Kovie 2025 Review: Everything You Need to Know

Summary

This comprehensive Kovie review examines a forex broker that has generated considerable discussion within the trading community. Much of this attention centers around questions of legitimacy and safety. Based on available information from WikiFX and other sources, Kovie operates as a forex broker offering trading services. The company's regulatory status and operational transparency remain unclear. The broker appears to target retail traders and beginners seeking accessible trading platforms. The lack of detailed trading conditions and limited user feedback makes it challenging to provide a definitive assessment. While some traders may be attracted to what could potentially be low-barrier entry requirements, several concerns arise. The absence of clear regulatory oversight and comprehensive service information raises significant concerns about the platform's reliability and trustworthiness in the competitive forex market.

Important Notice

This Kovie review is based on currently available information from public sources. These include regulatory databases and user feedback platforms. Readers should note that regulatory conditions and broker offerings can vary significantly across different jurisdictions. The information presented here may not reflect the complete picture of Kovie's operations in all regions. The evaluation methodology employed in this review combines analysis of publicly available data, user testimonials where available, and comparison with industry standards. Given the limited transparency surrounding this broker's operations, potential clients are strongly advised to conduct additional due diligence before engaging with Kovie's services.

Rating Framework

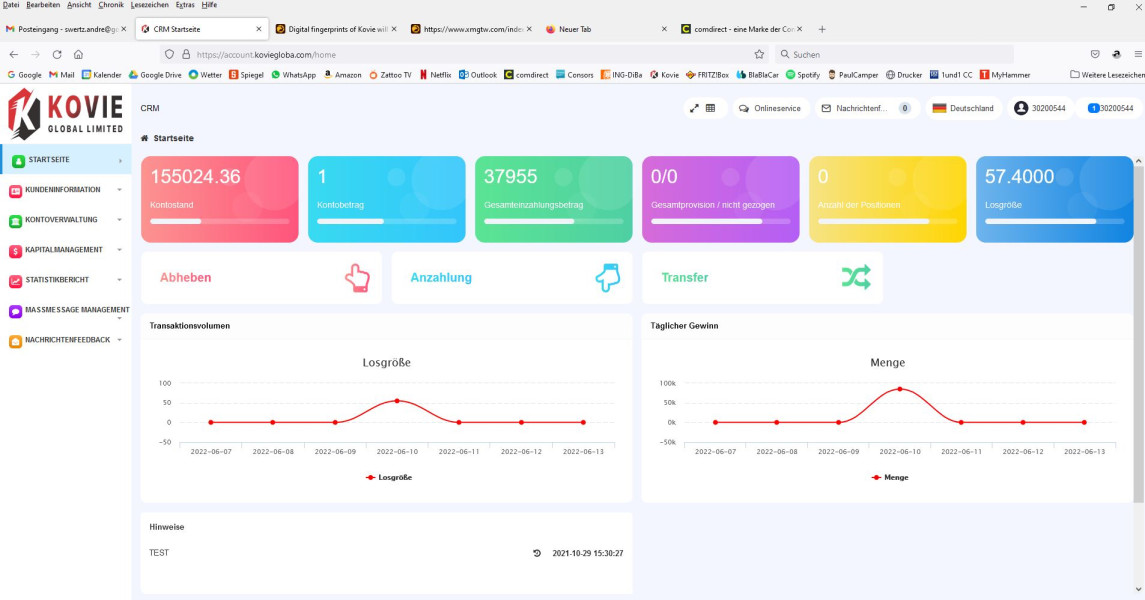

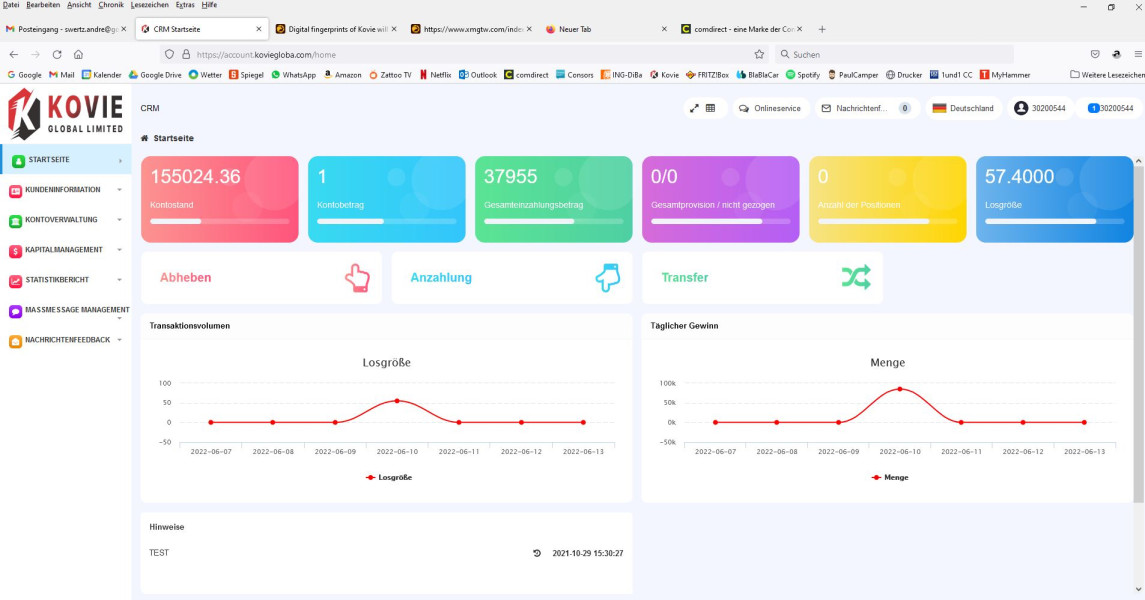

Broker Overview

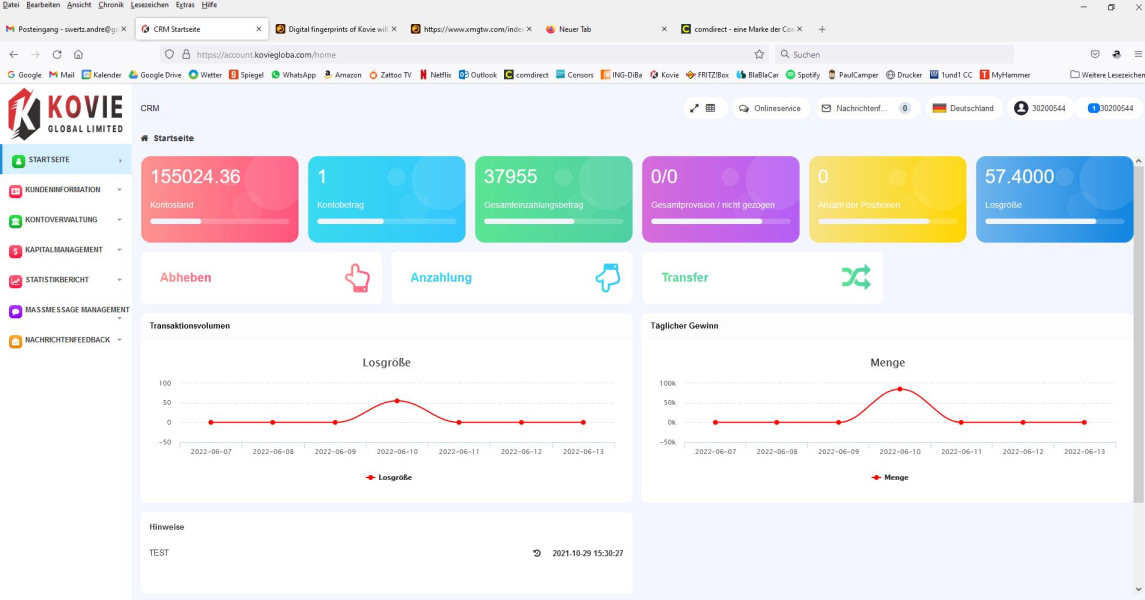

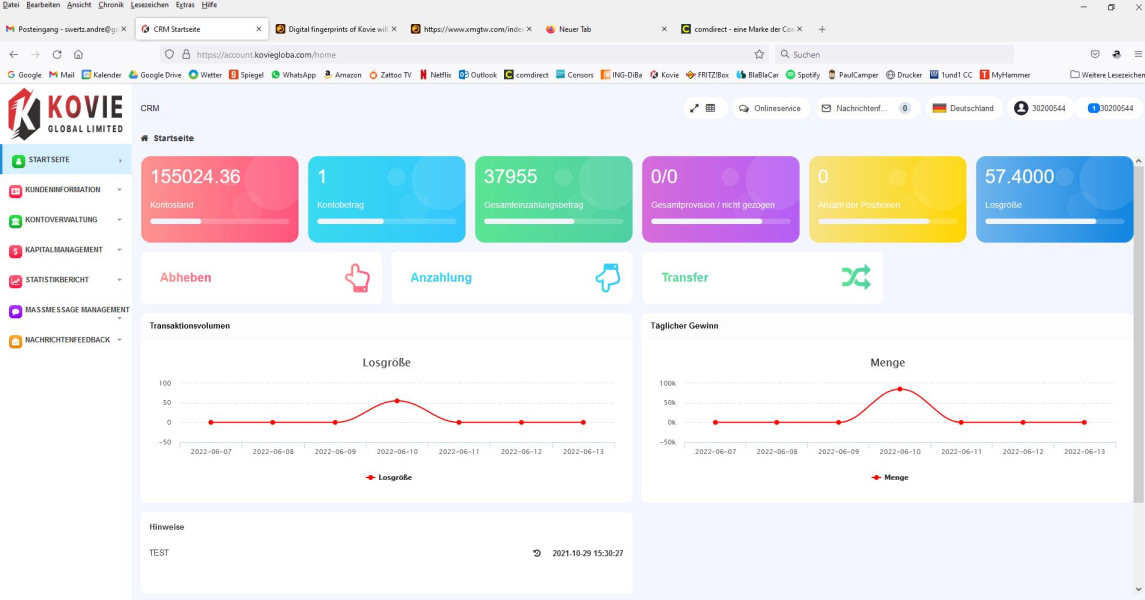

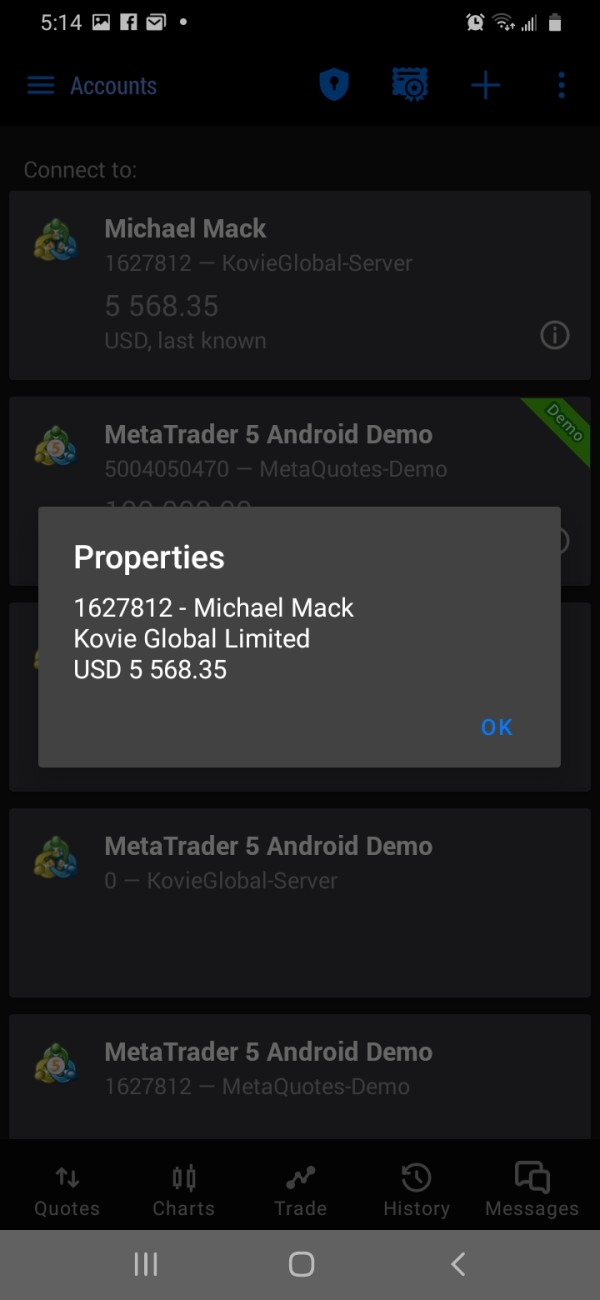

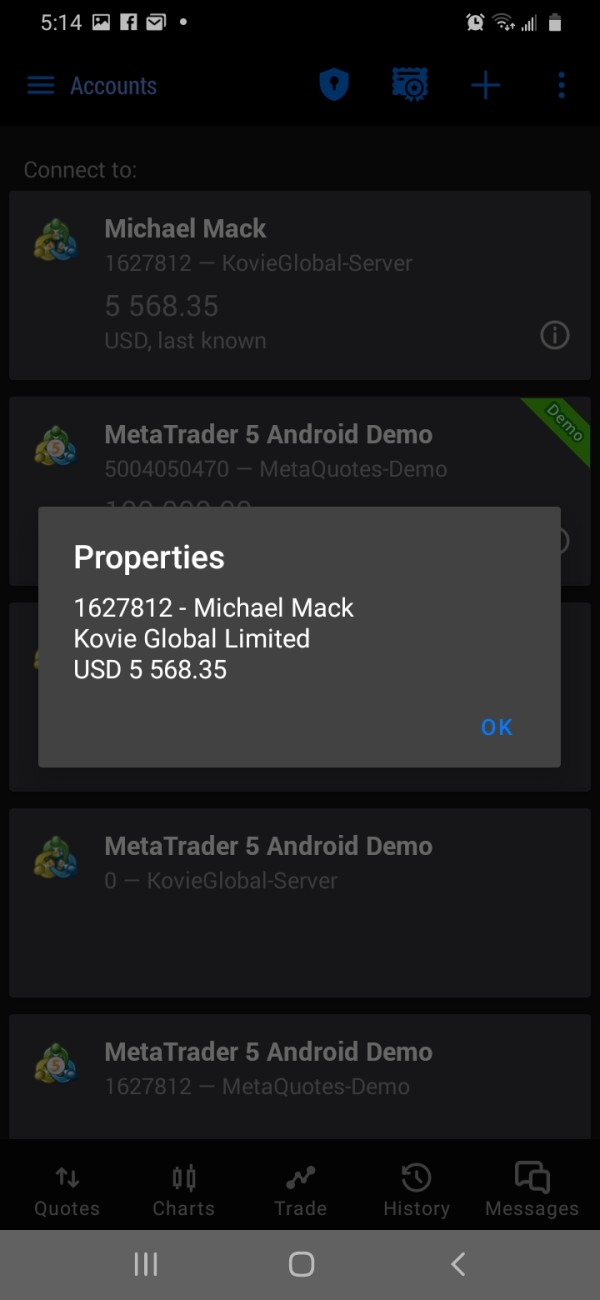

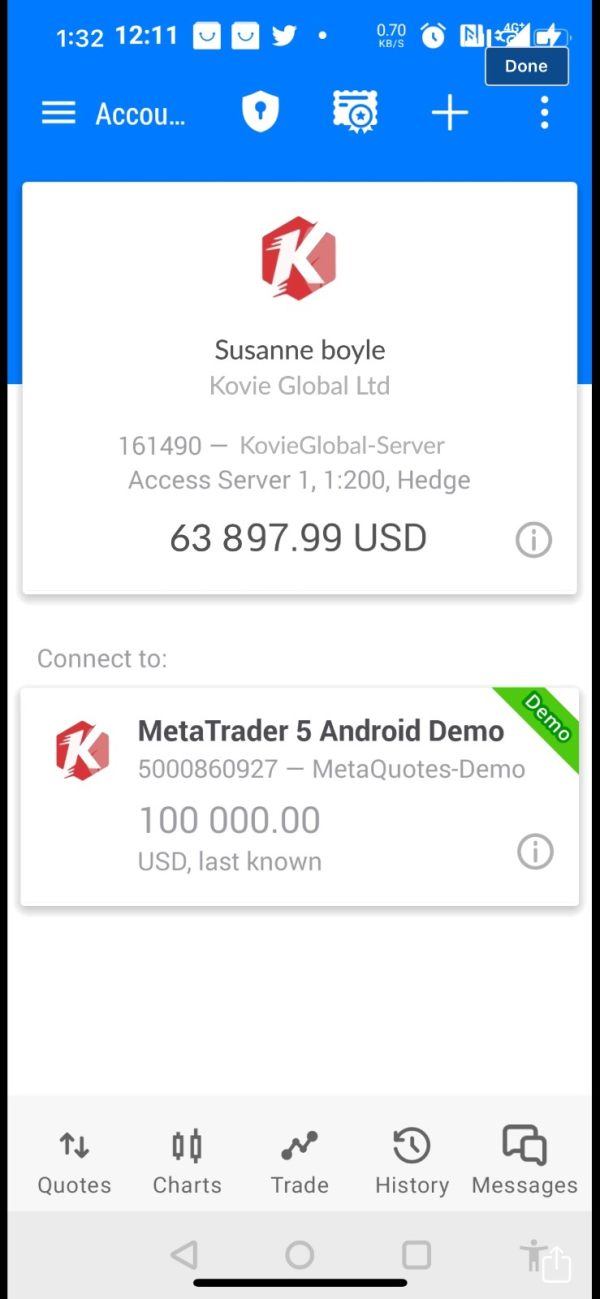

Kovie operates as a forex broker in the competitive online trading market. Specific details about its establishment date and corporate background remain unclear from available sources. According to WikiFX, the platform has been subject to discussions regarding its legitimacy. Some users question whether it represents a legitimate trading opportunity or potential scam. The broker appears to focus primarily on forex trading services. The exact scope of its business model and operational structure lacks transparency. Without clear information about the company's founding, headquarters location, or management team, traders face significant uncertainty when considering this platform.

The broker's service offerings appear centered around foreign exchange trading. There may be potential expansion into CFD trading based on user discussions, though comprehensive details about available instruments remain limited. This Kovie review must note the absence of clear regulatory information. This represents a significant concern for potential clients seeking secure trading environments. The platform's target market seems to include retail traders and possibly beginners attracted to accessible trading conditions. Without detailed information about account requirements and trading terms, it's difficult to confirm the broker's actual positioning in the market.

Regulatory Status: Available information does not clearly specify Kovie's regulatory oversight or licensing details. This lack of transparent regulatory information represents a significant concern for potential clients seeking properly supervised trading environments.

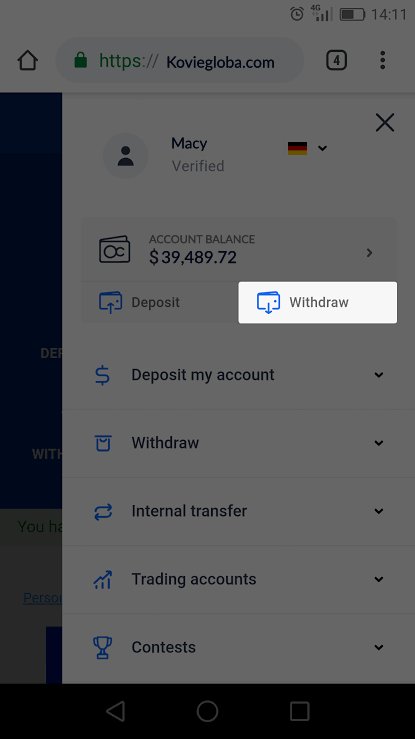

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available sources.

Minimum Deposit Requirements: The exact minimum deposit amount required to open trading accounts with Kovie is not specified in current available information.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not mentioned in available sources reviewing the broker's services.

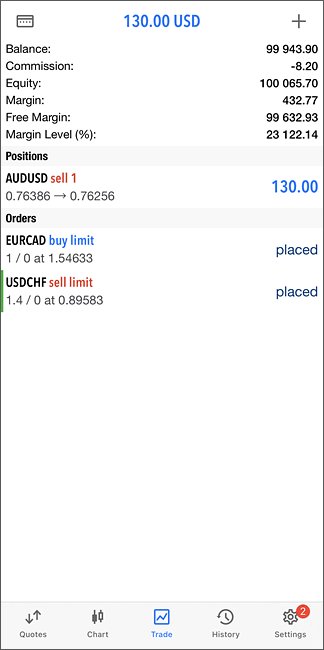

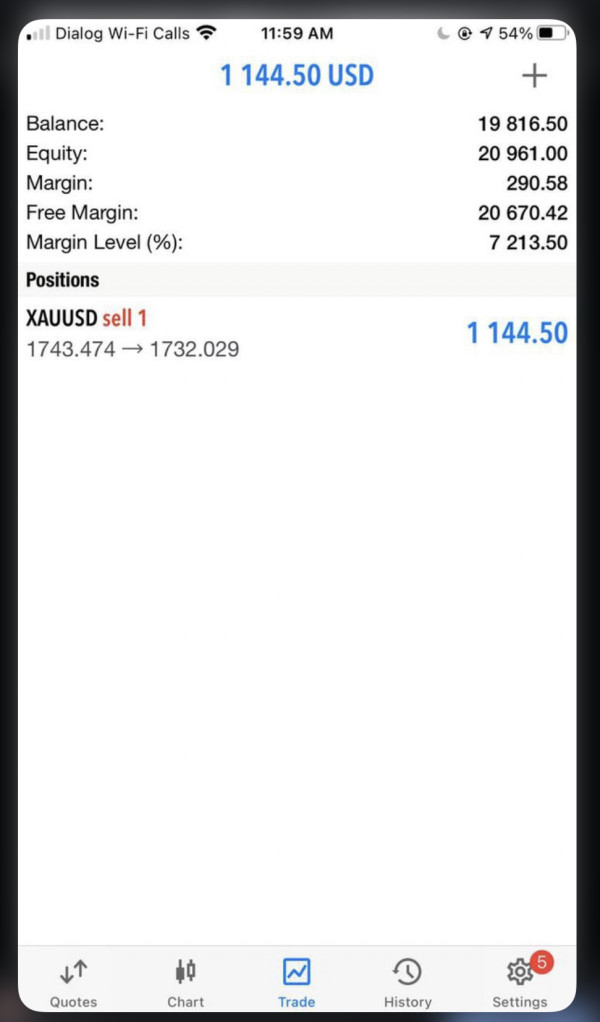

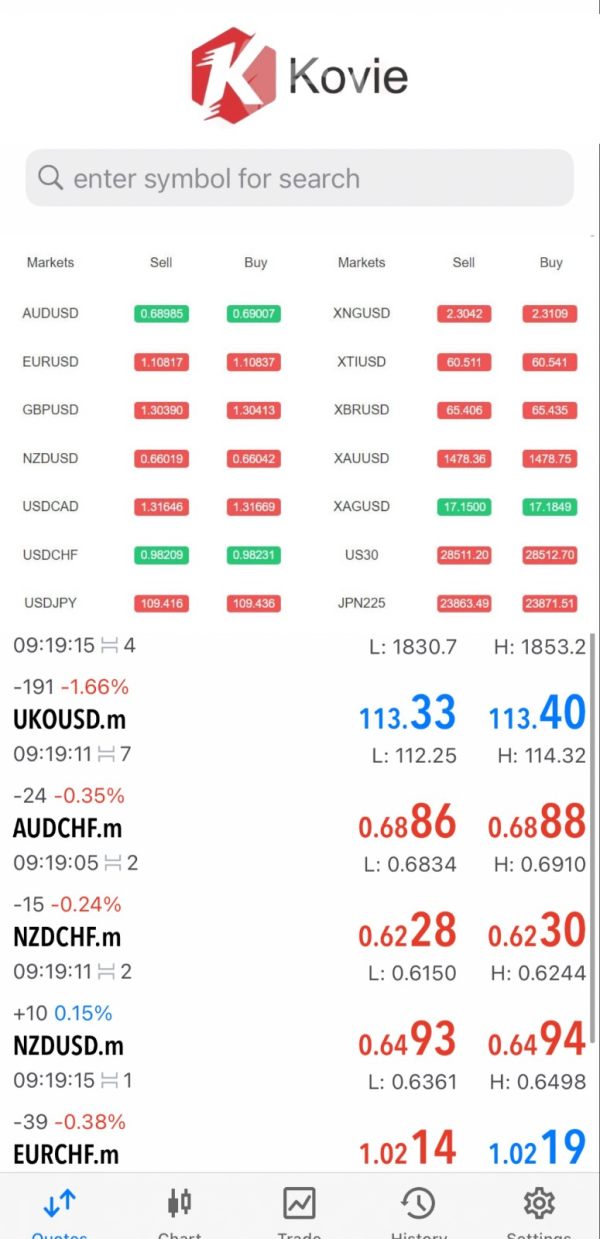

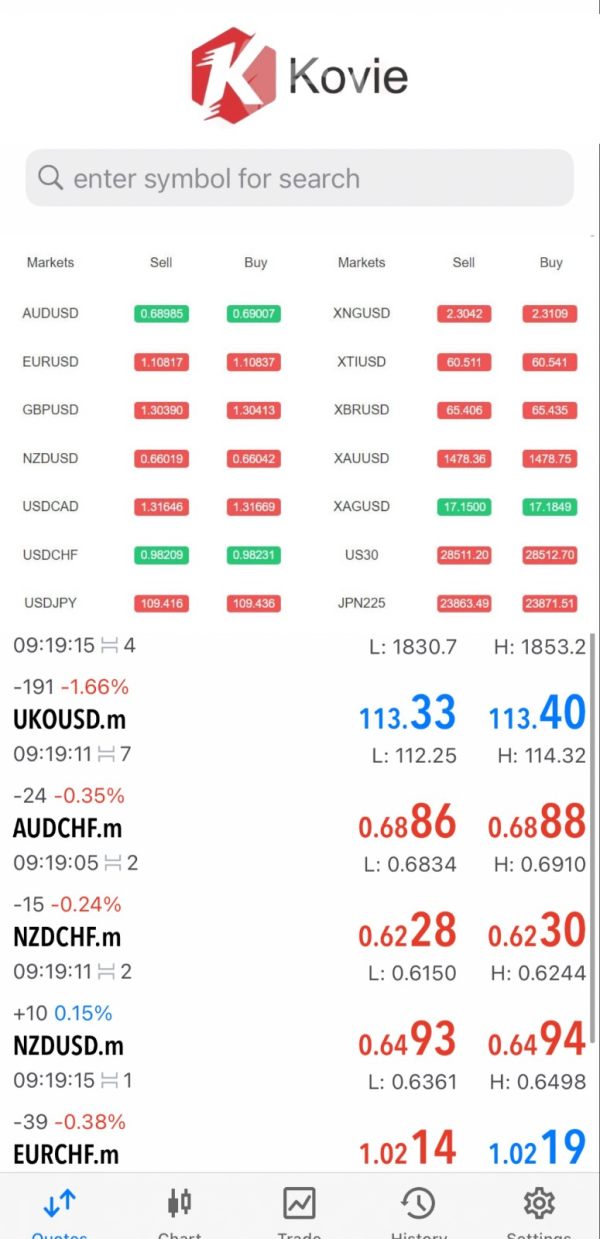

Available Trading Assets: Based on user discussions, Kovie appears to offer forex trading services with potential CFD options. Comprehensive asset lists and specific instruments are not detailed.

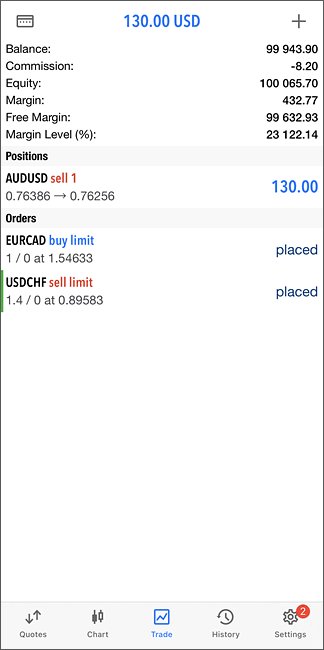

Cost Structure: Information about spreads, commissions, overnight fees, and other trading costs is not comprehensively available in current sources. This lack of pricing transparency makes it difficult for traders to assess the true cost of trading with this broker.

Leverage Options: Specific leverage ratios offered to different account types and regions are not detailed in available information.

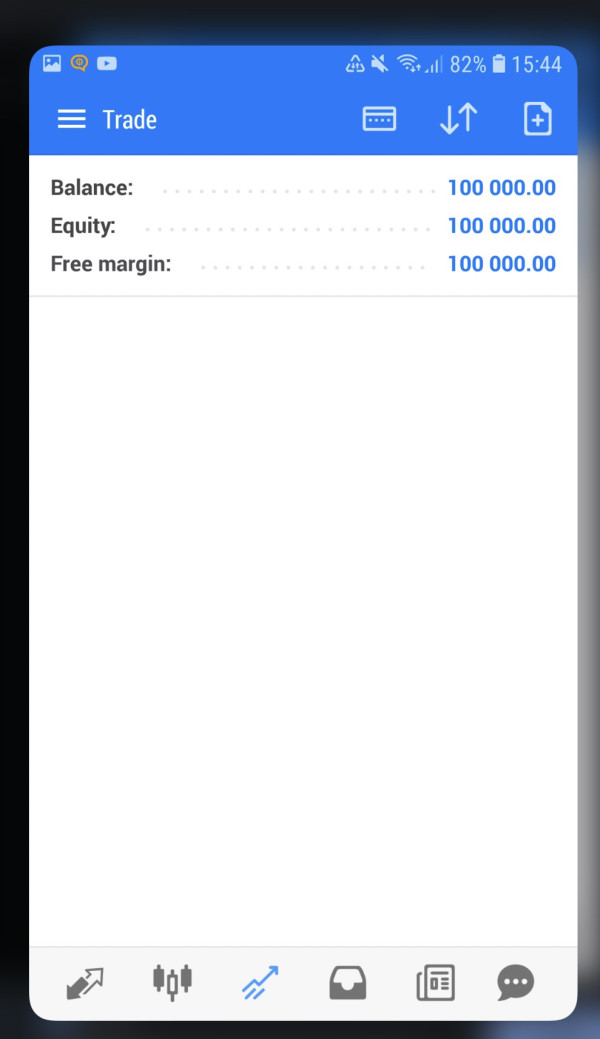

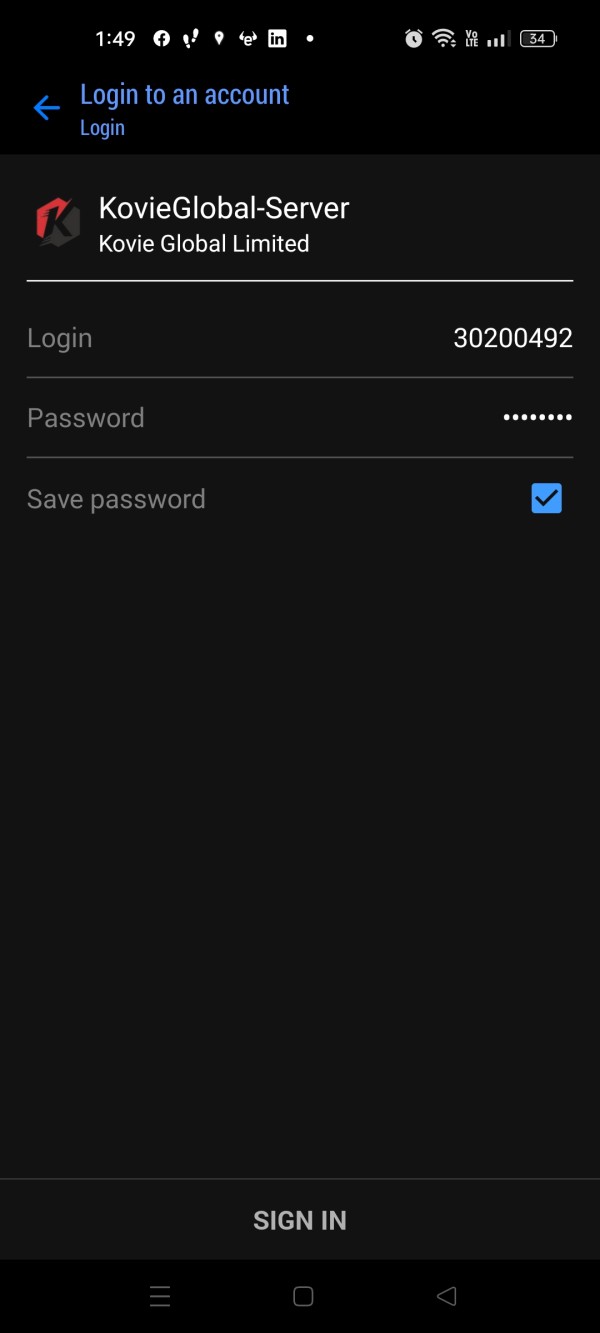

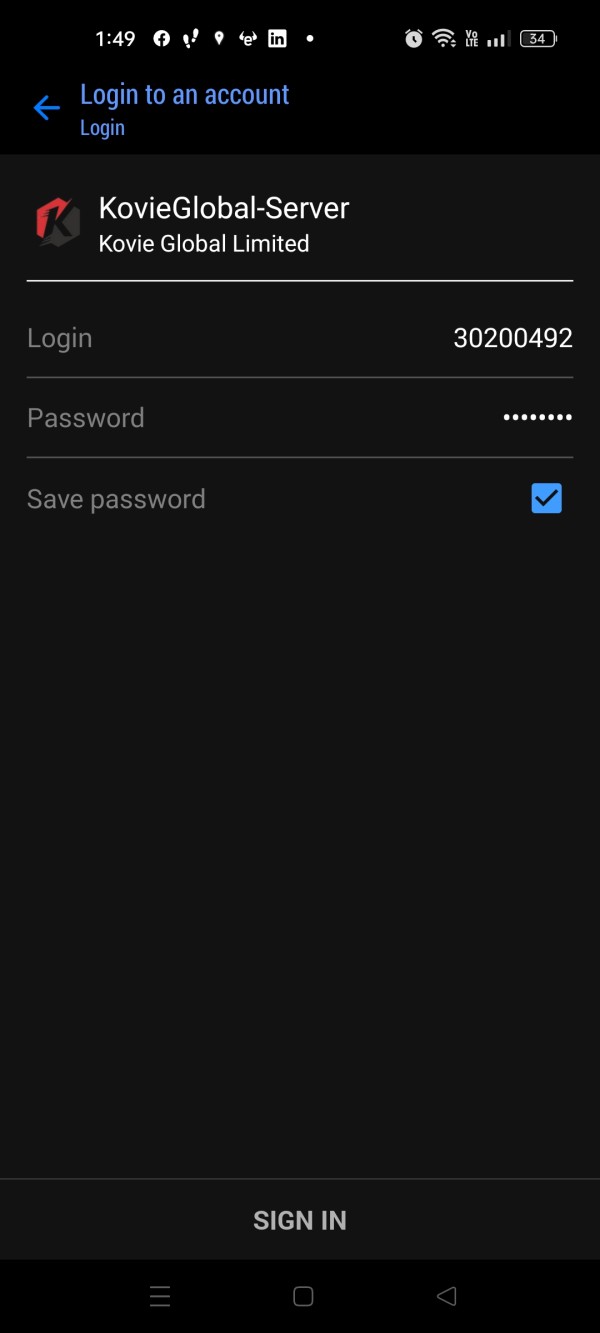

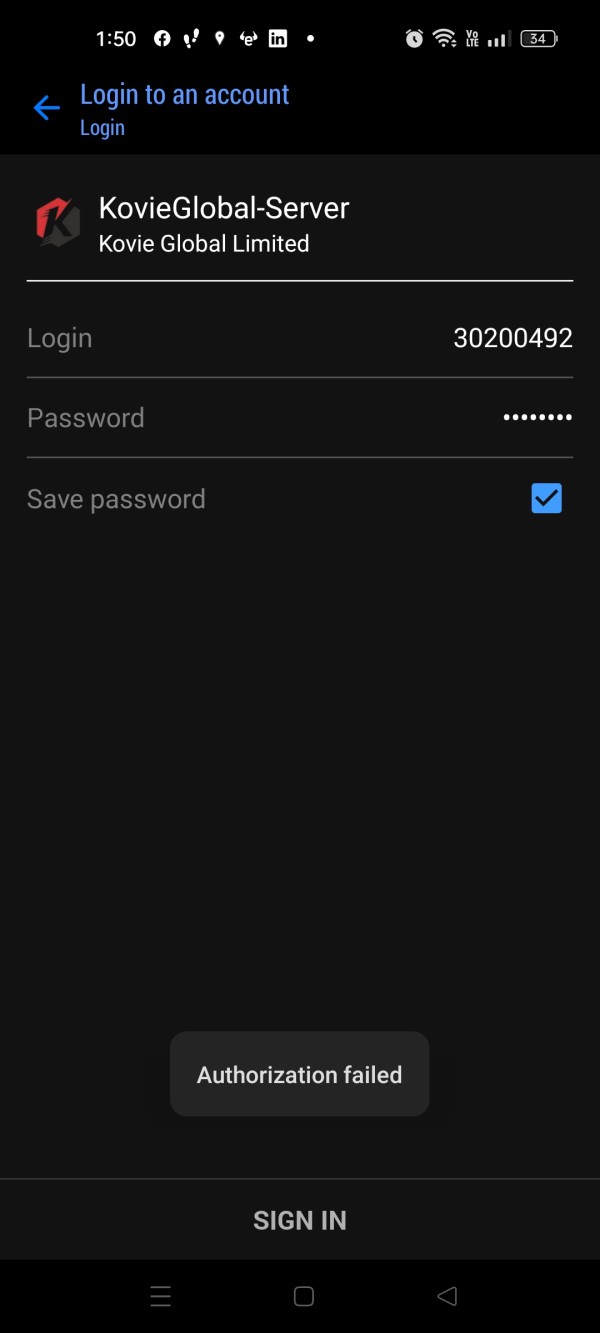

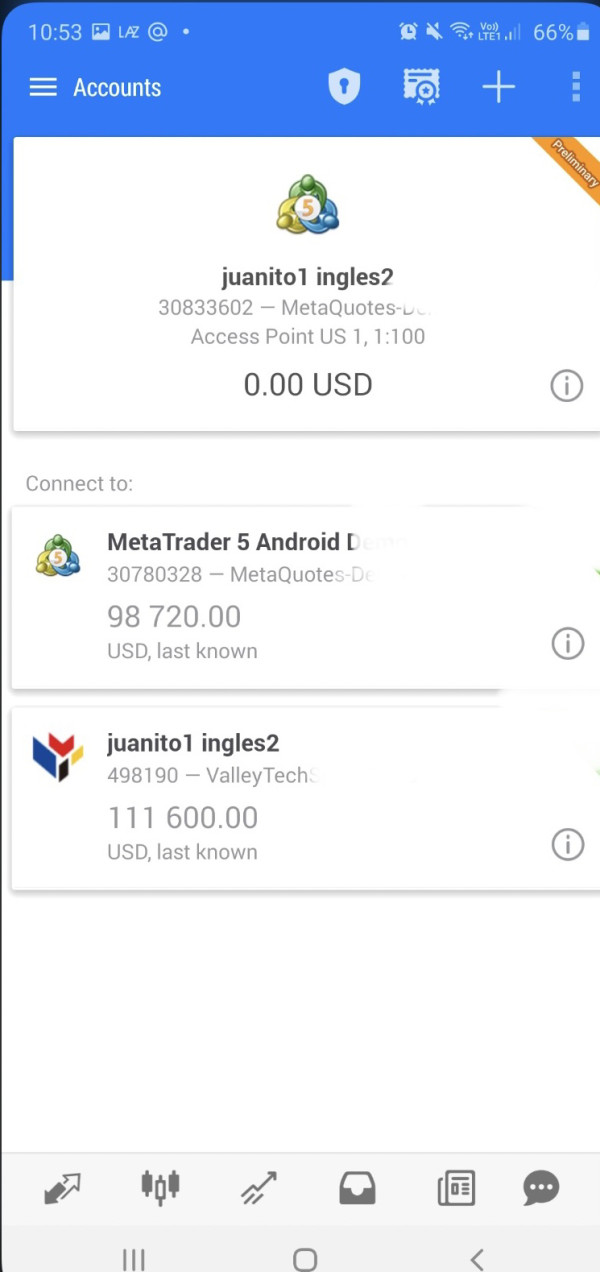

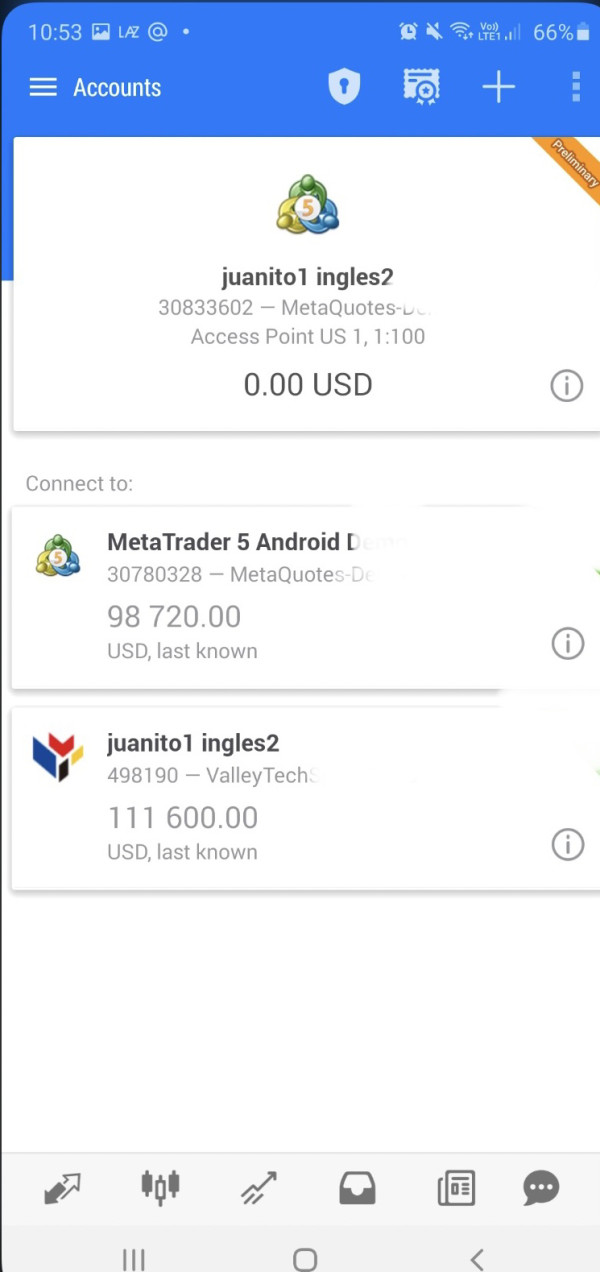

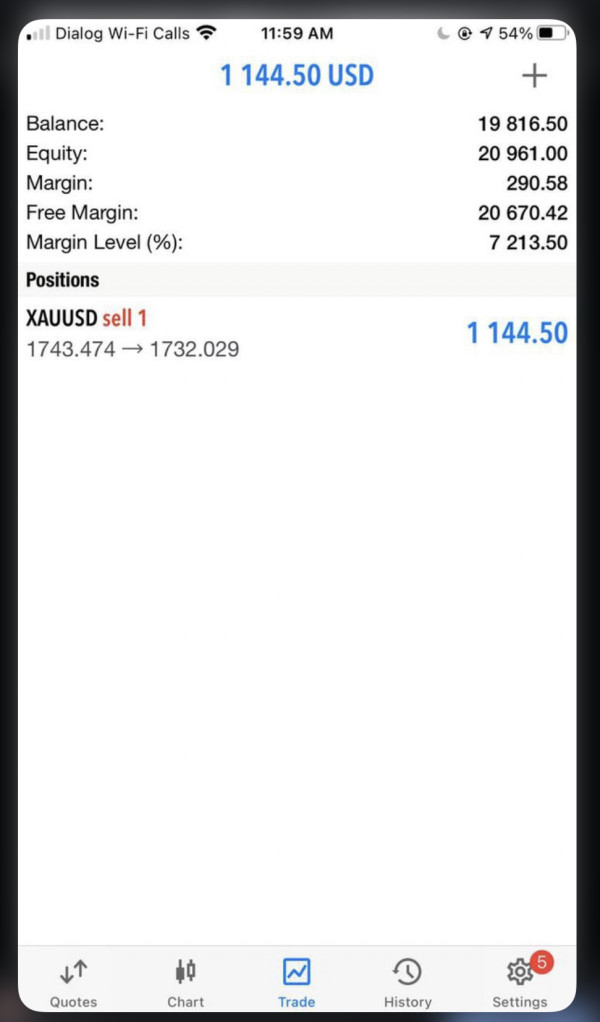

Platform Options: Details about trading platform software, mobile applications, and web-based trading interfaces are not specified in current sources.

Geographic Restrictions: Information about countries where Kovie's services are available or restricted is not clearly outlined.

Customer Support Languages: Available customer service languages and support options are not detailed in current information sources.

Detailed Rating Analysis

Account Conditions Analysis

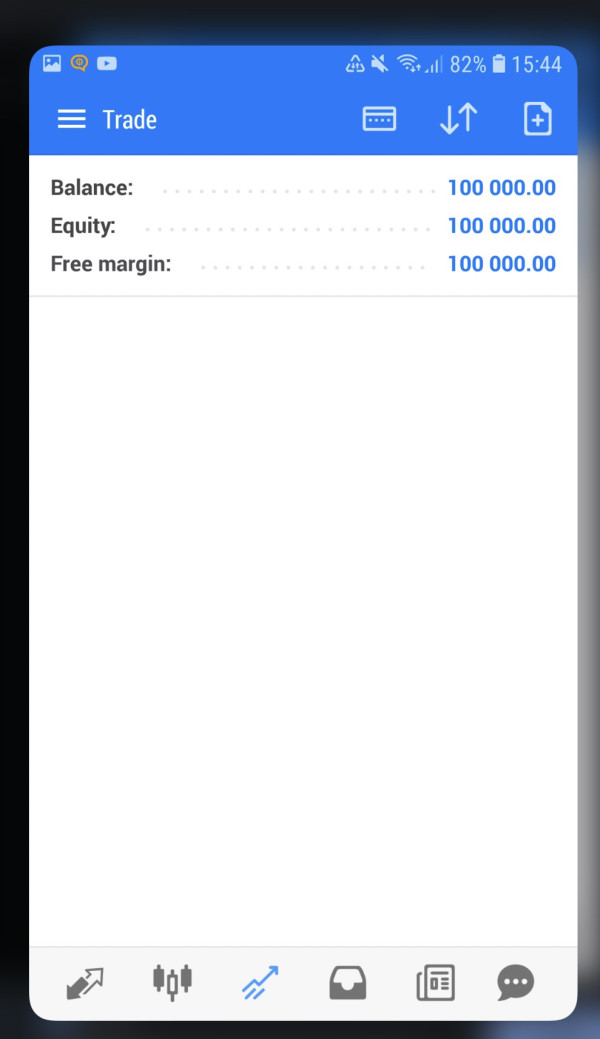

The evaluation of Kovie's account conditions proves challenging due to the limited information available about the broker's specific offerings. This Kovie review cannot identify distinct account types, their respective features, or the benefits associated with different account tiers. Without access to detailed information about minimum deposit requirements, account opening procedures, or special account features such as Islamic accounts for Muslim traders, it becomes difficult to assess how competitive the broker's account conditions are within the industry. The absence of clear documentation about account terms and conditions raises concerns about transparency and regulatory compliance.

Potential clients typically expect comprehensive information about account specifications. This includes leverage options, minimum trade sizes, and account maintenance requirements, none of which are clearly outlined in available sources. This lack of transparency significantly impacts the broker's credibility. It makes it challenging for traders to make informed decisions about account selection.

The assessment of Kovie's trading tools and resources reveals a significant gap in available information. This Kovie review cannot identify specific trading tools, technical analysis software, or research resources provided to clients. Professional traders typically require access to advanced charting tools, economic calendars, market analysis, and automated trading capabilities. None of these features are detailed in available information about Kovie. Educational resources, which are crucial for beginner traders, are also not mentioned in current sources.

The absence of information about research and analysis materials raises concerns. This includes daily market reports, expert commentary, or trading signals, which suggests either limited offerings or poor communication of available services. Without clear documentation of platform capabilities, third-party integrations, or proprietary trading tools, potential clients cannot assess whether Kovie provides the necessary resources for successful trading. This lack of detailed information about tools and resources significantly undermines the broker's appeal to serious traders who require comprehensive trading support.

Customer Service and Support Analysis

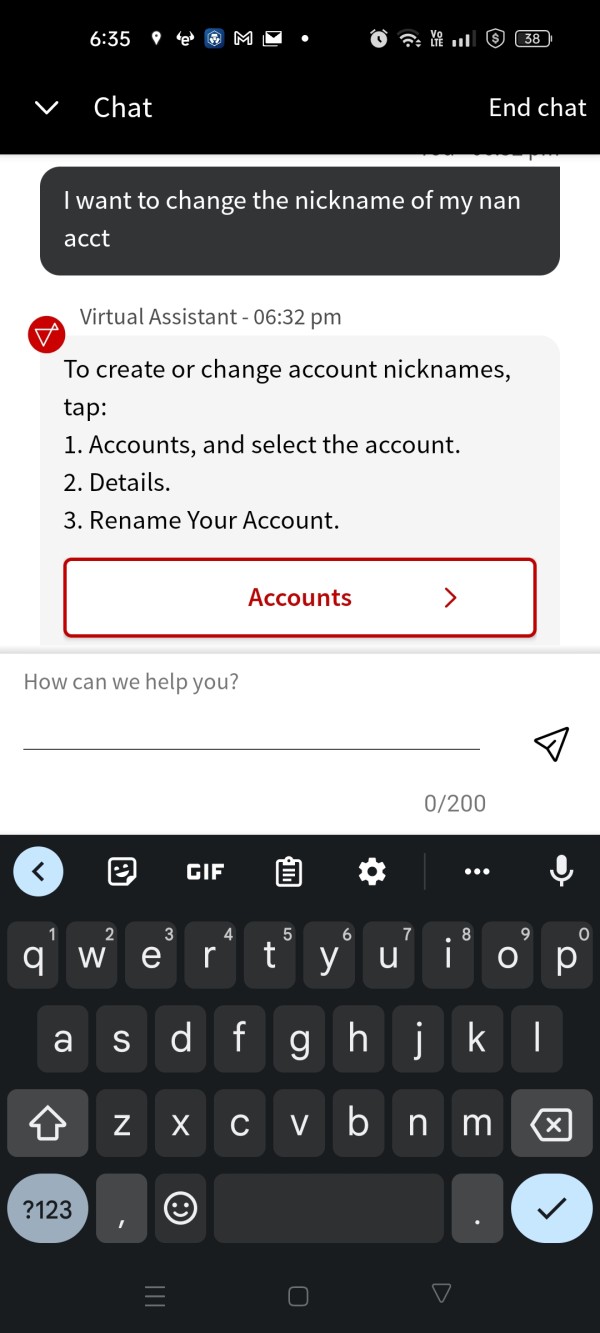

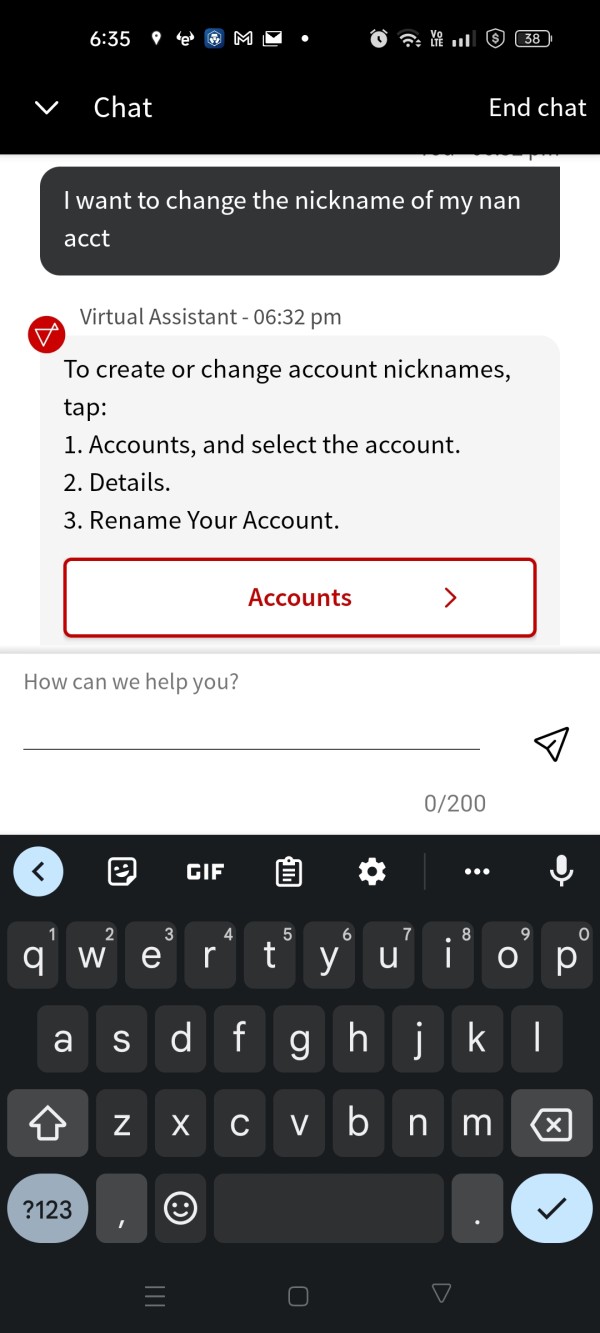

Evaluating Kovie's customer service quality presents significant challenges due to limited available information about support channels, response times, and service quality metrics. Professional forex brokers typically provide multiple contact methods including live chat, email support, and phone assistance. Specific details about Kovie's customer service infrastructure are not documented in available sources. The absence of information about customer service hours, multilingual support options, and response time commitments raises concerns about the broker's commitment to client support.

User feedback regarding customer service experiences is notably absent from available sources. This makes it impossible to assess real-world service quality or problem resolution effectiveness. Professional traders require reliable customer support for technical issues, account problems, and trading-related queries. Without documented service standards or user testimonials, potential clients cannot evaluate Kovie's support capabilities. This lack of transparency regarding customer service represents a significant weakness in the broker's overall offering and raises questions about operational professionalism.

Trading Experience Analysis

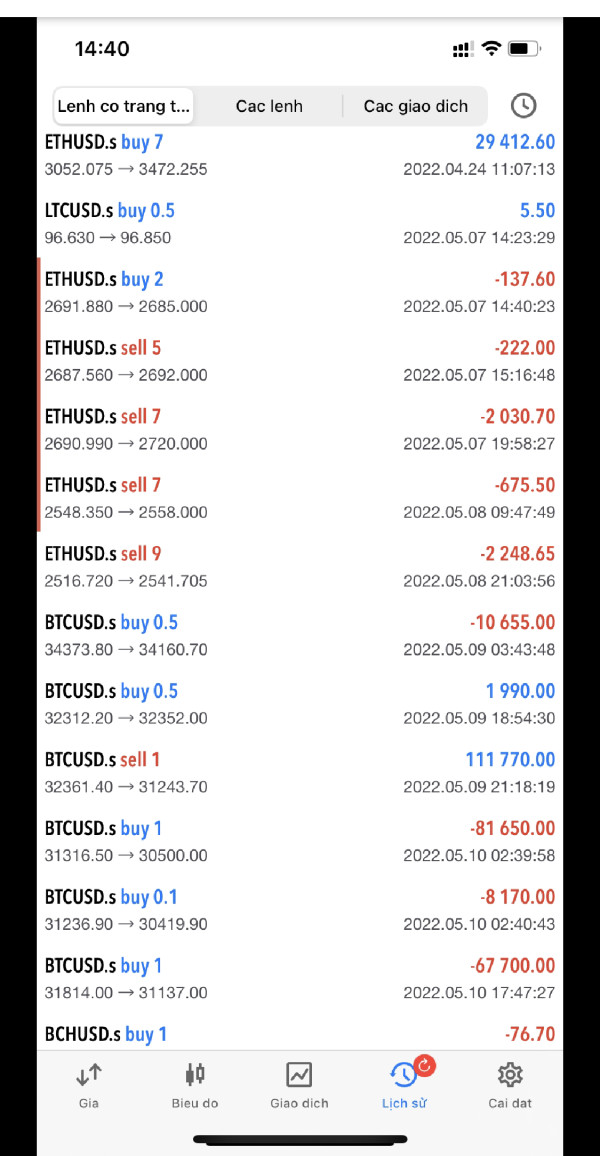

The analysis of trading experience with Kovie is severely limited by the absence of detailed platform information and user feedback. Critical factors such as platform stability, execution speed, and order processing quality cannot be assessed due to insufficient data about the broker's technological infrastructure. This Kovie review cannot evaluate platform functionality, mobile trading capabilities, or the overall user interface quality that directly impacts trading effectiveness.

Professional traders require information about execution methods, slippage rates, and platform uptime statistics. None of this information is available in current sources. The absence of user testimonials about trading experiences, platform performance during high-volatility periods, or overall satisfaction with execution quality makes it impossible to provide meaningful assessment of the trading environment. Without detailed information about platform features, order types, and trading tools integration, potential clients cannot determine whether Kovie provides a competitive trading experience compared to established brokers in the market.

Trust and Reliability Analysis

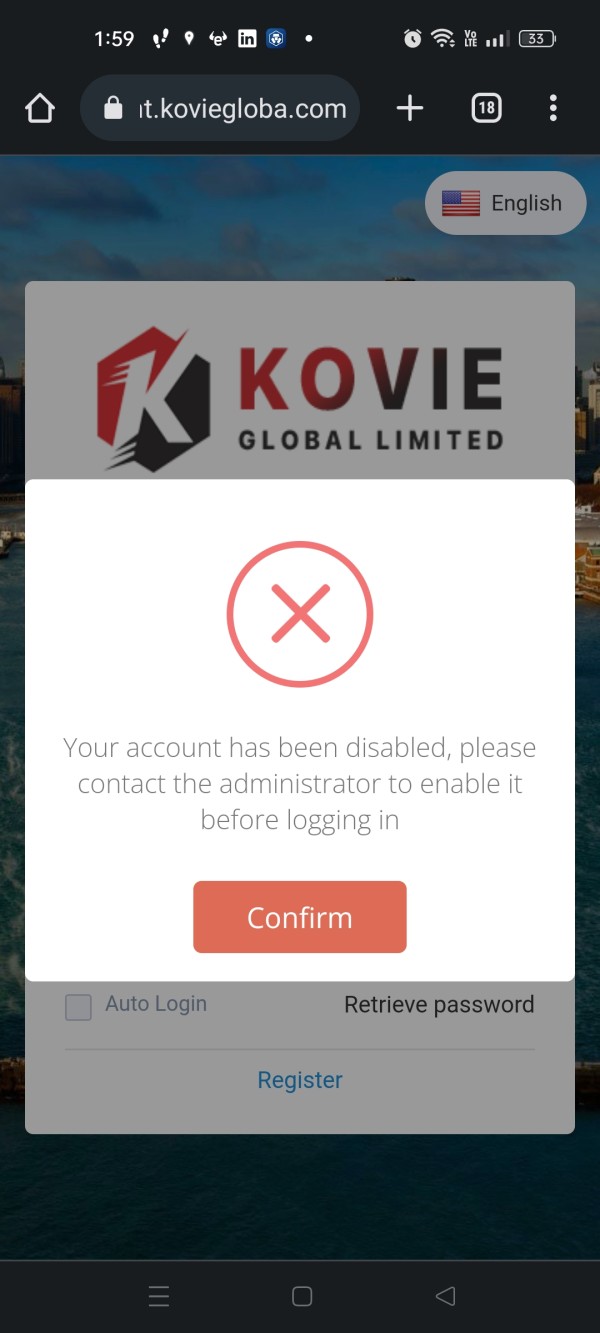

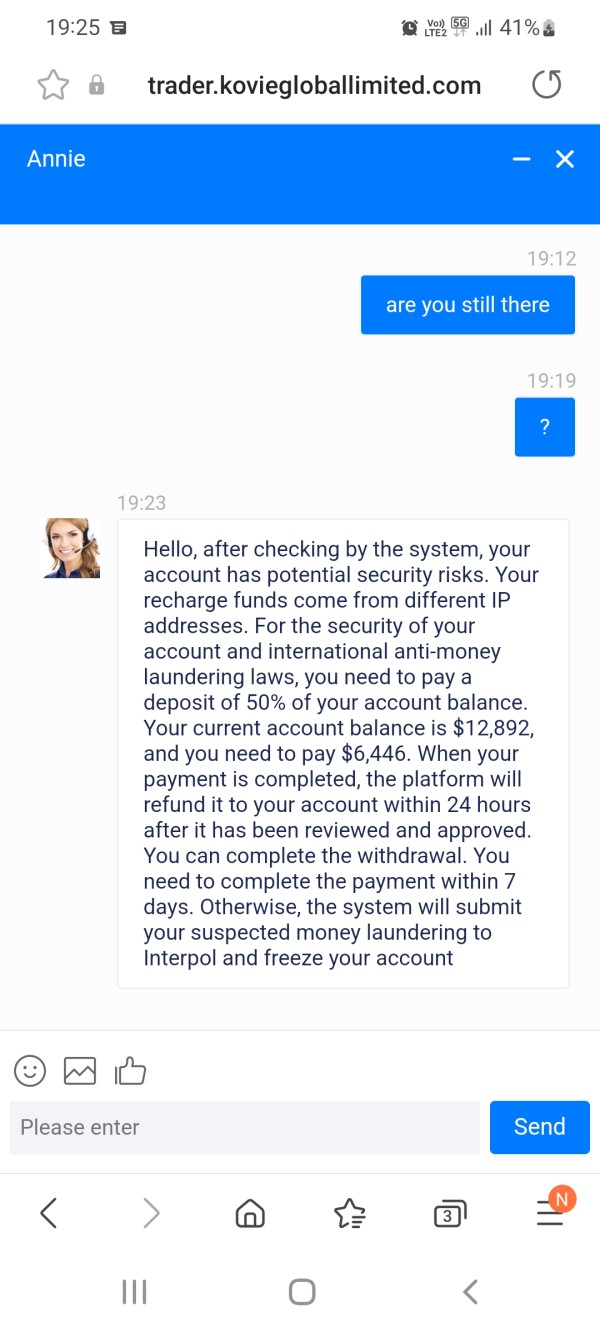

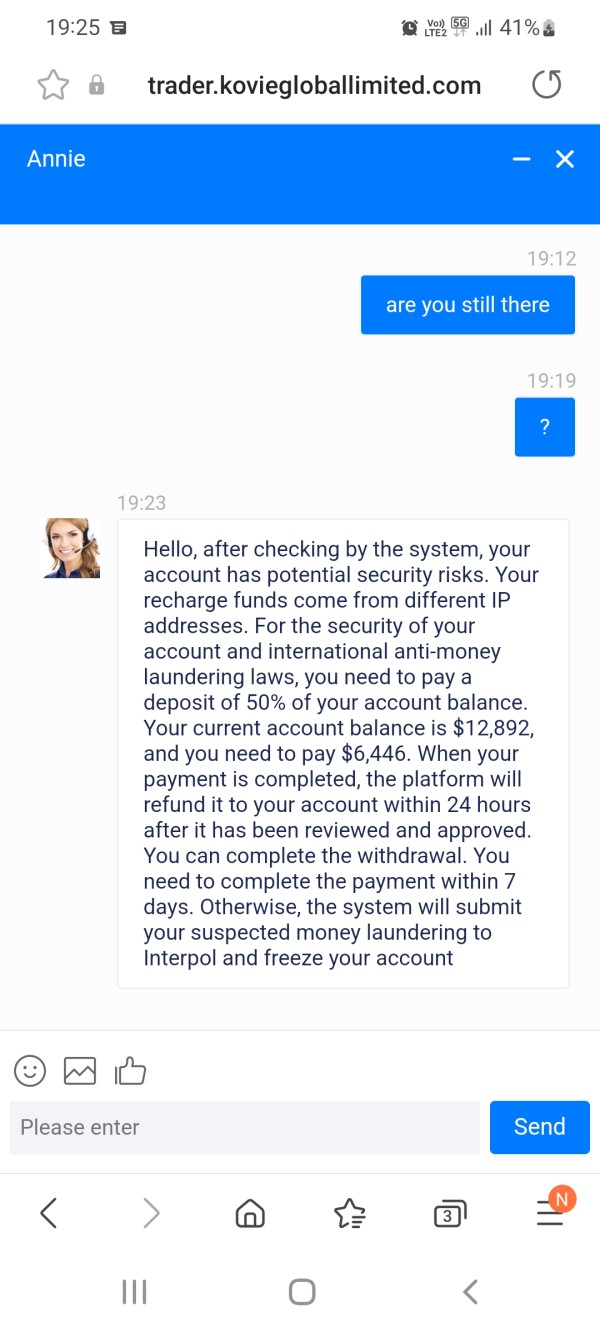

The trust and reliability assessment of Kovie reveals significant concerns that potential clients must carefully consider. According to WikiFX sources, discussions about the broker's legitimacy have emerged within the trading community. Some users question whether Kovie represents a legitimate trading opportunity or potential fraudulent operation. The absence of clear regulatory information represents a major red flag. Reputable forex brokers typically maintain transparent licensing and regulatory compliance documentation.

Without verified regulatory oversight from recognized financial authorities, clients lack important protections typically associated with properly supervised brokers. The limited availability of company background information, including corporate structure, management team details, and operational history, further undermines confidence in the broker's reliability. Professional traders typically require comprehensive due diligence information about their chosen brokers. This includes regulatory compliance records, financial stability indicators, and industry reputation metrics, most of which are unavailable for Kovie. These transparency concerns significantly impact the broker's trustworthiness and suggest potential clients should exercise extreme caution when considering this platform.

User Experience Analysis

Assessing the overall user experience with Kovie proves challenging due to the scarcity of comprehensive user feedback and testimonials in available sources. The limited information about interface design, navigation ease, and overall platform usability makes it difficult to evaluate how well the broker serves its clients' needs. Professional trading platforms typically receive extensive user reviews covering registration processes, account verification procedures, and day-to-day trading functionality. Such feedback is notably absent for Kovie.

The lack of detailed user testimonials about deposit and withdrawal experiences, customer service interactions, and overall satisfaction levels raises concerns about the broker's actual operational quality. Without comprehensive user feedback, it's impossible to identify the typical user profile that might benefit from Kovie's services or understand common user complaints and concerns. The absence of user experience data also prevents meaningful comparison with established brokers in terms of client satisfaction and service quality. This information gap significantly limits potential clients' ability to make informed decisions about whether Kovie would meet their trading needs and expectations.

Conclusion

This comprehensive Kovie review reveals a forex broker operating with limited transparency and questionable regulatory oversight. This raises significant concerns about its legitimacy and reliability in the competitive trading market. While the platform may potentially appeal to beginner traders seeking accessible entry points into forex trading, the substantial lack of detailed information about trading conditions, regulatory compliance, and service quality makes it difficult to recommend Kovie to serious traders. The primary advantages might include possible low-barrier entry requirements. Even this cannot be confirmed without detailed account information.

However, the disadvantages significantly outweigh potential benefits. These include unclear regulatory status, limited transparency about trading conditions, absence of comprehensive user feedback, and concerns raised about the broker's legitimacy within the trading community. Potential clients are strongly advised to consider well-established, properly regulated alternatives that provide transparent information about their services and maintain clear regulatory compliance standards.