Gemforex 2025 Review: Everything You Need to Know

Summary

This comprehensive Gemforex review evaluates a Japanese-based CFD and forex broker that has generated mixed reactions in the trading community. While Gemforex offers attractive features such as high leverage and spreads starting from zero, the broker faces significant challenges regarding regulatory transparency and user trust. The platform caters to both novice and experienced traders through its MetaTrader integration and diverse asset offerings including forex, commodities, cryptocurrencies, and indices.

According to various user feedback sources, Gemforex maintains a 4/5 rating on Trustpilot. Yet concerns persist about its offshore broker status and legitimacy questions. The broker's appeal lies primarily in its competitive trading conditions. But potential users should carefully consider the regulatory uncertainties and mixed user experiences before committing funds. This review provides an objective analysis based on available public information and user testimonials to help traders make informed decisions.

Important Notice

Regional Entity Differences: Gemforex operates as an offshore broker, which may impact user confidence regarding regulatory oversight and legal protections. The broker's offshore status means it may not be subject to the same strict regulatory requirements as brokers licensed in major financial jurisdictions.

Review Methodology: This evaluation is based on publicly available information, user feedback from various platforms, and reported trading conditions. The assessment does not include first-hand verification of all claims and services. Potential users should conduct their own research before opening accounts.

Rating Framework

Broker Overview

Gemforex positions itself as a comprehensive trading platform based in Japan. The broker offers CFD and forex trading services to international clients. Gemforex has established its presence in the competitive forex market by emphasizing low-cost trading conditions and high leverage options. According to available information, Gemforex focuses on providing accessible trading environments for retail traders while supporting various asset classes beyond traditional currency pairs.

The company operates primarily through the MetaTrader platform system. This enables traders to access familiar trading interfaces and automated trading capabilities. Gemforex's business model centers on offering competitive spreads starting from zero and providing high leverage ratios to attract both new and experienced market participants. The broker supports trading in forex pairs, commodities, cryptocurrencies, and indices. This positions itself as a multi-asset trading destination. However, specific details about the company's founding date and comprehensive corporate background remain limited in publicly available sources.

Regulatory Status: Available information does not specify concrete regulatory oversight from major financial authorities. This contributes to concerns about the broker's compliance framework and investor protection measures.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available sources.

Minimum Deposit Requirements: Concrete minimum deposit amounts for different account types are not specified in the reviewed materials. This potentially creates uncertainty for prospective traders.

Bonuses and Promotions: Details about welcome bonuses, trading incentives, or promotional offers are not mentioned in the available information sources.

Tradeable Assets: Gemforex supports trading across multiple asset categories including major and minor forex pairs, commodity CFDs, cryptocurrency derivatives, and stock indices. This provides diversification opportunities for traders.

Cost Structure: The broker advertises spreads starting from zero pips. However, specific commission structures and additional trading costs are not clearly outlined in available documentation.

Leverage Ratios: High leverage options are available. Though exact maximum leverage ratios for different asset classes are not specified in the reviewed sources.

Platform Options: Trading is conducted primarily through MetaTrader platforms. This offers standard charting tools, technical indicators, and automated trading support.

Geographic Restrictions: Specific information about restricted countries or regional limitations is not detailed in available materials.

Customer Support Languages: Available customer service languages and support channels are not specified in the reviewed information.

Account Conditions Analysis

Gemforex's account structure lacks transparency in several key areas. This contributes to its moderate rating in this category. The broker does not clearly specify minimum deposit requirements across different account tiers. This makes it difficult for prospective traders to understand entry barriers. This Gemforex review finds that the absence of detailed commission information further complicates cost calculations for potential users.

The account opening process details are not comprehensively outlined in available sources. This leaves questions about verification requirements and approval timelines. User feedback suggests varying experiences with account setup, with some traders reporting smooth processes while others encounter delays or complications.

Special account features such as Islamic accounts for Sharia-compliant trading are not mentioned in available documentation. The lack of detailed account specifications makes it challenging for traders to assess whether Gemforex meets their specific trading requirements. Compared to more established brokers that provide comprehensive account condition breakdowns, Gemforex's limited transparency in this area represents a significant drawback for informed decision-making.

Gemforex's trading infrastructure centers around MetaTrader platform integration. This provides users with industry-standard charting capabilities and technical analysis tools. The platform supports automated trading through Expert Advisors, though specific details about EA limitations or restrictions are not clearly documented.

Research and analysis resources appear limited based on available information. There is no mention of dedicated market research teams, daily analysis reports, or economic calendar integration. This represents a potential weakness for traders who rely on broker-provided market insights and educational content.

Educational resources for new traders are not prominently featured in available materials. This suggests that Gemforex may not prioritize trader education and development. User feedback indicates appreciation for the platform's basic functionality, but concerns arise regarding the depth of available learning materials and market analysis tools. The absence of comprehensive educational support may limit the broker's appeal to novice traders seeking guidance and skill development opportunities.

Customer Service and Support Analysis

Customer service quality at Gemforex receives mixed reviews from users. Response times and service effectiveness vary significantly across different support channels. Available user feedback indicates inconsistent experiences, with some traders reporting satisfactory support while others express frustration with delayed responses and resolution times.

Specific customer service channels, including live chat availability, email support response times, and phone support options, are not clearly detailed in available documentation. This lack of transparency regarding support accessibility creates uncertainty for traders who may need assistance during critical trading situations.

The absence of clearly defined customer service hours and multilingual support capabilities further complicates the support landscape. User testimonials suggest that service quality improvements are needed, particularly in response time consistency and issue resolution effectiveness. Without comprehensive support channel information and mixed user experiences, Gemforex's customer service represents an area requiring significant enhancement to meet industry standards.

Trading Experience Analysis

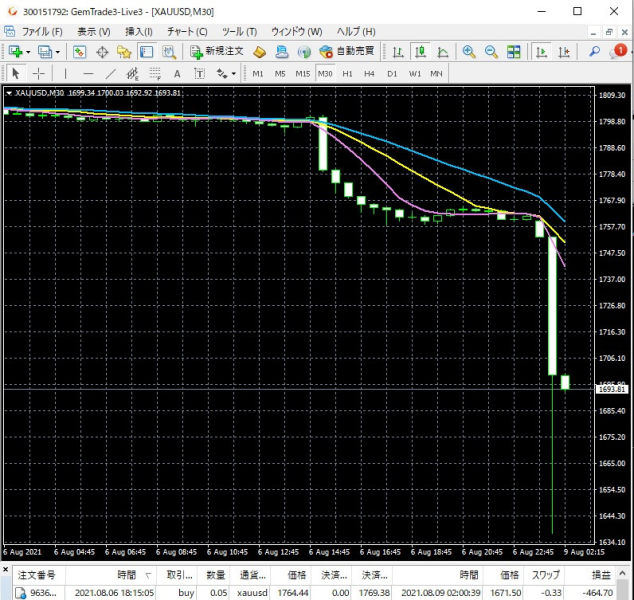

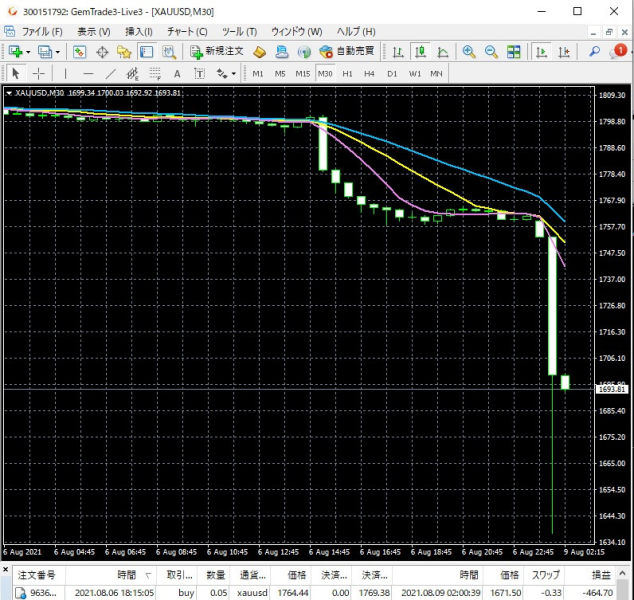

The trading environment at Gemforex offers both advantages and concerns that impact overall user experience. High leverage availability and spreads starting from zero create attractive trading conditions for cost-conscious traders. However, user feedback reveals stability issues that can affect trading performance during active market periods.

Platform functionality through MetaTrader provides standard charting tools and technical indicators. This meets basic trading requirements for most users. Order execution quality receives mixed reviews, with some users reporting satisfactory performance while others note concerns about slippage during volatile market conditions.

Mobile trading experience details are not comprehensively covered in available sources. This leaves questions about platform accessibility across different devices. The trading environment's appeal lies primarily in its cost structure, but stability concerns and mixed execution feedback suggest that this Gemforex review must highlight both positive aspects and potential performance issues that traders may encounter.

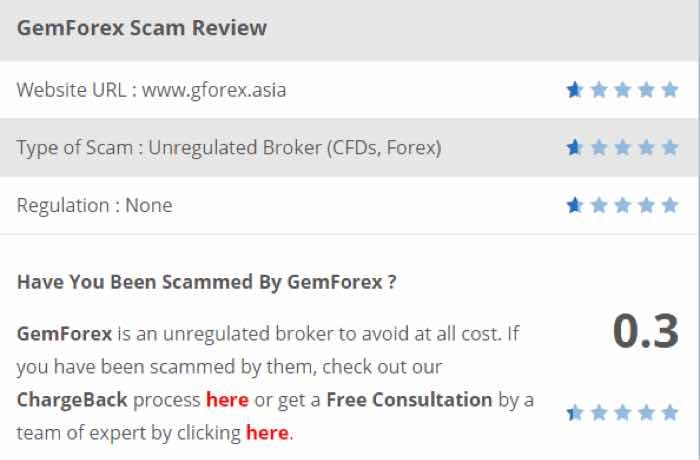

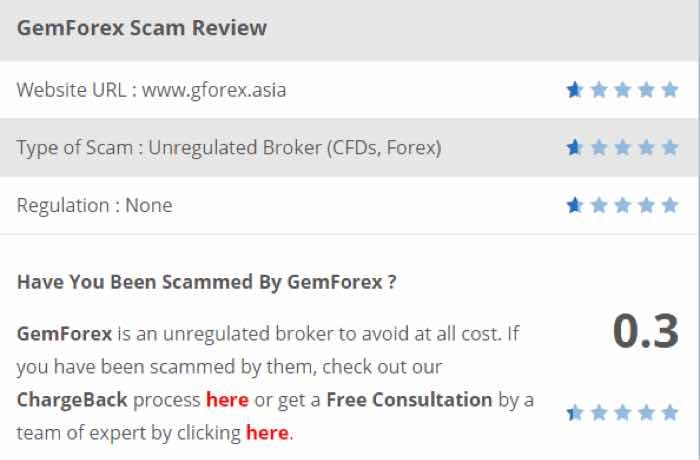

Trust and Reliability Analysis

Trust represents Gemforex's most significant challenge. Regulatory transparency issues create substantial concerns for potential users. The broker's offshore status raises questions about investor protection measures and regulatory oversight, particularly for traders accustomed to dealing with regulated entities.

Specific regulatory licenses and compliance certifications are not clearly documented in available sources. This contributes to legitimacy concerns expressed in user feedback. Fund safety measures, including segregated account practices and insurance coverage, are not detailed in accessible information, further impacting trust assessment.

Company transparency regarding corporate structure, ownership details, and operational history remains limited. This makes it difficult for users to verify the broker's credibility. Industry reputation suffers from ongoing disputes about legitimacy and regulatory compliance, with negative feedback affecting overall market perception. The absence of clear regulatory validation and transparency issues represent significant barriers to establishing trust with potential clients.

User Experience Analysis

Overall user satisfaction with Gemforex shows a complex picture. A 4/5 Trustpilot rating is offset by significant negative feedback regarding various operational aspects. Interface design and platform usability receive moderate praise through MetaTrader integration, though specific user interface innovations are not highlighted in available feedback.

Registration and account verification processes are not comprehensively detailed. This creates uncertainty about onboarding experiences. User complaints frequently focus on regulatory concerns and service quality issues, indicating that operational improvements are necessary to enhance overall satisfaction.

The user base appears to include both novice and experienced traders. This suggests that the platform's basic functionality meets diverse needs despite underlying concerns. Common user complaints center on legitimacy questions and inconsistent service delivery rather than core trading functionality. Improvement recommendations from user feedback emphasize the need for enhanced transparency, better customer service consistency, and clearer regulatory positioning to address satisfaction concerns.

Conclusion

This comprehensive evaluation reveals Gemforex as a broker offering competitive trading conditions through high leverage and low spreads. However, the broker faces significant challenges in regulatory transparency and user trust. The platform serves both new and experienced traders through MetaTrader integration and multi-asset support, yet concerns about offshore status and legitimacy disputes cannot be overlooked.

Primary advantages include attractive cost structures and platform accessibility. Major disadvantages encompass regulatory uncertainty and inconsistent service quality. Potential users should carefully weigh the competitive trading conditions against transparency concerns and mixed user experiences before making account decisions.