Is TradeGF safe?

Business

License

Is TradeGF Safe or a Scam?

Introduction

TradeGF is a forex and CFD broker that has emerged in the competitive landscape of online trading. Founded in 2020 and operating under the name Get Financial Ltd, TradeGF claims to provide a range of trading services, including access to various financial instruments such as currencies, commodities, and indices. However, as the forex market continues to grow, so does the number of brokers, making it essential for traders to carefully assess the credibility and safety of these platforms.

Investors need to exercise caution when selecting a forex broker due to the potential risks involved, including the possibility of fraud, poor trading conditions, and inadequate customer support. In this article, we will evaluate whether TradeGF is a safe trading platform or a scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

Our investigation is based on a thorough analysis of various online sources, including user reviews, regulatory databases, and expert opinions. We will present the findings in a structured manner, providing a clear picture of TradeGF's legitimacy and safety for potential investors.

Regulation and Legitimacy

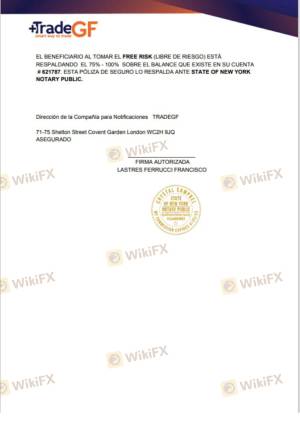

One of the most critical factors in determining the safety of a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict standards and practices that protect clients' interests. Unfortunately, TradeGF currently lacks regulation from any reputable financial authority, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not regulated |

The absence of regulation by recognized authorities such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the U.S. is alarming. Unregulated brokers like TradeGF can operate without oversight, leaving clients vulnerable to potential fraud and malpractice. Furthermore, there are claims that TradeGF has previously operated under different names that have been flagged for suspicious activities, further complicating its credibility.

The quality of regulation is paramount; brokers regulated by top-tier authorities are required to maintain high standards of transparency and client protection, including segregated accounts and compensation schemes. The lack of such oversight for TradeGF makes it a risky choice for traders, prompting the question: Is TradeGF safe? Based on the regulatory landscape, the answer leans towards no, as the absence of regulation significantly increases the risk of encountering scams or fraudulent activities.

Company Background Investigation

Understanding the background of a broker is crucial in assessing its trustworthiness. TradeGF is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory framework, often attracting brokers seeking to evade stringent oversight. The company's ownership structure remains opaque, with limited information available about its founders and management team.

The management team's experience in the financial industry is another key aspect to consider. A knowledgeable and experienced team can enhance a broker's credibility. However, TradeGF has not provided sufficient information regarding the qualifications or backgrounds of its key personnel, which raises further concerns about the company's transparency.

Moreover, the level of information disclosure is critical for building trust with clients. TradeGF's website lacks comprehensive details about its operations, trading conditions, and risk management practices, further diminishing its credibility. In an industry where transparency is vital, the absence of clear and accessible information about the company's history and management team leads to skepticism regarding its legitimacy.

Trading Conditions Analysis

Evaluating the trading conditions offered by a broker provides insight into its overall reliability and fairness. TradeGF advertises various account types, each with different minimum deposit requirements and trading conditions. However, the overall fee structure and trading costs associated with TradeGF appear to be concerning.

| Cost Type | TradeGF | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.2 pips (minimum) | 0.6 - 1.0 pips |

| Commission Model | Not specified | Varies |

| Overnight Interest Range | Not disclosed | 0.5 - 1.5% |

While the broker claims to offer competitive spreads, they are significantly higher than the industry average, which could impact traders' profitability. Additionally, TradeGF does not provide clear information on its commission structure, leaving potential clients in the dark about the true costs of trading. This lack of transparency is a red flag, as reputable brokers typically offer detailed breakdowns of their fees.

Moreover, the absence of information regarding overnight interest rates is concerning. Traders often rely on this information to understand the costs associated with holding positions overnight. The lack of clarity in these areas raises questions about the broker's commitment to fair trading practices and transparency.

Client Fund Security

The safety of client funds is paramount when evaluating a broker. TradeGF's approach to fund security is questionable, as it does not appear to offer any significant measures to protect client deposits. Reliable brokers typically implement strict protocols, such as segregating client funds from operational funds and providing negative balance protection.

Unfortunately, TradeGF has not disclosed any information regarding its fund security measures. The absence of segregated accounts means that clients' funds may be at risk if the broker faces financial difficulties. Additionally, without investor protection schemes in place, clients may have little recourse in the event of a dispute or financial loss.

Historically, unregulated brokers have faced various issues related to fund security, including reports of fund mismanagement and fraudulent activities. Given TradeGF's lack of transparency and regulatory oversight, it is imperative for potential clients to consider the risks associated with trading on this platform. The question of Is TradeGF safe? is increasingly difficult to answer positively when considering the potential risks to client funds.

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reputation. Reviews of TradeGF indicate a mix of experiences, with several users expressing dissatisfaction with the platform. Common complaints include difficulties in withdrawing funds, unresponsive customer support, and lack of transparency regarding fees and trading conditions.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Unresolved |

| Lack of Transparency | High | No clear answers |

Many users have reported challenges when attempting to withdraw their funds, with delays and complications that raise concerns about the broker's reliability. Additionally, the quality of customer support has been criticized, with clients noting long wait times and inadequate responses to their inquiries.

These complaints suggest a pattern of issues that potential clients should be aware of. The lack of effective communication and resolution of problems can significantly impact a trader's experience and overall trust in the broker. The negative feedback surrounding TradeGF reinforces the notion that caution is warranted when considering this platform.

Platform and Execution

The trading platform offered by TradeGF is another critical aspect of its overall evaluation. A reliable and efficient trading platform is essential for executing trades smoothly and effectively. However, reviews indicate that TradeGF's platform may not meet industry standards.

Users have reported issues with platform stability, including frequent outages and slow execution speeds. These problems can lead to missed trading opportunities and increased frustration for traders. Additionally, the quality of order execution, including slippage and rejection rates, is crucial for maintaining a positive trading experience.

If a broker's platform exhibits signs of manipulation or unreliable performance, it poses significant risks to traders. Given the concerns raised by users regarding TradeGF's platform, potential clients should carefully consider whether this broker can provide the necessary tools for successful trading.

Risk Assessment

When evaluating the overall risk associated with using TradeGF, several factors come into play. The lack of regulation, transparency issues, and negative customer feedback contribute to a heightened risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation from reputable authorities |

| Fund Security Risk | High | Lack of segregation and protection |

| Customer Support Risk | Medium | Poor responsiveness and unresolved complaints |

| Platform Stability Risk | High | Frequent outages and execution issues |

Given these risks, it is crucial for potential clients to exercise caution when considering TradeGF as a trading option. To mitigate these risks, traders should conduct thorough research, consider starting with a small deposit, and explore alternative brokers with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that TradeGF poses significant risks to potential investors. The lack of regulation, transparency issues, and negative customer experiences raise serious concerns about the broker's credibility and safety. Therefore, it is prudent for traders to approach TradeGF with caution and consider alternative options.

For those seeking reliable forex brokers, it is advisable to choose platforms that are regulated by reputable authorities and have a proven track record of positive customer experiences. Some recommended alternatives include brokers such as IG, OANDA, or Forex.com, which offer robust regulatory oversight and transparent trading conditions.

In summary, Is TradeGF safe? Based on the analysis presented, it is clear that potential clients should be wary of this broker and prioritize their safety by exploring more reputable options in the forex market.

Is TradeGF a scam, or is it legit?

The latest exposure and evaluation content of TradeGF brokers.

TradeGF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradeGF latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.