Is TradeFCM safe?

Business

License

Is TradeFCM Safe or Scam?

Introduction

TradeFCM is an online forex brokerage that claims to provide a range of trading services, including forex, commodities, and cryptocurrencies. Positioned as a UK-based broker, it aims to attract both novice and experienced traders with promises of high leverage and low spreads. However, the necessity for traders to exercise caution when selecting a forex broker cannot be overstated. The forex market is rife with unregulated entities that can jeopardize traders' investments. This article aims to investigate the legitimacy of TradeFCM by evaluating its regulatory status, company background, trading conditions, customer feedback, and overall safety measures. To do this, we have analyzed multiple sources, including user reviews, regulatory databases, and expert assessments.

Regulation and Legitimacy

Understanding the regulatory framework that governs a broker is crucial for assessing its legitimacy. TradeFCM claims to operate from the UK, but it is essential to note that it is not regulated by the Financial Conduct Authority (FCA), the primary regulatory body overseeing financial services in the UK. This lack of regulation raises significant concerns about the safety of funds and the broker's operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Regulated |

The absence of a valid license from a recognized authority like the FCA suggests that TradeFCM does not adhere to the stringent requirements imposed on regulated brokers. These requirements typically include maintaining client funds in segregated accounts, providing negative balance protection, and ensuring transparent operations. The lack of regulatory oversight is a major red flag, indicating that traders may not have legal recourse in the event of disputes or financial losses.

Company Background Investigation

TradeFCM claims to have been established in 2016 and operates from an address in Glasgow, UK. However, the company's ownership structure remains opaque, with no clear information available about its founders or management team. This lack of transparency is concerning, as reputable brokers usually provide detailed information about their leadership and operational history.

The absence of ownership information combined with the lack of regulatory oversight raises questions about the broker's credibility. A legitimate company would typically be forthcoming about its management team and their qualifications. In this case, the vagueness surrounding TradeFCM's ownership could indicate a lack of accountability, making it difficult for traders to trust the broker.

Trading Conditions Analysis

TradeFCM offers various account types with high minimum deposit requirements, which is atypical for the industry. The minimum deposit to open an account starts at $1,000, significantly higher than the industry average, which generally ranges from $100 to $250. This high barrier to entry is often a tactic used by unregulated brokers to maximize their earnings from new clients.

| Fee Type | TradeFCM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 0.5 - 1 pip |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Low |

The spreads offered by TradeFCM, starting from 1 pip for major currency pairs, may seem competitive at first glance. However, these spreads can be misleading, especially when combined with the broker's high minimum deposit and lack of transparency regarding additional fees. Furthermore, the absence of a demo account option prevents potential clients from testing the trading conditions before committing their funds, which is another concerning aspect of TradeFCM's operations.

Client Fund Security

The safety of client funds is paramount when assessing a broker's reliability. TradeFCM does not provide adequate information regarding its fund security measures. There is no indication that client funds are held in segregated accounts or that the broker offers any investor protection schemes. This lack of information leaves traders vulnerable to potential losses, as unregulated brokers often do not have the same safeguards in place as their regulated counterparts.

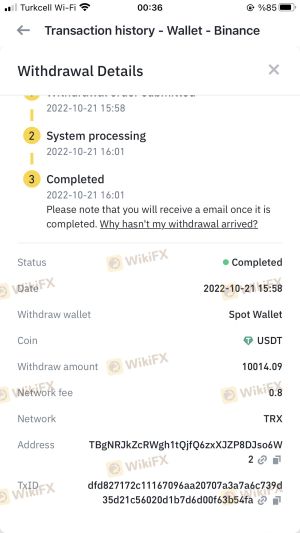

Moreover, the absence of negative balance protection means that traders could lose more than their initial investment, exposing them to significant financial risk. Historical complaints about fund withdrawals from similar unregulated brokers further highlight the potential dangers associated with trading with TradeFCM.

Customer Experience and Complaints

Customer feedback is an essential component in evaluating a broker's reliability. Reviews and testimonials about TradeFCM are predominantly negative, with many users reporting difficulties in withdrawing funds and lack of responsive customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

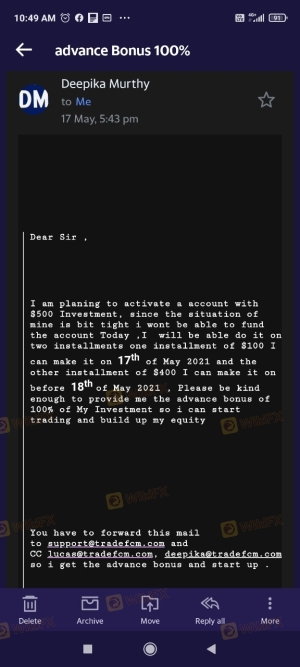

| Misleading Promotions | High | Unresponsive |

For instance, several traders have reported that their withdrawal requests were either delayed or entirely ignored, which is a common tactic employed by scam brokers to retain client funds. Additionally, the quality of customer support has been criticized, with users noting long wait times and unhelpful responses to inquiries. These issues raise serious concerns about the overall customer experience and the broker's willingness to address client needs.

Platform and Trade Execution

TradeFCM claims to offer the popular MetaTrader 4 (MT4) platform; however, there are reports suggesting that the platform may not perform as advertised. Issues such as slippage, order rejections, and overall platform stability have been cited by users. The execution quality appears to be subpar, with some traders experiencing delays that could adversely affect their trading outcomes.

Moreover, there are indications of potential platform manipulation, as some users have reported discrepancies in their account balances and trade executions. Such practices are often associated with unregulated brokers looking to exploit traders for financial gain.

Risk Assessment

Using TradeFCM presents various risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Security Risk | High | Lack of segregation and protection measures. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Support Risk | High | Poor response to complaints and issues. |

To mitigate these risks, it is advisable for traders to seek out regulated brokers with a proven track record of reliability and customer service. Additionally, conducting thorough research and reading user reviews can help identify potential red flags before committing funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that TradeFCM is not a safe broker. The absence of regulatory oversight, coupled with a lack of transparency regarding its operations and ownership, raises significant concerns about the broker's legitimacy. Furthermore, the high minimum deposit requirements, negative user experiences, and potential risks associated with fund security and trade execution make it imperative for traders to exercise caution.

For traders seeking reliable alternatives, it is recommended to consider well-regulated brokers such as eToro, XM, or IG, which offer robust regulatory protections, competitive trading conditions, and responsive customer support. Ultimately, the key to successful trading lies in selecting a broker that prioritizes safety, transparency, and client satisfaction.

Is TradeFCM a scam, or is it legit?

The latest exposure and evaluation content of TradeFCM brokers.

TradeFCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradeFCM latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.