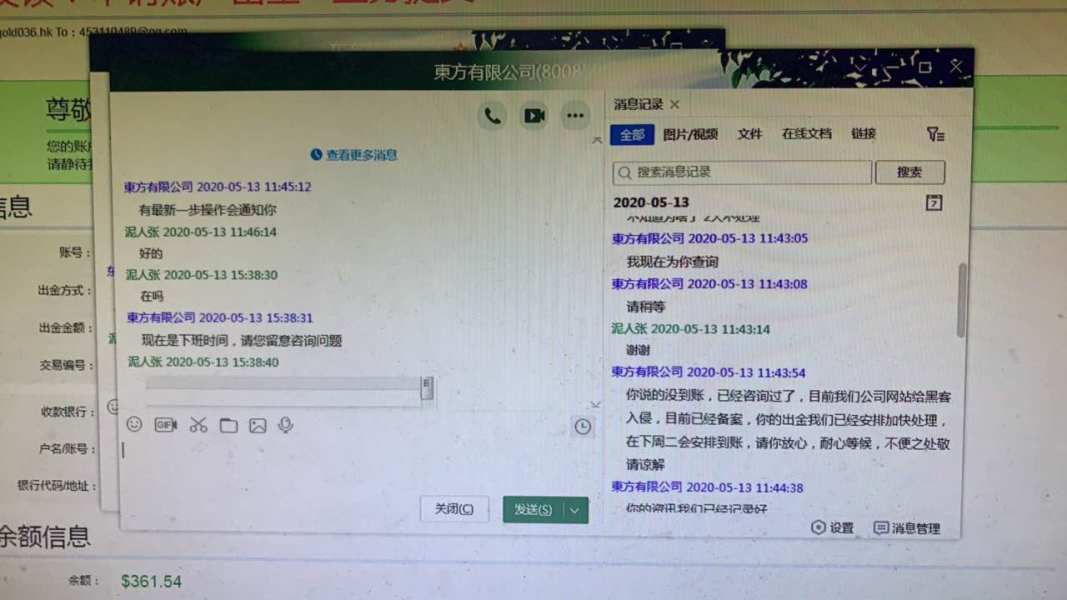

Customer Service and Support: Customer service ratings are notably low, with reports of slow response times and limited language support. This can significantly impact the trading experience for users needing immediate assistance.

Trading Setup (Experience): The trading experience is marred by concerns over the broker's regulatory status and potential hidden costs. The lack of clarity in trading conditions can lead to confusion and dissatisfaction among users.

Trustworthiness: The trustworthiness of Orient Futures is a major concern, with multiple sources labeling it as a clone broker. This raises significant red flags for potential investors regarding the safety of their funds.

User Experience: Overall user experience is rated poorly due to the combination of unclear trading conditions, potential issues with customer service, and concerns over regulatory compliance.

In conclusion, the Orient Futures review highlights a range of concerns that potential investors should consider carefully. While there are some positive aspects to the broker, the overarching issues regarding trustworthiness and regulatory legitimacy warrant caution before engaging with this platform.