One Ozo 2025 Review: Everything You Need to Know

Executive Summary

This one ozo review looks at a broker that works without proper rules and oversight. One Ozo calls itself an online trading platform that offers forex, CFDs, indices, stocks, and cryptocurrency trading services to customers around the world. The broker gets attention with low minimum deposit requirements that start at $100 for their Ozo Start account. However, the lack of regulatory protection creates serious concerns about trader safety and fund security.

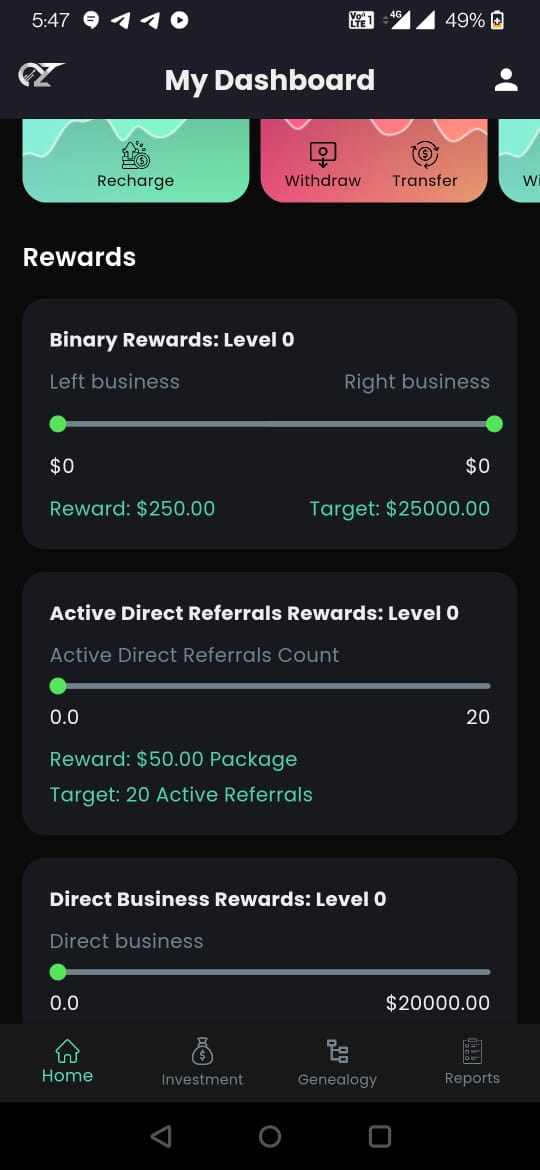

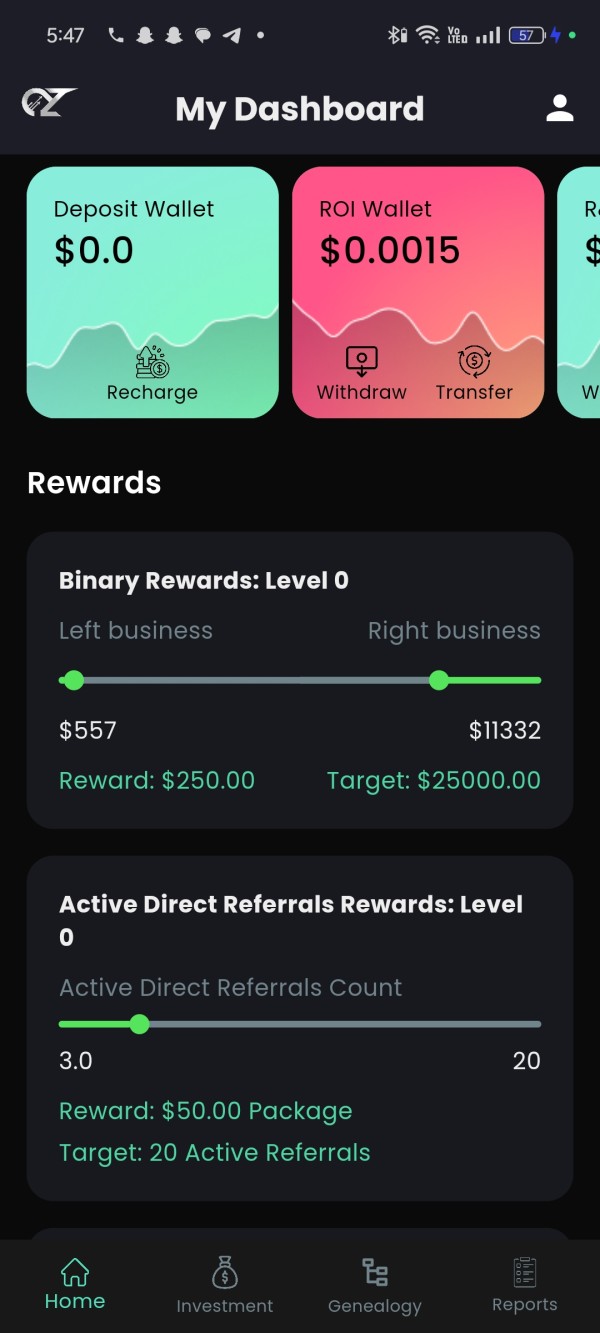

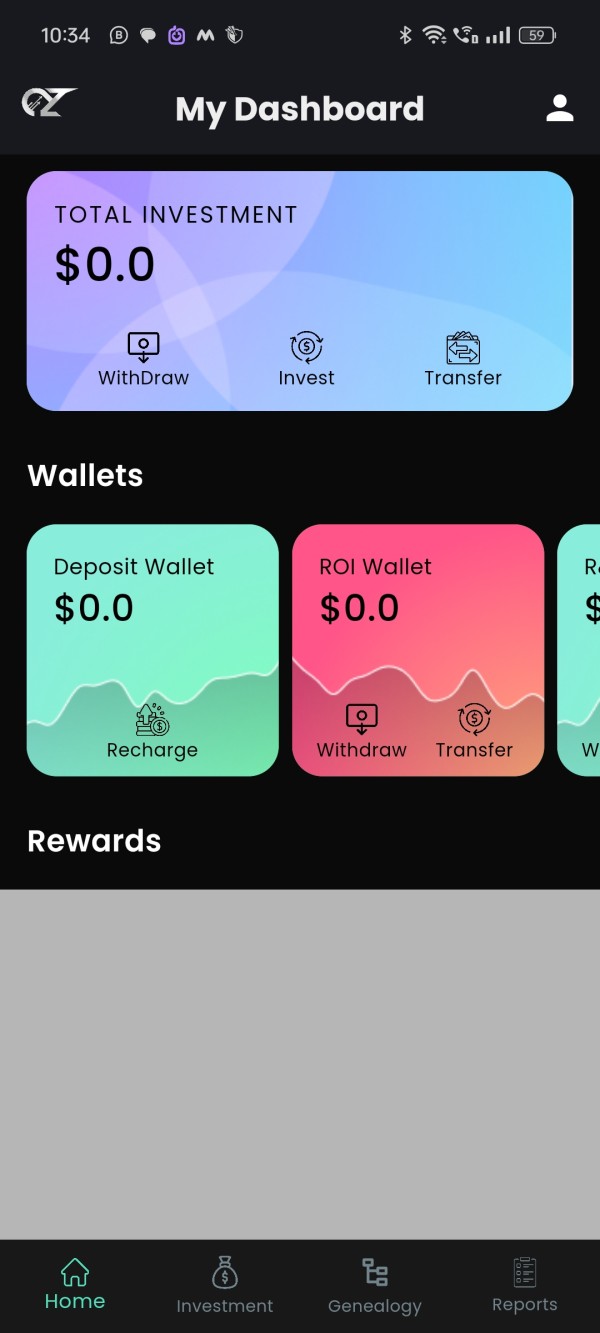

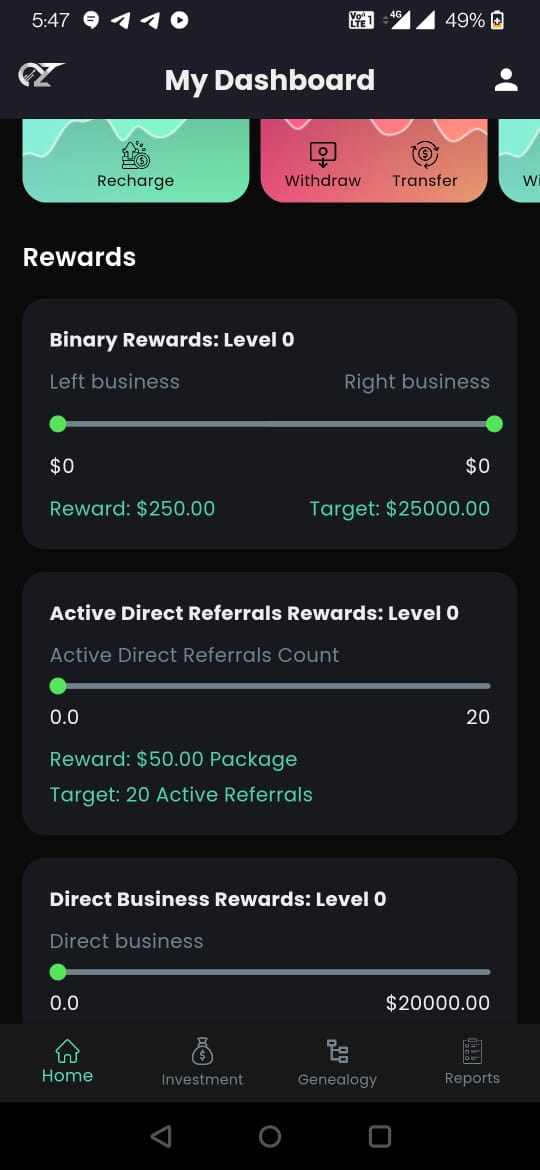

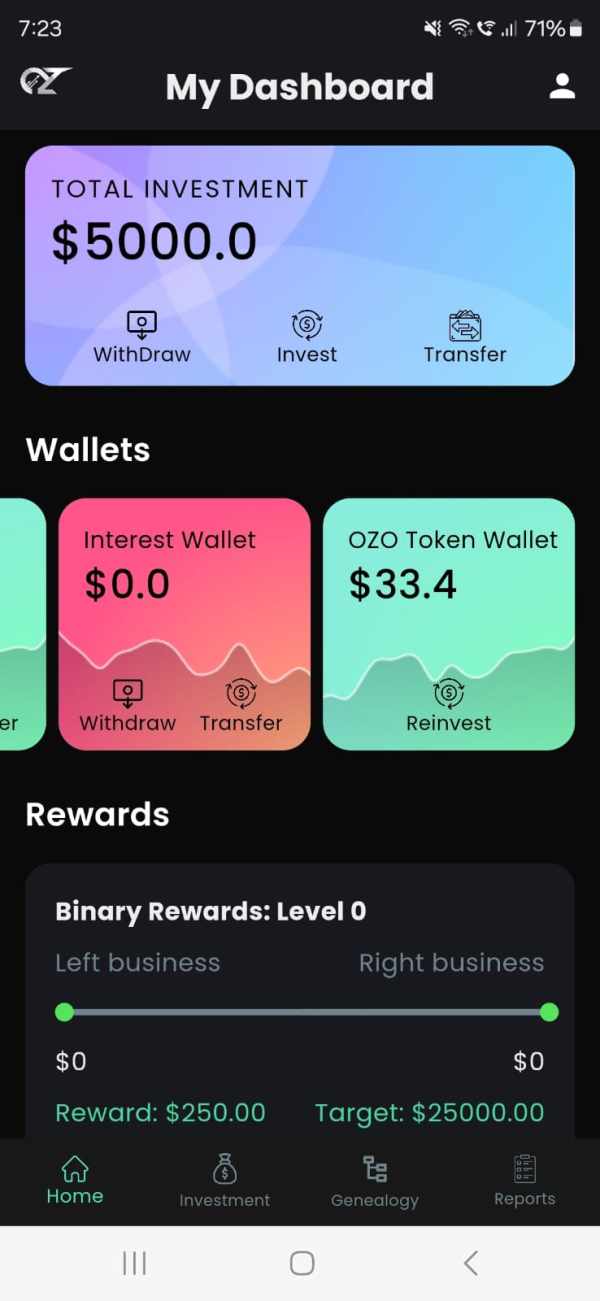

The platform works on desktop computers, mobile devices, and web browsers. Still, specific technical details about the trading software remain unclear in available materials. One Ozo mainly targets beginner traders and those who prefer lower risk through its easy entry requirements. User feedback shows concerning issues, especially with withdrawal processes that have left some clients frustrated and unable to access their funds easily. The broker offers leverage up to 1:300, which attracts some traders but adds another layer of risk given the unregulated status. Traders who consider One Ozo must understand these basic problems before putting money into the platform.

Important Notice

One Ozo operates as an unregulated broker. This means traders in different regions may face varying levels of legal protection and ways to solve problems. The regulatory landscape for unregulated brokers differs significantly across countries and regions. Potential clients should check local laws about trading with such companies before opening accounts.

This review uses publicly available information and user feedback from various sources. We did not conduct direct interviews or visit the company offices for this evaluation. The review method relies on company information that anyone can access, trading conditions, and community reports rather than private testing or exclusive broker communications. Given the limited regulatory oversight, traders should be very careful and think about the increased risks that come with unregulated brokers before making any financial commitments.

Rating Framework

Broker Overview

One Ozo operates from the United Kingdom and presents itself as a complete online trading platform. The company serves the global retail trading market with access to multiple asset classes through various trading platforms. Specific establishment dates and detailed corporate history remain unclear in available documentation.

The broker's business model focuses on providing leveraged trading opportunities across forex pairs, contracts for difference, equity indices, individual stocks, and cryptocurrency instruments. The platform works on desktop applications, mobile solutions, and web-based interfaces, though the specific trading software platforms remain unspecified in current materials. One Ozo's asset coverage includes traditional forex markets, popular stock indices, individual equity positions, and emerging cryptocurrency markets.

However, the broker's most significant problem lies in its regulatory status. One Ozo operates without oversight from recognized financial authorities, which places it in the high-risk category for trader protection and fund security. This one ozo review emphasizes the importance of understanding these regulatory gaps before engaging with the platform.

Regulatory Status: One Ozo operates without regulation from recognized financial authorities. This creates high risks for traders regarding fund protection, dispute resolution, and operational oversight. The unregulated status means clients cannot access compensation schemes or regulatory help that licensed brokers typically provide.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and fees for deposits and withdrawals is not detailed in available materials. Traders need to contact the broker directly for clarification on these important details.

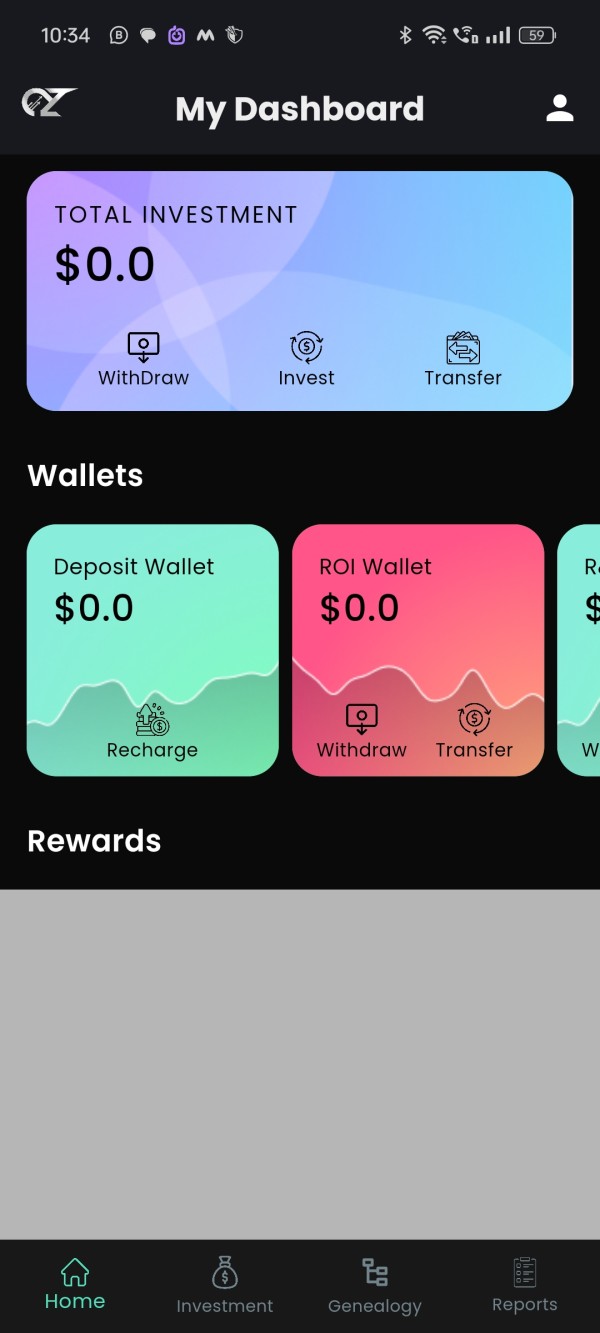

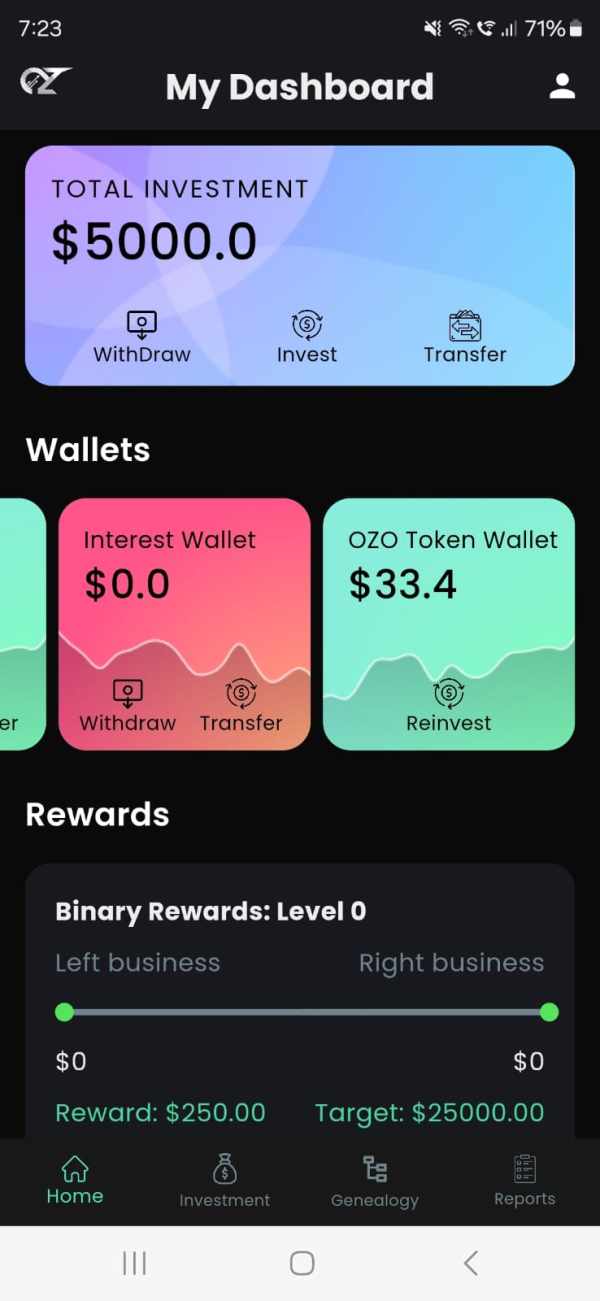

Minimum Deposit Requirements: The Ozo Start account requires a minimum deposit of $100. The standard account increases this requirement to $200. These relatively low entry barriers make the platform accessible to beginning traders, though the unregulated status adds significant risk to any deposited funds.

Promotional Offers: Current available information does not detail any specific bonus programs, promotional offers, or incentive structures. One Ozo may or may not offer these benefits to new or existing clients.

Trading Assets: The platform provides access to forex currency pairs, contracts for difference on various underlying assets, major stock indices, individual company stocks, and cryptocurrency instruments. This offers reasonable diversification for a smaller broker in the market.

Cost Structure: Specific details about spreads, commissions, overnight financing charges, and other trading costs require further verification directly with the broker. This information is not clearly outlined in available materials, which creates transparency concerns.

Leverage Offerings: One Ozo provides leverage up to 1:300. This represents aggressive leverage ratios that can amplify both profits and losses significantly, which is particularly concerning given the unregulated environment.

Platform Options: The broker supports desktop, mobile, and web-based trading platforms. However, specific software providers or proprietary platform details remain unspecified in current documentation.

Geographic Restrictions: Specific information about countries or regions where One Ozo restricts services is not detailed in available materials. Potential clients should verify service availability in their jurisdiction.

Customer Support Languages: Available documentation does not specify which languages One Ozo's customer service team supports. This one ozo review highlights the significant information gaps that potential clients should address before opening accounts.

Account Conditions Analysis

One Ozo structures its account offerings around two primary account types. The Ozo Start account and a standard account option provide different entry points for traders. The Ozo Start account targets beginning traders with its $100 minimum deposit requirement, making it relatively accessible compared to many established brokers who require significantly higher initial investments.

However, the standard account's $200 minimum deposit still maintains reasonable accessibility. It presumably offers enhanced features or conditions, though specific differences between account types remain unclear in available documentation. The account opening process details are not thoroughly documented in available materials, leaving potential clients uncertain about verification requirements, documentation needs, or approval timeframes.

This lack of transparency extends to special account features, VIP programs, or institutional offerings. Higher-tier clients might have access to these benefits, but the information is not readily available. The absence of detailed account condition information represents a significant concern, particularly for an unregulated broker where clients cannot rely on standardized regulatory disclosures.

User feedback regarding withdrawal processes has raised concerns about the practical accessibility of funds once deposited. This directly impacts the attractiveness of even the lower minimum deposit requirements. When compared to regulated brokers offering similar minimum deposits, One Ozo's unregulated status significantly diminishes the value proposition despite competitive entry requirements.

This one ozo review emphasizes that low minimum deposits lose their appeal when fundamental protections and transparent processes are absent.

One Ozo's trading infrastructure includes multiple platform types. Desktop applications, mobile trading solutions, and web-based interfaces provide different access methods for traders. However, the specific software providers or proprietary technology details remain undisclosed in available materials.

This multi-platform approach suggests an attempt to serve traders across different devices and preferences. But the lack of specific information about platform capabilities, charting tools, or analytical features makes it difficult to assess the actual quality and functionality of these offerings. Research and analytical resources that typically support informed trading decisions are not detailed in available documentation.

Professional traders often rely on market analysis, economic calendars, news feeds, and research reports provided by their brokers. One Ozo's offerings in this area remain unclear, which could impact trading success. Similarly, educational resources such as trading guides, webinars, tutorials, or market education materials are not specified, which could be particularly important given the broker's apparent focus on beginning traders.

Automated trading support is not mentioned in available materials. This includes expert advisors, algorithmic trading capabilities, or copy trading features that have become increasingly important in modern trading environments. Their absence or unclear availability represents a potential limitation for traders who rely on these tools.

The overall assessment of tools and resources suffers from the lack of detailed information. This makes it impossible for potential clients to properly evaluate whether One Ozo's platform capabilities meet their trading requirements.

Customer Service and Support Analysis

Customer service quality represents a critical concern for One Ozo based on available user feedback. Withdrawal processing issues have frustrated some clients and created serious doubts about the broker's commitment to customer satisfaction. While specific customer service channels, availability hours, and response time metrics are not detailed in available documentation, user reports suggest that support quality may not meet industry standards.

This is especially true when clients encounter problems with fund access. The withdrawal issues reported by users indicate potential systemic problems with either the broker's operational processes or its commitment to client service. These concerns are particularly serious for an unregulated broker, as clients have limited options when standard customer service channels fail to resolve problems satisfactorily.

The absence of regulatory oversight means that dispute resolution mechanisms available with licensed brokers are not accessible to One Ozo clients. Multilingual support capabilities, 24/7 availability, and specialized support for different account types or trading issues remain unclear in available materials. Professional traders often require sophisticated support for technical issues, platform problems, or complex trading scenarios, but One Ozo's capacity to provide such specialized assistance is not documented.

The combination of user-reported problems and lack of detailed support information creates significant concerns. Clients should expect potential challenges with the overall customer service experience from this broker.

Trading Experience Analysis

The trading experience evaluation for One Ozo faces significant limitations. Available documentation lacks specific performance data, user experience reports, and technical specifications. Platform stability and execution speed are crucial factors for active traders, but they cannot be properly assessed without detailed technical information or comprehensive user feedback about actual trading conditions.

Order execution quality remains undocumented in available materials. This includes fill rates, slippage characteristics, and requote frequency that directly impact trading profitability. These factors are particularly important when dealing with leveraged positions up to 1:300 that One Ozo offers.

The absence of execution statistics or performance benchmarks makes it impossible to evaluate whether the broker provides competitive trading conditions. Mobile trading experience lacks specific details regarding app functionality, feature completeness compared to desktop platforms, or user interface quality. Similarly, the trading environment assessment suffers from missing information about spreads, liquidity sources, and market depth, all of which significantly impact the actual cost and feasibility of executing trading strategies.

The overall trading experience assessment is further complicated by the unregulated status. Even if trading conditions appear competitive, the fundamental risks associated with fund safety and broker reliability overshadow technical platform considerations. This one ozo review emphasizes that trading experience quality becomes secondary when basic regulatory protections are absent.

Trust and Reliability Analysis

Trust and reliability represent One Ozo's most significant weaknesses. The broker operates without regulation from recognized financial authorities, which creates fundamental problems for client protection. This unregulated status means that clients lack access to investor compensation schemes, regulatory oversight of business practices, and standardized dispute resolution mechanisms.

These protections are fundamental in the modern brokerage industry. Fund safety measures are not detailed in available documentation, including segregated client accounts, tier-1 bank relationships, and independent auditing of client funds. For regulated brokers, these protections are typically required and regularly verified by supervisory authorities, but unregulated brokers operate without such oversight.

This creates significant risks for client capital. Company transparency suffers from limited public disclosure about corporate structure, financial backing, key personnel, or operational history. Professional traders and institutional clients typically require detailed due diligence information that appears unavailable for One Ozo.

The absence of industry recognition, regulatory awards, or third-party certifications further undermines confidence in the broker's credibility. The handling of negative events, particularly the withdrawal issues reported by users, demonstrates concerning patterns that suggest operational problems or inadequate commitment to client service. Without regulatory oversight to enforce proper business practices, clients must rely entirely on the broker's voluntary compliance with industry standards.

This represents an unacceptable risk level for most serious traders.

User Experience Analysis

Overall user satisfaction with One Ozo appears problematic based on available feedback. Withdrawal processes have left some clients frustrated and concerned about fund accessibility, which represents a fundamental failure in broker operations. These reports suggest that while the initial account opening and deposit processes may function adequately, the crucial exit process faces significant challenges.

This directly impacts user confidence in the platform. Interface design and platform usability cannot be thoroughly evaluated due to limited specific feedback about the trading platforms' user experience. However, the multi-platform approach suggests an attempt to accommodate different user preferences, though the actual implementation quality remains unclear without detailed user reviews or independent testing.

Registration and account verification processes lack detailed documentation. This leaves potential clients uncertain about requirements, timeframes, and potential complications. The uncertainty is particularly problematic for an unregulated broker where clients cannot rely on standardized procedures mandated by regulatory authorities.

The fund operation experience represents the most significant user experience concern based on available feedback. Users have reported difficulties accessing their funds, which represents a fundamental failure of broker operations regardless of other platform features or capabilities. For traders considering One Ozo, the user experience assessment suggests that while entry barriers are low, exit processes may present serious challenges.

These challenges could trap funds or create extended delays in accessing capital.

Conclusion

This one ozo review reveals a broker that presents significant risks despite some attractive features. Low minimum deposits and diverse asset offerings may seem appealing, but they come with serious drawbacks. One Ozo's operation without proper regulatory oversight creates fundamental concerns about trader protection, fund safety, and dispute resolution that overshadow any potential benefits from its trading conditions or platform accessibility.

The broker appears most suitable for traders with extremely high risk tolerance who understand and accept the implications of trading with an unregulated entity. However, even risk-tolerant traders should carefully consider whether the limited benefits justify the substantial risks, particularly given the availability of regulated alternatives offering similar or better conditions with proper oversight. The primary advantages include relatively low entry barriers and multi-asset trading opportunities, but these are significantly outweighed by serious disadvantages.

These disadvantages include unregulated status, user-reported withdrawal issues, and lack of transparency in operations and policies. Most traders would be better served by choosing regulated brokers that provide equivalent or superior services with appropriate regulatory protections. Regulated brokers also offer established track records of reliable client service that One Ozo cannot match.