orcaragold exclusive 2025 Review: Everything You Need to Know

1. Abstract

OrcaraGold started in 2021. This emerging online forex broker has quickly made its mark in the trading world with its wide range of services and high-leverage options. In this orcaragold exclusive review, we examine a broker that offers many different asset classes like spot forex, CFDs on commodities, metals, energies, bonds, stocks, indices, and futures. One feature that stands out is its very high leverage option of up to 1:1000, which can attract traders who want bigger returns. However, people thinking about using this broker should know that OrcaraGold is registered offshore in Saint Vincent and the Grenadines and has no regulation, which creates risks. The broker targets active traders who can handle risk and want many trading options. While user ratings show some good points about the variety of assets available, the lack of official oversight means traders should be more careful. This review uses multiple public data sources and user feedback reports to give an honest look at OrcaraGold's services and how it operates.

2. Important Considerations

Investors must think carefully about OrcaraGold's offshore status. The broker's registration in Saint Vincent and the Grenadines, without any watching regulator, creates extra risks that clients should understand before moving forward. This review uses publicly available data and user reviews to give a complete look at the broker's business model, trading platform, and customer service. Some aspects like deposit methods and bonus offers are still unclear in the available information. So while the broker offers attractive leverage and many different assets, traders should do their homework and make sure they understand the legal and financial risks of using unregulated brokers.

3. Score Framework

The following table summarizes our evaluation scores across six crucial dimensions:

4. Broker Overview

OrcaraGold started in 2021 and has its headquarters in Thailand. The company entered the online trading market to provide many different financial tools while keeping trading conditions competitive. The broker mainly focuses on offering online trading of forex and various financial products. OrcaraGold claims to help both new and experienced traders who want to diversify their investments with an innovative approach. Their commitment to providing advanced yet easy-to-use online trading solutions shows in their development of the OrcaraGold Terminal, an HTML5-based web application that promises simple use along with strong trading features.

The second part of our overview looks at the platform and asset types that OrcaraGold offers. The broker gives access to many markets, including spot forex, CFDs on commodities, bonds, metals, energies, stocks, indices, and futures. Even though OrcaraGold offers an appealing set of asset classes, it is registered in Saint Vincent and the Grenadines and has no regulation. This regulatory status creates clear problems for investor protection and transparency. In this orcaragold exclusive review, while the extensive asset coverage and high leverage ability look attractive, the lack of credible regulatory oversight may scare away careful traders. The broker's business model shows a modern approach to online trading, but the details of offshore operations require careful investor review.

Below is a detailed breakdown of key details for OrcaraGold:

Regulatory Region: OrcaraGold is registered in Saint Vincent and the Grenadines and has no regulation currently. As many sources point out, this regulatory status exposes investors to potential legal and operational risks.

Deposit and Withdrawal Methods: Specific details about deposit and withdrawal methods are not provided in the available materials. People thinking about using this broker should contact OrcaraGold directly to get clear guidelines on these processes.

Minimum Deposit Requirement: Information about minimum deposit requirements is not clearly shown in the existing documentation. Potential traders need to ask more questions to understand the financial entry threshold.

Bonuses and Promotions: The review of bonus promotions and incentive schemes has not been detailed in public sources, so this remains unclear for traders looking at OrcaraGold.

Tradable Assets: OrcaraGold offers a large list of tradable assets, including spot forex, CFDs on commodities, bonds, metals, energies, stocks, indices, and futures. This strong offering helps traders use a diversified trading approach.

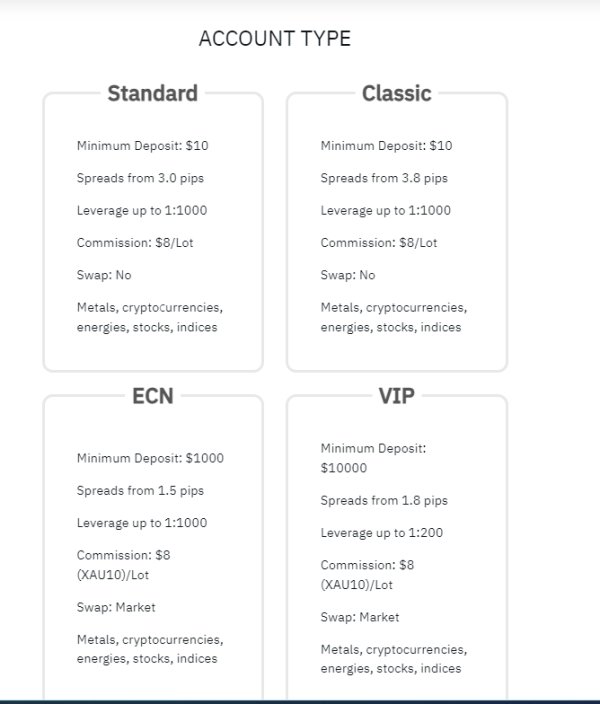

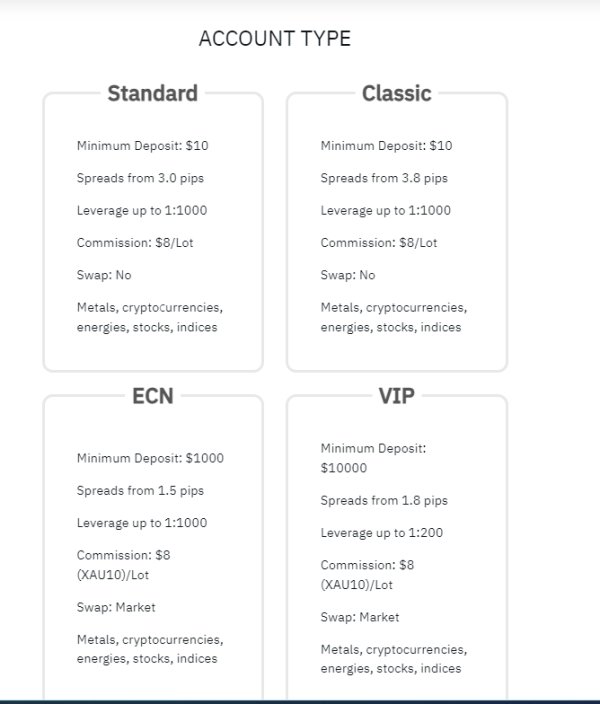

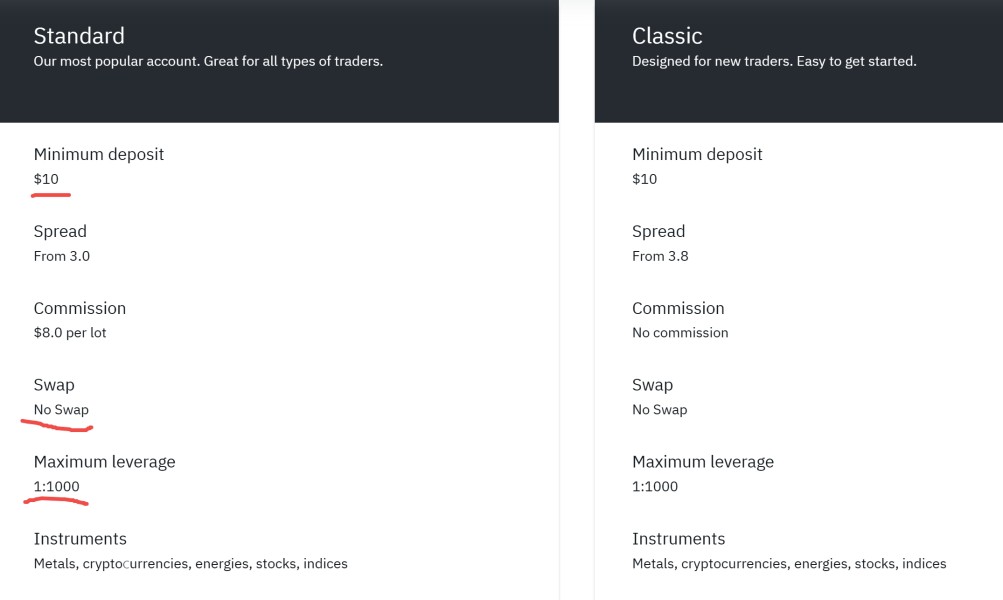

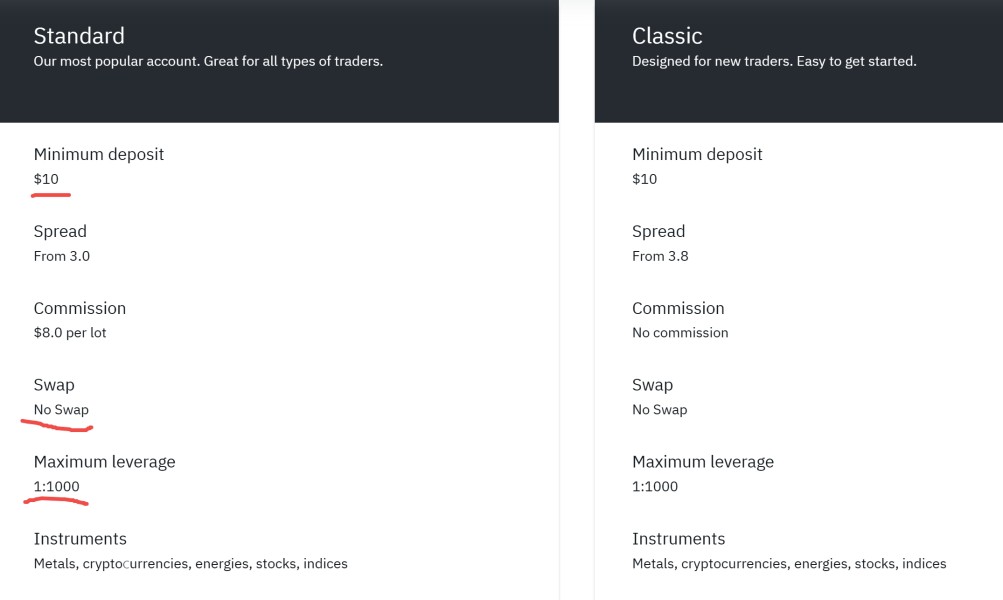

Cost Structure: Details on commissions, spreads, and other cost-related factors are limited. Although the broker offers competitive leverage, the lack of detailed cost information makes it hard to fully assess the fee structure.

Leverage Ratio: One of the most notable features is the high leverage that reaches up to 1:1000. This powerful leverage can increase gains, though it equally raises the risk factor.

Platform Options: Trading happens only through the proprietary OrcaraGold Terminal, an HTML5 web application designed to work on different devices with a responsive interface.

Regional Restrictions: Clear details about any geographic trading restrictions were not mentioned in the available information. This information gap should be clarified directly with the broker.

Customer Service Languages: Although the language abilities of customer support have not been explained, further clarification from the broker is recommended for non-English speaking traders.

This section forms the backbone of our orcaragold exclusive review by systematically showing the available parameters and highlighting key areas where detailed information is currently missing. The lack of transparent details in deposit methods, minimum deposit requirements, bonus promotions, and customer service channels suggests that while OrcaraGold offers a diverse trading product range, careful research is necessary before opening an account.

6. Detailed Score Analysis

6.1 Account Conditions Analysis

Our analysis of account conditions for OrcaraGold shows several areas of uncertainty. The available data does not show detailed commission structures, commonly associated spreads, or the minimum deposit requirement for opening an account. Without these core details, traders have limited insight into the cost of doing business through the OrcaraGold platform. The account opening process itself, including potential variations such as the availability of an Islamic account option, has not been specified clearly. Compared to other more transparent brokers, this uncertainty puts OrcaraGold at a disadvantage, especially for traders who value cost clarity and transparent fee structures. There is also little verified feedback from users about the account setup process. So while the broker does provide many tradable instruments, the lack of detailed account conditions significantly impacts the overall perception of value. As noted in our orcaragold exclusive review, prospective clients need to directly contact the broker for further clarification on these unresolved aspects. This gap in account-related information should be a key consideration for those assessing the risk-reward balance when entering high-leverage markets.

The OrcaraGold platform offers a diverse range of tools and trading resources. The proprietary OrcaraGold Terminal, an HTML5 web application, provides access to a complete set of trading instruments including spot forex, CFDs on commodities, bonds, metals, energies, stocks, indices, and futures. This wide range of asset classes gives traders the opportunity to diversify their portfolios significantly. However, beyond the availability of these instruments, details about additional research and analysis resources, educational content, or support for automated trading have not been clearly mentioned. In our analysis, while the platform clearly delivers strong core functionality, the absence of advanced analytical tools or educational resources may limit its appeal for newer traders who rely heavily on such supports. User feedback on these points remains limited, stressing the need for more transparent communication about the extra resources provided. Nonetheless, from a functionality perspective, the OrcaraGold platform's multi-asset offering is impressive and remains a strong highlight in this orcaragold exclusive review despite the identification of areas where toolsets could be expanded.

6.3 Customer Service & Support Analysis

The quality and availability of customer support are critical elements for any broker. OrcaraGold's status in this area appears to be mixed based on available information. Detailed information on the specific channels or operating hours of the support team has not been provided in the publicly available documentation. There is little to no mention of whether multilingual support is available for traders who might need help in languages other than English. User experience reports about customer support have been minimal, making it difficult to judge responsiveness and problem-solving efficiency. In our orcaragold exclusive review, the limited visibility into the customer service framework suggests that while the broker might be able to offer standard support, potential clients are advised to verify these details independently. The absence of clear guidelines or response time metrics leaves a gap in trust for those who prioritize immediate and competent customer service. In summary, while there may be some positive elements not captured here, the overall evidence does not convincingly elevate the customer service and support metrics, warranting the moderate score reflected in our analysis.

6.4 Trading Experience Analysis

The trading experience on OrcaraGold's platform is largely defined by the proprietary OrcaraGold Terminal. While the terminal is built on modern HTML5 technology, ensuring access across multiple devices, critical aspects like platform stability during high volatility, order execution speed, and comprehensive functionality remain less clearly documented. There is little user-sourced data regarding slippage, latency issues, or the efficiency of order matching, which are crucial for high-frequency trading environments.