TXV 2025 Review: Everything You Need to Know

Executive Summary

TXV started in 2020. This company shows concerning signs for forex traders who want a reliable broker. This txv review reveals serious red flags that need careful thought before opening an account.

The broker serves clients in the Czech Republic, Germany, Italy, and Mexico. However, it operates without clear rules or proper user protection measures. Available data shows TXV has a WikiFX rating of just 1 out of 10.

This rating indicates very high risk levels for traders. The lack of clear regulatory information creates big concerns about the broker's legitimacy. Limited disclosure about trading conditions, platforms, and customer support also raises questions about operational standards.

The target group appears to be new forex traders and those with higher risk tolerance. This focus particularly targets European and Latin American markets. However, the lack of complete information about account conditions, trading tools, and safety measures makes it hard to recommend TXV to any trader category.

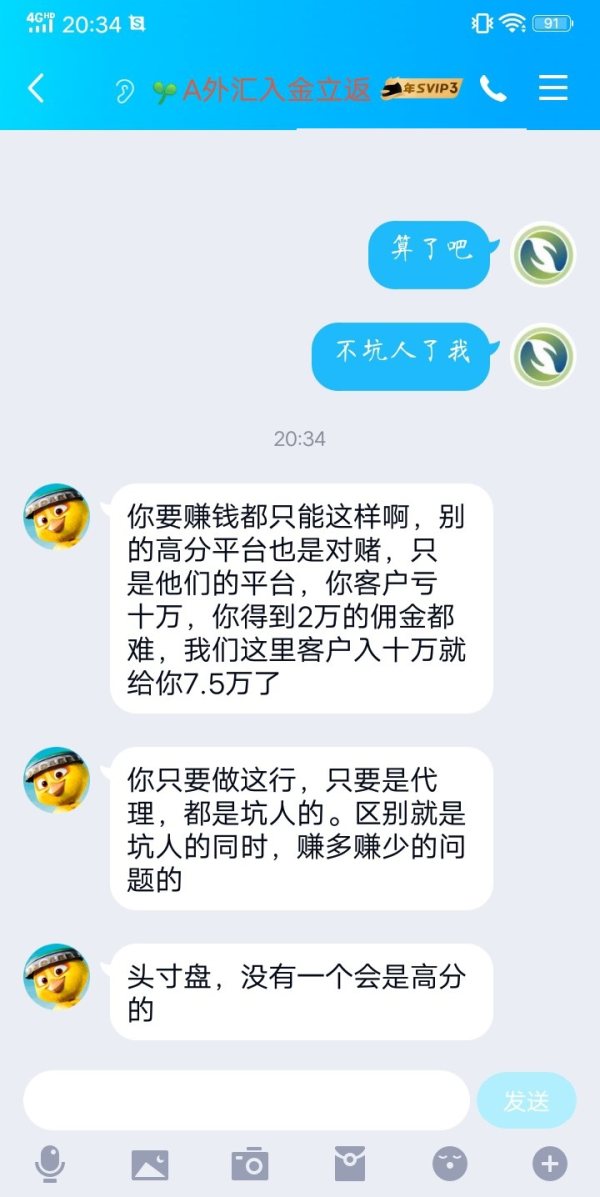

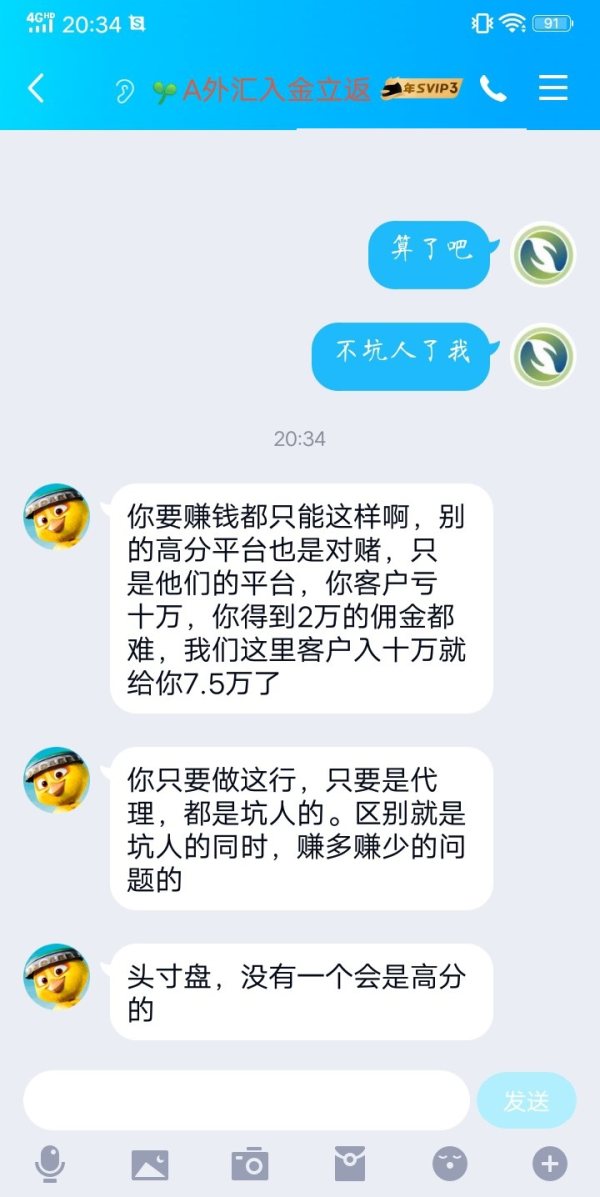

The very negative user feedback and absence of regulatory protection create an environment where client funds face significant uncertainty. Trading experiences also face major risks.

Important Notice

This evaluation covers TXV's operations across multiple regions. These include the Czech Republic, Germany, Italy, and Mexico. However, the broker has not provided clear information about regulatory compliance or licensing in these areas.

This creates potential gaps in user protection that vary by location. This review is based on currently available information and user feedback as of 2025. Given the limited transparency from TXV regarding its operations, trading conditions, and regulatory status, information may be incomplete or subject to change.

Traders should conduct additional research and consider regulatory warnings before making any investment decisions with this broker.

Rating Framework

Broker Overview

TXV appeared in the forex trading world in 2020. The company positions itself as a broker serving European and Latin American markets. Despite being relatively new to the industry, the company has tried to establish a presence across multiple countries including the Czech Republic, Germany, Italy, and Mexico.

However, the broker's operational transparency and regulatory compliance remain questionable. The company's business model appears to focus only on forex trading services. Specific details about their operational structure, company registration, and management team are notably missing from available public information.

This lack of transparency is particularly concerning for a financial services provider where client trust and regulatory compliance are essential. According to available data, TXV operates without clear oversight from recognized financial authorities. This txv review finds no evidence of licensing from major regulatory bodies such as the FCA, CySEC, ASIC, or other reputable financial supervisors.

The absence of proper regulatory framework creates significant risks for clients. There are no established mechanisms for dispute resolution, compensation schemes, or operational oversight that typically protect traders' interests. The broker's primary focus on forex trading suggests a narrow service offering compared to more established brokers who typically provide access to multiple asset classes.

Without detailed information about trading platforms, account types, or specific service features, potential clients face uncertainty about what they can expect from the trading experience.

Regulatory Status: Available information indicates no clear regulatory oversight from recognized financial authorities. This creates significant compliance concerns for potential clients across all operating regions.

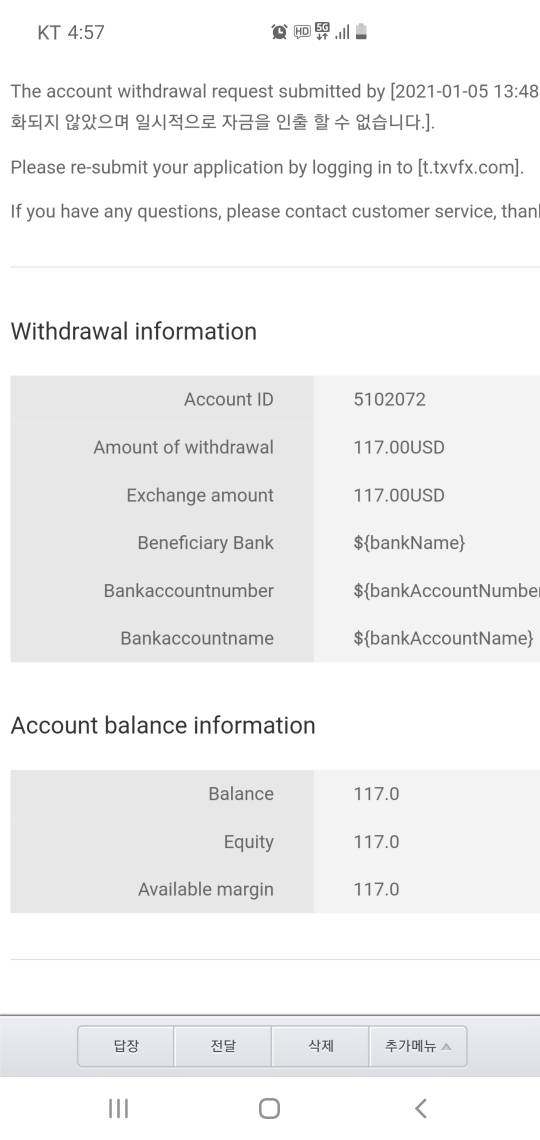

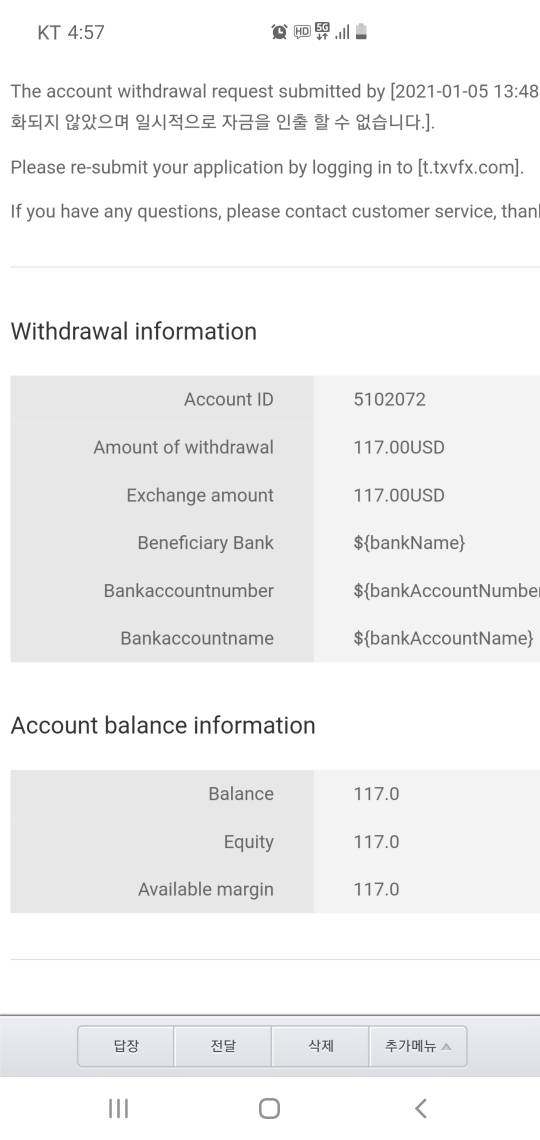

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees has not been disclosed by the broker. This leaves clients uncertain about money management procedures.

Minimum Deposit Requirements: TXV has not published clear information about minimum deposit amounts for different account types. This makes it difficult for traders to assess accessibility and entry requirements.

Promotions and Bonuses: No information is available regarding welcome bonuses, trading incentives, or promotional offers that might be available to new or existing clients.

Available Assets: The broker appears to focus primarily on forex trading pairs. However, the specific currency pairs offered, exotic options, and any additional instruments remain undisclosed in available materials.

Cost Structure: Critical information about spreads, commission rates, overnight financing charges, and other trading costs has not been transparently communicated. This prevents proper cost analysis for potential clients. This txv review finds the lack of pricing transparency particularly concerning for traders trying to evaluate competitiveness.

Leverage Options: Information about maximum leverage ratios, margin requirements, and leverage restrictions across different account types or regions has not been clearly specified.

Trading Platforms: Details about available trading platforms, whether proprietary or third-party solutions like MetaTrader, mobile applications, and platform features remain undisclosed.

Geographic Restrictions: While TXV serves clients in the Czech Republic, Germany, Italy, and Mexico, specific restrictions or limitations for other regions have not been clearly communicated.

Customer Support Languages: Available support languages and regional customer service capabilities have not been specified in available documentation.

Account Conditions Analysis

The account conditions offered by TXV remain largely unclear. This presents significant challenges for traders attempting to evaluate the broker's suitability. Without clear information about account types, minimum deposit requirements, or specific features available to different client categories, potential users face uncertainty about basic trading parameters.

The absence of detailed account specifications raises concerns about the broker's operational transparency. Established brokers typically provide complete information about standard accounts, premium tiers, Islamic accounts for Muslim traders, and demo account availability. TXV's failure to clearly communicate these fundamental aspects suggests either poor marketing practices or potentially incomplete service offerings.

Account opening procedures, verification requirements, and documentation standards have not been outlined in available materials. This lack of clarity creates potential friction for new clients and raises questions about the broker's compliance with anti-money laundering and know-your-customer regulations that are standard in regulated financial services.

The txv review process reveals no information about account protection measures, such as negative balance protection, which has become a standard feature among reputable brokers. Similarly, details about account maintenance fees, inactivity charges, or other ongoing costs that could affect client accounts remain undisclosed. This prevents proper cost assessment for long-term trading relationships.

TXV's trading tools and educational resources present a significant information gap. This undermines the broker's credibility. Professional forex brokers typically offer complete suites of analytical tools, market research, and educational materials to support trader success.

The absence of clear information about these essential services raises serious concerns about the broker's commitment to client support. Market analysis tools, economic calendars, technical indicators, and charting capabilities are fundamental requirements for serious forex trading. Without specification of available analytical resources, traders cannot assess whether TXV provides the necessary tools for informed decision-making.

This limitation particularly affects both novice traders who need educational support and experienced traders who require sophisticated analytical capabilities. Educational resources such as webinars, trading guides, market commentary, and tutorial materials are typically hallmarks of legitimate brokers invested in client success. The absence of information about educational offerings suggests either minimal investment in client development or poor communication about available resources.

Automated trading support, including expert advisor compatibility, API access, and algorithmic trading capabilities, represents another area where TXV has failed to provide clear information. Modern traders increasingly rely on automated solutions, making this transparency gap particularly problematic for the broker's competitive positioning.

Customer Service and Support Analysis

Customer service quality and availability represent critical factors in broker selection. Yet TXV provides minimal information about support capabilities. The absence of clear communication channels, response time commitments, and service level standards creates uncertainty about the help clients can expect when issues arise.

Professional brokers typically offer multiple contact methods including phone support, live chat, email ticketing systems, and sometimes social media support. Without specification of available channels, potential clients cannot assess whether TXV provides adequate support accessibility for their needs and preferences.

Response time expectations and service hour coverage are particularly important for forex traders operating across global markets with 24-hour trading cycles. The lack of information about support availability during different market sessions raises concerns about assistance during critical trading periods or emergency situations.

Multilingual support capabilities become especially relevant given TXV's claimed service areas across multiple European and Latin American countries. Without clear information about language support, clients in different regions face uncertainty about communication effectiveness with customer service representatives.

Problem resolution procedures, escalation processes, and complaint handling mechanisms remain undisclosed. This creates potential concerns about how disputes or technical issues would be addressed. Established brokers typically provide clear frameworks for issue resolution, including regulatory complaint procedures where applicable.

Trading Experience Analysis

The trading experience offered by TXV suffers from significant transparency issues. These prevent proper evaluation of platform quality and execution standards. Without clear information about trading platforms, execution models, or performance metrics, potential clients cannot assess whether the broker meets modern trading requirements.

Platform stability and execution speed are fundamental requirements for forex trading success, yet TXV has not provided performance data or platform specifications. The absence of information about server locations, uptime statistics, or execution quality metrics raises concerns about the technical infrastructure supporting client trading activities.

Order execution quality, including fill rates, slippage statistics, and requote frequency, represents critical factors affecting trading profitability. Professional brokers typically provide transparency about execution statistics and may offer execution quality reports. TXV's failure to address these performance indicators suggests either poor execution quality or inadequate performance monitoring.

Mobile trading capabilities have become essential for modern traders who need platform access across devices and locations. Without information about mobile applications, responsive web platforms, or cross-device synchronization, traders cannot assess whether TXV supports flexible trading approaches.

This txv review finds the lack of trading environment transparency particularly concerning, as it prevents evaluation of whether the broker operates market maker, STP, or ECN execution models. Each of these affects trading conditions and potential conflicts of interest.

Trust and Safety Analysis

Trust and safety concerns represent the most significant issues identified in this evaluation of TXV. The absence of clear regulatory oversight from recognized financial authorities creates fundamental risks for client fund safety and dispute resolution capabilities.

Regulatory compliance typically provides essential protections including segregated client funds, compensation schemes, operational oversight, and established complaint procedures. Without regulatory supervision, clients lack these standard protections and face increased risks of fund loss or operational issues without recourse.

Fund safety measures such as segregated client accounts, tier-one bank relationships, and insurance coverage have not been clearly communicated by TXV. Legitimate brokers typically provide detailed information about client fund protection as a key selling point and regulatory requirement.

Company transparency regarding ownership structure, management team, financial statements, and operational details remains notably absent. This lack of corporate transparency makes it difficult for clients to assess the broker's financial stability, operational competence, and long-term viability.

The WikiFX rating of 1 out of 10 provides external validation of the elevated risks associated with TXV. This exceptionally low rating from an independent evaluation service aligns with the transparency and regulatory concerns identified throughout this assessment.

User Experience Analysis

User experience feedback for TXV indicates mostly negative sentiment. Particular concerns focus on safety, transparency, and service quality. The limited available user feedback suggests dissatisfaction with various aspects of the broker's operations and client treatment.

Overall user satisfaction appears significantly compromised by the fundamental trust and transparency issues that characterize TXV's operations. Users have expressed concerns about the lack of regulatory protection and unclear operational practices that create uncertainty about fund safety and trading conditions.

Interface design and platform usability cannot be properly assessed due to limited information about trading platforms and user interface features. This information gap itself represents a user experience problem, as potential clients cannot evaluate platform suitability before account opening.

Registration and verification processes remain undocumented, creating potential friction for new users who cannot understand requirements or timeframes for account activation. Clear onboarding procedures are essential for positive initial user experiences.

Common user complaints focus on the lack of regulatory oversight and inadequate user protection measures. These fundamental concerns overshadow other potential service issues and create an environment where users question the broker's legitimacy and operational standards.

Conclusion

This complete txv review reveals significant concerns that make TXV unsuitable for most forex traders. The broker's operation without clear regulatory oversight, combined with limited transparency about trading conditions, platforms, and corporate structure, creates unacceptable risks for client funds and trading experiences.

While TXV may appeal to traders with extremely high risk tolerance who prioritize access over safety, the overwhelming evidence suggests that most traders would be better served by regulated alternatives. The absence of basic transparency about account conditions, trading costs, and customer support creates an environment where clients cannot make informed decisions about their trading relationship.

The broker's wide geographic service area across Europe and Latin America cannot compensate for fundamental deficiencies in regulatory compliance and operational transparency. Until TXV addresses these core issues through proper licensing and improved disclosure practices, traders should exercise extreme caution and consider well-regulated alternatives that provide appropriate client protections and service standards.