Is Monafoli safe?

Business

License

Is Monafoli A Scam?

Introduction

In the ever-evolving landscape of the forex market, Monafoli has positioned itself as a broker offering a range of trading instruments, including forex, commodities, indices, and cryptocurrencies. However, the rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to thoroughly evaluate the legitimacy of brokers before investing their hard-earned money. This article aims to objectively analyze whether Monafoli is a safe trading platform or a potential scam. Our investigation is based on a comprehensive review of various online sources, user testimonials, and regulatory information, providing a balanced view of the broker's operations and credibility.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant factors affecting its credibility and trustworthiness. Monafoli claims to operate from the United Kingdom; however, it lacks any valid licenses from recognized regulatory bodies, which raises serious concerns about its legitimacy. Below is a summary of the regulatory information available for Monafoli:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Blacklisted |

The absence of a regulatory license from the Financial Conduct Authority (FCA) means that Monafoli does not adhere to the strict standards set for financial service providers in the UK. This includes crucial protections like segregated accounts, negative balance protection, and access to compensation funds. The FCA has issued warnings against Monafoli, categorizing it as an unregulated entity that poses significant risks to traders. Such regulatory failures indicate a lack of oversight, which is a red flag for potential fraud.

Company Background Investigation

Monafoli's operational history appears opaque, with limited information available regarding its ownership structure and management team. The broker claims to be based in the UK, yet there are no verifiable records to support this assertion. This lack of transparency is concerning, as it makes it difficult for potential investors to assess the credibility of the broker.

The management team's background is equally unclear, with no publicly available information about their professional experience or qualifications in the financial sector. This absence of information suggests a lack of accountability, which is critical for any trading platform. Traders should be wary, as the anonymity surrounding Monafoli could indicate a deliberate attempt to evade scrutiny and accountability.

Trading Conditions Analysis

When evaluating whether Monafoli is safe for trading, it's essential to examine its trading conditions, including fees and spreads. Monafoli has set its minimum deposit at an unusually high level of $10,000, which is significantly above the industry average. Below is a comparison of Monafoli's core trading costs against industry standards:

| Fee Type | Monafoli | Industry Average |

|---|---|---|

| Spread on Major Pairs | 0.6 pips | 1.0 pips |

| Commission Structure | Vague | $6 per lot |

| Overnight Interest Range | Not disclosed | 1-3% |

While the spread on major currency pairs may appear competitive, the lack of clarity regarding commissions and other fees raises concerns. Traders have reported hidden fees and charges that often surface during the withdrawal process, indicating a potentially exploitative fee structure. This ambiguity in fees is a common tactic among fraudulent brokers, making it essential for traders to fully understand the cost implications before engaging with Monafoli.

Client Fund Security

A critical aspect of assessing whether Monafoli is safe involves examining its client fund security measures. Monafoli does not provide sufficient information regarding its policies on fund segregation or investor protection. The absence of these measures means that client funds could be at risk, as they may not be held in separate accounts away from the broker's operational funds.

Furthermore, the lack of a negative balance protection policy means that traders could lose more than their initial investment, which is a significant risk. Historical reports indicate that Monafoli has faced complaints related to fund withdrawals, with many clients alleging that their requests were either delayed or denied altogether. Such issues highlight the potential dangers of trading with an unregulated broker like Monafoli.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience of trading with Monafoli. Reviews from various sources indicate a pattern of dissatisfaction among users, with many reporting issues related to withdrawals and customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Misleading Promotions | Medium | Unresponsive |

| Lack of Customer Support | High | Poor |

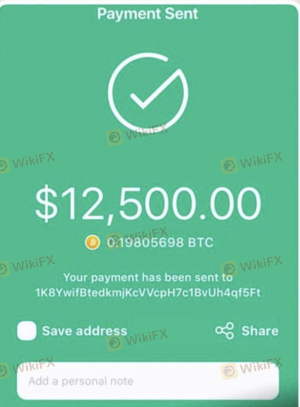

Many users have expressed frustration over the broker's inability to process withdrawal requests in a timely manner. Reports suggest that once clients attempt to withdraw their funds, they are often met with demands for additional fees or taxes, which is a common tactic used by scam brokers to retain client funds. The overall response from Monafoli has been described as poor, with many users reporting unhelpful or nonexistent customer service.

Platform and Trade Execution

The trading platform offered by Monafoli is another critical factor in assessing its reliability. While the broker claims to provide a user-friendly web-based platform, many reviews suggest that the platform is prone to issues such as slow execution times and high slippage rates. This can significantly impact trading outcomes, especially for those engaged in high-frequency trading strategies.

Additionally, there are concerns regarding potential platform manipulation. Users have reported discrepancies between displayed prices and actual execution prices, raising suspicions about the integrity of trade execution. Such issues are alarming, particularly for traders who rely on accurate and timely order execution.

Risk Assessment

In summary, the overall risk of trading with Monafoli appears to be high, given its unregulated status and the numerous complaints from users. Below is a risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight from recognized bodies. |

| Financial Risk | High | Lack of fund protection and high minimum deposits. |

| Operational Risk | Medium | Platform issues and potential execution manipulation. |

To mitigate these risks, it is essential for traders to conduct thorough research and consider using regulated brokers with established reputations. Additionally, traders should avoid depositing more than they can afford to lose and should be cautious about sharing sensitive financial information.

Conclusion and Recommendations

In conclusion, the evidence suggests that Monafoli is not a safe trading platform and exhibits several characteristics typical of a scam. The lack of regulation, high minimum deposits, poor customer feedback, and issues with fund withdrawals all indicate significant risks for potential investors. Therefore, it is advisable for traders to avoid engaging with Monafoli and to seek out regulated alternatives that offer greater transparency and security.

For those looking to enter the forex market, consider brokers that are well-regulated and have a proven track record of customer satisfaction. Always prioritize safety and due diligence when selecting a trading partner, as the risks associated with unregulated brokers like Monafoli can lead to substantial financial losses.

Is Monafoli a scam, or is it legit?

The latest exposure and evaluation content of Monafoli brokers.

Monafoli Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Monafoli latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.