Regarding the legitimacy of GMTBTC forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is GMTBTC safe?

Business

License

Is GMTBTC markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Prospero Markets Pty Ltd

Effective Date: Change Record

2012-12-19Email Address of Licensed Institution:

prosperomarkets@brifnsw.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2024-09-25Address of Licensed Institution:

--Phone Number of Licensed Institution:

1300291012Licensed Institution Certified Documents:

Is GMTBTC Safe or a Scam?

Introduction

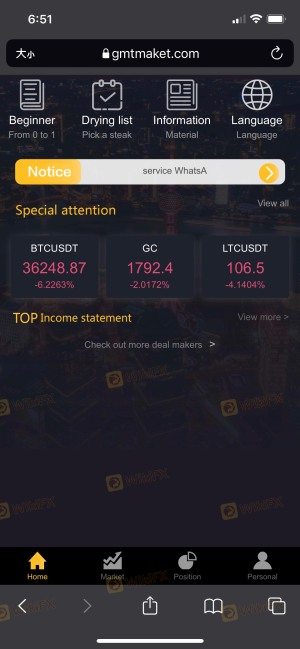

In the ever-evolving landscape of the foreign exchange (forex) market, GMTBTC has emerged as a trading platform that claims to offer various trading instruments, including forex and cryptocurrencies. As traders increasingly seek opportunities in this dynamic environment, it is vital for them to exercise caution and conduct thorough evaluations of forex brokers. The potential for scams and fraudulent activities in the forex industry is significant, making it essential for traders to assess the legitimacy and safety of platforms like GMTBTC. This article aims to provide an objective analysis of GMTBTC's credibility by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk factors. The findings are based on a comprehensive review of multiple sources, including user feedback, regulatory disclosures, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety. A regulated broker is typically subject to stringent oversight, which can offer traders some level of protection. In the case of GMTBTC, the platform's regulatory claims have raised several red flags. According to various sources, GMTBTC operates without proper regulation from recognized financial authorities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Unverified |

The absence of a legitimate license from a reputable regulatory body such as the Australian Securities and Investments Commission (ASIC) indicates that GMTBTC does not meet the necessary legal requirements to operate as a forex broker. Furthermore, it has been reported that GMTBTC is a "suspicious clone" of other regulated entities, which raises concerns about its legitimacy. The lack of regulatory oversight can expose traders to significant risks, including the potential loss of their funds without any recourse. Therefore, it is essential to approach GMTBTC with caution, as its unregulated status is a clear indicator of potential fraud.

Company Background Investigation

Understanding the company behind a trading platform is crucial for assessing its reliability. GMTBTC claims to be based in Australia and was established in 2021. However, detailed information about its ownership structure and management team is scarce. This lack of transparency is concerning, as reputable brokers typically provide comprehensive details about their management and operational history.

The absence of verifiable information regarding GMTBTC's founders and their professional backgrounds raises questions about the company's credibility. Furthermore, the company's website does not disclose any significant achievements or milestones that would suggest a stable and trustworthy operation. The limited information available makes it challenging for potential traders to gauge the company's reliability. In light of these factors, it is prudent for traders to remain skeptical about the legitimacy of GMTBTC, as the lack of transparency and verifiable information often correlates with fraudulent practices.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's profitability and overall experience. GMTBTC presents various account types and trading options, but the details surrounding its fee structure and trading conditions are often vague. A closer examination reveals that GMTBTC has been criticized for its unclear and potentially exploitative fee policies.

| Fee Type | GMTBTC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information regarding spreads, commissions, and overnight fees is alarming. Traders may find themselves facing unexpected costs that can erode their profits. Additionally, reports of excessive withdrawal fees and conditions that seem designed to trap users into depositing more funds are concerning. Such practices are often indicative of a scam, as they can prevent traders from accessing their funds and lead to significant financial losses. Therefore, it is crucial for potential users to carefully scrutinize GMTBTC's trading conditions before committing any capital.

Customer Funds Security

The security of customer funds is paramount in the forex trading landscape. Reputable brokers implement robust measures to protect their clients' investments, including segregated accounts, investor protection schemes, and negative balance protection. However, GMTBTC's approach to fund security has raised several concerns.

Reports indicate that GMTBTC does not provide adequate information regarding its fund protection measures. The absence of segregated accounts means that traders' funds may not be kept separate from the company's operational funds, increasing the risk of loss in the event of insolvency. Additionally, there are no indications of investor protection schemes or negative balance protection policies in place, which further exacerbates the risk of trading with GMTBTC. The lack of transparency regarding these crucial security measures is a significant red flag, suggesting that traders should be wary of depositing funds with this broker.

Customer Experience and Complaints

Examining customer feedback is essential in assessing the overall reliability of a trading platform. In the case of GMTBTC, user reviews and complaints reveal a troubling pattern of dissatisfaction. Many customers have reported issues with withdrawals, including excessive fees and requests for additional deposits before funds can be released.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Excessive Fees | Medium | Poor |

| Misleading Information | High | Poor |

The severity of these complaints, coupled with GMTBTC's inadequate response to customer issues, raises significant concerns about the broker's integrity. In particular, users have expressed frustration over being unable to access their funds, which is a common tactic employed by fraudulent brokers to retain clients' money. Such experiences are indicative of a potentially dangerous trading environment, prompting traders to think twice before engaging with GMTBTC.

Platform and Trade Execution

The performance of a trading platform plays a crucial role in a trader's success. GMTBTC claims to offer a user-friendly trading environment, but reports suggest that the platform may not deliver on these promises. Users have indicated issues with platform stability, order execution quality, and slippage during trades.

The presence of slippage and high rejection rates for orders can severely impact trading outcomes, leading to unexpected losses. Furthermore, any signs of platform manipulation should raise alarms for potential users. The combination of these factors suggests that GMTBTC may not provide the reliable trading experience that traders seek, further corroborating the concerns surrounding its legitimacy.

Risk Assessment

Engaging with GMTBTC involves inherent risks that traders must consider. The lack of regulation, transparency issues, and negative customer experiences contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated entity |

| Financial Risk | High | Lack of fund protection |

| Operational Risk | Medium | Platform stability issues |

Given these risks, traders are advised to exercise extreme caution when considering GMTBTC as a trading platform. Implementing risk mitigation strategies, such as limiting capital exposure and conducting thorough research, can help protect investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that GMTBTC raises several red flags that warrant serious consideration. The absence of regulation, transparency issues, and numerous customer complaints indicate that this broker may not be safe for trading. Traders should be particularly cautious of potential scams and exploitative practices that could lead to significant financial losses.

For those seeking to engage in forex trading, it is advisable to consider reputable and regulated alternatives. Brokers with established track records and transparent operations can provide a safer trading environment. In light of the findings, it is clear that GMTBTC is not a safe option for traders, and individuals should thoroughly research and choose regulated brokers to protect their investments.

Is GMTBTC a scam, or is it legit?

The latest exposure and evaluation content of GMTBTC brokers.

GMTBTC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GMTBTC latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.