Is 6HOURSTRADE safe?

Business

License

Is 6hourstrade Safe or Scam?

Introduction

6hourstrade is a relatively new player in the forex market, positioning itself as a broker that aims to cater to both novice and experienced traders. With the allure of competitive spreads and a user-friendly platform, it has attracted attention. However, as with any financial service, especially in the volatile realm of forex trading, it is crucial for traders to carefully evaluate the credibility and safety of the broker they choose. The forex market is rife with scams and unregulated brokers, making due diligence essential for protecting investments. This article investigates the legitimacy of 6hourstrade, utilizing a combination of regulatory information, company background checks, trading conditions, customer feedback, and risk assessments to provide a comprehensive overview of its safety.

Regulation and Legitimacy

The regulatory status of a forex broker is a fundamental aspect that determines its legitimacy and operational safety. A regulated broker is typically subject to stringent oversight, which can protect traders from fraud and malpractice. Unfortunately, 6hourstrade lacks valid regulatory information, raising red flags about its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation means that 6hourstrade does not have to adhere to the same operational standards as regulated brokers. This absence of oversight can lead to potential risks, such as the mishandling of client funds and lack of recourse in case of disputes. Historically, unregulated brokers have been associated with higher incidences of fraud and financial misconduct. Therefore, the absence of regulatory verification is a significant concern for potential clients considering whether 6hourstrade is safe.

Company Background Investigation

Understanding the company behind a broker is essential for evaluating its trustworthiness. 6hourstrade claims to be based in the United Kingdom, but there is little verifiable information regarding its history, ownership structure, or operational transparency. The absence of detailed information about its management team and their professional backgrounds further complicates the assessment of its credibility.

A transparent broker typically provides information about its founding, ownership, and key personnel. However, 6hourstrade's lack of such disclosures raises concerns regarding its operational integrity. The company's website does not offer insights into its corporate governance or the experience of its leadership, making it challenging to ascertain whether the team possesses the necessary expertise to manage a forex brokerage effectively.

Given these factors, it is prudent for traders to approach 6hourstrade with caution, as the lack of transparency can often indicate underlying issues that could compromise the safety of client funds and trading experiences.

Trading Conditions Analysis

Another critical aspect to consider when evaluating a forex broker is its trading conditions, which include spreads, commissions, and overall fee structures. 6hourstrade advertises competitive spreads, but without proper regulation, these claims must be scrutinized.

| Fee Type | 6hourstrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Structure | Varies | Varies |

| Overnight Interest Rates | High | Moderate |

The fee structure at 6hourstrade appears to be higher than the industry average, particularly concerning overnight interest rates. Such fees can significantly impact a traders profitability, especially for those engaging in long-term positions. The variability in spreads also raises concerns, as traders may not receive the competitive pricing they expect.

Furthermore, the lack of clarity regarding commission structures and potential hidden fees could lead to unexpected costs for traders. Therefore, it is crucial for prospective clients to thoroughly understand the trading conditions before committing funds, as these factors directly influence the overall trading experience and profitability.

Client Fund Safety

Client fund safety is paramount in the forex trading landscape, where the risk of losing money is already high. A reliable broker should implement robust security measures, including segregated accounts and investor protection policies. Unfortunately, 6hourstrade does not provide clear information on its fund safety protocols.

The absence of segregated accounts means that client funds may not be protected in the event of the broker's insolvency, leaving traders vulnerable to significant losses. Additionally, there is no mention of negative balance protection, which is a crucial feature that prevents traders from losing more than their initial investment.

The lack of historical data regarding any past fund security issues or disputes further complicates the assessment of 6hourstrades safety. As a result, potential clients must be wary of the risks associated with entrusting their capital to a broker that does not prioritize fund safety.

Customer Experience and Complaints

Analyzing customer feedback and experiences can provide valuable insights into a broker's reliability. Reviews and ratings for 6hourstrade are mixed, with several users expressing concerns about withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow/Unresponsive |

| Poor Customer Support | Medium | Inconsistent |

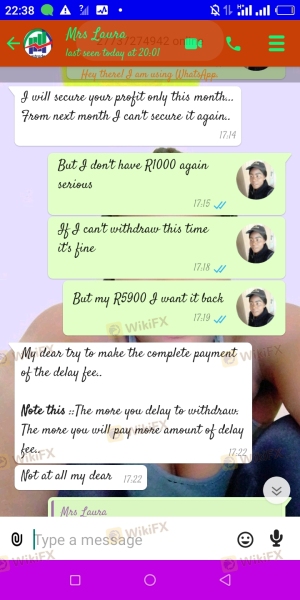

Common complaints include delays in fund withdrawals and inadequate customer service. Such issues can be detrimental to a trader's experience, particularly when immediate access to funds is necessary. The severity of these complaints suggests that traders may face challenges when attempting to manage their accounts or resolve issues with the broker.

In one notable case, a user reported waiting several weeks for a withdrawal to be processed, leading to frustrations and concerns about the broker's legitimacy. This pattern of complaints raises significant questions about whether 6hourstrade is safe for potential clients.

Platform and Execution

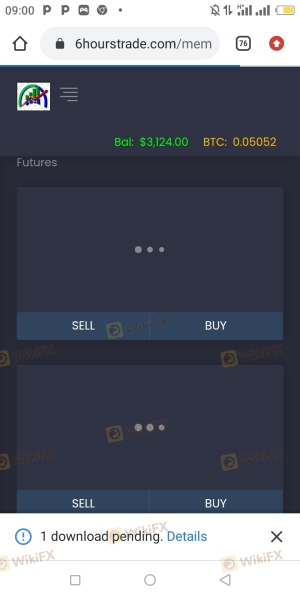

The trading platform's performance and execution quality are vital for a smooth trading experience. While 6hourstrade claims to offer a user-friendly interface, the lack of transparency regarding platform stability and execution metrics is concerning.

Issues such as slippage and order rejections can severely impact trading outcomes, especially in a fast-moving market. Without verifiable data on execution quality, traders may encounter unexpected challenges that could lead to financial losses.

Given the potential for platform manipulation and the absence of robust oversight, traders should be cautious when considering 6hourstrade as their trading platform.

Risk Assessment

Using 6hourstrade carries inherent risks that potential clients should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Fund Safety Risk | High | Lack of fund segregation and protection. |

| Execution Risk | Medium | Potential for slippage and order rejections. |

| Customer Service Risk | High | Reports of poor responsiveness and support. |

To mitigate these risks, potential clients should conduct thorough research, consider starting with a minimal investment, and maintain a diversified trading approach. Engaging with regulated brokers can also provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that 6hourstrade raises several red flags regarding its safety and legitimacy. The absence of regulation, lack of transparency, and numerous customer complaints indicate that traders should approach this broker with caution. While it may offer attractive trading conditions, the potential risks associated with unregulated brokers often outweigh the benefits.

For traders seeking a safer trading environment, it is advisable to consider well-established and regulated alternatives such as Interactive Brokers, Fidelity, or Charles Schwab. These brokers provide robust regulatory oversight, transparent fee structures, and a proven track record of customer satisfaction. Ultimately, thorough research and careful consideration are essential for ensuring a safe trading experience in the forex market.

Is 6HOURSTRADE a scam, or is it legit?

The latest exposure and evaluation content of 6HOURSTRADE brokers.

6HOURSTRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

6HOURSTRADE latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.